Media & Internet Concentration in Canada, 1984-2019, the 2nd in the @CMCRP1 annual 2-part series is out http://www.cmcrp.org/wp-content/uploads/2020/12/Media-and-Internet-Concentration-in-Canada-1984%E2%80%932019-16122020.pdf #CRTC #CDNpoli #CDNmedia

The main goal of the rpt is to investigate whether the comms, Internet & media industries in Canada have b/c more or less concentrated over time, & whether the fear of domination by global Internet giants such as Google, Facebook, Amazon, Apple, Netflix and so forth is justified.

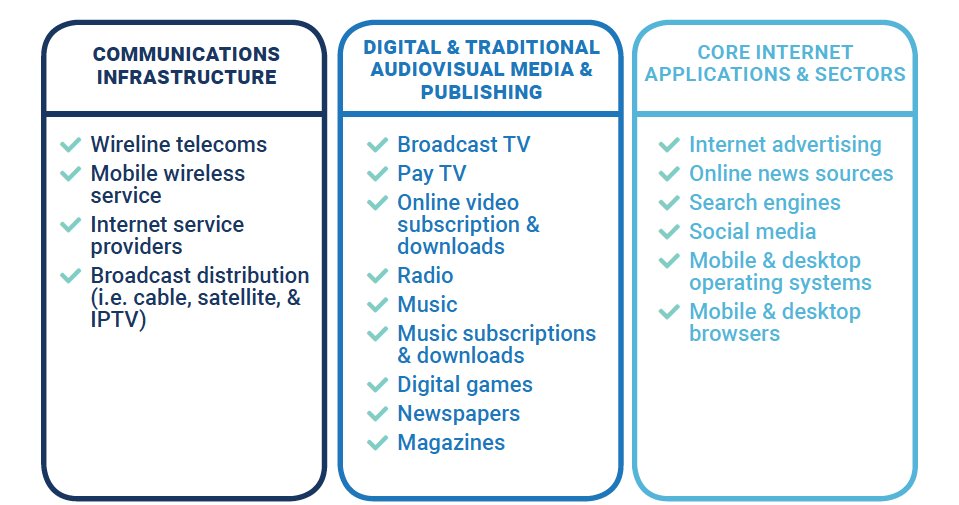

The report covers 20 sectors of the communications, internet & media industries in Canada over a 35-year period.

It brims w/ data, analysis, commentary & policy recos regarding the fast-evolving place of Google, Facebook, Amazon, Apple & Netflix, incl. the challenges they pose to CDN players like Bell, Rogers, Telus, Shaw, Quebecor, &the CBC & their impact on the media landscape generally.

It concludes with 4 principles for a new generation of Internet regulation drawn from the history of comms regulation in NA: structural separation (break-ups & divestitures), line of business restrictions (firewalls), public obligations & the need for new public alternatives ...

including an initial call for the creation of a new entity, the Great Canadian Communications Corporation (GC3). Here's some of the headline findings-->

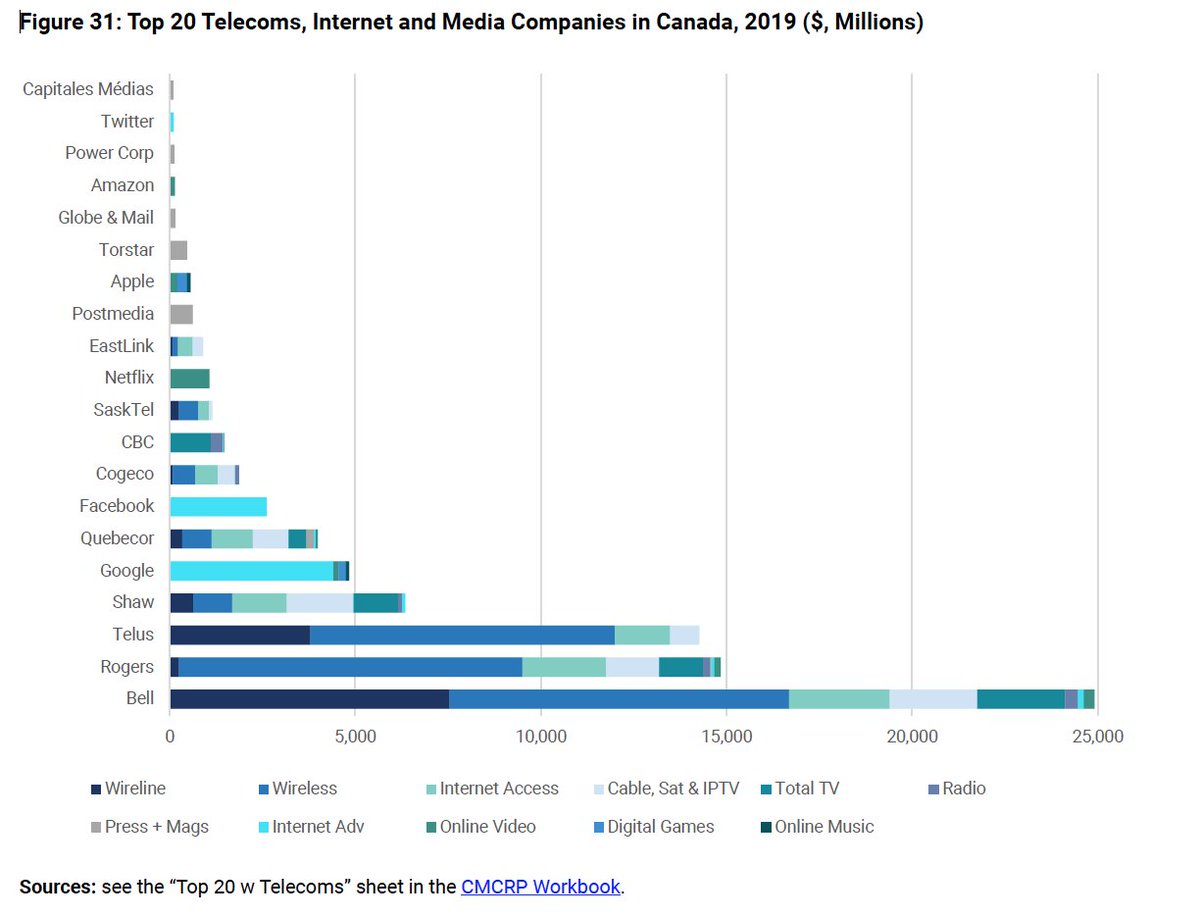

Bell is the biggest comms, Internet & media player in Canada by far, w/ $24.9B in revenue last year—nearly three times Google, Facebook, Netflix, Apple, Amazon, & Twitter’s $ in Canada combined. Bell single-handedly accounted for ~28% of the $91.3B network media economy last yr.

The top five Canadian companies—Bell, Telus, Rogers, Shaw and Quebecor—accounted for 72.5% of network media economy revenue last year; in contrast, the “big six” US-based Internet giants’ combined revenue in Canada of $9.3 billion gave them a 10% market share.

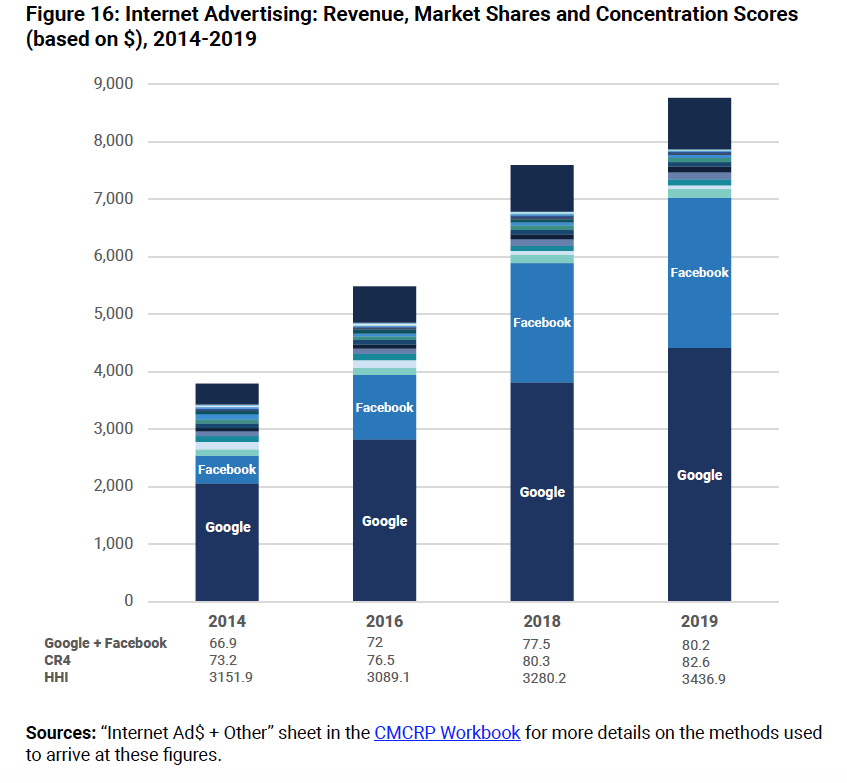

Google and Facebook are now the fifth and seventh largest entities in the network media economy in Canada, respectively. Collectively, they accounted for 80% of online advertising revenue while their share of total ad spend across all media reached 45% last year.

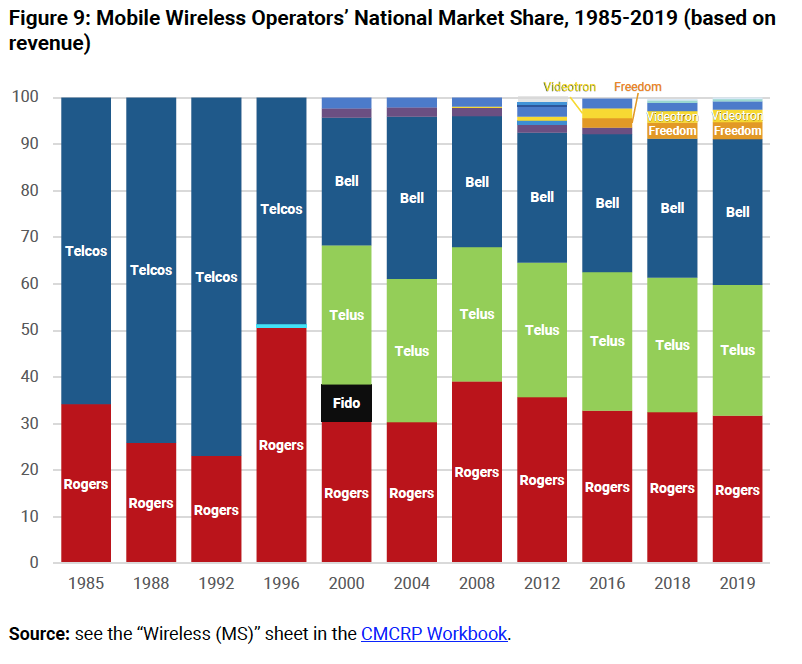

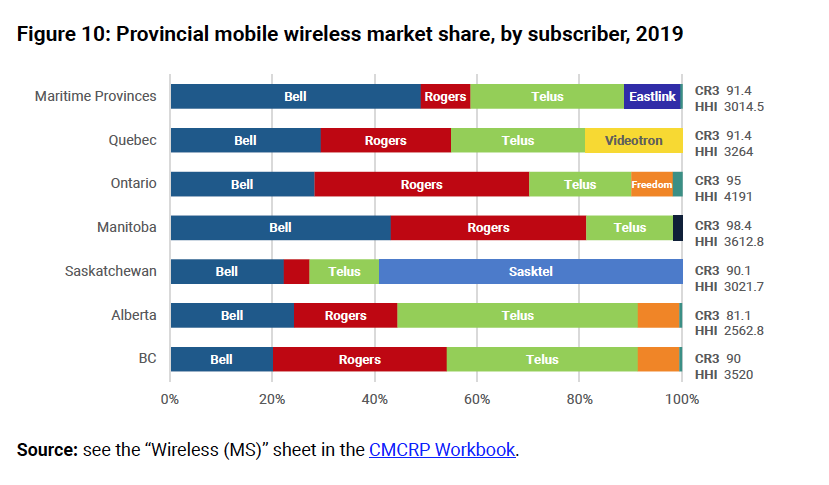

Mobile wireless remains very highly concentrated with Rogers, Telus and Bell accounting for 91% of the sector’s revenue last year—a figure that has stayed stubbornly stable despite policy and regulatory measures ostensibly designed to address such conditions.

New mobile wireless entrants Shaw (Freedom), Videotron & Eastlink’s share of the wireless market rose to 6.8% in 2019. The most competitive mobile wireless market is in Quebec, where Videotron had 13% market share by revenue & 19% based on subs—a small increase over the year.

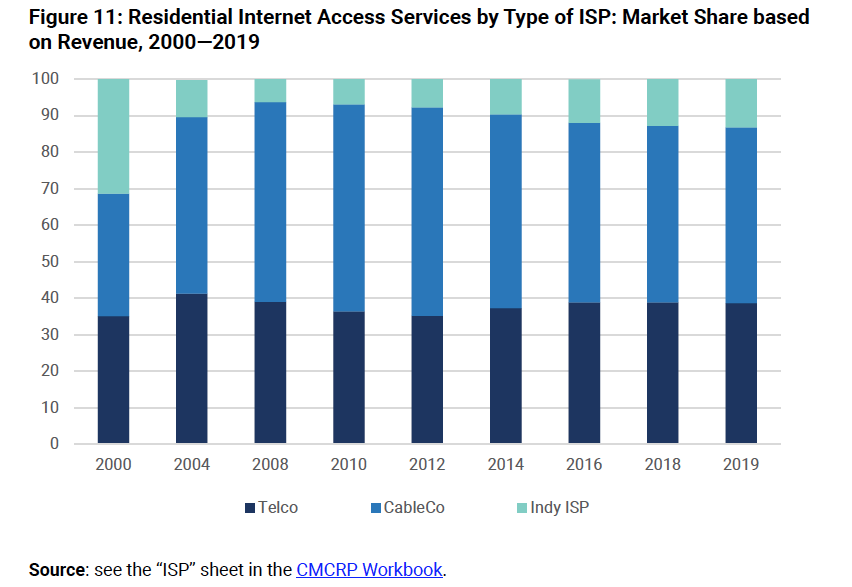

Incumbent telecom & cable cos still dominated the residential Internet access market in 2019, w/ 86% of the $12.7B sector by revenue (87% based on subs), although indy ISPs continue to claw out marginal gains in subscribers, revenue and market share for themselves.

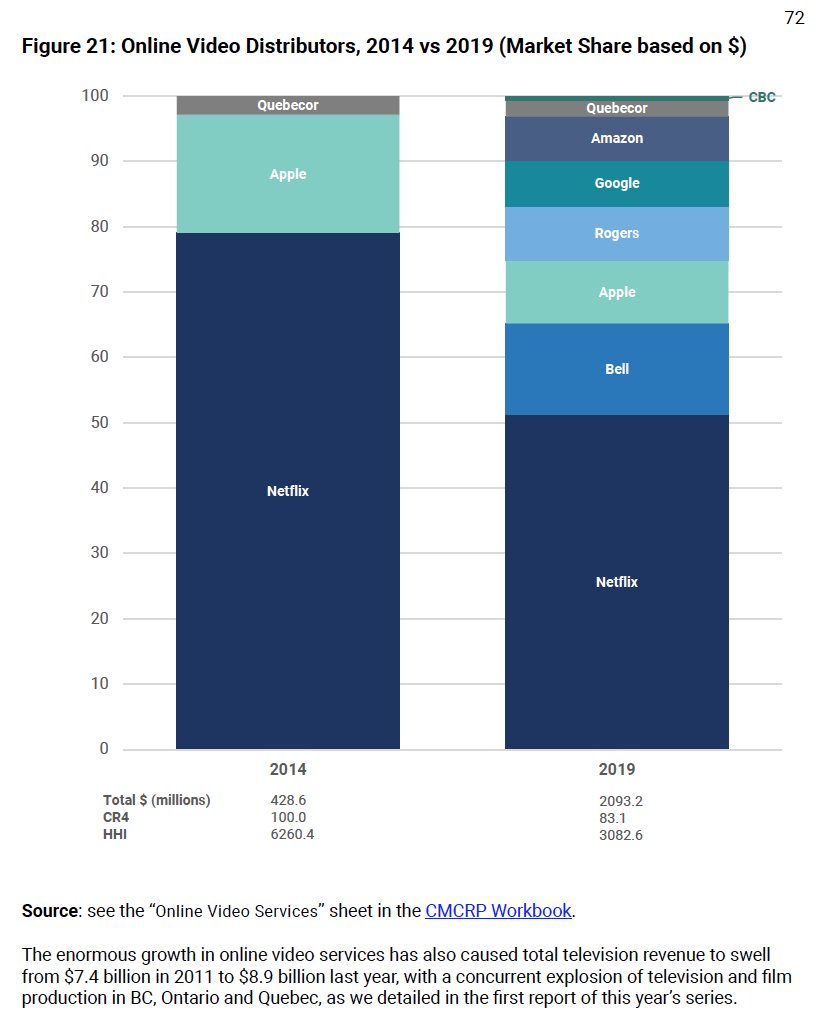

The steep rise in TV concentration b/w 2010-2014 is beginning to be reversed due to the rise of online video services & the spin-off of several pay TV services by Bell & Shaw to the benefit of smaller players such as DHX, Stingray, Blue Ant, Channel Zero and CHEK.

The “big 5” TV operators’ took 78% of all TV revenue (including Internet streaming) last year: Bell, Shaw (Corus), Rogers, CBC & Netflix.

Netflix had revenue of $1.1 billion in Canada last year and a 12.1% stake of all television services revenues. On a stand-alone basis, the online video market is highly concentrated, but the trend is downward over time.

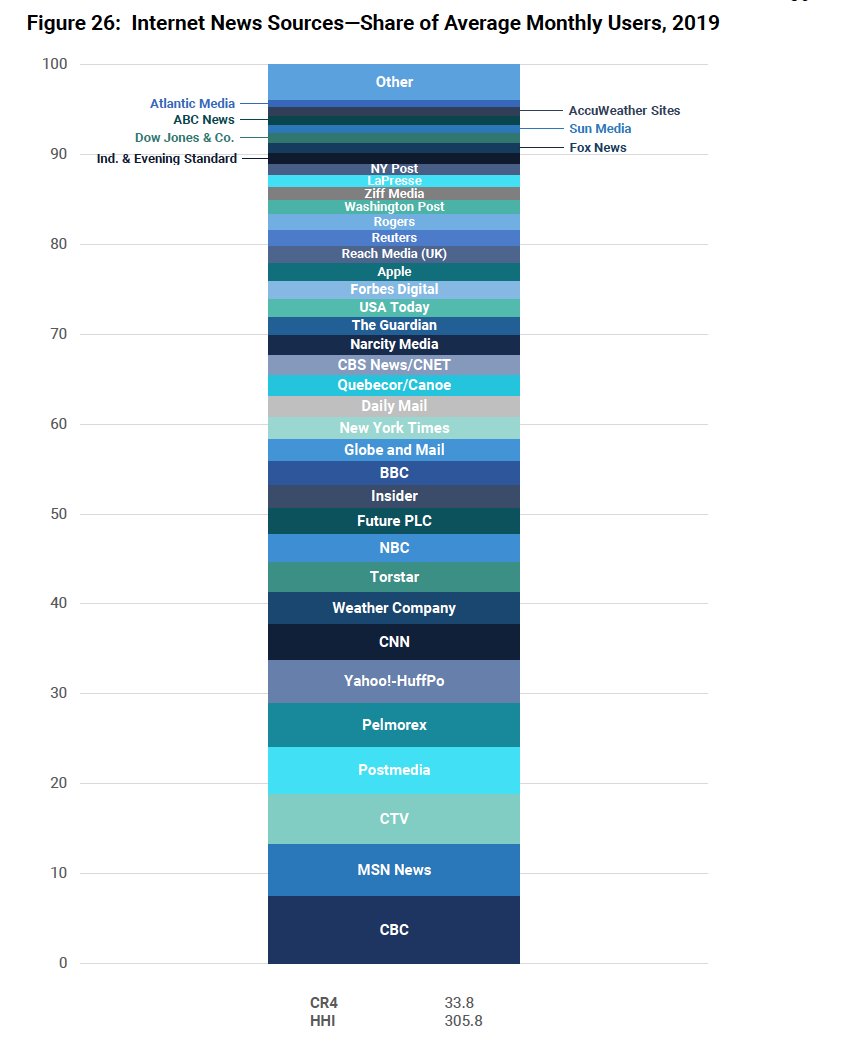

As the crisis of journalism deepens, large newspaper chains such as Postmedia, Torstar & Quebecor have spun off daily & community papers while consolidating their activities on a regional basis. As a result, the top 4 firms’ share of nat'l $ fell from 83% in 2010 to 62% last yr.

Online, Canadians get their news from a wide plurality of news sources, both old (CBC, Postmedia, CTV, Toronto Star,) and new (National Observer), as well as domestic and foreign (CNN, CBS, BBC, NBC, Guardian, New York Times).

The CRTC took fairly strong steps to address the realities of persistently high levels of media concentration & sky-high levels of vertical & diagonal integration between 2012-2017 but that resolve appears to have crumbled under its current chair and as the Liberal govt reverts..

to a stance of regulatory hesitance and vacillating policy positions. @AnjaKaradeglija @davidakaye @KarlBode @bergmayer @bhaggart @ProMarket_org @mckelveyf @YBenkler @neil_neilzone @blakereid @haroldfeld @1Br0wn @alexposadzki @heidiTworek @aracalacana @gmastrini @mgeist

@jason_kint @ceciliakang @HertzBarry @superwuster

@MichaelSocolow @matthewstoller @emilybell

@Sally_Hubbard @RrjohnR @biancawylie @ChrisTMarsden @1lucabelli @NTusikov @nhelberger @AnnemarieBridy @silvertje @gamespacenl @smgrimes @gregorytaylor1 @tpoell @s_guilbeault

@MichaelSocolow @matthewstoller @emilybell

@Sally_Hubbard @RrjohnR @biancawylie @ChrisTMarsden @1lucabelli @NTusikov @nhelberger @AnnemarieBridy @silvertje @gamespacenl @smgrimes @gregorytaylor1 @tpoell @s_guilbeault

Read on Twitter

Read on Twitter