Very happy to announce that my paper “The macroeconomic effects of oil supply news: Evidence from OPEC announcements” has been accepted at the 𝘼𝙢𝙚𝙧𝙞𝙘𝙖𝙣 𝙀𝙘𝙤𝙣𝙤𝙢𝙞𝙘 𝙍𝙚𝙫𝙞𝙚𝙬. To celebrate, let me briefly summarize the main insights and conclusions (Thread).

MOTIVATION: A long literature studied the macroeconomic effects of oil price shocks. This question could not be more topical given the current situation on oil markets. Just last week, OPEC+ met but failed to agree to extend the significant production cuts made earlier this year.

A key insight in this literature dating back to Kilian (AER, 2008), is that oil price shocks do not occur ceteris paribus. Consequently, it is important to account for the fundamental drivers of oil prices, e.g. demand shocks (Kilian, 2008) or oil supply shocks (Hamilton, 2003).

From a policy perspective, supply shocks are of particular interest because of their stagflationary effects. However, as oil prices are forward-looking, not only current supply matters but also supply expectations. Identifying such expectational shocks is difficult, however.

THIS PAPER: I propose a novel approach to identify a shock to oil supply expectations, exploiting institutional features of OPEC and high-frequency data. The oil market has a peculiar structure as it is dominated by a big player, OPEC, that makes regular announcements on its

production plans. These decisions are closely watched by markets and can lead to significant market reactions. Exploiting high-frequency variation around OPEC announcements allows me to isolate a series of oil supply surprises.

Reverse causality of the global economic outlook can be plausibly ruled out because it is already priced in at the time of the announcement and is unlikely to change within the tight window.

Using this series as an external instrument (𝗦𝘁𝗼𝗰𝗸 and 𝗪𝗮𝘁𝘀𝗼𝗻, 𝗠𝗲𝗿𝘁𝗲𝗻𝘀 and @MortenORavn) in an oil market VAR model, I am able to identify a structural 𝗼𝗶𝗹 𝘀𝘂𝗽𝗽𝗹𝘆 𝗻𝗲𝘄𝘀 𝘀𝗵𝗼𝗰𝗸.

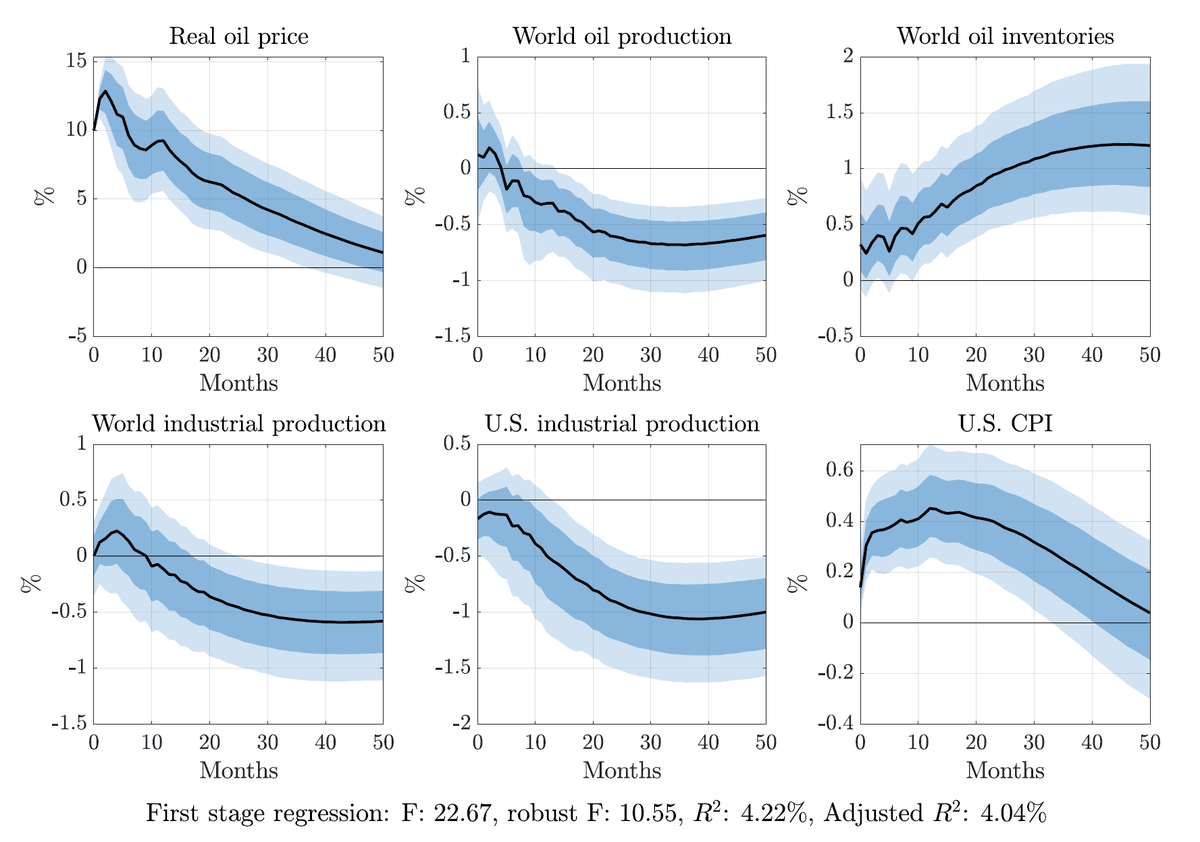

MAIN RESULTS: Oil supply news shocks have statistically and economically significant effects. Negative news leads to an immediate increase in oil prices, a gradual fall in oil production and an increase in inventories.

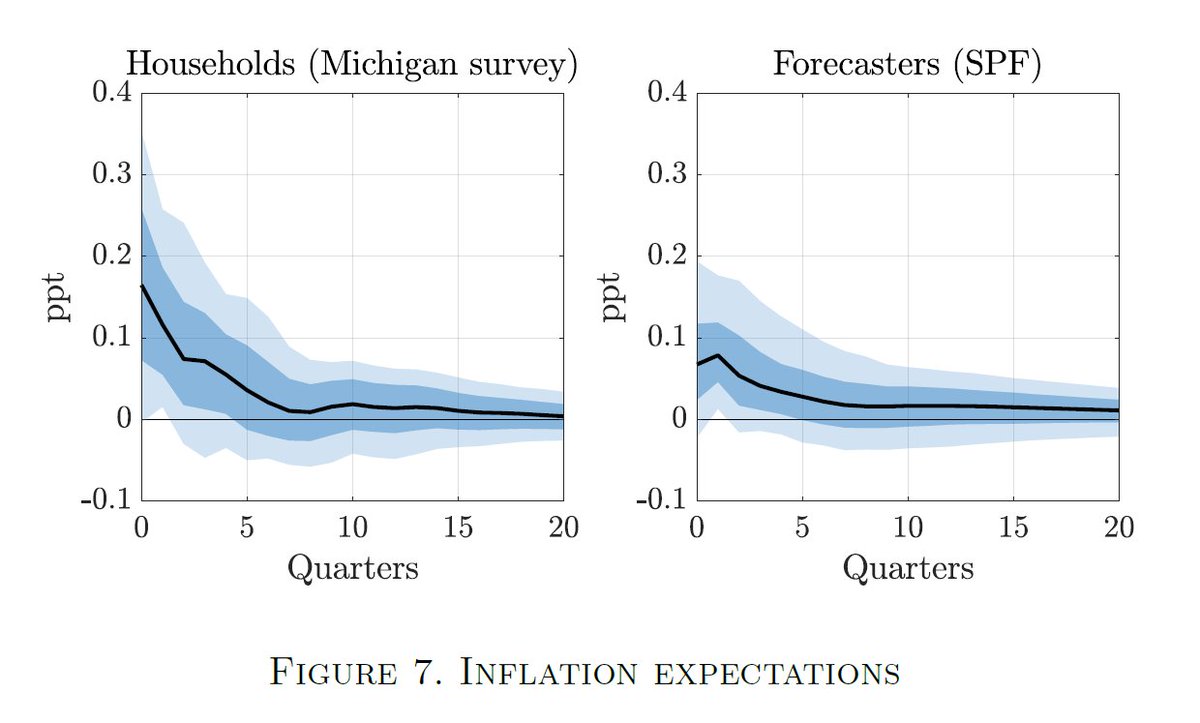

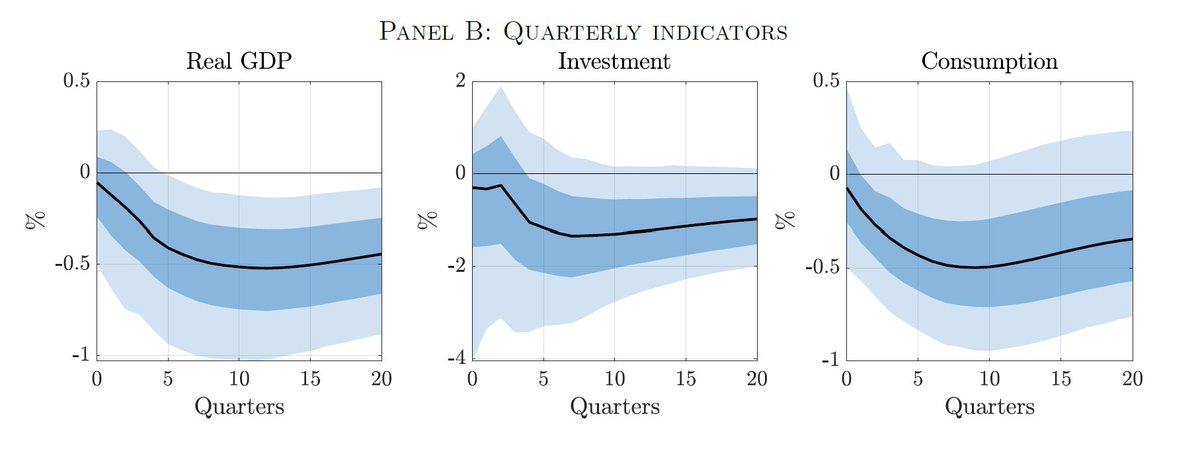

This has consequences for the U.S. economy: activity falls, prices and inflation expectations rise, and the dollar depreciates - providing evidence for a strong channel operating through supply expectations.

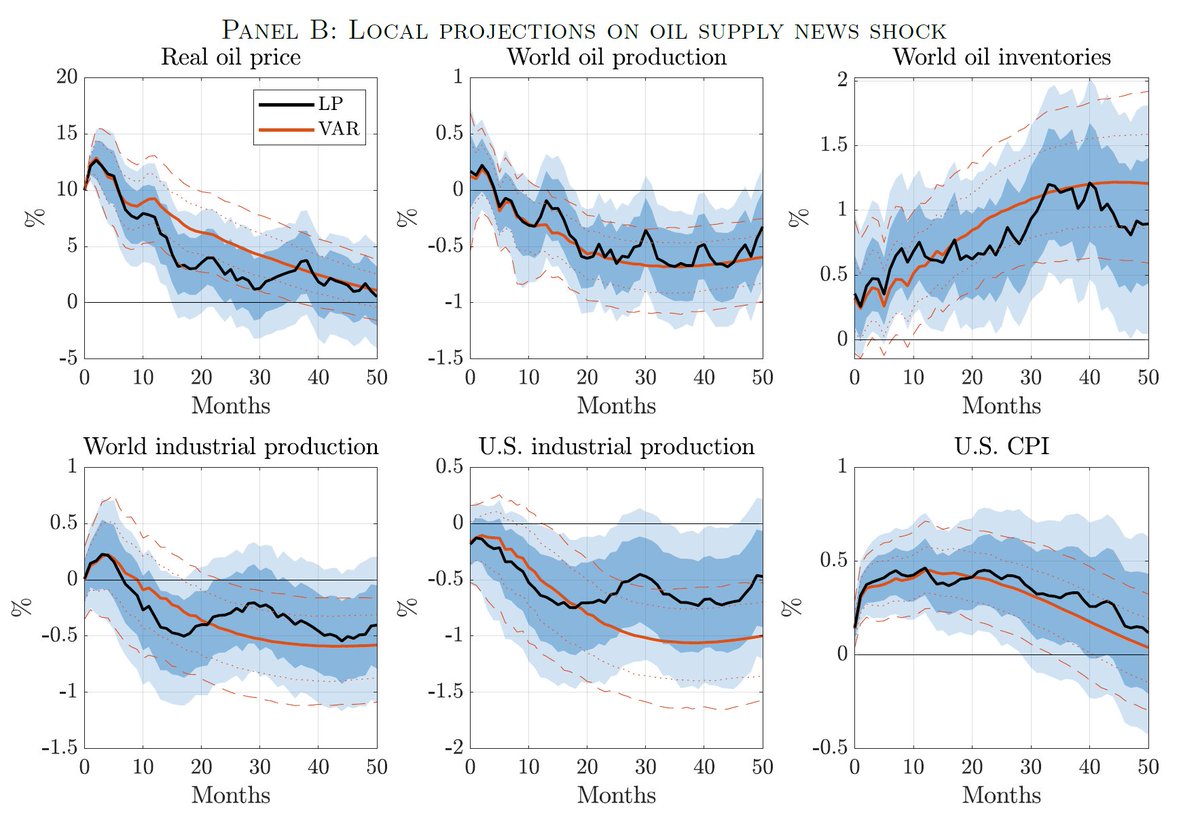

The results are robust to controlling for background noise using an heteroskedasticity-based estimator ( @RobertoRigobon, 𝗡𝗮𝗸𝗮𝗺𝘂𝗿𝗮- @JonSteinsson) or estimating the responses using local projections (𝗝𝗼𝗿𝗱𝗮).

Oil supply news contribute meaningfully to historical variations in the oil price, illustrating that major episodes in oil markets, e.g. political events in the Middle East, impact oil prices not only through current supply but, crucially, also through changes in expectations.

For more information, see the paper here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3185839. The instrument, the shock series as well as the replication files (in Matlab) can be found on my webpage: http://www.diegokaenzig.com/research .

On a more personal note, I want to take this opportunity to thank the people that have helped me along the way of this journey. I started this paper as my second year project and it would never have gotten to the point it is now without the generous help of many.

I am indebted to my supervisor, 𝗣𝗮𝗼𝗹𝗼 𝗦𝘂𝗿𝗶𝗰𝗼, as well as other faculty at LBS including @helene_rey, @LucreziaReichli, @EliasPapaioann2, 𝗝𝗼𝗮𝗼 𝗖𝗼𝗰𝗰𝗼, @VStavrakeva, @josebammartinez for their continuous guidance and support.

I would also like to thank my discussants, @td_econ and @JHamilton_UCSD, as well as all the people that took the time to read my paper (in some cases multiple times!) and provided me with very helpful comments and feedback, including 𝗖𝗵𝗿𝗶𝘀𝘁𝗶𝗮𝗻𝗲 𝗕𝗮𝘂𝗺𝗲𝗶𝘀𝘁𝗲𝗿,

@HCBjornland, 𝗝𝗼𝗻𝗮𝘀 𝗔𝗿𝗶𝗮𝘀, @RefetGurkaynak, 𝗟𝘂𝘁𝘇 𝗞𝗶𝗹𝗶𝗮𝗻, 𝗞𝘂𝗿𝘁 𝗟𝘂𝗻𝘀𝗳𝗼𝗿𝗱, @GertPeersman, 𝗜𝘃𝗮𝗻 𝗣𝗲𝘁𝗿𝗲𝗹𝗹𝗮, 𝗠𝗶𝗰𝗵𝗲𝗹𝗲 𝗣𝗶𝗳𝗳𝗲𝗿, 𝗠𝗶𝗸𝗸𝗲𝗹 𝗣𝗹𝗮𝗴𝗯𝗼𝗿𝗴-𝗠𝗼𝗹𝗹𝗲𝗿, 𝗩𝗮𝗹𝗲𝗿𝗶𝗲 𝗥𝗮𝗺𝗲𝘆, @ricco_giovanni, and @krogoff!

I am also indebted to my PhD colleagues, 𝗠𝗶𝗰𝗵𝗲𝗹𝗲 𝗔𝗻𝗱𝗿𝗲𝗼𝗹𝗹𝗶, @JuanAntolinDiaz, 𝗟𝘂𝗶𝘀 𝗙𝗼𝗻𝘀𝗲𝗰𝗮, and 𝗧𝘀𝘃𝗲𝘁𝗲𝗹𝗶𝗻𝗮 𝗡𝗲𝗻𝗼𝘃𝗮 for their patience and the many discussions we had about this project.

Finally, I would like to thank the coeditor in charge, 𝗘𝗺𝗶 𝗡𝗮𝗸𝗮𝗺𝘂𝗿𝗮, as well as three anonymous referees for their constructive approach, very helpful feedback and efficient turnaround times! Thank you!

Read on Twitter

Read on Twitter