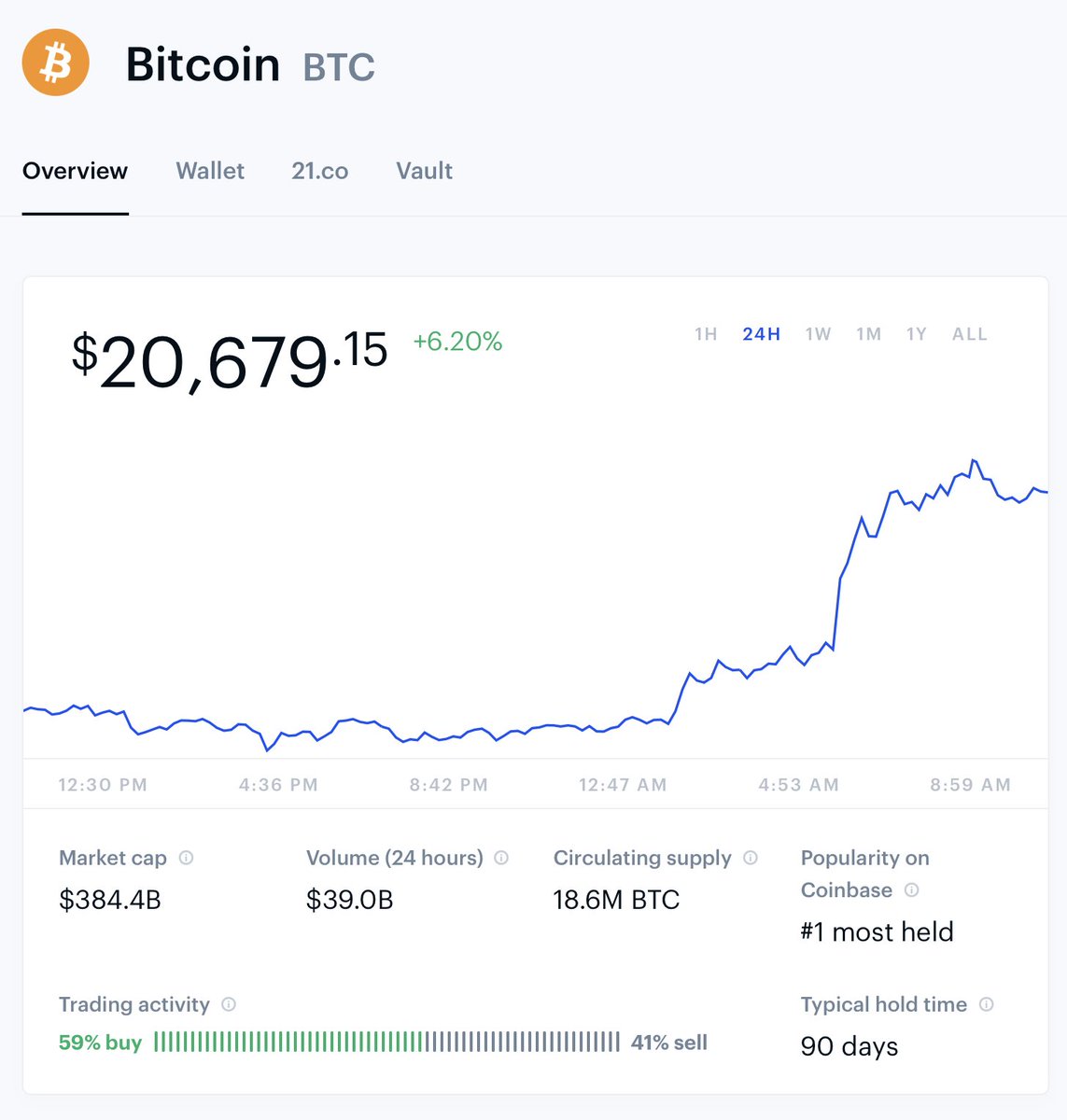

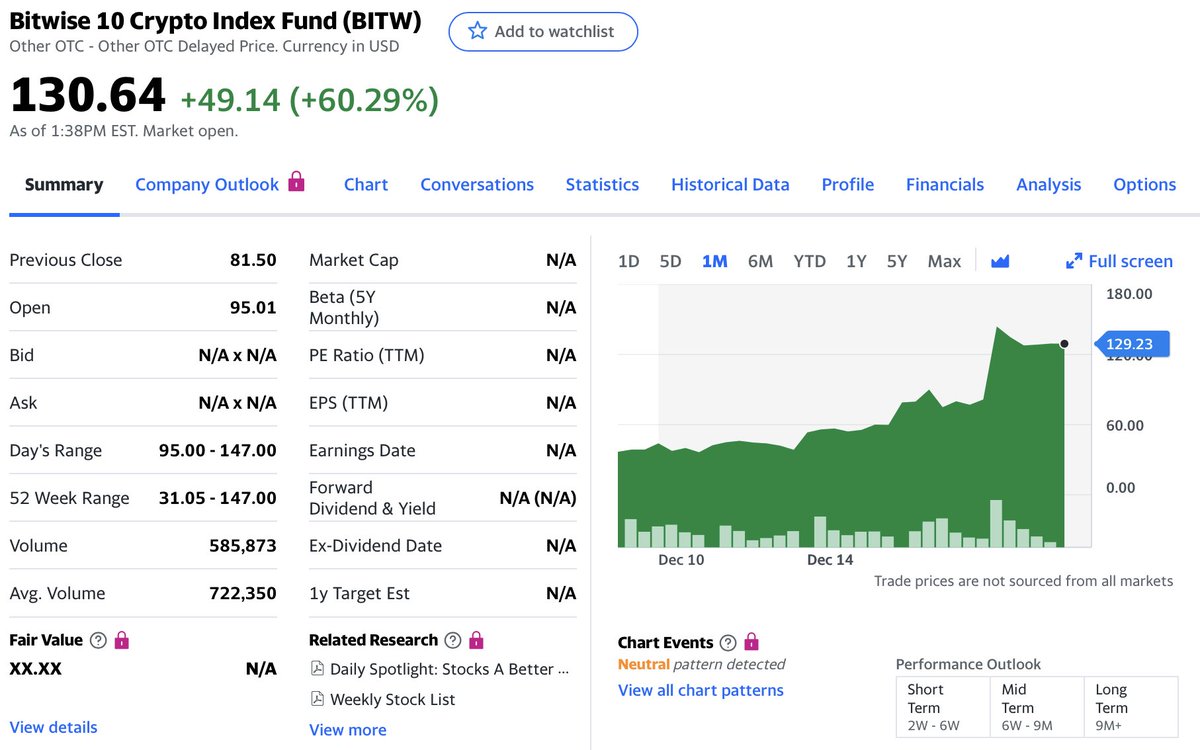

1/ Given that $BTC is over $20K today, and $BITW is over $130 and that I've tweeted about both in recent weeks, I want to remind anyone who cares how crypto does (or does not) make sense in a long term portfolio...

2/ For those who don't want to follow a thread, much of this material is covered in my Personal Finance class @Stanford. Slides from 2020 are online today.

For everyone else, onward! https://www.slideshare.net/adamnash/stanford-cs-00710-2020-personal-finance-for-engineers-additional-topics-vc-private-equity-derivatives-crypto?ref=https://cs007.blog/

https://www.slideshare.net/adamnash/stanford-cs-00710-2020-personal-finance-for-engineers-additional-topics-vc-private-equity-derivatives-crypto?ref=https://cs007.blog/

For everyone else, onward!

https://www.slideshare.net/adamnash/stanford-cs-00710-2020-personal-finance-for-engineers-additional-topics-vc-private-equity-derivatives-crypto?ref=https://cs007.blog/

https://www.slideshare.net/adamnash/stanford-cs-00710-2020-personal-finance-for-engineers-additional-topics-vc-private-equity-derivatives-crypto?ref=https://cs007.blog/

3/ The hypothesis that crypto belongs in a long-term, diversified portfolio is based on similar logic to other types of assets. So the first question is simple:

"Is Bitcoin / Crypto an Asset Class?"

"Is Bitcoin / Crypto an Asset Class?"

4/ My answer to this is "It likely is." Rationale: If you believe that digital assets are real, have value, and likely have different financial characteristics than tangible commodities, they likely will meet most financial standards for a unique type of asset.

5/ Aside: Economists have long struggled with how to properly account for intangible assets, and software has made this problem much more serious. Digital assets, like Bitcoin, amplify this problem. How do you properly value access to a network, developers, APIs? All unsolved.

6/ However, for the purpose of this hypothesis, you mostly just have to believe that digital assets do have value, even if much of that value is intangible, and that there will be ongoing (even increasing) value assigned to digital assets.

7/ So if crypto is an asset class, does it belong in a portfolio? On the one hand, this seems easy. We have standard portfolio construction techniques in finance, like Sharpe ratio, to look at the risk vs. reward in adding anything to a portfolio. So how does $BTC look?

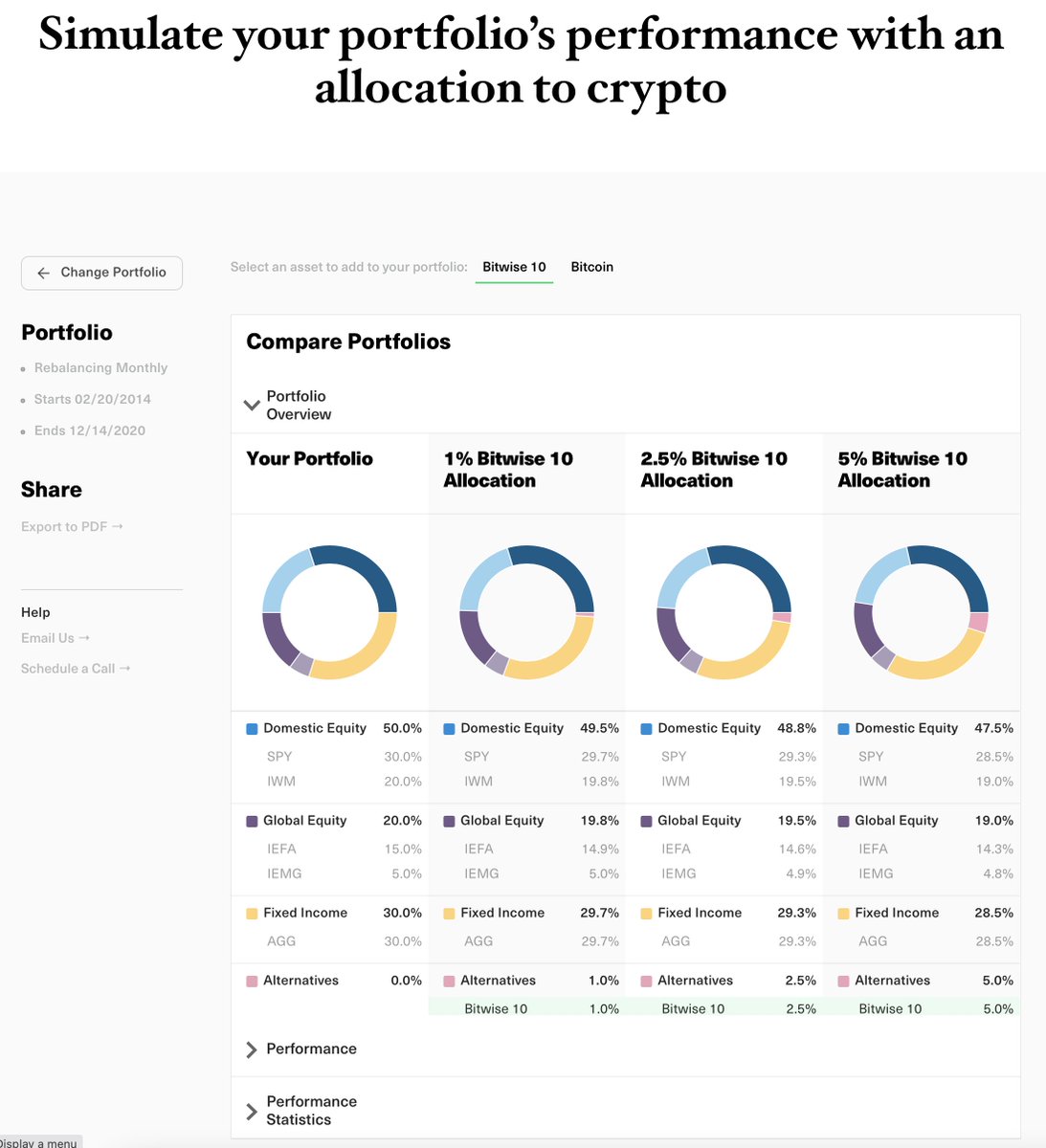

8/ Answer: It looks very good, but with an asterisk. Crypto is way too young (and small) to have high confidence in the data. @BitwiseInvest has done some of the best publicly available research on portfolio construction w/ crypto. They even have an app!

https://www.bitwiseinvestments.com/advisors

https://www.bitwiseinvestments.com/advisors

9/ Now, a lot of people will think that this is just because Bitcoin has skyrocketed in value & of course, that is meaningful. But we also know how volatile crypto is. Up & down. This analysis concludes that the ups & downs are worth it, but only in the context of a portfolio!

10/ That last part is what people are missing, often in a speculative fervor. This isn't about get rich quick. It's about have a small % of your long term savings in digital assets.

The % solves for two problems!

The % solves for two problems!

11/ First, it solves for the problem of having too much volatility! If you have 1, 2, or even 5% in crypto, the ups & downs, while significant, won't move your whole portfolio that much at any given time.

12/ Second, it gets you largely out of the business of market timing, because rebalancing keeps your portfolio from becoming all crypto when it skyrockets, and underinvested when it tanks. And as we all know, both have happened before, and will happen again.

13/ So the @BitwiseInvest research assumes rebalancing. What is the best way to do rebalancing? @Vanguard published some good work on different strategies & @Wealthfront did even more detailed work.

The right answer is likely "trigger based."

The right answer is likely "trigger based."

14/ Trigger based rebalancing isn't on a fixed schedule, it's based on variance from your ideal portfolio. So if you want 2% of your portfolio in crypto, and with the run-up it goes to 10%, you likely should rebalance.

15/ Rebalancing is fundamentally hard because of taxes & emotions. Selling something high to buy something low feels bad, especially if the thing going up keeps going up! Also, the IRS wants their cut every time you sell.

16/ However, with crypto, it's incredibly valuable, because of the volatility combined with high gains. At least, this is what the portfolio analysis says. By selling some crypto at peaks, you ensure your portfolio doesn't become too volatile, and you capture some of the value.

17/ So what does this mean practically? For short term traders and speculators, nothing. For most people, that's just gambling. Maybe you win, maybe you lose.

18/ For long term investors, however, it gives you a practical and simple strategy to add crypto to a diversified portfolio that looks like it will, over time, yield you a higher overall return at a reasonable price of increased volatility.

19/ Remember, however, this is all still hypothetical. Most financial assets have been around for centuries (or more!) We have very little data on crypto, and as a result, the assumptions could be wrong.

This is one of the reasons to keep the allocation relatively small.

This is one of the reasons to keep the allocation relatively small.

20/ Follow on links (if useful). Invest responsibly!

Bitwise research links:

https://www.bitwiseinvestments.com/advisors

Slides 22-29 from class: https://www.slideshare.net/adamnash/stanford-cs-00710-2020-personal-finance-for-engineers-additional-topics-vc-private-equity-derivatives-crypto?ref=https://cs007.blog/

Bitwise research links:

https://www.bitwiseinvestments.com/advisors

Slides 22-29 from class: https://www.slideshare.net/adamnash/stanford-cs-00710-2020-personal-finance-for-engineers-additional-topics-vc-private-equity-derivatives-crypto?ref=https://cs007.blog/

Read on Twitter

Read on Twitter