89% GROWTH

89% GROWTH

$EMBRAC is a M&A machine growing by 89%

$EMBRAC is a M&A machine growing by 89% It counts 135 video games project in its pipeline

It counts 135 video games project in its pipeline And an ARMY of 3,600 developers

And an ARMY of 3,600 developers Is it TAKING over the world?

Is it TAKING over the world?Here is an EASY thread

Embracer Group is a Swedish  video game holding company and was founded in 2008

video game holding company and was founded in 2008

It currently employs around 5,000 people in +40 countries and counts 55 development studio

It currently employs around 5,000 people in +40 countries and counts 55 development studio

video game holding company and was founded in 2008

video game holding company and was founded in 2008 It currently employs around 5,000 people in +40 countries and counts 55 development studio

It currently employs around 5,000 people in +40 countries and counts 55 development studio

It has 6 direct subsidiaries: Amplifier Game Invest, Coffee Stain Holding, DECA Games, Koch Media, Saber Interactive, and THQ Nordic

Each one has its own operations and development studios

Each one has its own operations and development studios

Each one has its own operations and development studios

Each one has its own operations and development studios

But what exactly is the Embracer Group?

Founder

Founder

Games and market

Games and market

Growth strategy

Growth strategy

Founder

Founder Games and market

Games and market Growth strategy

Growth strategy

Founder

FounderLars Wingefors started its business career at 13 with LW Comics, a company that sold second-hand comic books

Books were sold through a mail order system using a mailing list from a defunct company

Books were sold through a mail order system using a mailing list from a defunct company

When he was 16, Lars started a second company: Nordic Games which sold used video games and generated $ 600k in sales in its first year

The founder ultimately sold Nordic Games to http://gameplay.com for £6m only to buy it back years later for a symbolic Krone ($0.1)

The founder ultimately sold Nordic Games to http://gameplay.com for £6m only to buy it back years later for a symbolic Krone ($0.1)

The founder ultimately sold Nordic Games to http://gameplay.com for £6m only to buy it back years later for a symbolic Krone ($0.1)

The founder ultimately sold Nordic Games to http://gameplay.com for £6m only to buy it back years later for a symbolic Krone ($0.1)

Lars Wingefors later founded Game Outlet Europe which bought surplus inventory from large publishers, repackaged the games and sold these to retail chains

In 2008, Nordic Games started to morph into its definitive shape by establishing a video game publishing subsidiary

In 2008, Nordic Games started to morph into its definitive shape by establishing a video game publishing subsidiary

In 2008, Nordic Games started to morph into its definitive shape by establishing a video game publishing subsidiary

In 2008, Nordic Games started to morph into its definitive shape by establishing a video game publishing subsidiary

Quickly, the company focussed on an aggressive M&A strategy, often buying the assets of bankrupt video games publishers

In 2014, it acquires the “THQ” trademark. In 2018, it acquired Koch Media (which operated the Deep Silver video game label) for € 121m

In 2014, it acquires the “THQ” trademark. In 2018, it acquired Koch Media (which operated the Deep Silver video game label) for € 121m

In 2014, it acquires the “THQ” trademark. In 2018, it acquired Koch Media (which operated the Deep Silver video game label) for € 121m

In 2014, it acquires the “THQ” trademark. In 2018, it acquired Koch Media (which operated the Deep Silver video game label) for € 121m

In 2020 it acquired Saber Interactive for $ 525m and raised $ 164m to fund the operation https://www.reuters.com/article/us-embracer-acquisition-saber-idUSKBN20D0S7

In 2020 it acquired Saber Interactive for $ 525m and raised $ 164m to fund the operation https://www.reuters.com/article/us-embracer-acquisition-saber-idUSKBN20D0S7

Games and market

Games and marketThe company now operates 6 direct subsidiaries and has a catalogue of over 200 franchises such as:

· Saints Row

· Goat Simulator

· Dead Island

· Darksiders

· Metro

· TimeSplitters

· Satisfactory

· Wreckfest

· Insurgency

· World War Z

These games can be played on mobile, PC, gaming consoles

So here we have a diversified gaming conglomerate

So here we have a diversified gaming conglomerate

· Wreckfest

· Insurgency

· World War Z

These games can be played on mobile, PC, gaming consoles

So here we have a diversified gaming conglomerate

So here we have a diversified gaming conglomerate

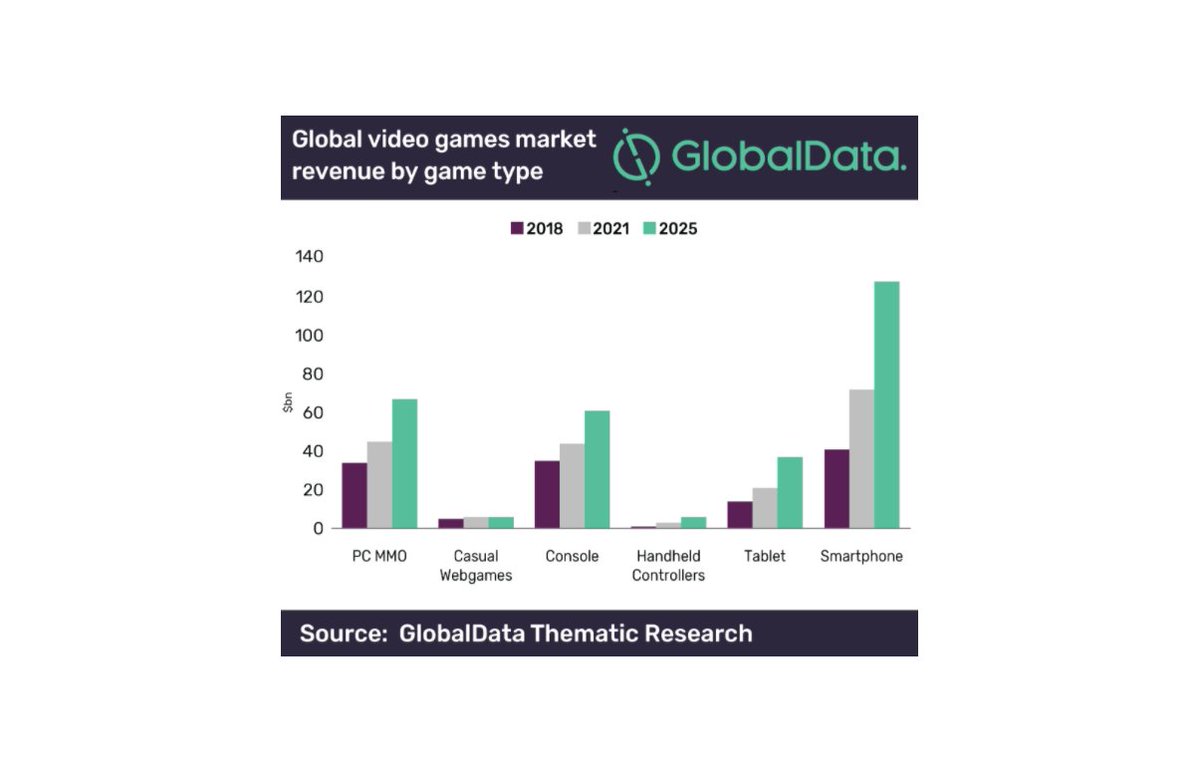

But how is the global gaming market doing?

Mordor Intelligence reports that the market is set to grow by 9.2% a year over the 2020 - 2025 period

Mordor Intelligence reports that the market is set to grow by 9.2% a year over the 2020 - 2025 period

Mordor Intelligence reports that the market is set to grow by 9.2% a year over the 2020 - 2025 period

Mordor Intelligence reports that the market is set to grow by 9.2% a year over the 2020 - 2025 period

Going from $ 151B in 2019 to $ 257B by 2025 and driven by the upgrade cycle in consoles (Sony and Microsoft), the emergence of cloud gaming and the rise of eSports

Going from $ 151B in 2019 to $ 257B by 2025 and driven by the upgrade cycle in consoles (Sony and Microsoft), the emergence of cloud gaming and the rise of eSports

Global Data reports that the market could reach $ 300B by 2025 up from $ 131B in 2018

Global Data reports that the market could reach $ 300B by 2025 up from $ 131B in 2018 Driven by the advent of mobile gaming, cloud gaming and virtual reality gaming and new payments model (in-game micro-payments) which boost spending

Driven by the advent of mobile gaming, cloud gaming and virtual reality gaming and new payments model (in-game micro-payments) which boost spending

“At the same time, new technologies like 5G, cloud, and virtual reality will usher in a new phase of innovation” - Ed Thomas, Global Data https://variety.com/2019/gaming/news/video-games-300-billion-industry-2025-report-1203202672/

Growth strategy

Growth strategyThe market is growing at a steady pace! How is Embracer growing?

You have seen it, Embracer is an M&A machine: https://venturebeat.com/2020/11/17/embracer-group-acquires-10-game-studios-and-a-pr-firm/

It finds gaming studios with a proven track record, raises capital and buys them over

It finds gaming studios with a proven track record, raises capital and buys them over  The company now has over 135 game projects in the works up from 118 in May

The company now has over 135 game projects in the works up from 118 in May

This M&A strategy has enable is deeply ingrained in the company:

The main objectives for all operating units are to generate organic growth with high incremental ROIC

The main objectives for all operating units are to generate organic growth with high incremental ROIC

And to scout their network for suitable, attractive bolt on acquisitions of entrepreneur-led companies

And to scout their network for suitable, attractive bolt on acquisitions of entrepreneur-led companies

The main objectives for all operating units are to generate organic growth with high incremental ROIC

The main objectives for all operating units are to generate organic growth with high incremental ROIC And to scout their network for suitable, attractive bolt on acquisitions of entrepreneur-led companies

And to scout their network for suitable, attractive bolt on acquisitions of entrepreneur-led companies

“M&A market is more active than ever and we are gearing up across our operating groups. We discussed with more than 100 entrepreneurs in the last quarter [...]“ - Q3 ’20 Report

How is it funding all these acquisitions?

Well, it raises capital by issuing shares

How is it funding all these acquisitions?

Well, it raises capital by issuing shares

21st February 2019  “Substantially oversubscribed share issue brings on a range of new investors for growing publisher” https://www.gamesindustry.biz/articles/2019-02-21-thq-nordic-raises-usd225m-for-further-acquisitions

“Substantially oversubscribed share issue brings on a range of new investors for growing publisher” https://www.gamesindustry.biz/articles/2019-02-21-thq-nordic-raises-usd225m-for-further-acquisitions

“Substantially oversubscribed share issue brings on a range of new investors for growing publisher” https://www.gamesindustry.biz/articles/2019-02-21-thq-nordic-raises-usd225m-for-further-acquisitions

“Substantially oversubscribed share issue brings on a range of new investors for growing publisher” https://www.gamesindustry.biz/articles/2019-02-21-thq-nordic-raises-usd225m-for-further-acquisitions

8th April 2020  “Embracer Group raises $164m for acquisition and expansion” https://www.gamesindustry.biz/articles/2020-04-08-embracer-group-raises-usd160m-for-acquisition-and-expansion

“Embracer Group raises $164m for acquisition and expansion” https://www.gamesindustry.biz/articles/2020-04-08-embracer-group-raises-usd160m-for-acquisition-and-expansion

“Embracer Group raises $164m for acquisition and expansion” https://www.gamesindustry.biz/articles/2020-04-08-embracer-group-raises-usd160m-for-acquisition-and-expansion

“Embracer Group raises $164m for acquisition and expansion” https://www.gamesindustry.biz/articles/2020-04-08-embracer-group-raises-usd160m-for-acquisition-and-expansion

8th October 2020  “Embracer Group issues new shares to raise money for future acquisitions” https://www.gamesindustry.biz/articles/2020-10-08-embracer-group-issues-new-shares-to-raise-money-for-future-acquisitions

“Embracer Group issues new shares to raise money for future acquisitions” https://www.gamesindustry.biz/articles/2020-10-08-embracer-group-issues-new-shares-to-raise-money-for-future-acquisitions

“Embracer Group issues new shares to raise money for future acquisitions” https://www.gamesindustry.biz/articles/2020-10-08-embracer-group-issues-new-shares-to-raise-money-for-future-acquisitions

“Embracer Group issues new shares to raise money for future acquisitions” https://www.gamesindustry.biz/articles/2020-10-08-embracer-group-issues-new-shares-to-raise-money-for-future-acquisitions

Of course, this strategy is not without risks

$EMBRAC might be over-paying for its targets, destroying shareholder value

$EMBRAC might be over-paying for its targets, destroying shareholder value

It might run into anti-trust issues at some point, constraining its growth strategy

It might run into anti-trust issues at some point, constraining its growth strategy

$EMBRAC might be over-paying for its targets, destroying shareholder value

$EMBRAC might be over-paying for its targets, destroying shareholder value It might run into anti-trust issues at some point, constraining its growth strategy

It might run into anti-trust issues at some point, constraining its growth strategy

Managing a conglomerate of acquired companies comes with its own difficulties (culture, communications, strategy, competition)

Managing a conglomerate of acquired companies comes with its own difficulties (culture, communications, strategy, competition)

But why does it work so well for $EMBRAC ?

Well, this M&A game is not specific to $EMBRAC as the whole gaming industry is growing through M&A

Well, this M&A game is not specific to $EMBRAC as the whole gaming industry is growing through M&A

Well, this M&A game is not specific to $EMBRAC as the whole gaming industry is growing through M&A

Well, this M&A game is not specific to $EMBRAC as the whole gaming industry is growing through M&A

“Total investment and M&A activity […] in April-June 2020 surpassed USD$10.5bn, representing an approximate 315% increase over the previous quarter” https://www.thegamingeconomy.com/2020/07/27/tge-index-quarterly-investment-report-q2-2020/

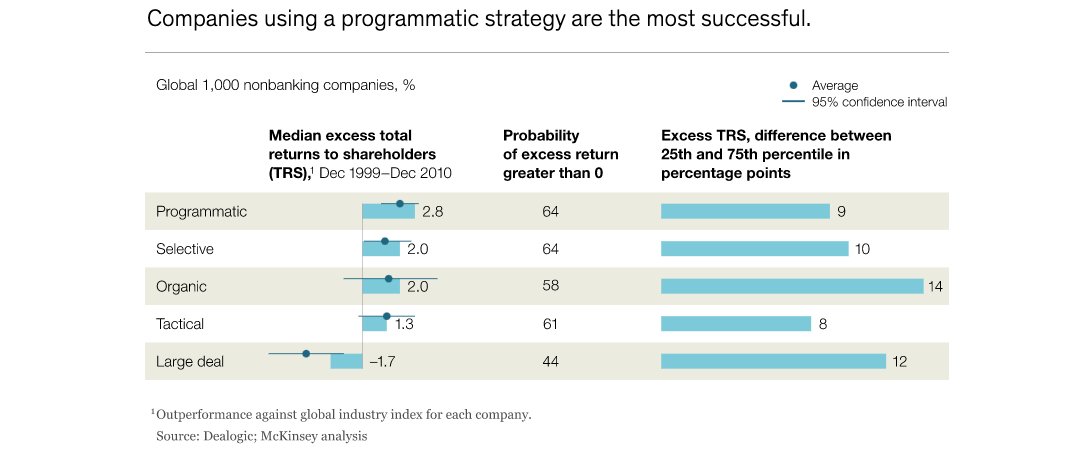

Moreover, its often reported that M&As pressure shareholder value, but this concerns the large deals according to McKinsey & Company

Moreover, its often reported that M&As pressure shareholder value, but this concerns the large deals according to McKinsey & Companyhttps://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/taking-a-longer-term-look-at-m-and-a-value-creation

When acquiring a new studio, $EMBRAC doesn’t need to merge the studio’s operations with the group’s operations

When acquiring a new studio, $EMBRAC doesn’t need to merge the studio’s operations with the group’s operations Rather, the acquired studio can stay independent and work on the games it is best at

Rather, the acquired studio can stay independent and work on the games it is best at

Here is a report on the M&A activity inside the gaming industry: https://www.taylorwessing.com/en/insights-and-events/insights/2020/07/achievement-unlocked-investment-and-ma-in-the-video-games-industry

Financials Check

Financials Check

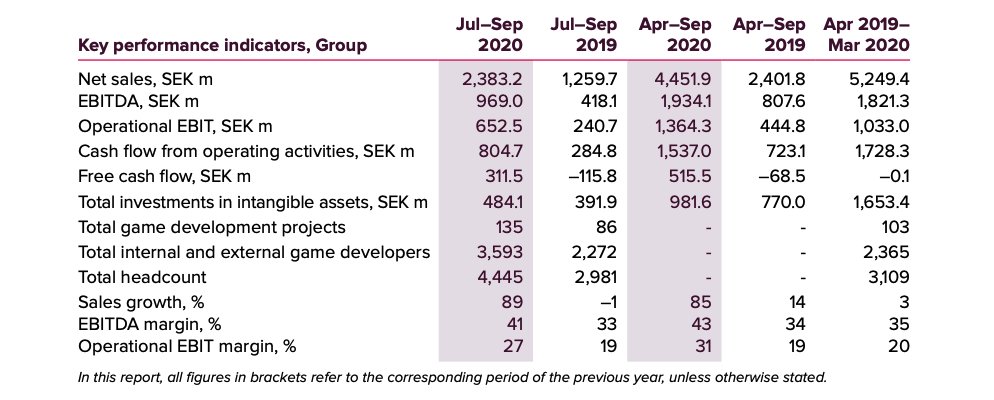

Net sales reached $ 283m in Q2 ’20 growing 89% YoY versus 81% growth in previous Q.

Net sales reached $ 283m in Q2 ’20 growing 89% YoY versus 81% growth in previous Q. Operational EBIT reached $78m in Q2 ’20 growing 171% YoY with margins at 27% versus 34% in previous Q.

Operational EBIT reached $78m in Q2 ’20 growing 171% YoY with margins at 27% versus 34% in previous Q.

It invested $52m in game development versus $ 54m in previous Q

It invested $52m in game development versus $ 54m in previous Q Company had $ 559m in cash as of Sep 30 ’20 and raised $ 690m for growth investments

Company had $ 559m in cash as of Sep 30 ’20 and raised $ 690m for growth investments

THE BOTTOM LINE

THE BOTTOM LINE

$EMBRAC is a fast growing game publisher, funding its aggressive M&A strategy by issuing shares

$EMBRAC is a fast growing game publisher, funding its aggressive M&A strategy by issuing shares The gaming market is well suited to an M&A strategy as the acquirer can let the target company prosper independently, reducing the merger-related risks

The gaming market is well suited to an M&A strategy as the acquirer can let the target company prosper independently, reducing the merger-related risks

The video game market is not loosing steam and constantly growing as innovations (new gaming consoles, 5G, streaming, cloud eSports) push the industry forward

The video game market is not loosing steam and constantly growing as innovations (new gaming consoles, 5G, streaming, cloud eSports) push the industry forward

$EMBRAC is growing at 89% YoY and already profitable - In the longer run, the company might be able to stop issuing shares and self-fund its acquisitions

$EMBRAC is growing at 89% YoY and already profitable - In the longer run, the company might be able to stop issuing shares and self-fund its acquisitions $EMBRAC ’s M&A strategy might come under anti-trust pressure as the company grows

$EMBRAC ’s M&A strategy might come under anti-trust pressure as the company grows

Disclaimer - This is not investment advice in any form and investors are responsible for conducting their own research before investing.

Sources

✑ Investor presentation

✑ Company website

✑ Reuters

✑ Statista

Sources

✑ Investor presentation

✑ Company website

✑ Reuters

✑ Statista

✑ Mordor Intelligence

✑ Global Data

✑ Venture Beat

✑ Game Economy

✑ Gaming Industry

✑ Global Data

✑ Venture Beat

✑ Game Economy

✑ Gaming Industry

Hope you liked this thread!

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

Read on Twitter

Read on Twitter