How do you develop a plan to reach a goal?

Whether that goal be to:

> retire comfortably

> go on a vacation

> buy a home

> remodel a kitchen

//THREAD//

Whether that goal be to:

> retire comfortably

> go on a vacation

> buy a home

> remodel a kitchen

//THREAD//

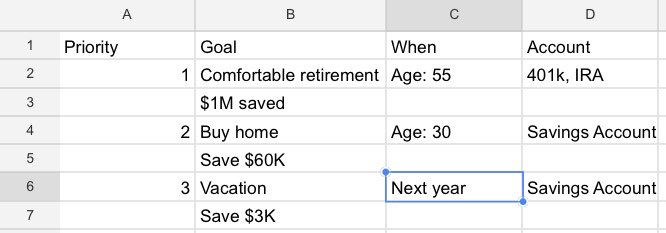

Step one: Keep it Simple

Create a table with

> a list of your goals

> put them in a prioritize list

> set a deadline of when you want to accomplish the goal

> name of account funding your goal

It doesn’t need to be accurate. Write it down, improve on it later.

Example:

Create a table with

> a list of your goals

> put them in a prioritize list

> set a deadline of when you want to accomplish the goal

> name of account funding your goal

It doesn’t need to be accurate. Write it down, improve on it later.

Example:

The goal of the above exercise is to personalize your short and long term wants.

By placing guesstimates you’ve subconsciously started the process of wanting to improve your numbers.

You’ll start looking for ways to pinpoint what you’ll truly need.

By placing guesstimates you’ve subconsciously started the process of wanting to improve your numbers.

You’ll start looking for ways to pinpoint what you’ll truly need.

Step 2: Improve the estimates

Typically the shorter term the goal is, the more accurate an estimate can be.

Example: Vacation

To improve an estimate I could look at costs for:

> flight

> lodging

> transportation

> food

> entertainment

This should provide a good picture.

Typically the shorter term the goal is, the more accurate an estimate can be.

Example: Vacation

To improve an estimate I could look at costs for:

> flight

> lodging

> transportation

> food

> entertainment

This should provide a good picture.

What about retirement?

Considerations for retiring include:

> how much do I need saved?

> how to invest my savings?

> access to a pension?

> when to start social security?

> how do I handle risk?

Considerations for retiring include:

> how much do I need saved?

> how to invest my savings?

> access to a pension?

> when to start social security?

> how do I handle risk?

Step 3: Prioritize your buckets

Each bucket will hold

>needs

>wants

>wishes

Examples within each bucket

Need :

:

>food

>mortgage/rent

>healthcare

>taxes

Want :

:

>vacations

>dining out

>entertainment

Wish :

:

> philanthropy

>leaving an inheritance

Each bucket will hold

>needs

>wants

>wishes

Examples within each bucket

Need

:

:>food

>mortgage/rent

>healthcare

>taxes

Want

:

:>vacations

>dining out

>entertainment

Wish

:

:> philanthropy

>leaving an inheritance

Step 4: Matching Risk to Bucket

The objective is to have your safest investments ensure payment of the need and riskier investments fund your wants

and riskier investments fund your wants  & wish

& wish  .

.

You never know when the market will crash and mitigating risk is critical to ensuring a comfortable retirement.

The objective is to have your safest investments ensure payment of the need

and riskier investments fund your wants

and riskier investments fund your wants  & wish

& wish  .

.You never know when the market will crash and mitigating risk is critical to ensuring a comfortable retirement.

Example:

John decides he needs $80K a year for retirement.

Within that 80K, he determines he needs $50K for his needs , $25K for his wants

, $25K for his wants  and $5K for his wish

and $5K for his wish

The $50K can be funded by a combination of social security, pensions, selling of low risk bonds.

John decides he needs $80K a year for retirement.

Within that 80K, he determines he needs $50K for his needs

, $25K for his wants

, $25K for his wants  and $5K for his wish

and $5K for his wish

The $50K can be funded by a combination of social security, pensions, selling of low risk bonds.

The $30K  & $5K

& $5K can be funded by a combination of IRA, 401k holdings & real estate.

can be funded by a combination of IRA, 401k holdings & real estate.

The objective is to turn your retirement savings into monthly income.

This is why fund allocation is so important in your retirement accounts as you get closer to retiring.

& $5K

& $5K can be funded by a combination of IRA, 401k holdings & real estate.

can be funded by a combination of IRA, 401k holdings & real estate.The objective is to turn your retirement savings into monthly income.

This is why fund allocation is so important in your retirement accounts as you get closer to retiring.

Why should you care about all this? Because what you want is to mitigate the risks that lie ahead when you retire.

Such as

>out living your money

>stock market volatility

>inflation

Such as

>out living your money

>stock market volatility

>inflation

This isn’t a one-time goal creation.

Your goals, wants and desires will change.

Adjusting every year gives you a direction to follow.

The closer you get to the when date, the easier things will be to estimate.

Your goals, wants and desires will change.

Adjusting every year gives you a direction to follow.

The closer you get to the when date, the easier things will be to estimate.

If you found this thread helpful, you’ll definitely find my book right up your alley.

It has everything you’ll need to know about your 401k and how to optimize it for your goals. https://upshotwealth.com/products/the-ins-outs-of-maximizing-your-401k-ebook

It has everything you’ll need to know about your 401k and how to optimize it for your goals. https://upshotwealth.com/products/the-ins-outs-of-maximizing-your-401k-ebook

Read on Twitter

Read on Twitter