$FEAC $SKLZ - The future of Esports for everyone

With the merger vote of $FEAC and $SKLZ finalized today thought I’d shares my thoughts on @skillz

Plus I need every opportunity to use this gif before $FEAC ticker is retired

Thread

With the merger vote of $FEAC and $SKLZ finalized today thought I’d shares my thoughts on @skillz

Plus I need every opportunity to use this gif before $FEAC ticker is retired

Thread

$SKLZ is a mobile gaming platform that enables game developers to monetize through competition. Skillz powered games allows player to compete for cash and prizes, whether that be head to head, in bracketed tournaments or massive live events.

$SKLZ was founded by CEO Andrew Paradise (Top 5 CEO name) and CRO Casey Chafkin in 2012.

Paradise states that he created Skillz because as a gamer he was frustrated by the industry standard for video game monetization, which is disruptive ads and in app purchases (pay to win).

Paradise states that he created Skillz because as a gamer he was frustrated by the industry standard for video game monetization, which is disruptive ads and in app purchases (pay to win).

They founded the company going after the mobile game space which in 2012 was only an 8B market compared to the 64B beast it is now. This shows the vision they had even back then. Management frequently references their 100 year plan which is unheard of to me is the type of long..

term thinkers I want running the companies I invest in.

Paradise started and sold 2 other companies before $SKLZ, 1 he sold to @Intuit where served as a director before $SKLZ. In a recent interview Paradise said that he has sold companies in the past but would not sell $SKLZ.

Paradise started and sold 2 other companies before $SKLZ, 1 he sold to @Intuit where served as a director before $SKLZ. In a recent interview Paradise said that he has sold companies in the past but would not sell $SKLZ.

$SKLZ is trying to bring Esports to everyone through fair, fun and meaningful competition.

We often see professional Esports players competing in massive live competitions but those are less than 1% of gamers. $SKLZ is targeting the other 99%. Think casual Esports.

We often see professional Esports players competing in massive live competitions but those are less than 1% of gamers. $SKLZ is targeting the other 99%. Think casual Esports.

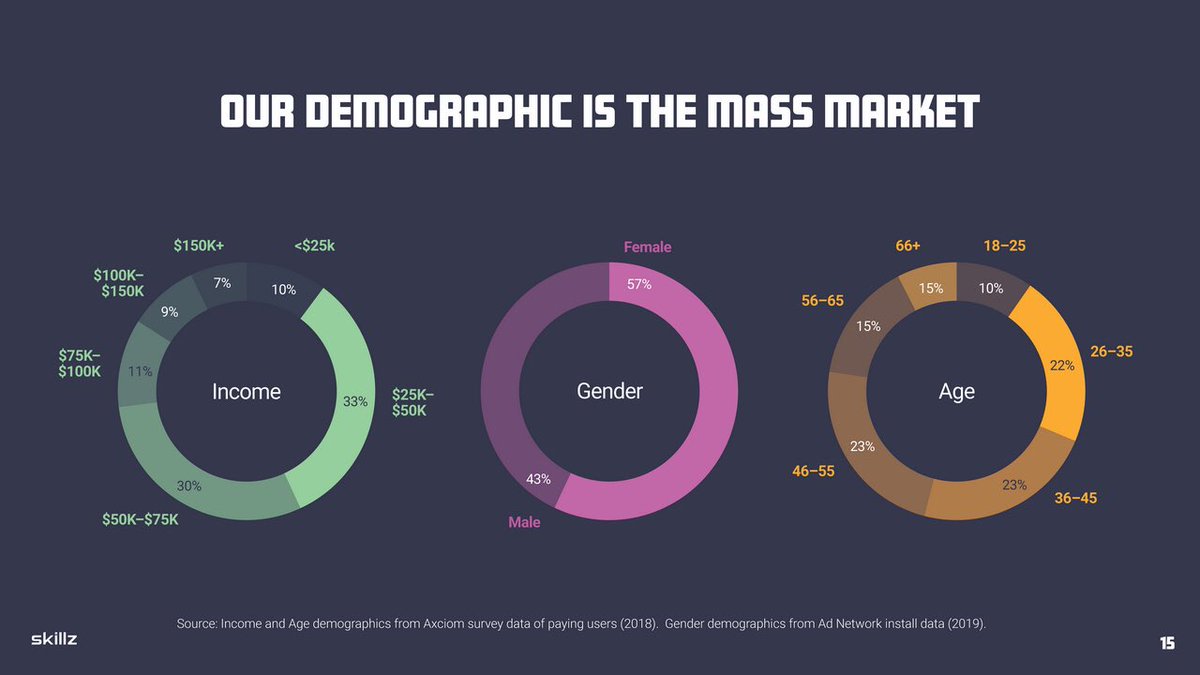

One look at their demographics and its easy to see that they really meant Esports for everyone! Boy or girl, young or old, poor or rich. @skillz powered games are for everyone!

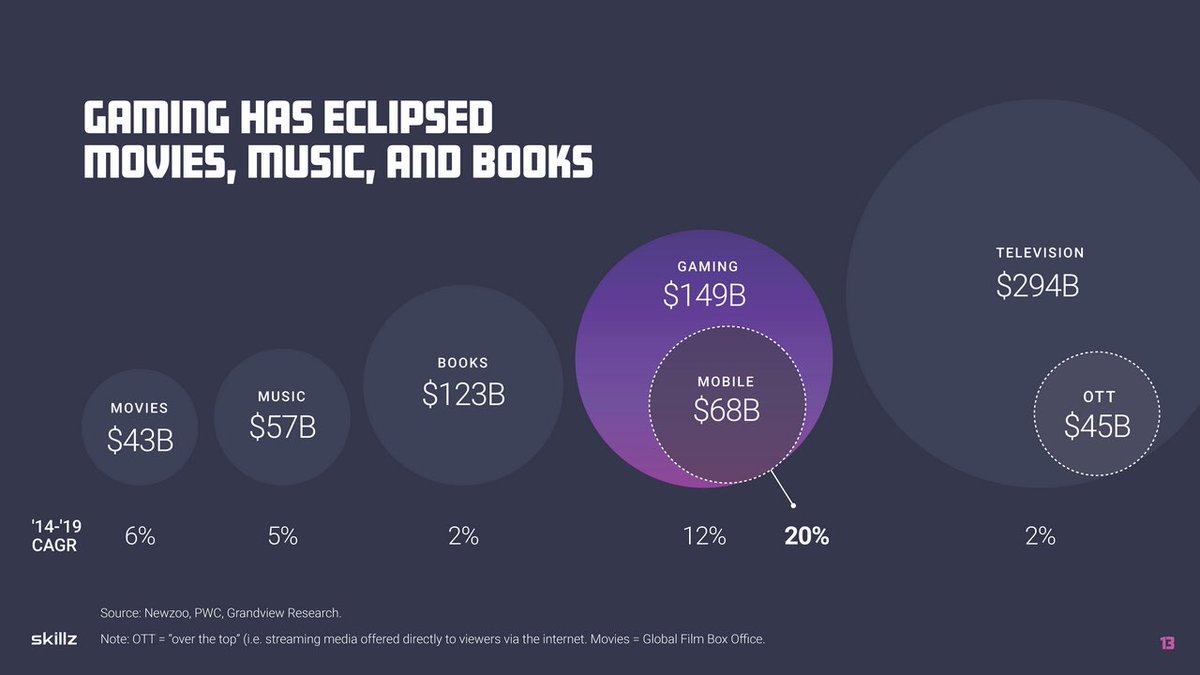

Gaming is one of the fastest growing entertainment industries and Mobile is becoming one of its largest segments standing at 68B at the end of 2019 and is projected to grow to 150B by 2025.

Developers

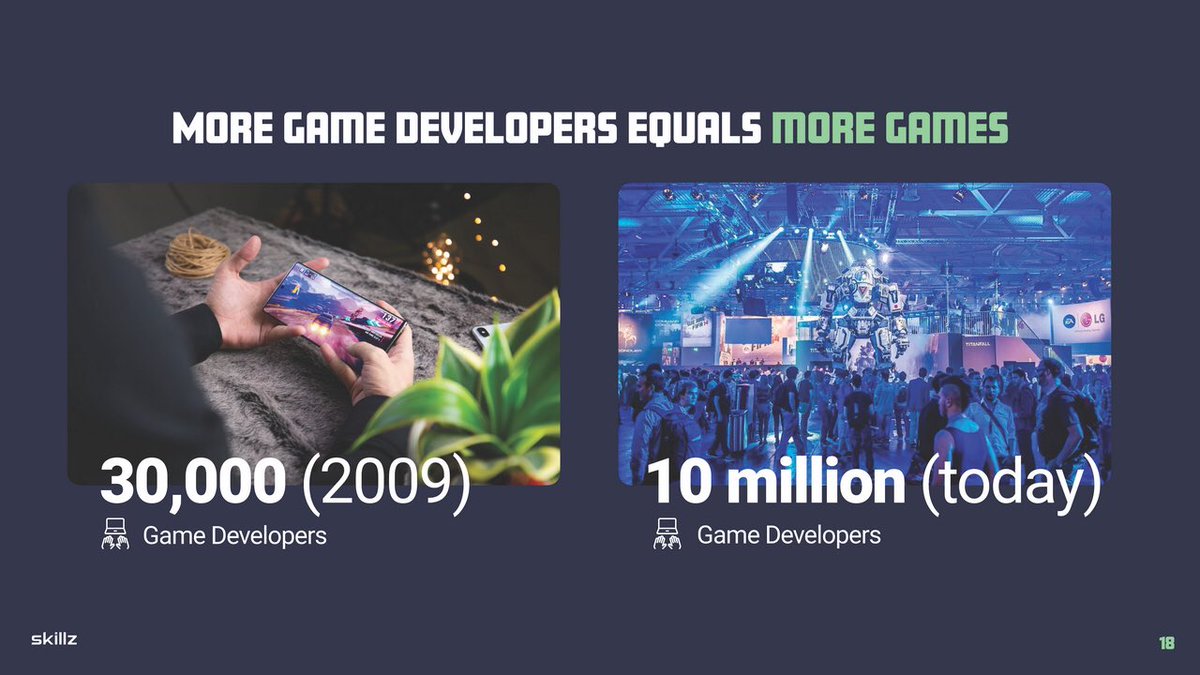

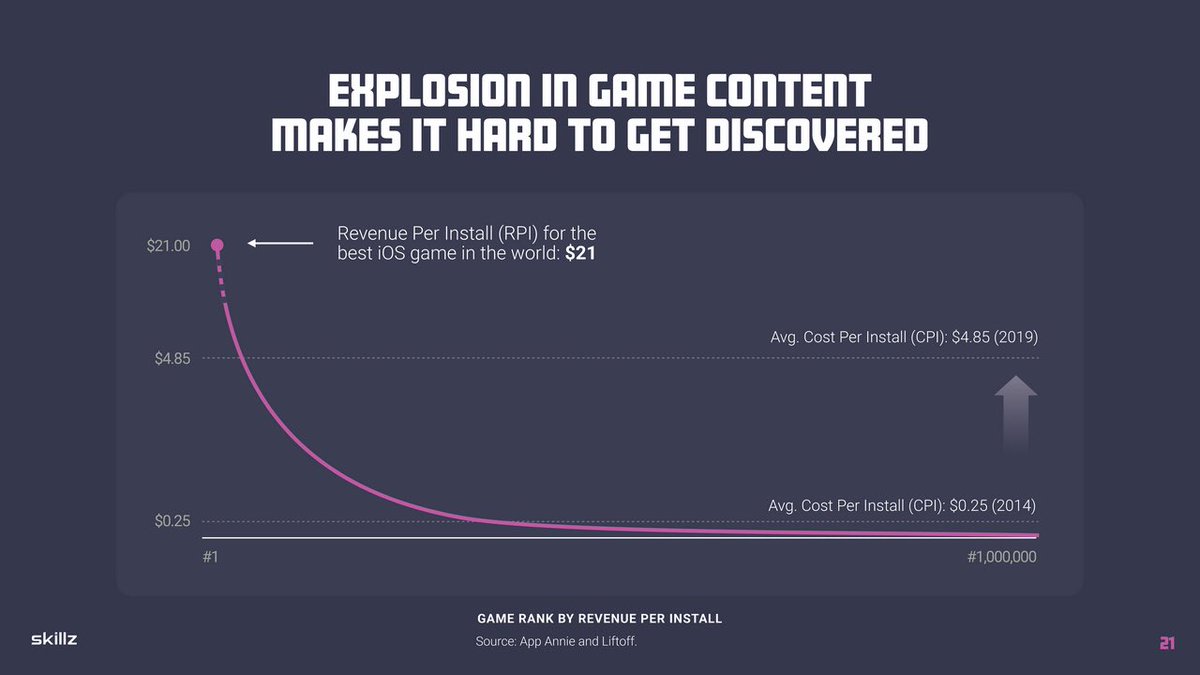

The number of developers has skyrocketed in the last decade which has lead to an explosion in the number of games. As a result it has become harder for small to medium sized developers to get their games noticed, making monetizing them difficult. The average cost...

The number of developers has skyrocketed in the last decade which has lead to an explosion in the number of games. As a result it has become harder for small to medium sized developers to get their games noticed, making monetizing them difficult. The average cost...

per install continues to climb and the pay off remains unchanged. $SKLZ offers developers an alternate avenue for monetizing their games through competition. This allows the developer to focus on making a great game instead of the unit economics.

$SKLZ understands that video games is a hit driven industry and that creating an attractive platform to developers, especially the small to medium sized ones is key. The CEO stated in an interview that 8 out of the top 10 games of the last decade have come from small developers.

Moat

The moat for $SKLZ is their data science. They have 58 pending patents on technology that enables them to detect fraud and cheating, superior matchmaking and rating systems for fair and balanced competition. Their priority from day one has been the trust of their players.

The moat for $SKLZ is their data science. They have 58 pending patents on technology that enables them to detect fraud and cheating, superior matchmaking and rating systems for fair and balanced competition. Their priority from day one has been the trust of their players.

As for competition both $AMZN and $SNE have both attempted, in addition to over 50 venture backed startups over the years. None have been able to replicate the success of $SKLZ. $AMZN and $SNE have since bowed out of this space.

Merger

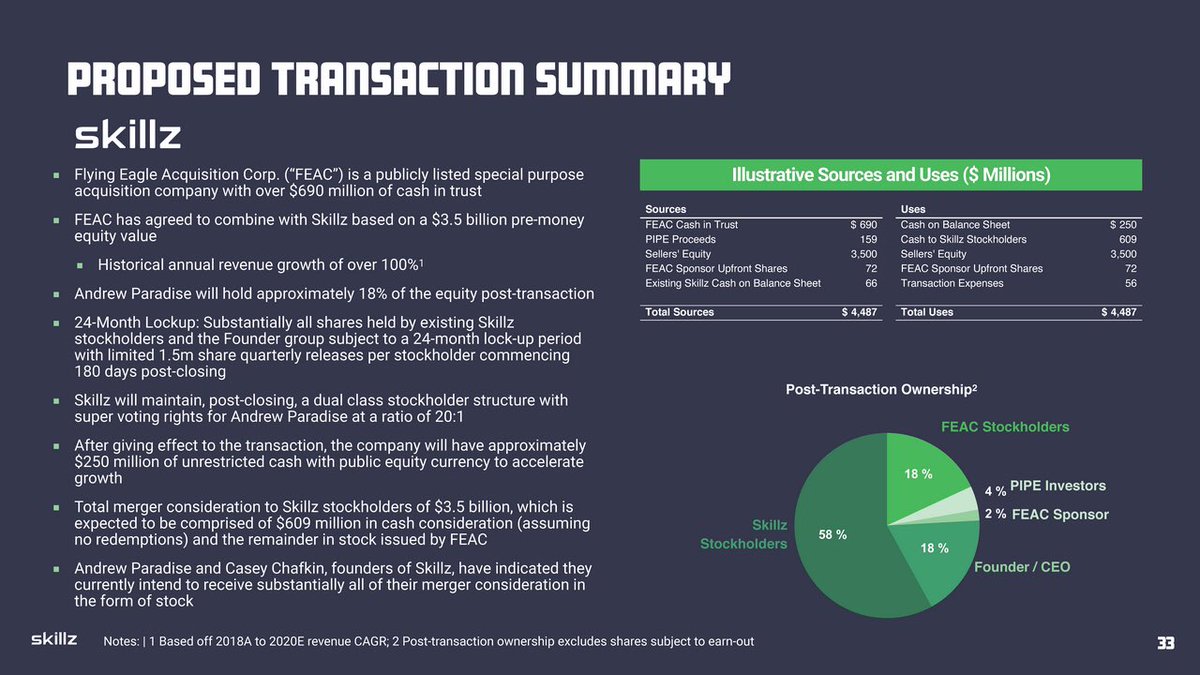

$SKLZ is merging with $FEAC which is the same team behind the $DKNG merger.

24 month lock-up period on shares held by existing Skillz stockholders and founders (That’s long)

CEO will own 18% of the company

Both founders will take most of their merger comps in shares

$SKLZ is merging with $FEAC which is the same team behind the $DKNG merger.

24 month lock-up period on shares held by existing Skillz stockholders and founders (That’s long)

CEO will own 18% of the company

Both founders will take most of their merger comps in shares

Growth drivers

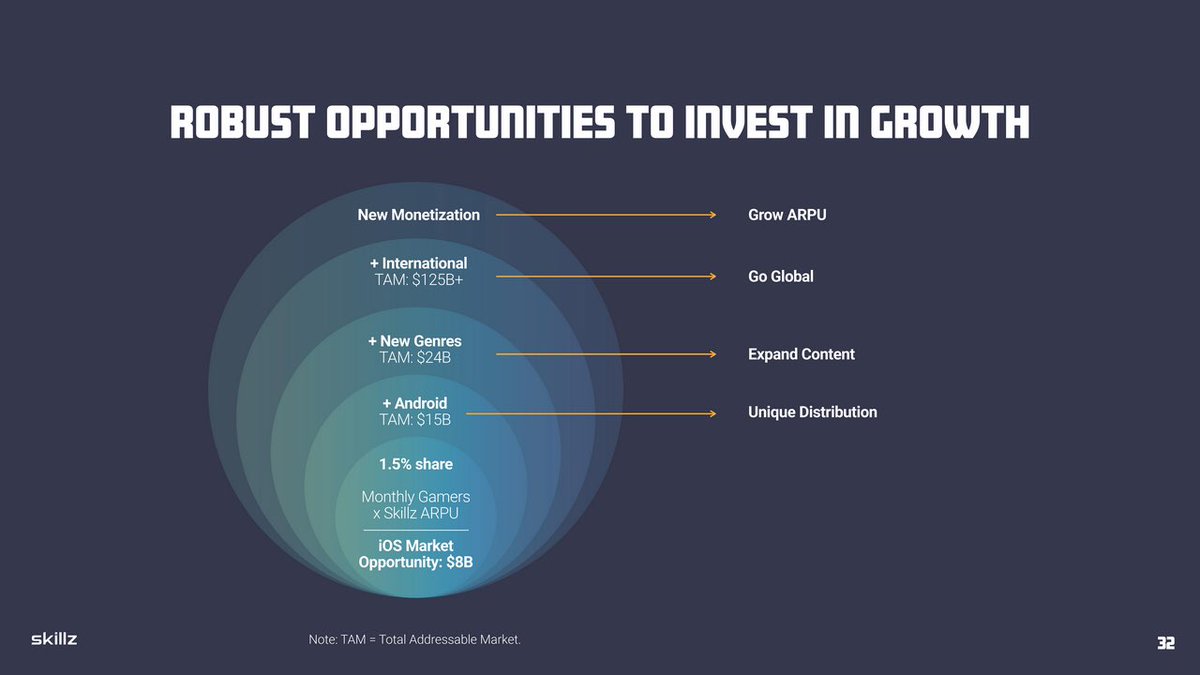

Along this 100 plan management has they have many growth levers they can pull:

- Android

- Different genres

- International

- New forms of monetization

Below I’ll discuss some of these further.

Along this 100 plan management has they have many growth levers they can pull:

- Android

- Different genres

- International

- New forms of monetization

Below I’ll discuss some of these further.

Android

Currently 90% of revenue is from IOS as Google play stir does not allow games with in game wagering. In spite of this Android revenue is growing 2x faster this means that users are seeking out $SKLZ powered games through either direct download or lesser known app stores

Currently 90% of revenue is from IOS as Google play stir does not allow games with in game wagering. In spite of this Android revenue is growing 2x faster this means that users are seeking out $SKLZ powered games through either direct download or lesser known app stores

International

Currently 90% of revenue is from the US. International is 4X the US market and $SKLZ has barely started to tap into that.

$SKLZ just recently announced their intentions to move into India in 2021. India has 300M smartphone users and a massive 1.2B population...

Currently 90% of revenue is from the US. International is 4X the US market and $SKLZ has barely started to tap into that.

$SKLZ just recently announced their intentions to move into India in 2021. India has 300M smartphone users and a massive 1.2B population...

for that number of smart phone users to grow that much larger. Not only that but average annual income in India is growing more rapidly than the US, like many developing nations which should provide them with more disposable income.

Brand sponsored Sponsorships are another big growth driver at least on the profitability side. Brands can sponsor a tournament and put up a portion of the prize pool which is $SKLZ ‘s biggest expense. If a brand put up say 10% of the prize pool take rate goes from 14% to 24%.

The Numbers

2020E

GMV 1.56B

Rev $225M (+88% yoy)

Take rate 14%

Adj EBITDA -$47M

MAU - 2.6M

2019 ARPU $6.30

2019 62 minutes/user/day

2021E

GMV 2.52B

Rev $366M (+62.3% yoy)

Take rate 15%

Adj EBITDA -$14M

2022E

GMV 3.79B

Rev $555M (+62.3% yoy)

Take rate 15%

Adj EBITDA $8M

2020E

GMV 1.56B

Rev $225M (+88% yoy)

Take rate 14%

Adj EBITDA -$47M

MAU - 2.6M

2019 ARPU $6.30

2019 62 minutes/user/day

2021E

GMV 2.52B

Rev $366M (+62.3% yoy)

Take rate 15%

Adj EBITDA -$14M

2022E

GMV 3.79B

Rev $555M (+62.3% yoy)

Take rate 15%

Adj EBITDA $8M

To start the 62 min/user/day metric is very impressive especially when comparing it to other apps.

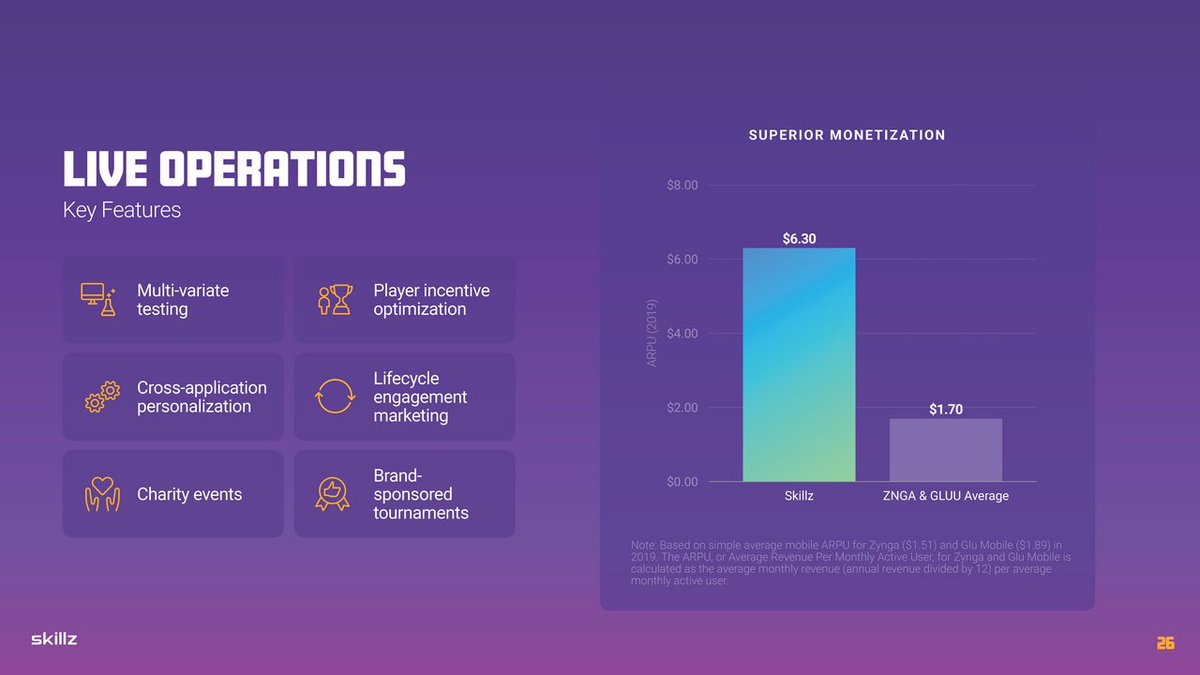

ARPU of $6.30 shows the value of monetization via competition compared to $ZNGA and $GLUU.

ARPU of $6.30 shows the value of monetization via competition compared to $ZNGA and $GLUU.

The revenue growth looks strong but what really makes me bullish is that their projections are only factoring in current geographies, current games and current distribution channels. That means that India and recently soft launched Tetris are not factored in to 2021 and 2022...

estimates. That also means that if $SKLZ has a hit game in the next few years that won’t be factored. I like when a company is conservative with their projections. It gives them some wiggle room on the downside and able to adjust each quarter.

In conclusion, I think that $SKLZ has a massive growth runway, a lot larger than people think it the current projections that they are currently stating will look small a few years down the road. If they can continue to focus on providing tools for the developer and maintaining..

the positive competitive experience for the players the sky is the limit there are so many avenues for growth and very little competition in sight in their niche. With the vote passed and the ticker change imminent we will send off $FEAC with its official GIF.

Special shoutout to

@saxena_puru for putting me on to $FEAC back in October

@AnthonyOhayon and @AviNMash for hitting $FEAC with a pound which gave me the push to add more.

which gave me the push to add more.

@EsportsEnigmist great gaming posts and info including $FEAC and valuation, under followed

@saxena_puru for putting me on to $FEAC back in October

@AnthonyOhayon and @AviNMash for hitting $FEAC with a pound

which gave me the push to add more.

which gave me the push to add more.@EsportsEnigmist great gaming posts and info including $FEAC and valuation, under followed

Also if you haven’t watched/listened to the CEOs interviews at the TMT conferences for both @WellsFargo and @UBS you are missing out. Provides a lot of info on the future of @skillz including the future of their role in competition outside of video games  will be a great 100 yr

will be a great 100 yr

will be a great 100 yr

will be a great 100 yr

Read on Twitter

Read on Twitter