The Treasury designating Vietnam a currency manipulator is the epitome of everything that is wrong with the entire concept. Treasury may well have been implementing the law correctly so this is as much a complaint about the law as anything. THREAD follows. https://home.treasury.gov/system/files/206/December-2020-FX-Report-FINAL.pdf

As background: the law is meant to flag and confront countries that "manipulate" their exchange rates in order to gain unfair competitive advantages in international trade, that is to weaken their exchange rates to boost their exports.

Two general problems with this:

1. All monetary policy affects exchanges rates & trade. When are these fair & when unfair? When we cut rates it weakens dollar & boosts exports, is that wrong?

2. "Manipulation" = fixed exchange rate, a reasonable choice for many countries.

1. All monetary policy affects exchanges rates & trade. When are these fair & when unfair? When we cut rates it weakens dollar & boosts exports, is that wrong?

2. "Manipulation" = fixed exchange rate, a reasonable choice for many countries.

And now some facts on Vietnam in particular:

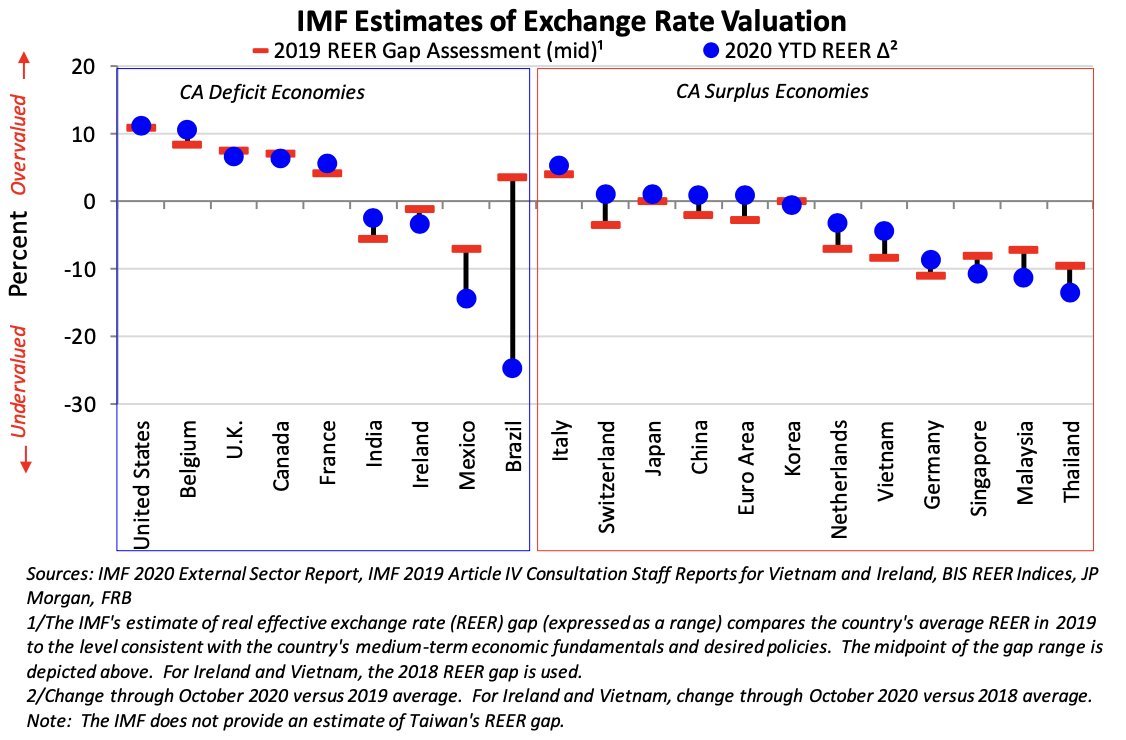

It largely fixes its exchange rate to the US dollar. As the dollar has appreciated this has meant the Vietnamese dong has appreciated with it. The Treasury even shows this in their report (blue dot above red bar).

It largely fixes its exchange rate to the US dollar. As the dollar has appreciated this has meant the Vietnamese dong has appreciated with it. The Treasury even shows this in their report (blue dot above red bar).

The IMF estimated that Vietnam was slightly undervalued in 2018 (when they last did this) and this undervaluation seems to have fallen since then. But these models are very fragile and about half the countries in the world are similarly undervalued according to them.

The IMF's latest World Economic Outlook projects that Vietnam's current account surplus will be 1.2% in 2020 and 1.7% in 2021. These are both relatively small--and are *down* from the 3.4% surplus in 2019. (Of course it should be down given their relative economic strength.)

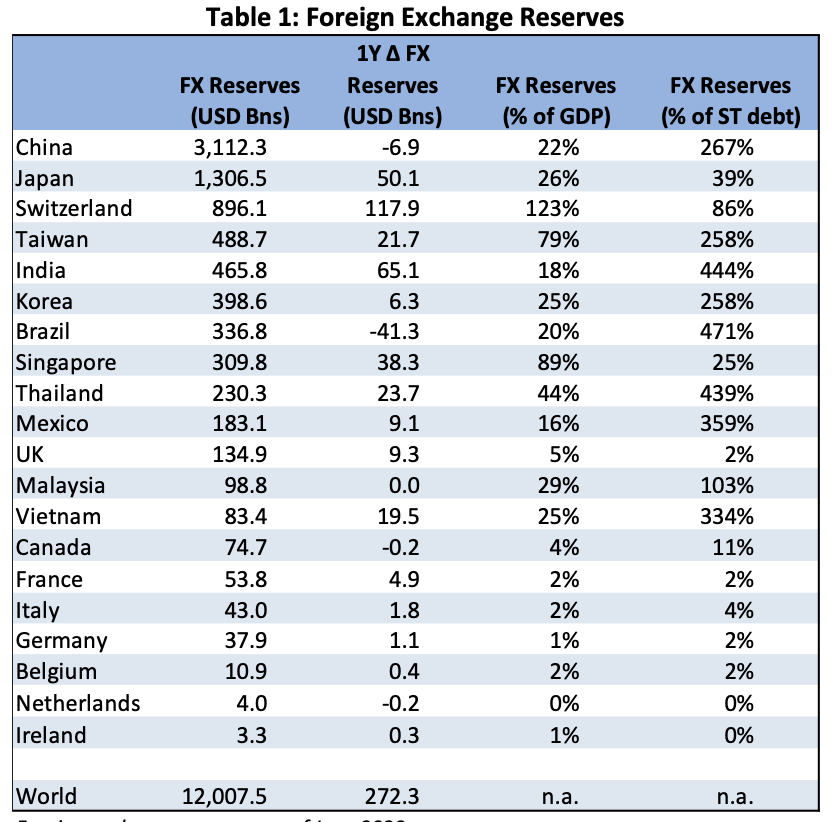

Vietnam has accumulated a lot of reserves in the last year (buying dollars weakens their exchange rate), but its reserves were low to being with and are now only 25% of GDP, hardly unusual for an emerging economy.

Why do I care? Vietnam's economy is 1% the size of the U.S. economy. Even if they were "manipulating" their exchange rate it would have a tiny impact on our economy (and one could debate the sign of that impact). This distracts from bigger issues with Vietnam and the region.

And more generally, if the United States is worried about its exchange rate and current account balance (and I'm not sure we should worry), the real solutions are to found in our domestic policies not in distracting ourself into trying to change policies everywhere else.

Read on Twitter

Read on Twitter