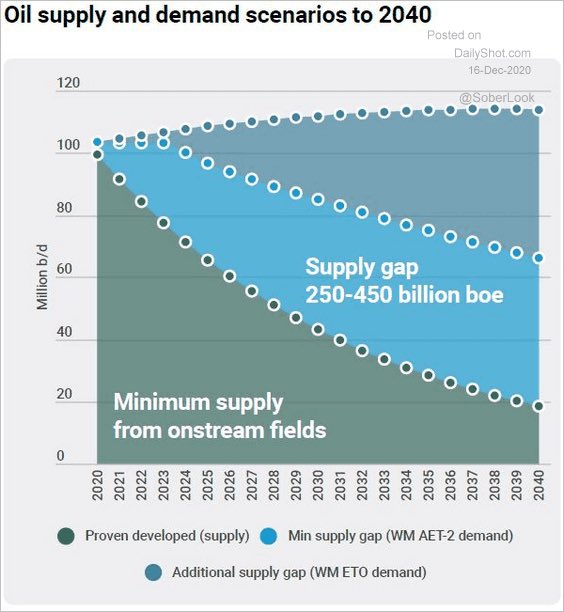

This looming gap between supply/demand for oil- not that dissimilar for Uranium (supply 120m, D 180m lb) will lead to a sea change in the investment climate. 1. This gap will not be closed quickly given Wall ST renowned focus on FCF so no one will quickly reinvest capex. Instead

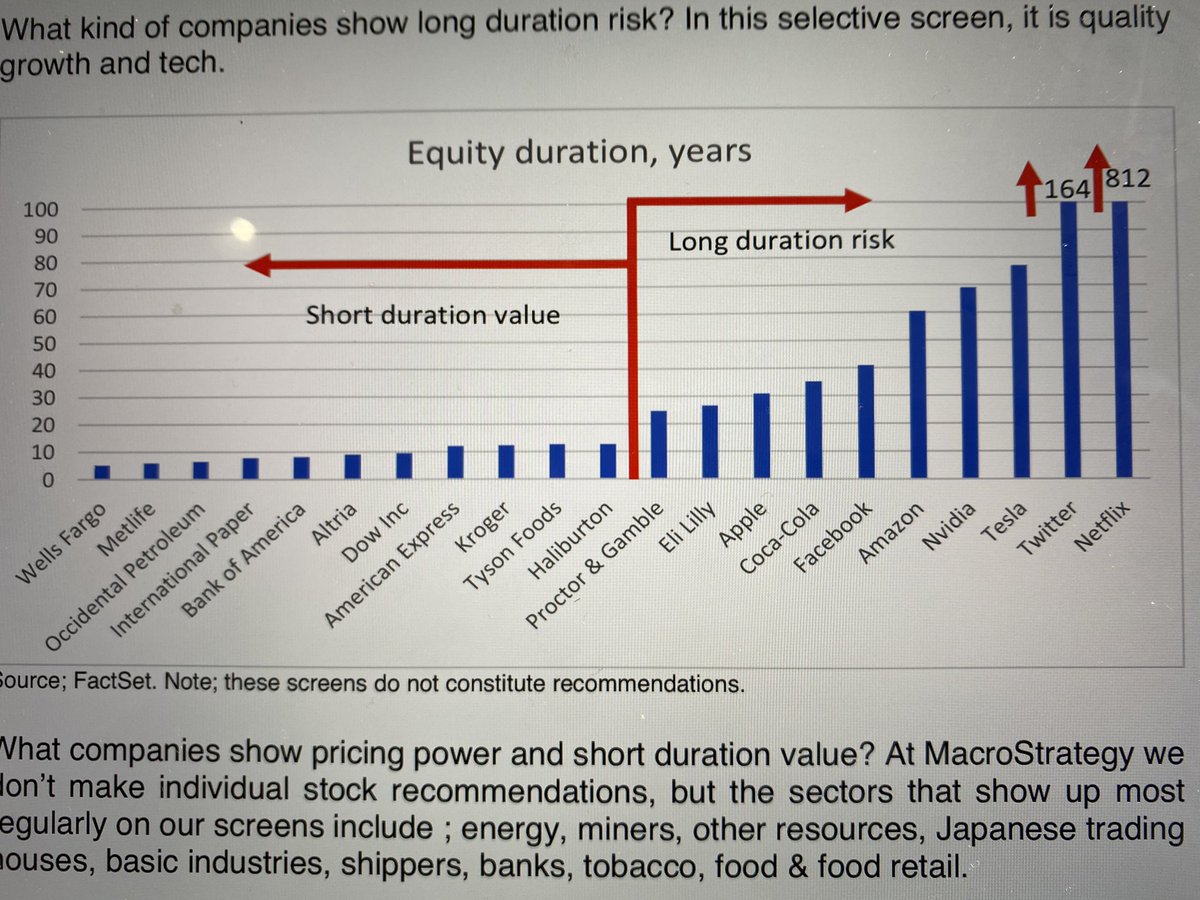

There will be a focus on debt reduction. On the $AR conf call last week when asked mgmt said any gas spike will not lead to new production. Vicky at $oxy said the same. Thus, i expect a pick up in inflation, leading to a sea change in the investment climate as long duration

Assets (tech, bonds) get destroyed vs short duration assets (commodities). The last 2 mos have been amazing with some names like $oxy, $pdn up 100%. But this is nothing as many are still down 90-95%. You will know were close to an end when a Real Vision Poll

See my tweet yesterday- lists Uranium/Energy as the majority pick. Right now consensus is Crypto Crypto Crypto/ cannabis, tech and then Precious metals/ EM. Only 1 respondent listed a 2% allocation to Uranium and just a few mentioned energy (most to green energy). Were still

At the beginning of a long and profitable journey. Just make sure your assets are on the Left hand side of the chart not the Right because any spike in rates will lead to a pin pricking an overcooked bubble (snow 200x sales, Tesla 1100x “fake-regulated credit” earnings etc)

Read on Twitter

Read on Twitter