1/ Demystifying UNI’s transactional moat and $SUSHI

As of today, $UNI is still heads n shoulders above the comp despite no LP. People are perplexed. Some investors reason it to better rep, TVL, or bonding mechanism.

BUT WHAT IS IT REALLY? Hear me out.

TL:DR: both can do well

As of today, $UNI is still heads n shoulders above the comp despite no LP. People are perplexed. Some investors reason it to better rep, TVL, or bonding mechanism.

BUT WHAT IS IT REALLY? Hear me out.

TL:DR: both can do well

2/ Moat #1: $UNI and $SUSHI can both list tokens that centralised exchanges cannot.

Permissionless listings allow new farm and rebase tokens to list quickly and opportunists to ape in.

Tokens that have the largest delta are usually new listings, which generates vol and fees.

Permissionless listings allow new farm and rebase tokens to list quickly and opportunists to ape in.

Tokens that have the largest delta are usually new listings, which generates vol and fees.

3/ Moat #2: Liquidity provisions and LP tokens

Liquidity provisions in $UNI and $SUSHI returns an LP token collateral that can be re-staked or restructured into other farm/collaterals protocol.

This is something that CEX or aggregators do not provide.

Liquidity provisions in $UNI and $SUSHI returns an LP token collateral that can be re-staked or restructured into other farm/collaterals protocol.

This is something that CEX or aggregators do not provide.

3b/ On this point, $SUSHI is incentivising low cap farm/new projects to list on Sushiswap through the ONSEN program. $BOR $BADGER

More shifts maybe?

More shifts maybe?

4/ Moat #3: Rebase tokens listings

Rebase tokens are perceived poor R/R for CEX due to potential nuisances.

Fluctuating balances means accting will be tricky.

Angry retail cust will prob rage at ‘helpdesk’ on why their tokens are disappearing from wallets – bad PR too.

– bad PR too.

Rebase tokens are perceived poor R/R for CEX due to potential nuisances.

Fluctuating balances means accting will be tricky.

Angry retail cust will prob rage at ‘helpdesk’ on why their tokens are disappearing from wallets

– bad PR too.

– bad PR too.

4b/ On this point, $SUSHI is incentivising rebase projects to list on Sushiswap through the ONSEN program. $AMPL $ESD

More shifts maybe?

More shifts maybe?

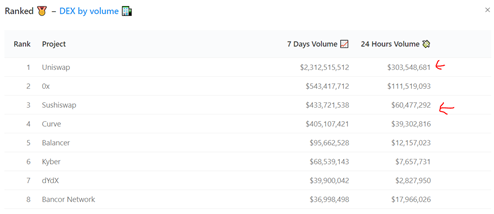

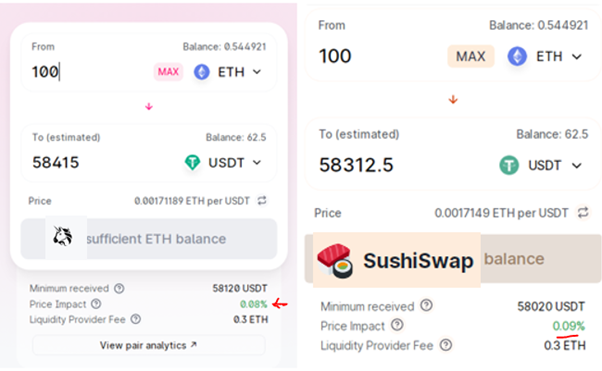

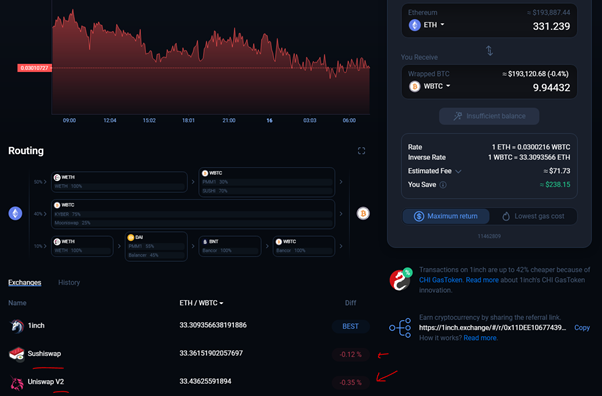

5/ Moat #4: Low trans fee and slippage among other DEX

Low trans fees and slippages means that aggregators will prioritise $UNI and now $SUSHI.

Transaction fees and slippages for both DEXs same now.

$SUSHI can only get better as it integrates more closely with YFI ecosystem

Low trans fees and slippages means that aggregators will prioritise $UNI and now $SUSHI.

Transaction fees and slippages for both DEXs same now.

$SUSHI can only get better as it integrates more closely with YFI ecosystem

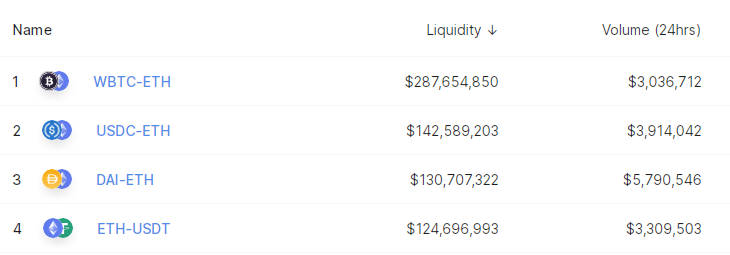

6/ Second order effects of new listings

New listings generally start with 1 listing pair due to liq constrains. Eg. Coin/ETH pair.

This means that for investors who wants to buy into the tokens using stables/btc, they need to make 2 jumps. USDT->ETH, ETH-> coin.

New listings generally start with 1 listing pair due to liq constrains. Eg. Coin/ETH pair.

This means that for investors who wants to buy into the tokens using stables/btc, they need to make 2 jumps. USDT->ETH, ETH-> coin.

6b/ This design generates cumulative demand and fees for any transactions. Of course, multiplier effect could be lifted easily over to $SUSHI, as new tokens shift through ONSEN.

7/ So what’s ONSEN again?

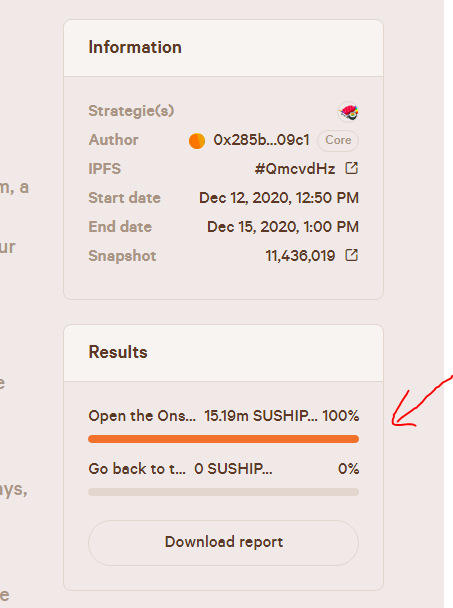

Onsen is a new liquidity mining incentivisation program by $SUSHI specially designed to incubate new and small cap projects.

Onsen is a new liquidity mining incentivisation program by $SUSHI specially designed to incubate new and small cap projects.

7b/ Through this initiative, tokens pairs will be able to enjoy joint liquidity mining or extra mining rewards (for new tokens), apart from regular mining rewards.

Onsen has been passed the community snapshot vote and will be coming online soon.

Onsen has been passed the community snapshot vote and will be coming online soon.

Read on Twitter

Read on Twitter