1/ My portfolio has had a GREAT year. And I know many of you have had even better years. That's awesome!

But I can't expect these types of annual returns, or even half these returns. Or a quarter!

This is a marathon that will see LONG periods of sideway movements and retreats. https://twitter.com/InvestmentTalkk/status/1338838080497836034

But I can't expect these types of annual returns, or even half these returns. Or a quarter!

This is a marathon that will see LONG periods of sideway movements and retreats. https://twitter.com/InvestmentTalkk/status/1338838080497836034

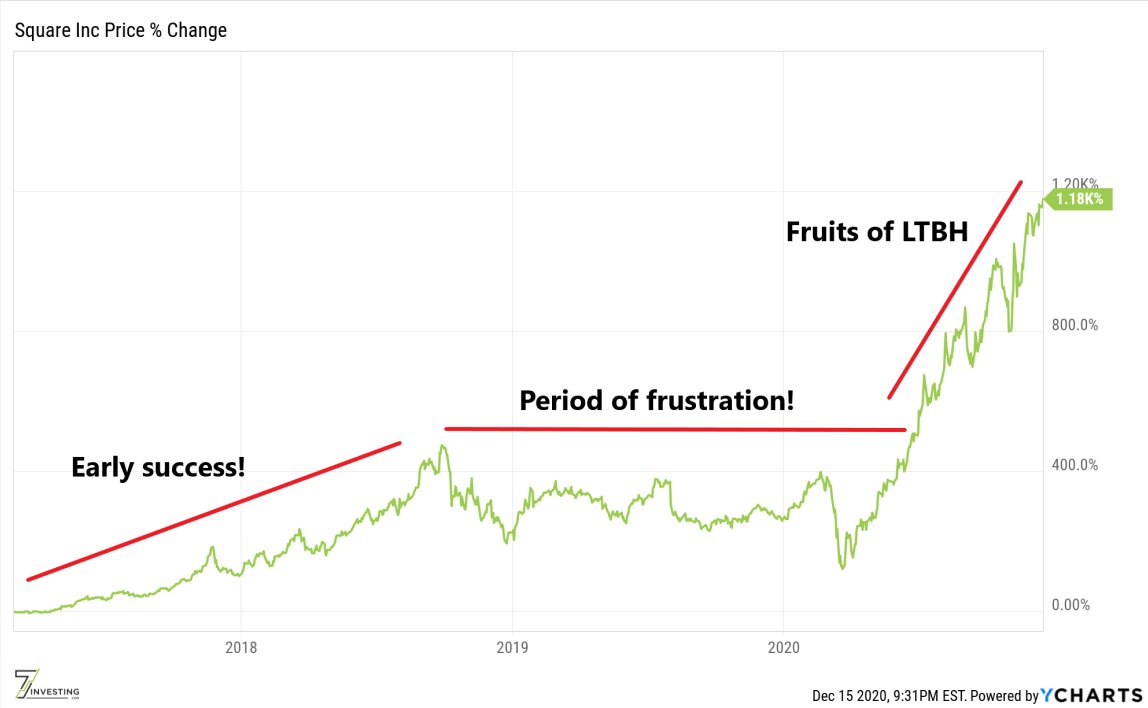

2/ I've been long $SQ for almost 4 years. My first purchase was about $20. And it's a 10-bagger in that time. Yet I probably spent half of those 4 years frustrated and saw many fellow shareholders bail.

Why? Let me show you...

Why? Let me show you...

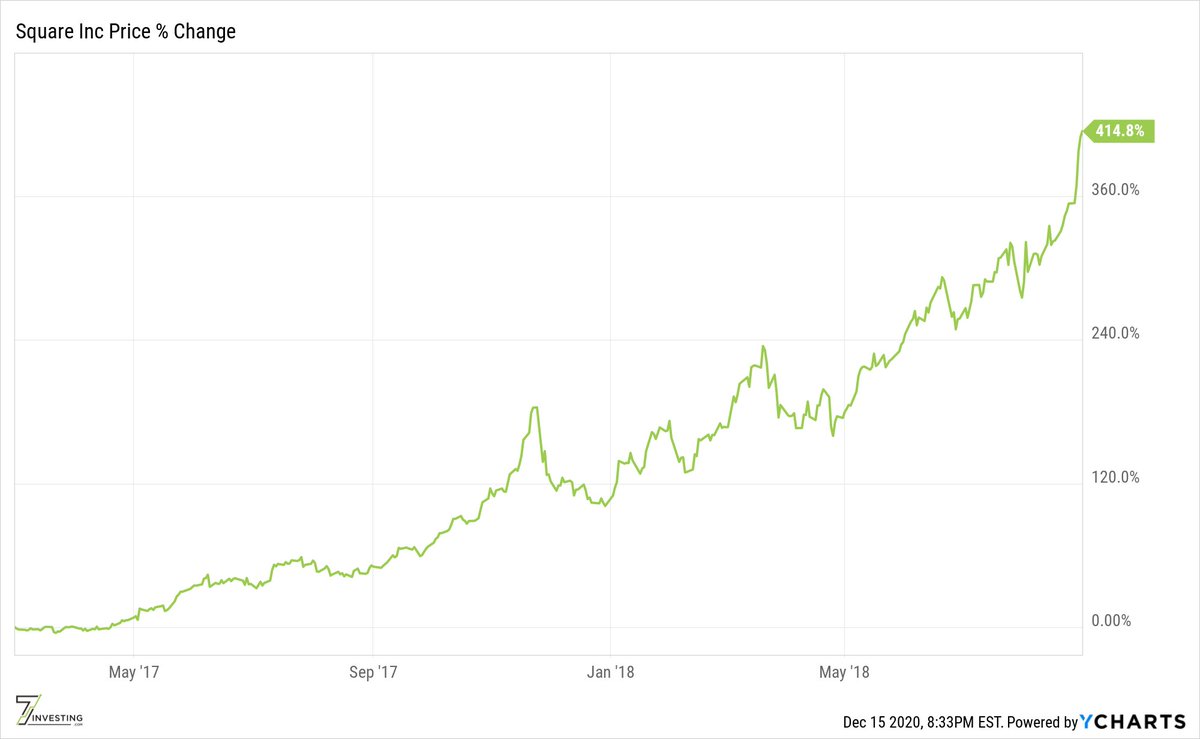

3/ After buying $SQ in early 2017 it exploded >400% in ~20 mos. Success!

Of course, in that time it went from a reasonable price for a great company to an expensive price for a great company. Or, at least, short-term expensive price, but arguably long-term reasonable.

Of course, in that time it went from a reasonable price for a great company to an expensive price for a great company. Or, at least, short-term expensive price, but arguably long-term reasonable.

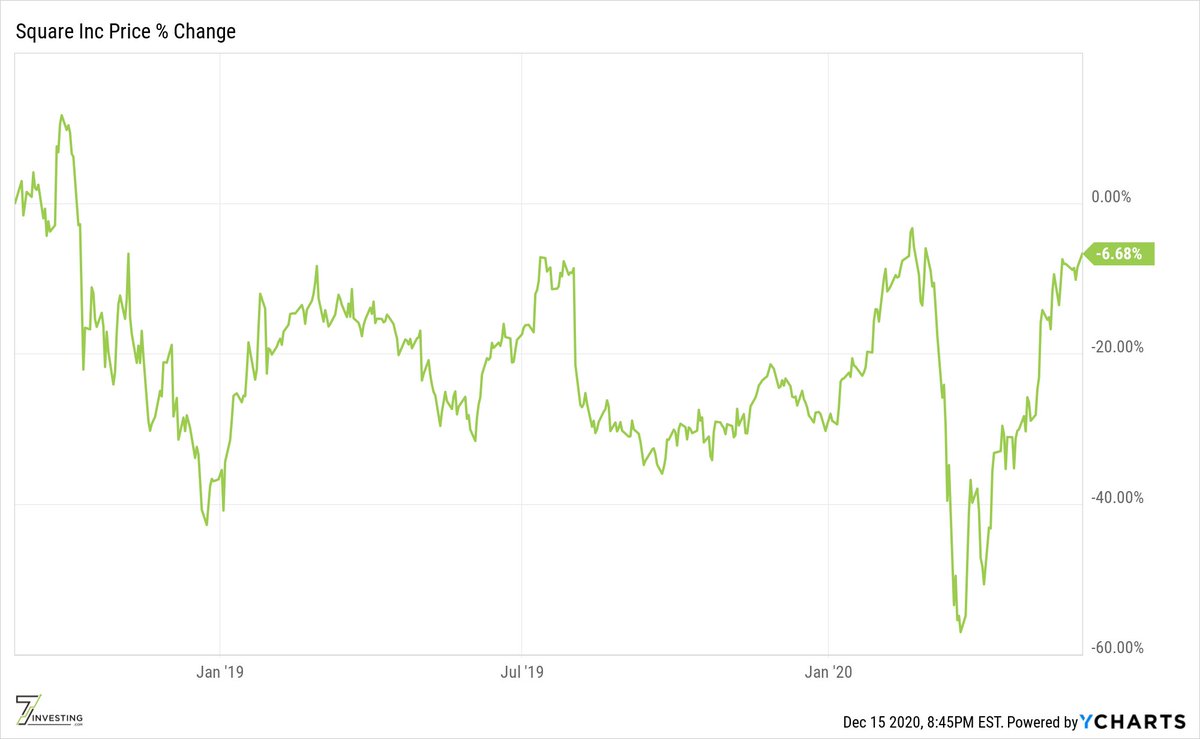

4/ $SQ's stock price declined and lagged for almost 2 years. It was too expensive w/too much good news baked in (at least short-term). Throughout this period though, I would argue (and did) that the company was performing well and the thesis was intact.

5/ The thing is, when $SQ was sitting at $100 in Aug '18, I felt this coming. It was predictable. But I didn't sell any shares. Indeed, I added over the next 2 yrs as SQ shares bounced around.

Why get cute w/ great companies?

Why get cute w/ great companies?

6/ Like Akre, I don't trust myself to know when to time these things. I'm not good at that. I feel like I can find great companies, tune out noise, and hold.

For yrs I fielded ???s about what was wrong w/ $SQ

A: Nothing, these things just take time! https://twitter.com/Matt_Cochrane7/status/1338846523166101505

For yrs I fielded ???s about what was wrong w/ $SQ

A: Nothing, these things just take time! https://twitter.com/Matt_Cochrane7/status/1338846523166101505

7/ Growth stocks like those tech/SaaS names many of us favor inevitably experience stomach-churning, agonizing drawdowns. Stocks don’t go up smoothly, nicely tracing their top- and bottom-line growth. Instead they go up in fits and starts, rocketing up before plummeting down.

8/ If you believe you're holding great cos, use 2020's gains to help you get through coming drawdowns. It's mentally easier to lose gains than principal.

Today I saw someone frustrated by $MSFT's recent price action. If this frustrates you, you're not ready for what's coming!

Today I saw someone frustrated by $MSFT's recent price action. If this frustrates you, you're not ready for what's coming!

9/ My experience: LTBH leads to amazing rewards, but inevitably you will go through some lean times. If you're calling yourself a long-term investor be ready for years ahead that are not as nearly rewarding. Don't let those years wash you out.

10/ Also, be careful about the valuations you pay for your stocks. While buying $SQ at $100 in Apr '18 eventually led to a nice return, it wasn't fun in the meantime. I personally think some (not all!) of these names are quite frothy.

11/ Most of all, I believe holding great companies through thick and thin is eventually very rewarding.

Happy investing!

Happy investing!

12/ Honestly this is a fantastic thread. Even holding a 46-bagger is agonizingly difficult. A 46-bagger!

Long-term investing is hard. Be ready.

Must read. https://twitter.com/iddings_sean/status/1338645392217534466

Long-term investing is hard. Be ready.

Must read. https://twitter.com/iddings_sean/status/1338645392217534466

Read on Twitter

Read on Twitter