1/ 1920-2020. A sobering brief summary of past and present monetary madness:

The inflationist system is a house of cards that must keep building higher, or risk exposing its weak structure.

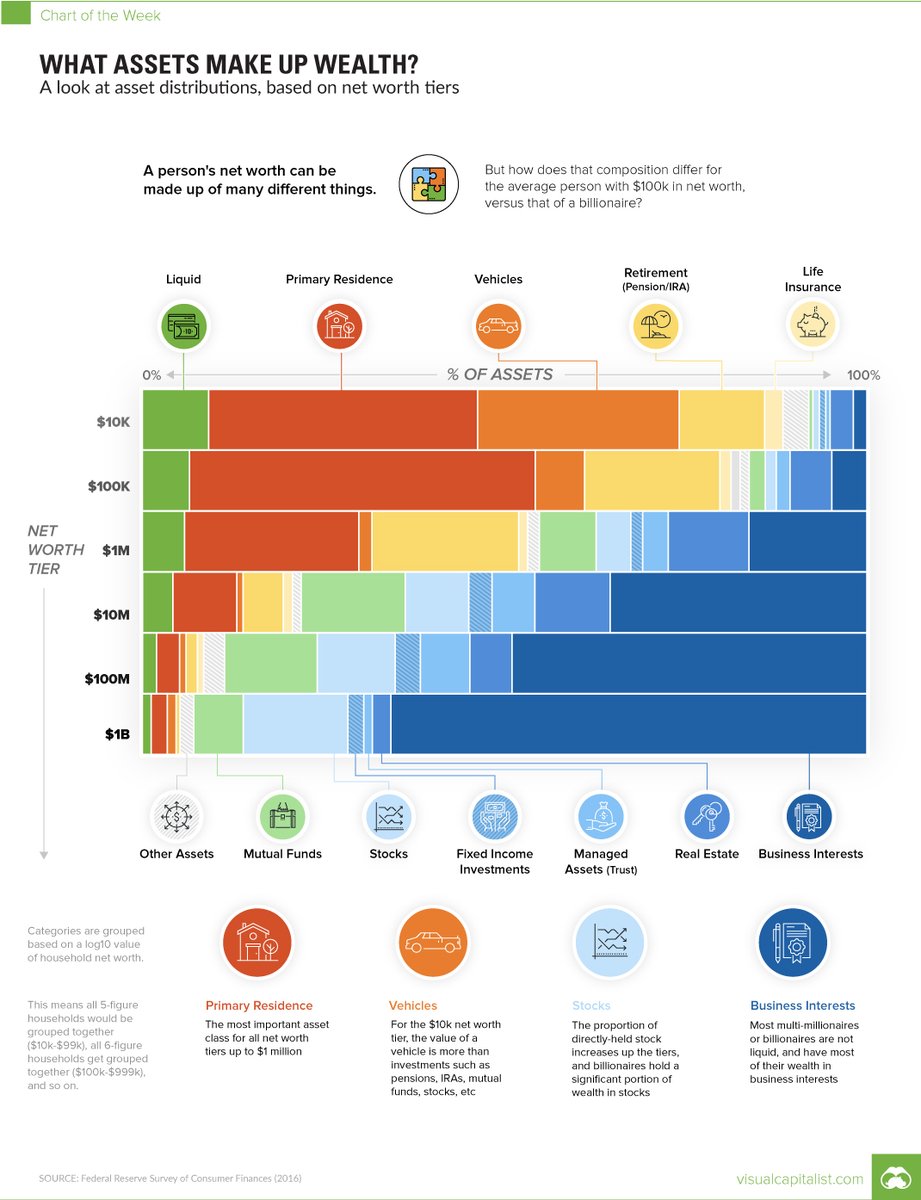

It stratifies wealth and keeps the majority on a hamster-wheel of increasing friction.

The inflationist system is a house of cards that must keep building higher, or risk exposing its weak structure.

It stratifies wealth and keeps the majority on a hamster-wheel of increasing friction.

2/ This tweet is more prescient even than it seems at first, especially given that he's off by over a decade; while we aren't in another Great Depression, we may just be leading ourselves down a similar path.

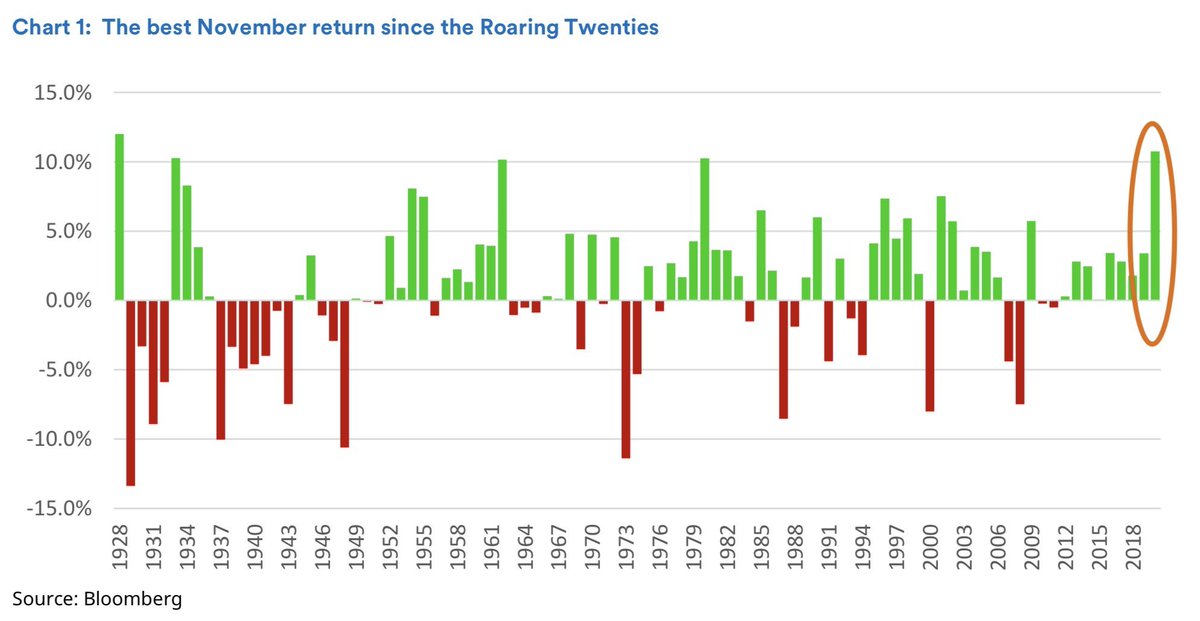

3/ Remember what *led* to the Great Depression, the Roarin' Twenties, a period of short-sighted misplaced glee built on capital misallocation fueled by inflation; like a addicts we binged (both literally and figuratively) and partied all decade long.

4/ Inflation itself is an addiction, the first hit feels amazing. But like a teenager drunk on the festivities of the night, we ignored the inevitable outcome of our actions: the hangover that comes after any serious binge.

5/ But few understand what really happened. They blame the crash hard money (gold), the real problem was soft money (paper inflation). No one printed excess gold, they printed more claims on that gold, facilitated by bad money and the establishment of the Fed.

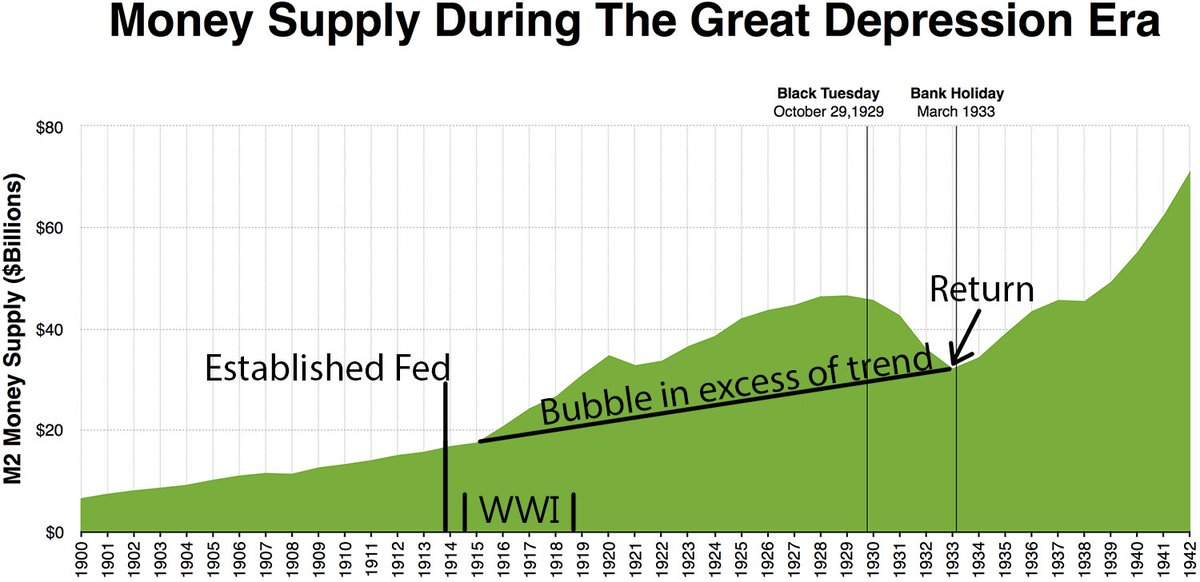

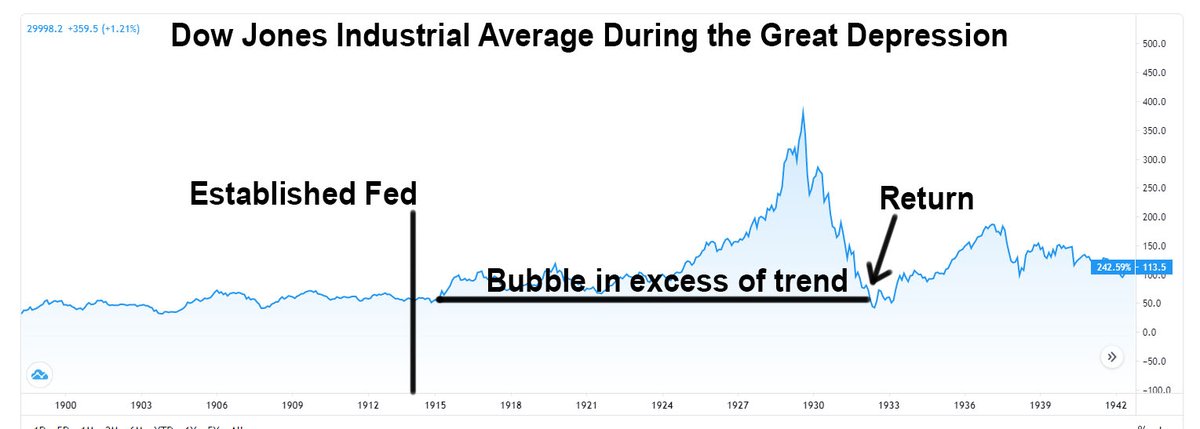

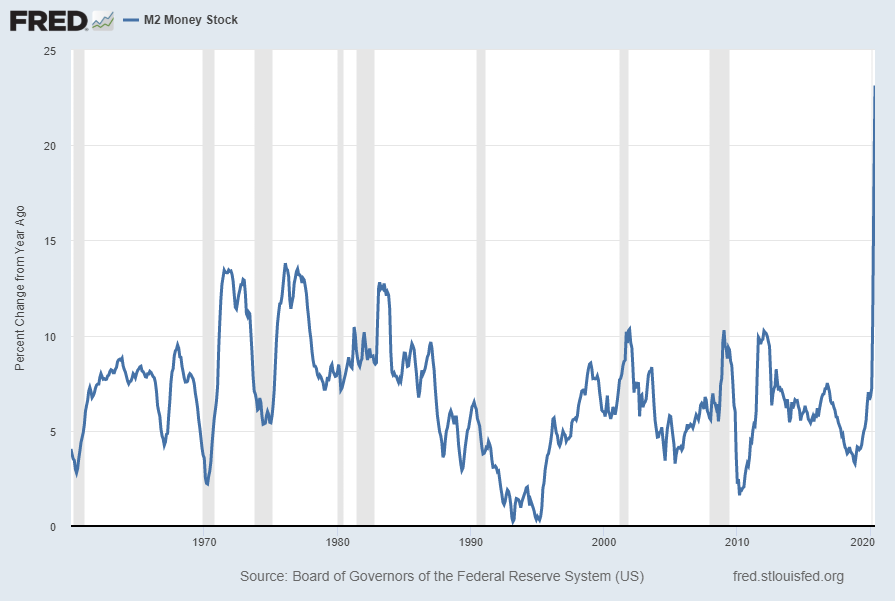

6/ This inflation drove capital allocation to companies investing in illusions, and dollars into harder assets ballooning the markets. There's a reason the stock market chart looks eerily similar to the money supply chart:

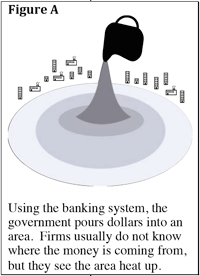

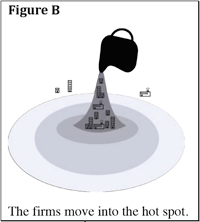

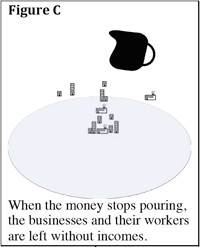

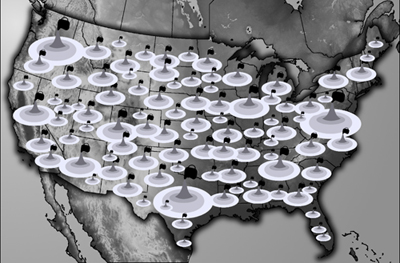

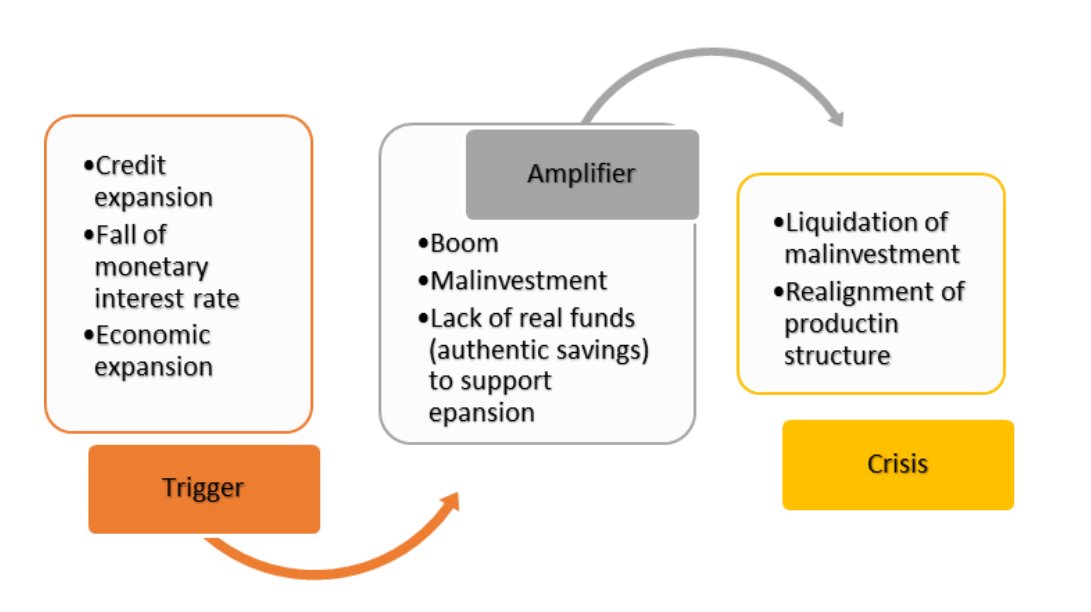

7/ But what's really happening is *malinvestment* as a result of distorted prices; those companies weren't worth more because there was suddenly more paper floating around, but it *seemed* like there was more capital and opportunity than the hidden reality:

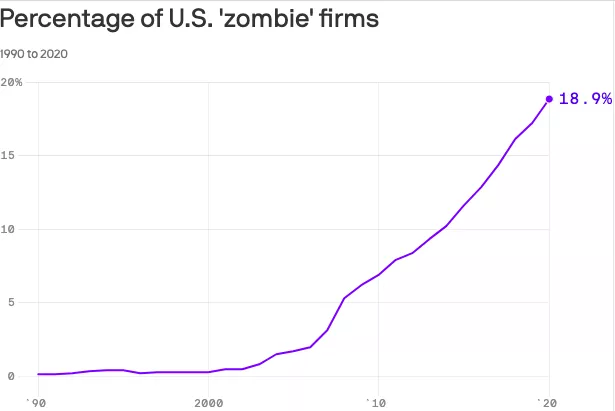

8/ What are we seeing today? While another Depression may or may not be around the corner, malinvestment has maybe never been higher. The situation is different, the system is different, the rules are different, but the fundamentals don't change.

9/ To understand what I mean by distorted prices and malinvestment, one must understand how and why prices are emergent; "fixing" or distorting prices only causes other problems (like whack-a-mole). The miracle of the pencil (the price system) explained:

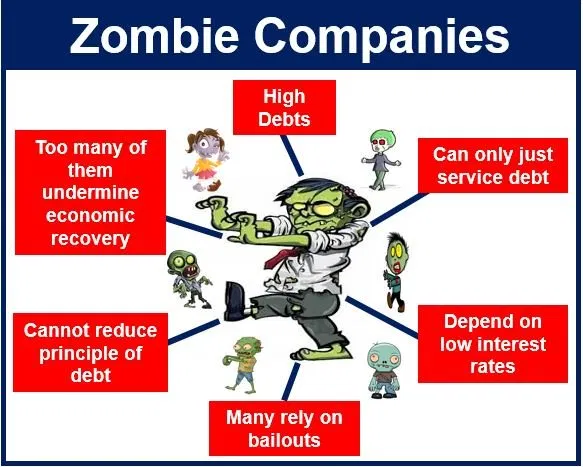

10/ When we disrupt the price system through price controls, inflation, interest-rate targeting, or suspension of redemption for specie (bank holiday), we are disrupting the system by which we collaborate, and disrupting the process of liquidation.

11/ Liquidation is painful, when a business sets out to provide value to a market and fails to do so, they are liquidated. A great deal of time, capital, and resources can be consumed in the process. But a company failing under a free market is a crucial component of markets.

12/ Rewards need risk. Despite best intentions of an entrepreneur their business fails, and thus must be cleared away to make room for more valuable firms. But extant capital from their failure (buildings, machines, people) are now free to contribute to more worthwhile projects.

13/ But w/ bailouts & low-interest we've hidden the risk. Zombie companies 'survive' through debt, and the economy is increasingly becoming undead. We aren't letting inefficient unprofitable businesses liquidate, and more pop up everyday. Capital is stranded in malinvestment.

14/ But who cares? Well we all do whether we know it or not. If you are part of a 'real' profitable firm (despite price distortions) then you are in competition with debt-reanimated waste, and if instead you work for debt-reanimated waste, well...

Neither firm benefits.

Neither firm benefits.

15/ And the stock market is soaring as we come out of a pandemic, much like 1920, but there are vast differences between then and now. That system tried to heal itself by returning to reality, while the current system prints like there's no tomorrow.

16/ We can't print away risk, we only hide it elsewhere; the zombies keep roaming and we roam amongst the hoard. But crucially, some benefit greatly from this system, inflation sucks value from dollars and piles it on assets which are disproportionately held by the top.

17/ And why wouldn't they hold assets? I don't blame them, everyone knows you can't store wealth in dollars! But the wealthier one is, the more wealth one can afford to store in assets, while the poorest hold only melting dollars.

18/ Inflationists tell you it's good because otherwise people would hoard (save) money. But it's a fallacy that only benefits the wealthy while the poor struggle to get raises to keep pace, and even if they do their savings still dwindle in value. https://twitter.com/mrcoolbp/status/1274348924896239619?s=20

19/ Where does that leave us? Billions have been locked in their homes while the money supply has increased by over 20% in a year. It's a powder-keg of inflation, malinvestment, and risk. We are in unprecedented times monetarily speaking.

20/ So where are we going? Will we get another Roaring 20s? Another crash? Will they BRRRR all the savings and zombies into oblivion? Will we get more instability/unrest? Will we cleanse ourselves & let the hangover hit, or will we get up and drink again? https://twitter.com/NorthmanTrader/status/1338574221732089856?s=20

21/ The long term good requires short term pain, it's unavoidable. But we are already in pain, only sound money can stop these vicious cycles and heal us.

And gold did fail us, it led us to money-by-decree.

Let's go back to money-by-choice, #Bitcoin . https://twitter.com/i/status/1338121495235551232

. https://twitter.com/i/status/1338121495235551232

And gold did fail us, it led us to money-by-decree.

Let's go back to money-by-choice, #Bitcoin

. https://twitter.com/i/status/1338121495235551232

. https://twitter.com/i/status/1338121495235551232

Read on Twitter

Read on Twitter