A lesson on the power of Delta during consolidation ranges - a Thread (1/12)

Cumulative Delta is one of the main drivers in my trading strategy. It is measuring the change in market order pressure on the buy and sell side. (2/12)

One of the most challenging setups to trade (for me) is a range day where the time charts look to be both bullish and bearish.

There is a way to trade this that puts you at a higher probability of success for when(not if) the breakout occurs. (3/12)

There is a way to trade this that puts you at a higher probability of success for when(not if) the breakout occurs. (3/12)

Most range traders will try and play both ends of a range, shorting the tops and longing the bottoms.

When you introduce CD into your trading strategy, you will notice that one side (long or short) will be favored in a range. (4/12)

When you introduce CD into your trading strategy, you will notice that one side (long or short) will be favored in a range. (4/12)

If CD is truly flat, neither side is favored and one should sit out.

The higher probability for trading comes from going WITH the side that is favored, that way you are on the correct side of the breakout, even if you are just scalping.

(5/12)

The higher probability for trading comes from going WITH the side that is favored, that way you are on the correct side of the breakout, even if you are just scalping.

(5/12)

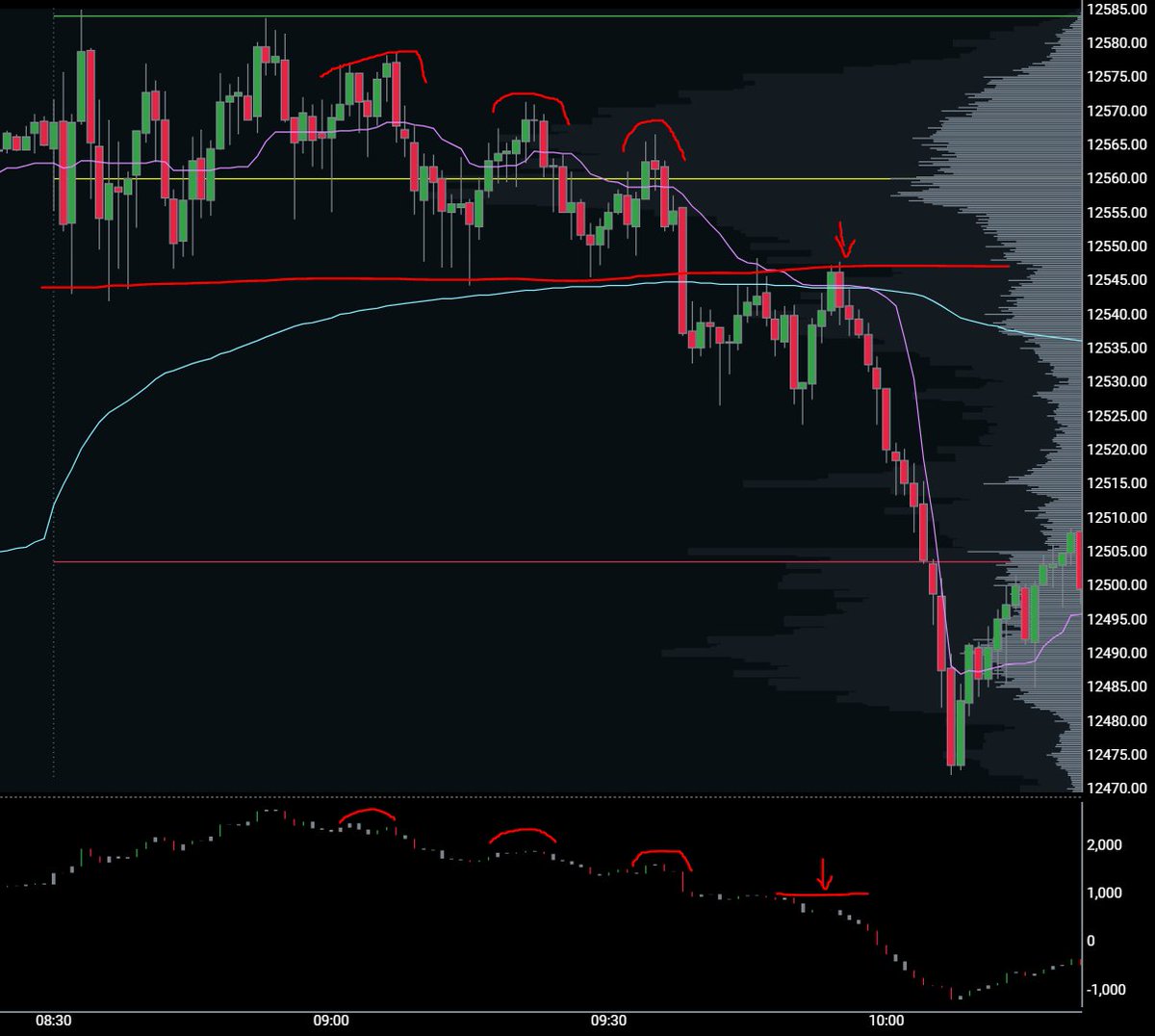

Take a look at this chart, paying attention to the highs noted on both CD and the 1min $NQ_F chart.

On this picture I have noted two lower highs on both the 1min chart AND the CD chart. (6/12)

On this picture I have noted two lower highs on both the 1min chart AND the CD chart. (6/12)

Both of these highs still fall within the consolidation range but we are able to see that sellers are in control of this move from this point on since buyers are failing to bring CD to a new high and the 1min price to new highs. (7/12)

Once we see this situtation start to unfold, we can immediately know that we should NOT be trying to long the bottom of the range, we should instead be shorting the pops and top of the range due to sellers beginning to own the move. (8/12)

Now in this picture a few minutes later, we see the lower highs are maintained on both the 1min and CD charts and then we finally broke out of the range.

Maybe you were short leading into this break. But the second big entry comes where the arrow is marked. (9/12)

Maybe you were short leading into this break. But the second big entry comes where the arrow is marked. (9/12)

Here you see CD remain flat (no buyers) while price pushes up to the bottom of the previous range we just broke. (10/12)

This is an ideal short setup in my book. Short the test of the bottom of the range with decreasing Delta, no Delta push, and ride out the short (in this example a move of 70 points in a few minutes).

(11/12)

(11/12)

I hope this thread offers some help if you are struggling with range trading and the inevitable breakouts either way. Maybe CD will be the answer to helping you establish a bias and finding polished entries. (12/12)

As a reminder, you can see my strats play out real time on my youtube channel (Trades by Matt) every morning on my free live stream at 8:20CT. It is a great place to chat with other traders and talk market commentary and real trading. I highly recommend you join.

Read on Twitter

Read on Twitter