Last week the SEC made the biggest updates to its market data policies since the 1970s.

Below I'll do my best to summarize the major changes & impacts of "NMS 2.0" on investors.

A thread:

Below I'll do my best to summarize the major changes & impacts of "NMS 2.0" on investors.

A thread:

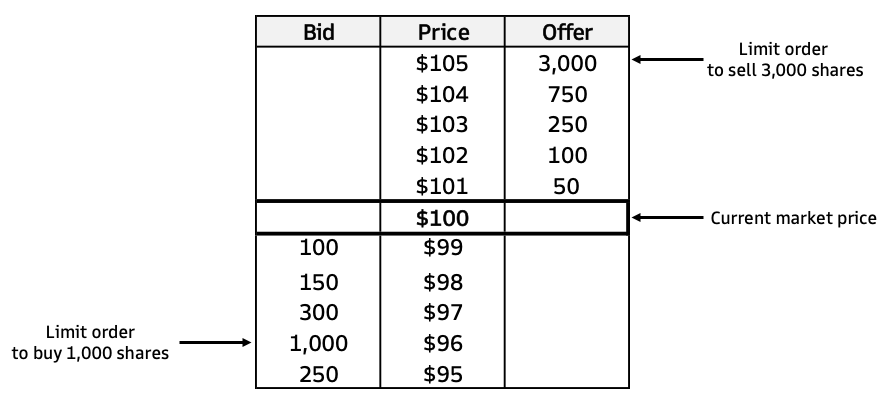

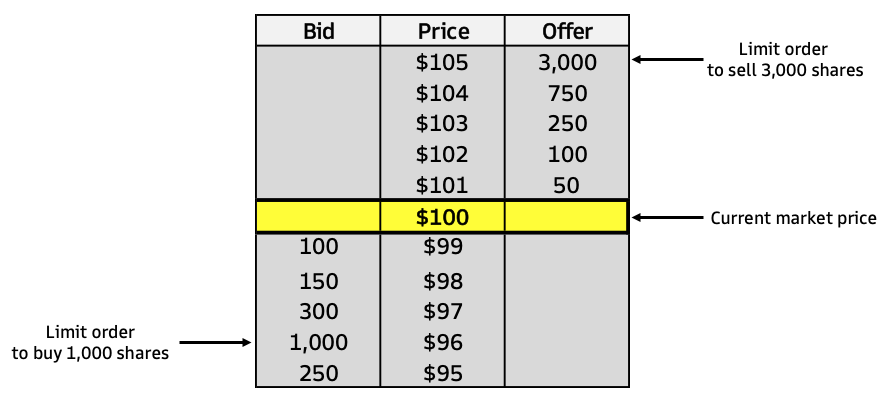

The core value of equity market data is the ability to see a stock's limit order book.

While everyone sees price, not everyone sees the limit orders "resting" above or below the price, ready to be executed if the market moves their way.

While everyone sees price, not everyone sees the limit orders "resting" above or below the price, ready to be executed if the market moves their way.

Institutions use this "depth of book" data to time trades.

If resting buy orders outweigh resting sell orders, the stock is probably moving higher in the immediate term & vice versa.

If resting buy orders outweigh resting sell orders, the stock is probably moving higher in the immediate term & vice versa.

With NMS 1.0, only prices were streamed on public data feeds & you had to pay huge fees to see depth of book data.

With the SEC's new rules, depth of book data for the 5 prices above & below the market price will now be sent through the public data feed.

With the SEC's new rules, depth of book data for the 5 prices above & below the market price will now be sent through the public data feed.

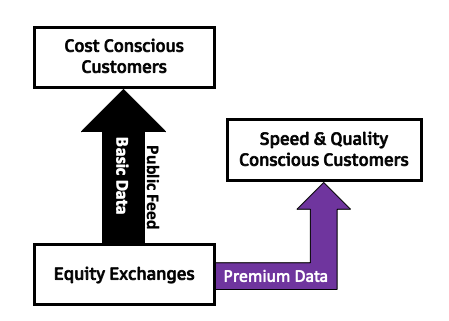

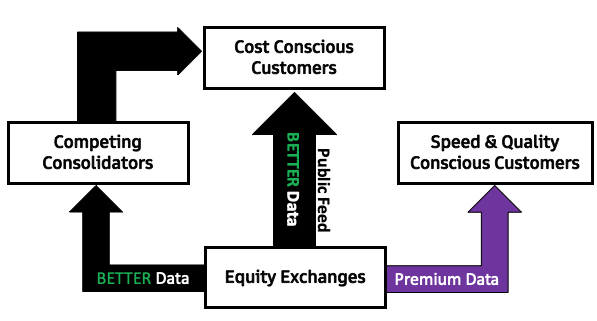

The 2nd big change with NMS 2.0 is the introduction of "competing consolidators".

With NMS 1.0, exchanges were required to send basic data through a lower cost public feed.

The premium data could still be sold through proprietary feeds at high cost.

With NMS 1.0, exchanges were required to send basic data through a lower cost public feed.

The premium data could still be sold through proprietary feeds at high cost.

With NMS 2.0, exchanges will now be forced to send data to a middle man - the competing consolidator - at a price the SEC sets.

The introduction of competition should *in theory* lower costs and improve quality of public data.

The introduction of competition should *in theory* lower costs and improve quality of public data.

We're already seeing competing consolidators pop up to prepare to challenge the legacy exchanges.

Below announcement from MIAX in November 2020:

https://www.prnewswire.com/ae/news-releases/miami-international-holdings-announces-that-it-is-evaluating-registration-as-a-competing-consolidator-830208417.html

Below announcement from MIAX in November 2020:

https://www.prnewswire.com/ae/news-releases/miami-international-holdings-announces-that-it-is-evaluating-registration-as-a-competing-consolidator-830208417.html

While I believe we're moving in the right direction, the system is still EXTREMELY complex and vulnerable to loopholes.

The original SEC proposal is a whopping 898 pages:

https://www.sec.gov/rules/final/2020/34-90610.pdf

The original SEC proposal is a whopping 898 pages:

https://www.sec.gov/rules/final/2020/34-90610.pdf

I acknowledge I'm still working to fully understand the changes, but the above is my impression so far.

What's missing? What else changed that's important/impactful?

More sources:

https://www.wsj.com/articles/sec-approves-plan-to-bring-more-detailed-stock-market-data-to-public-11607532641 https://www.findknowdo.com/news/12/10/2020/sec-introduces-competition-nms-data-collection-consolidation-and-delivery?utm_source=Newsletter&utm_medium=Email&utm_campaign=Cabinet+Newsletter

What's missing? What else changed that's important/impactful?

More sources:

https://www.wsj.com/articles/sec-approves-plan-to-bring-more-detailed-stock-market-data-to-public-11607532641 https://www.findknowdo.com/news/12/10/2020/sec-introduces-competition-nms-data-collection-consolidation-and-delivery?utm_source=Newsletter&utm_medium=Email&utm_campaign=Cabinet+Newsletter

Read on Twitter

Read on Twitter