Today’s @ONS data showed the labour market was continuing to deteriorate before the second national lockdown, with unemployment and redundancies rising. Here is our thread with the key charts...

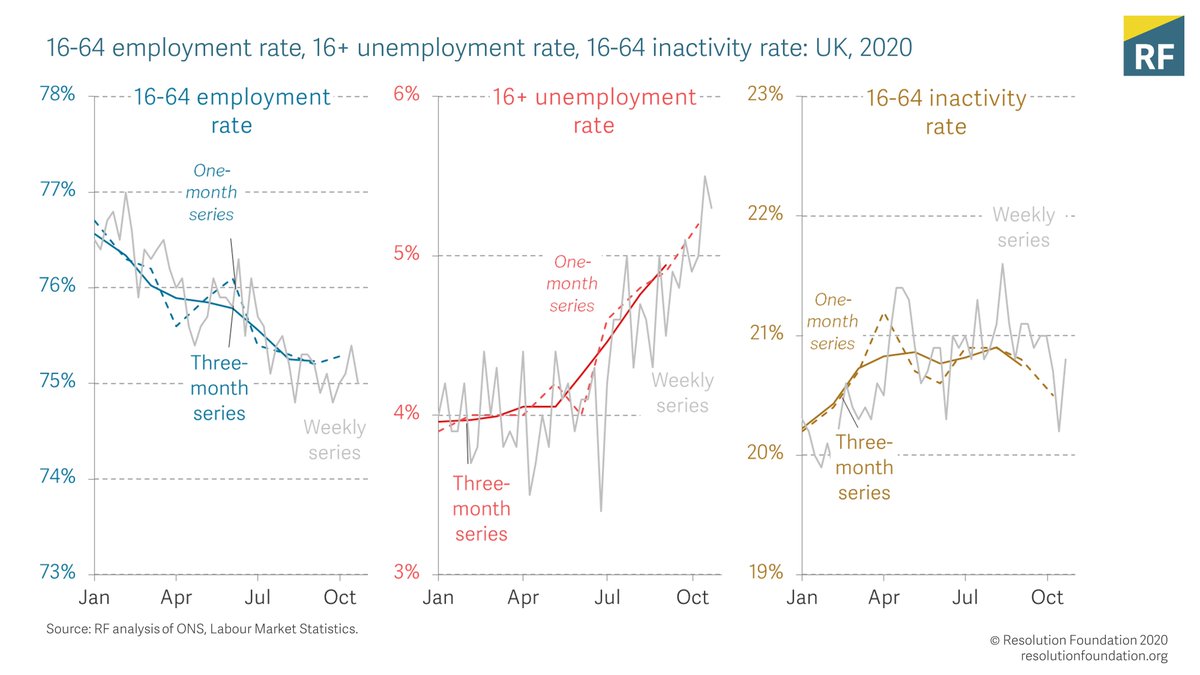

The 16+ unemployment rate rose to 5.2% in the single month of October, up 0.3 percentage points on the previous month. It remains low by historical standards, but the OBR expect unemployment to rise sharply in the first half of next year.

The even more timely weekly data shows the unemployment rate rising through to the end of the month. The employment rate, on the other hand, is actually up slightly in the single month data, and fairly steady in the latest weekly data.

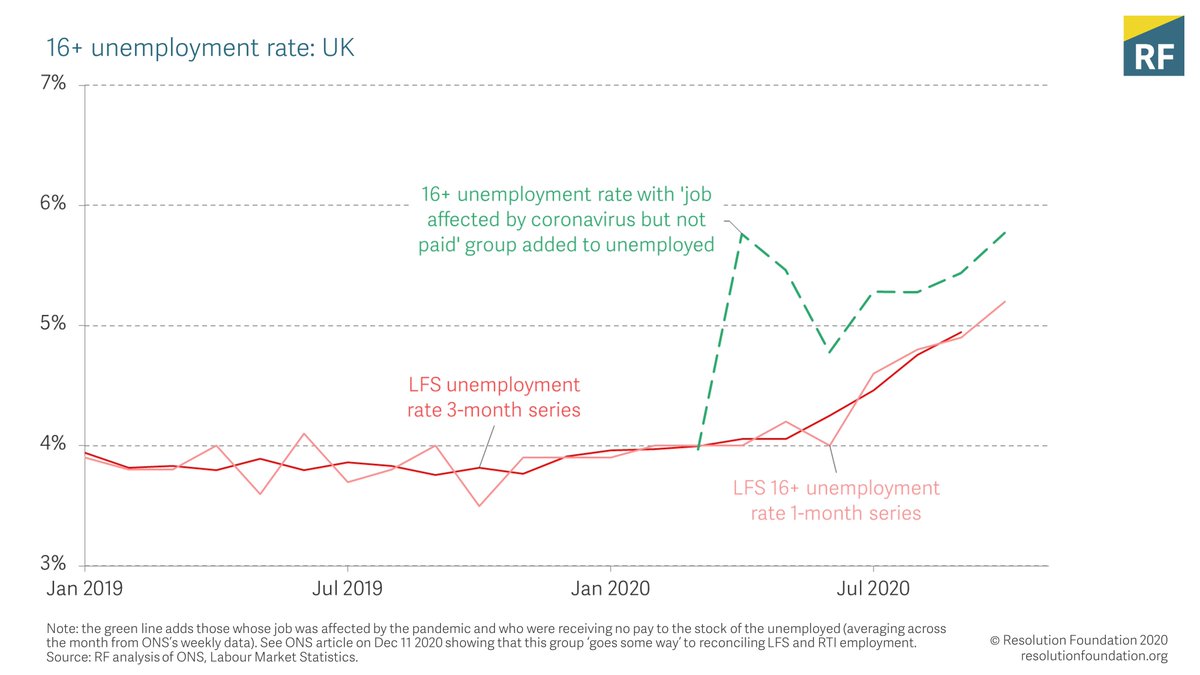

However, we need to be careful with the LFS data. It still suffers from measurement issues, with some people who aren’t working and who aren’t being paid reporting themselves as employed. The unemployment rate would be closer to 6% with that group classified as unemployed.

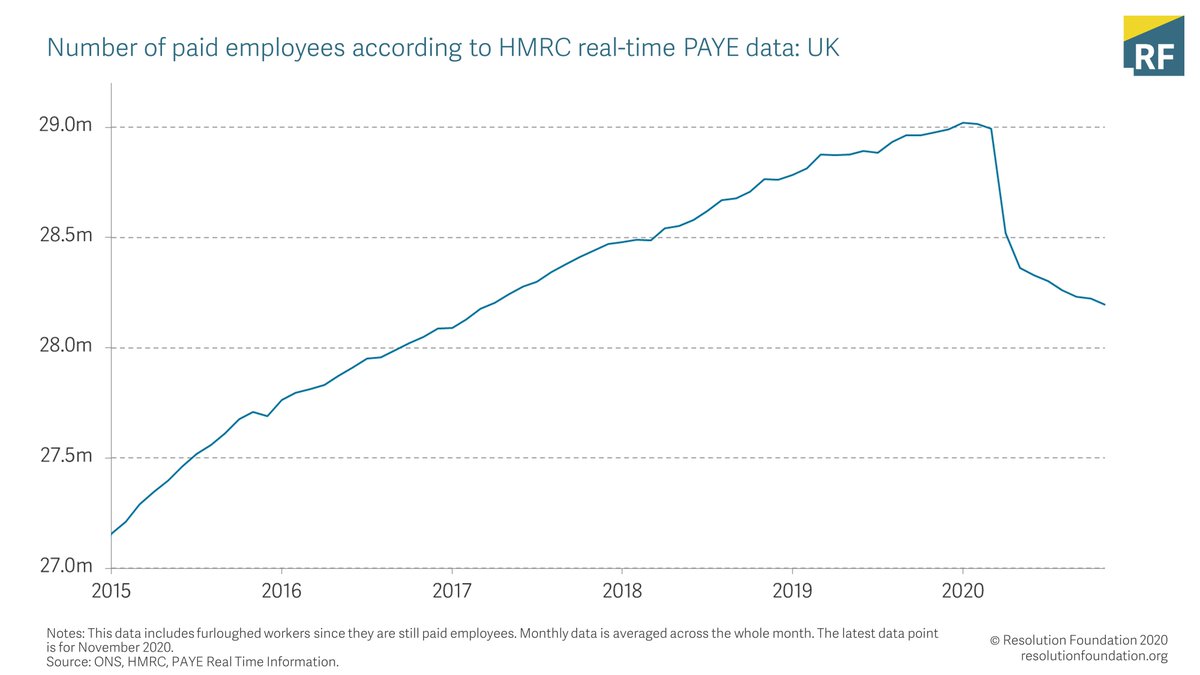

The @ONS showed last week that that ‘not working and not paid’ group goes some way to explaining the discrepancy between LFS employment (falling only moderately) and RTI payrolled employment, which is now down 819k on pre crisis.

The hospitality sector accounts for a big part (around a third) of this overall fall, with payrolled employment down 15% in November compared to pre-crisis. Big falls are also seen in Retail/wholesale, Manufacturing, and Leisure.

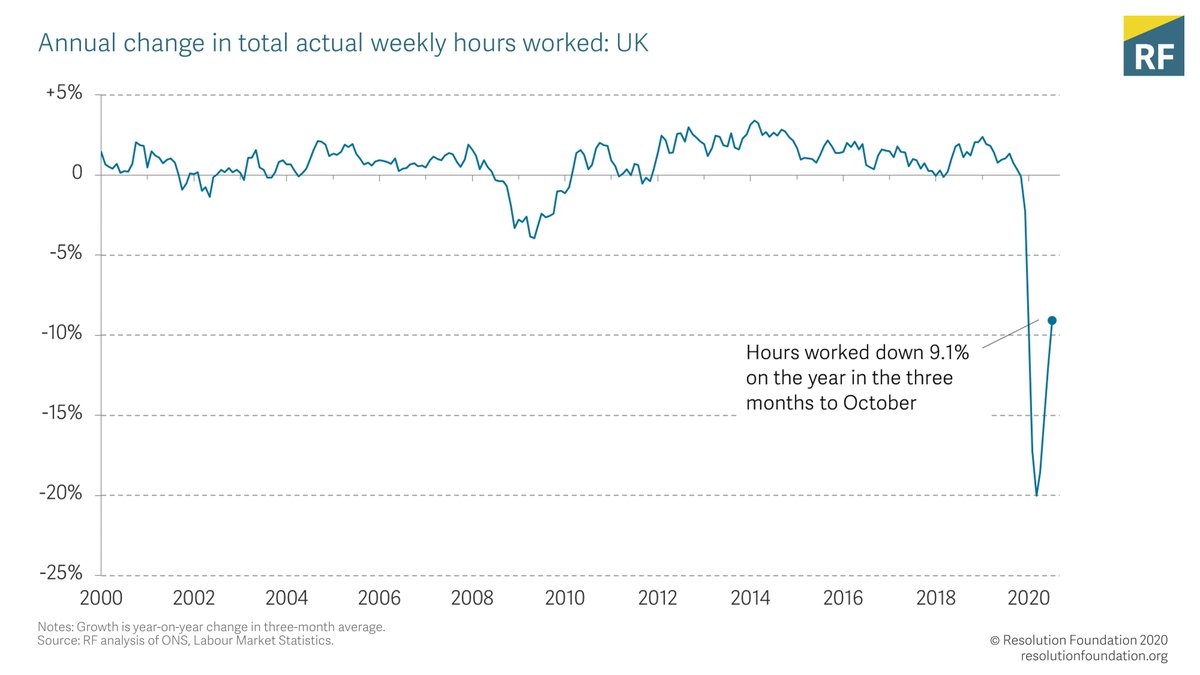

Total hours worked have continued to recover in the three months to October, but were still 9.1 per cent lower than a year earlier. At their lowest point (Apr-Jun) they were down 20 per cent on the year.

Timelier data on hours reflects more people returning to work over the autumn. Weekly figures show that average weekly hours rose slightly towards the end of October, reaching 30.6 (compared to an average of 31.7 pre-crisis).

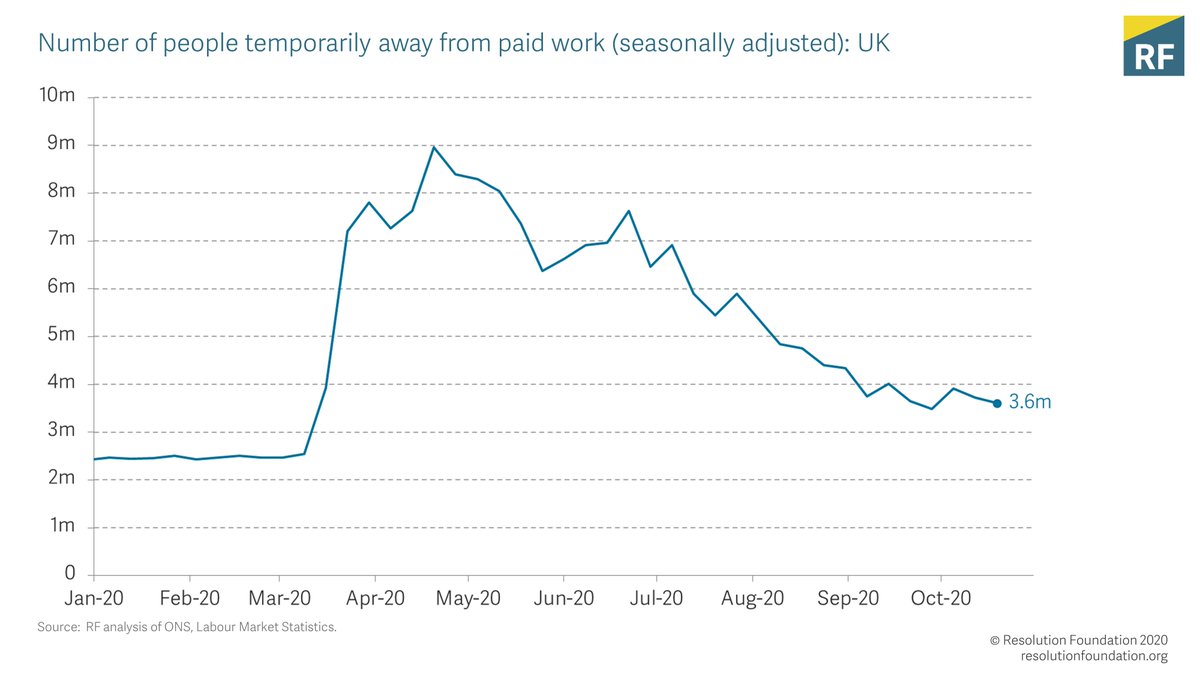

But the number of people temporarily away from work began to level off after four months of falling - standing at 3.6 million by the end of October, well below its April peak of 9 million.

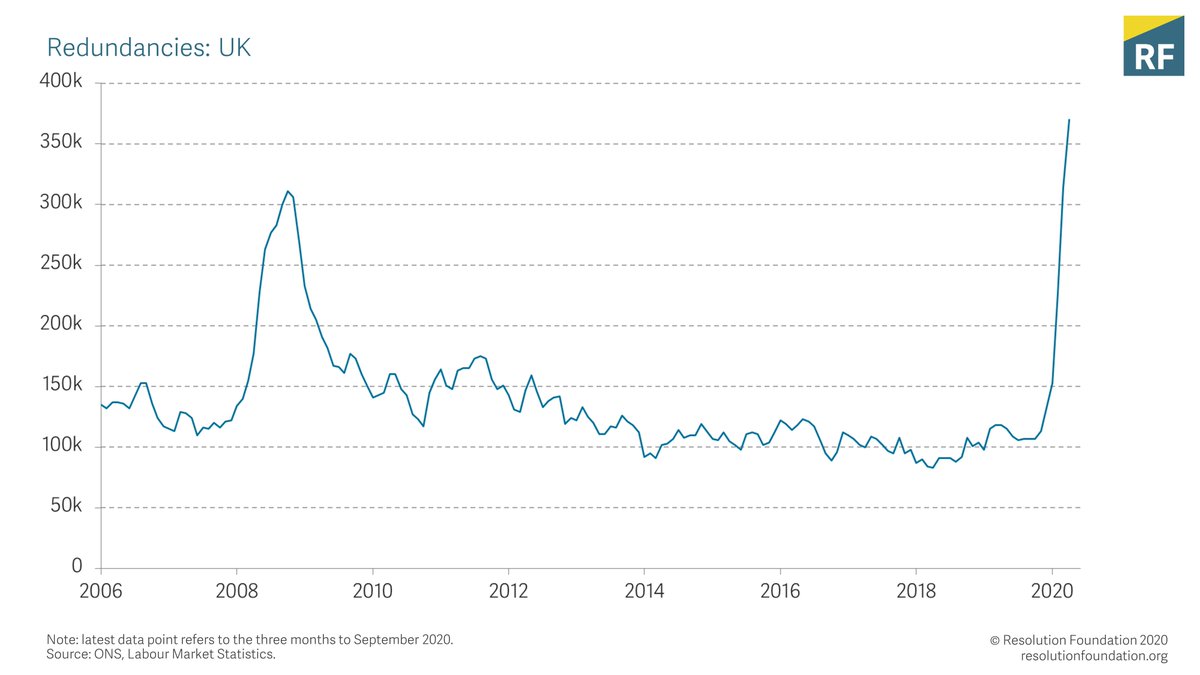

Apart from rising unemployment, the other grim statistic from this morning is that redundancies have reached a new record high of 370,000 in the three months to October. The more positive news is that the weekly data shows redundancies falling in the month of October.

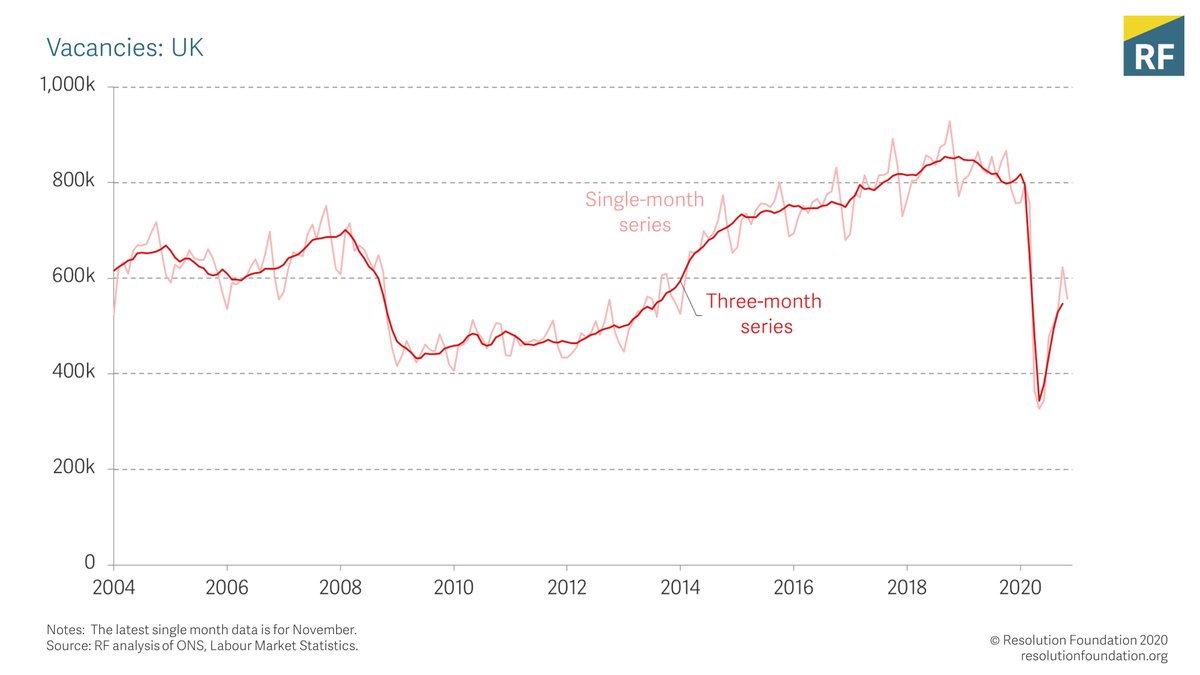

Vacancies remain around a third down on pre-pandemic levels (in the three months to November). More worryingly, the single month data shows vacancies falling again in November, for the first time since May.

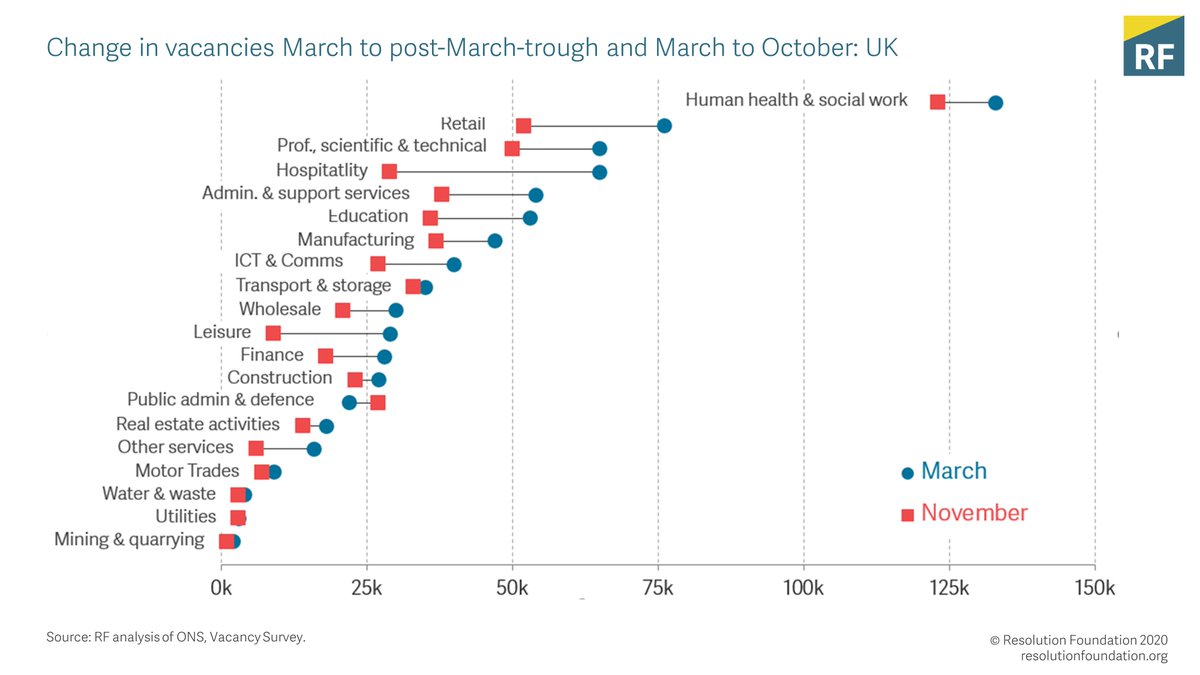

All sectors (apart from public administration) were still posting fewer vacancies in November than they were pre-crisis, with hospitality and leisure among the sectors facing the biggest reductions.

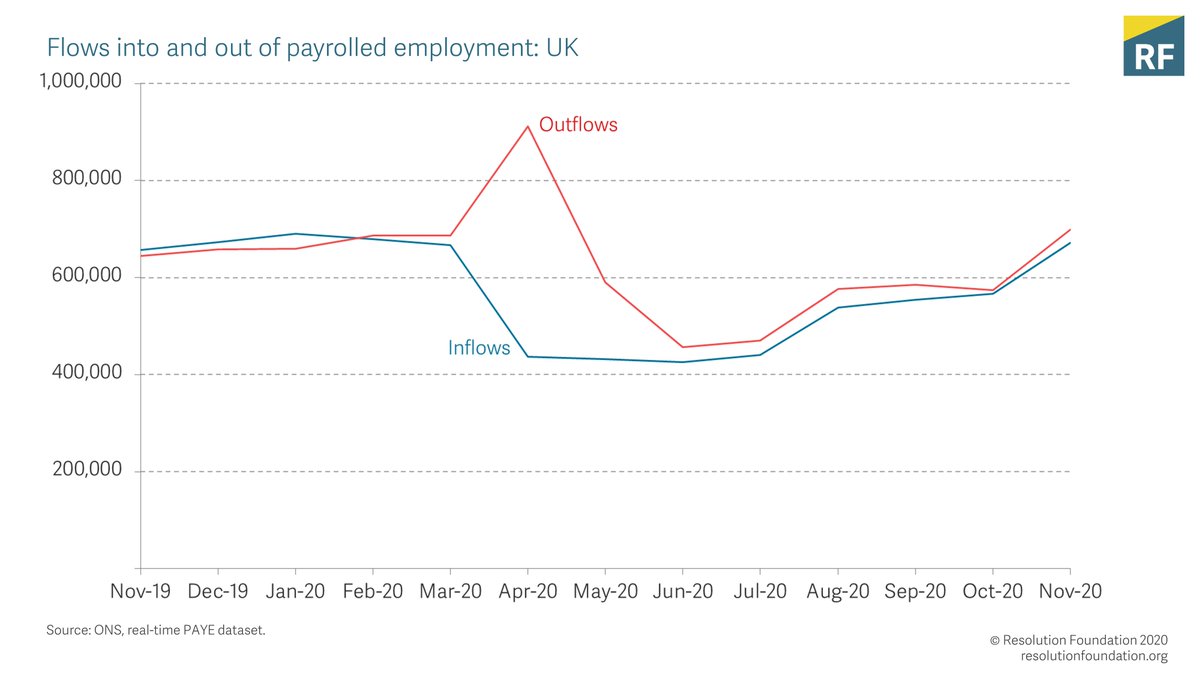

However, the flows into and out of payrolled employment tells a slightly different picture on hiring to the vacancies data. Inflows (along with outflows) to payrolled employment rose in November to roughly pre-pandemic levels.

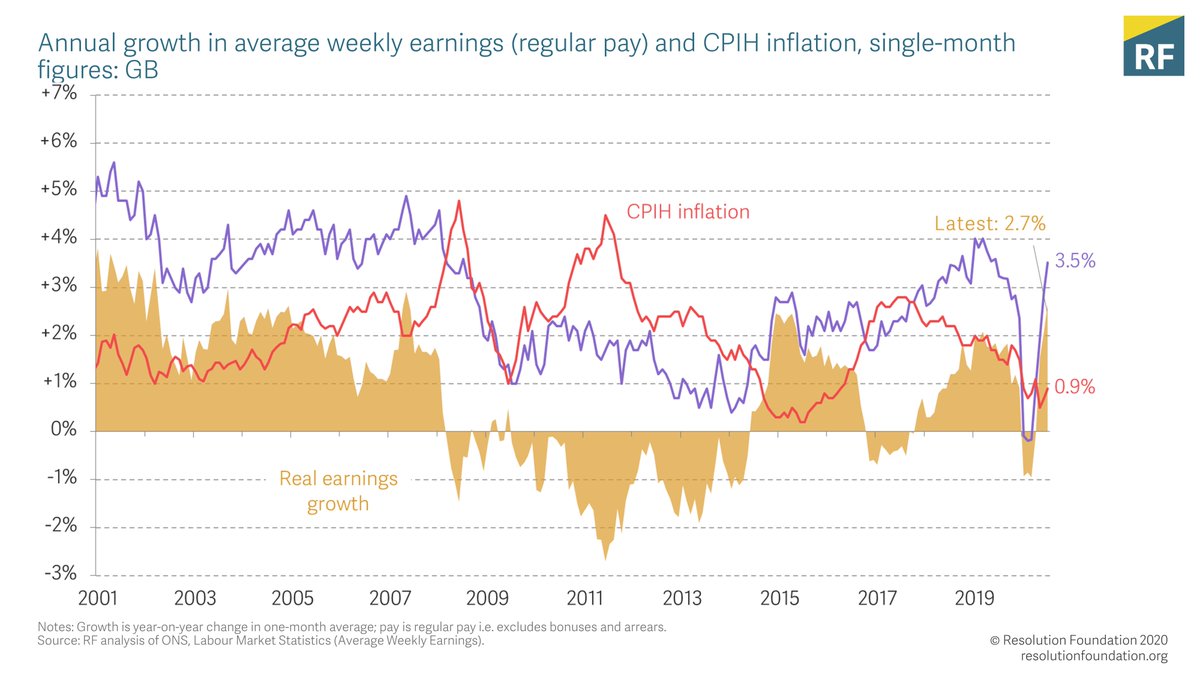

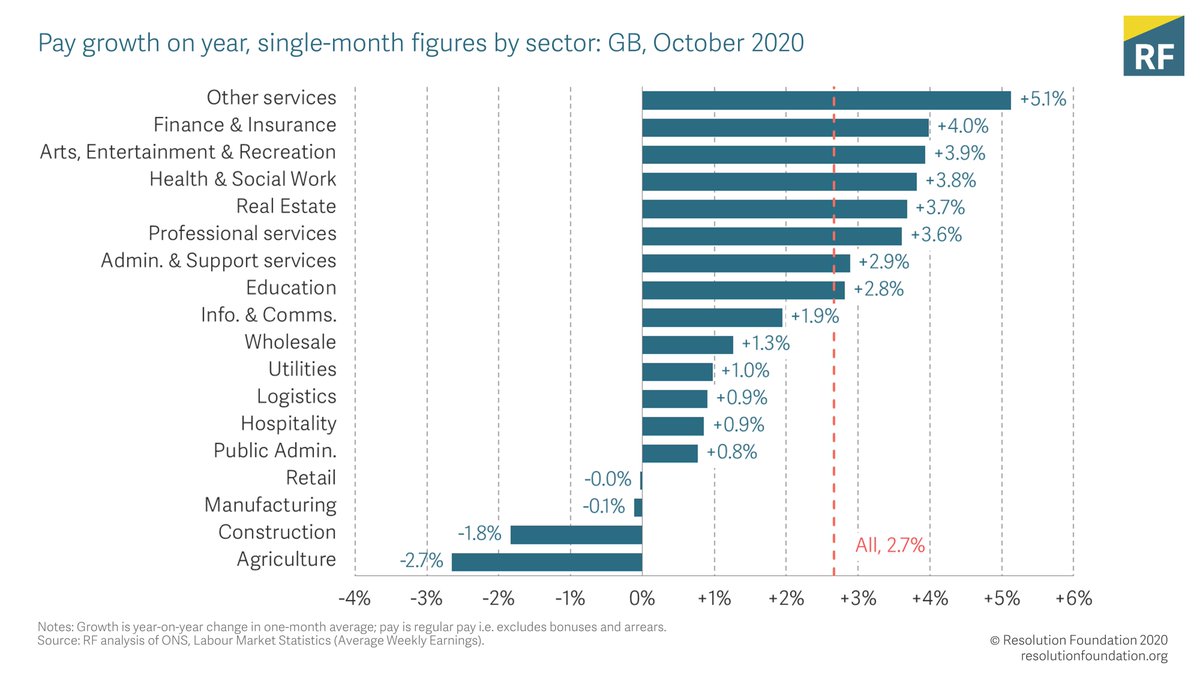

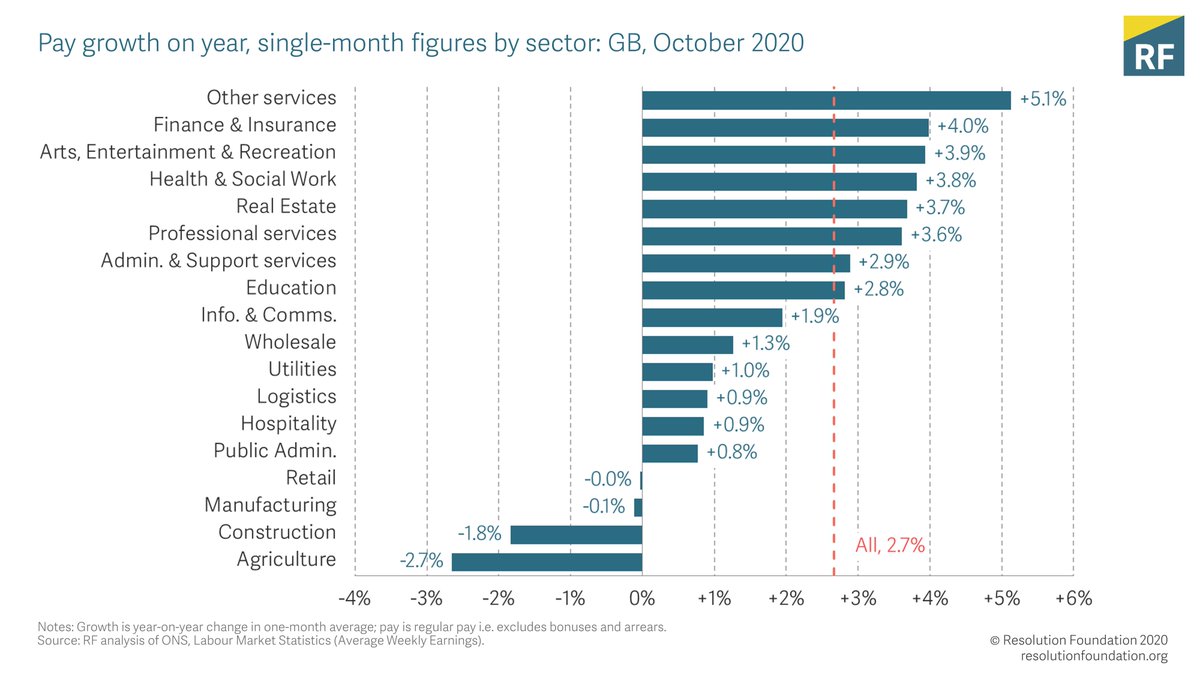

Regular pay growth has continued in the latest data, reaching 2.7 per cent in October in real terms, as nominal pay growth remained strong and inflation weak.

This is not as good as it sounds though. The @ONS has said that a substantial amount of this pay growth is down to compositional changes in the labour market - a fall in the number of employees in low-paying jobs pushes up average pay for those still in work.

Read on Twitter

Read on Twitter