1. A thread on "Optionality". A moment for me to understand why $SDGR will do better than $CERT and $SLP, even though they are in the same market

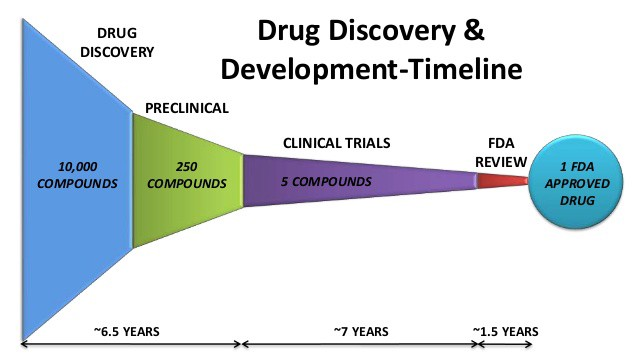

2. Biosimulation: To discover new drugs or to understand how chemical composition might work with each other to develop new drugs scientists use biosimulation software to “simulate” how compounds might work without chemical reagents, initial clinical trials, and experiments.

3. Biosimulation: This is like “flight simulator” – a pilot in training can simulate the flying experience on the ground to learn before they take to the sky.

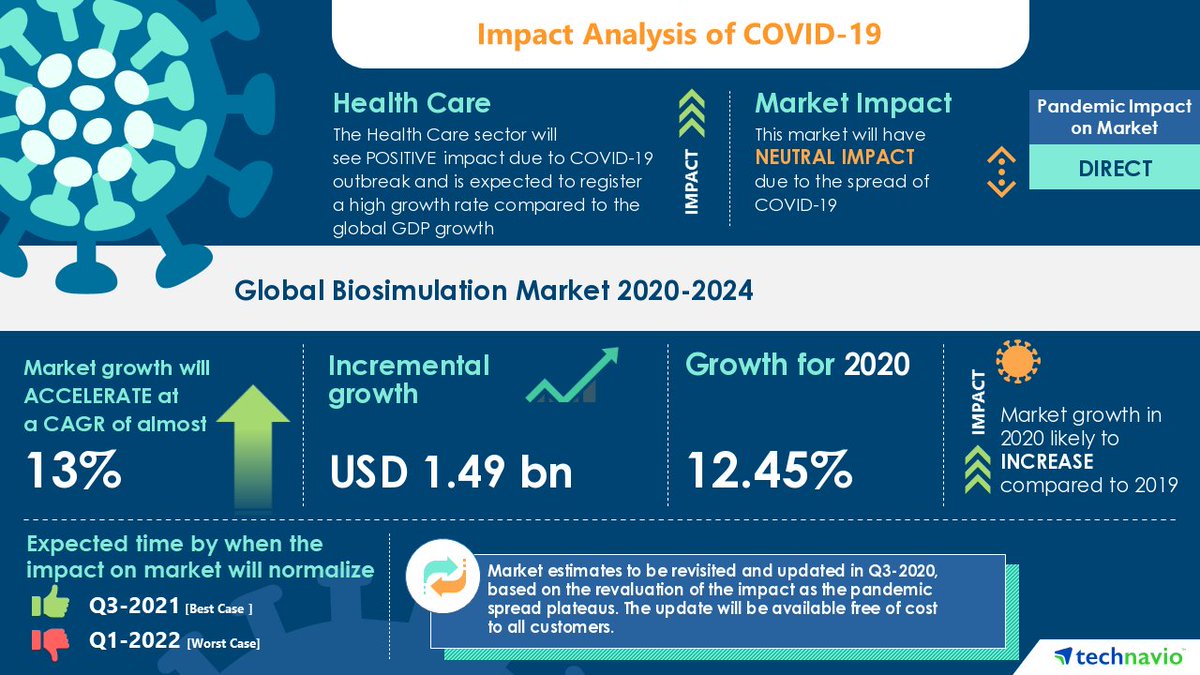

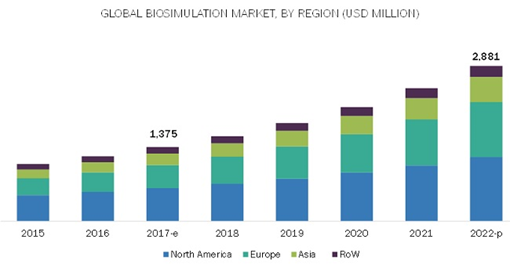

4. In 2017 the biosimulation market was $1.4B, growing at 15% annually to reach about $3B by 2022.North America is the largest market, followed by Europe.

5. Growth in biosimulation market is being driven by the need to reduce costs of drug development and discovery as part of healthcare expenditure. Driven by rising demand for biosimilars and the low probability of success in new R&D efforts for chemical entities.

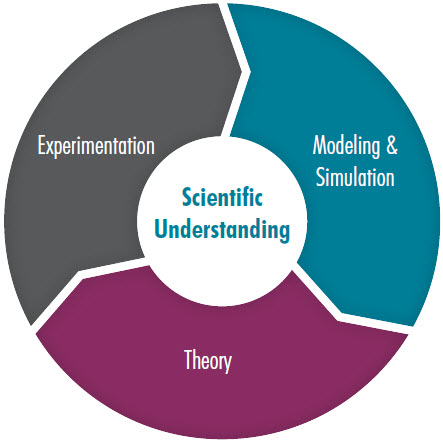

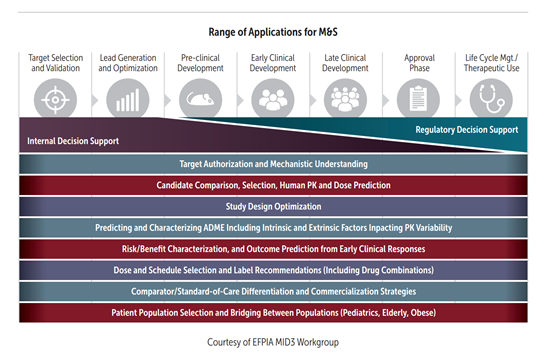

6. In 2004, the US FDA, initiated aggressive and collaborative effort to create a new generation of predictive tools, such as Modeling & Simulation (M&S), for informing crucial drug development decisions.

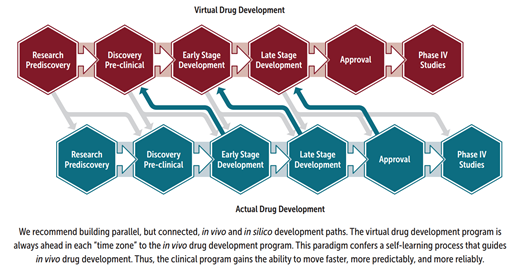

7. The power of M&S comes from the ability to produce dynamic images of drugs and binding sites in a 3D form, while also factoring other influences. Many compounds contained in electronic libraries can be screened for potential without making them. i.e. virtual drug development.

8. The key players in biosimulation and M&S are:

$SDGR, $SLP, $CERT and 20+ companies including Dassault systems, ACD/Labs and Accelrys

$SDGR, $SLP, $CERT and 20+ companies including Dassault systems, ACD/Labs and Accelrys

9. $CERT ~$200M rev, growing ~20%, MCap 5.6B

$SDGR ~$100M rev, growing 27%, Mcap 5.09B

$SLP $50M rev, growing 22%, Mcap 1.88B

Which ONE will you invest in?

$SDGR ~$100M rev, growing 27%, Mcap 5.09B

$SLP $50M rev, growing 22%, Mcap 1.88B

Which ONE will you invest in?

10. I dug deeper. Turns out M&S market has multiple software application needs and each company has "proprietary" data, algorithms and research focus

11. Q1: Should I invest in all 3? The market is not that big. It is $1.4B, and will double to ~$3B by 2023. Ok, that's till tiny. <relatively speaking>

Q2: Why is $SDGR so highly valued over 2 others?

I listened to a podcast with the CEO, heard their investor presentations

Q2: Why is $SDGR so highly valued over 2 others?

I listened to a podcast with the CEO, heard their investor presentations

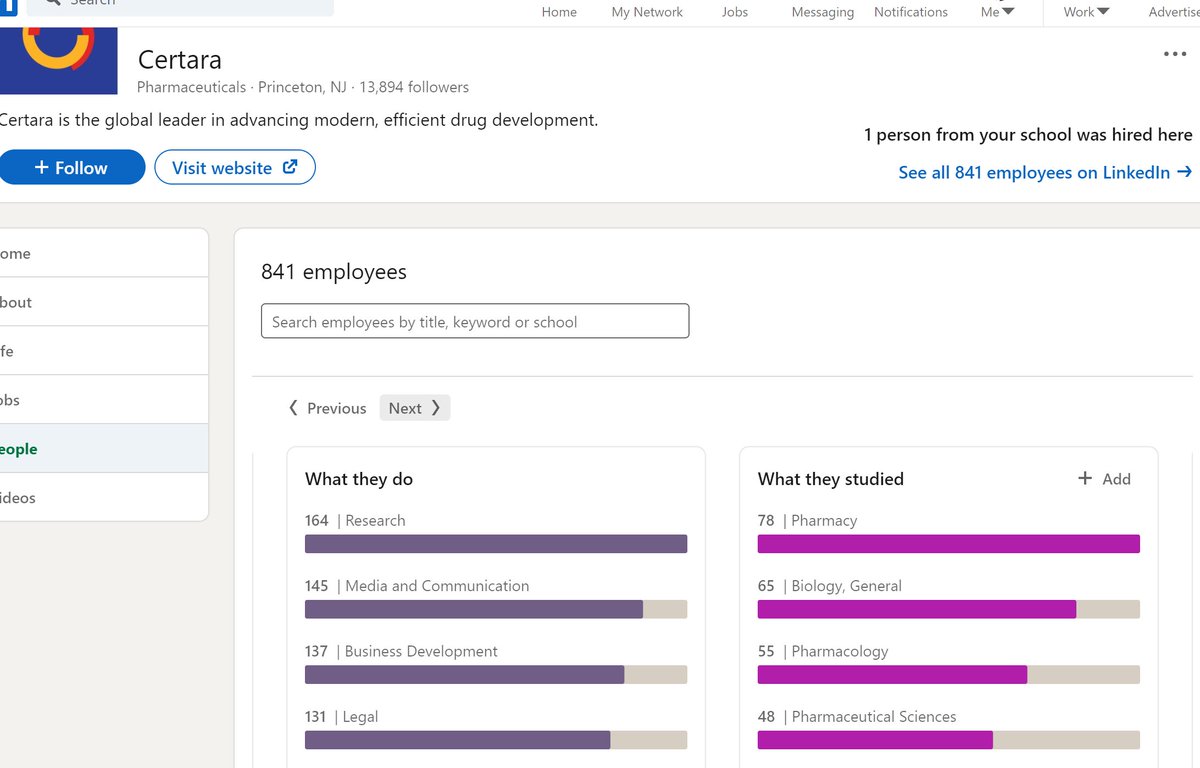

12: I dug deep into their financials and product presentations. I also stalked their LinkedIn employee pages to find answers on why $SDGR is valued more than $CERT?

13. Turns out $CERT is a rollup and a GREAT software company, selling to 1600 pharma, biotech, academic institutions etc. <software> that helps those companies find and develop drugs.

$SDGR does that too, but $SDGR is 1/2 the number of people and 1/2 the revenue

$SDGR does that too, but $SDGR is 1/2 the number of people and 1/2 the revenue

Read on Twitter

Read on Twitter