1/13: I’ve polled the #fintech community about Bank branches and what they think is going to happen to them by 2030. The general views aren’t surprising but I found the detailed comments really interesting (a few made me laugh). Unpacked:

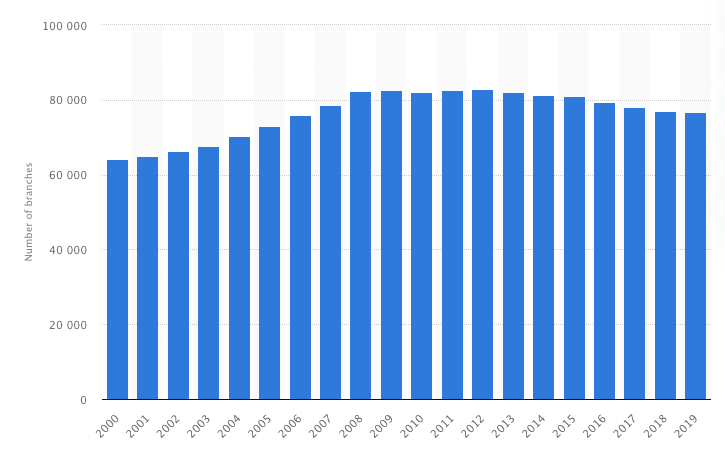

2/13: The first prediction from the community was that the number of branches would fall by a third to half by the end of the decade. The loss of 20-30K branches was thrown around by the #fintech community as if it’s a foregone conclusion.

3/13: One of the more interesting themes that emerged was that there is and will likely continue to be a reduction in the square footage of the branch system. The implication is that the # of branches isn’t the best way of measuring the downward trend.

4/13: Another theme that surfaced is that mergers have traditionally been the excuse used to rationalize branch closures. There’s no reason to believe that this playbook will change. In fact, it’s likely to accelerate and be the driver/justification for mergers.

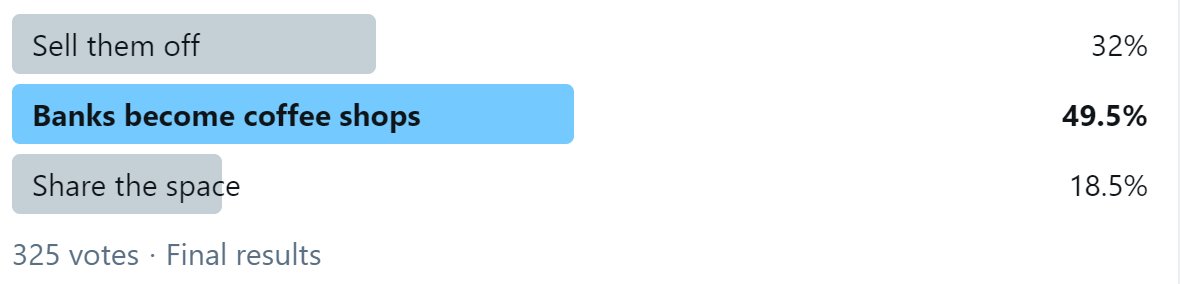

5/13: In another poll, I asked the #fintech community was what was going to happen to the branches being shuttered. 325 poor souls responded and many shared additional thoughts.

6/13: The comments were fun to read, especially those around who might buy the real estate. Ideas ranged from urgent care clinics (same footprint from a size and desired location standpoint) to dispensaries.

7/13: It was pointed out that buying and repurposing the real estate isn’t simple. Dealing with the vault is more problematic than people realize. Demolishing a vault takes cranes and wrecking balls and it sounds like a really difficult project.

8/13: Read this article if you want to learn more about demolishing a bank vault! https://www.dtspecializedservices.com/blog/posts/view/187/demolishing-a-bank-vault-what-would-it-take

9/13: It was also pointed out that any given time there are hundreds of branches for sale. @MatthewCHerra shared this link which is worth checking out if you want to track the trading activity in the space: https://www.loopnet.com/search/banks/usa/for-sale/

10/13: Half the votes were cast for the “Banks become coffee shops” option and while this isn’t likely the real outcome, it’s a statement that Banks need to rethink how branches are used by their customers. Visits are declining rapidly and this trend is only going to accelerate.

11/13: For instance, @ckneumann pointed out that in the UK, Barclays started turning branches into co-working spaces and created the @eagle_labs network.

12/13: My two cents: The concept of 50 X 50 boxes on street corners (branches) being customer origination and servicing locations is outdated. Today they’re giant, expensive billboards that do an OK job building awareness.

13/13: Tomorrow there will be fewer of them, they’ll serve multiple functions, and Banks will need to find different ways to make customers aware of their services. Fewer and fewer transactions are taking place in physical branches so running a Bank with this in mind is critical.

Read on Twitter

Read on Twitter