A few months ago I recapped the thesis laid out by @JeffBooth in ‘The Price of Tomorrow’ explaining the effects of deflationary technology.

This thread covers the other half of the equation- inflationary money.

This thread covers the other half of the equation- inflationary money.

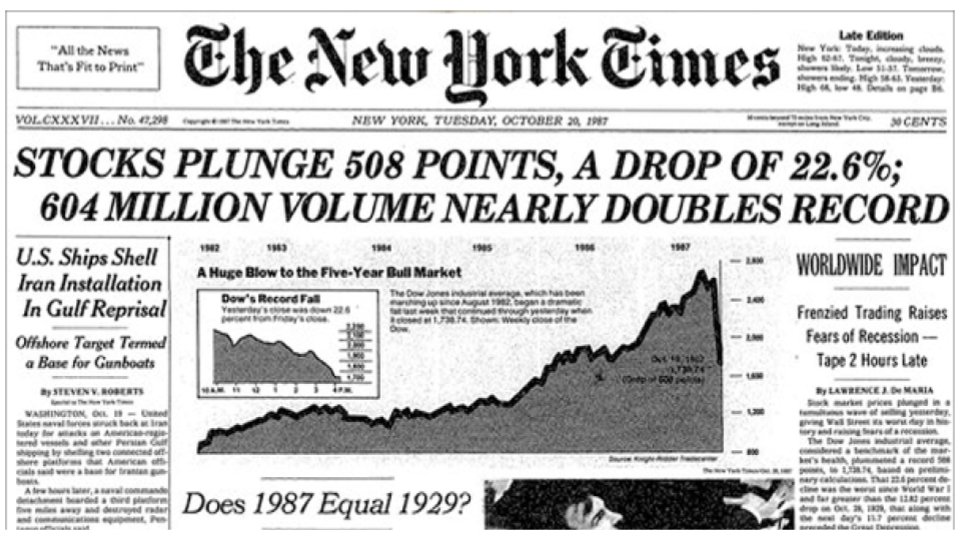

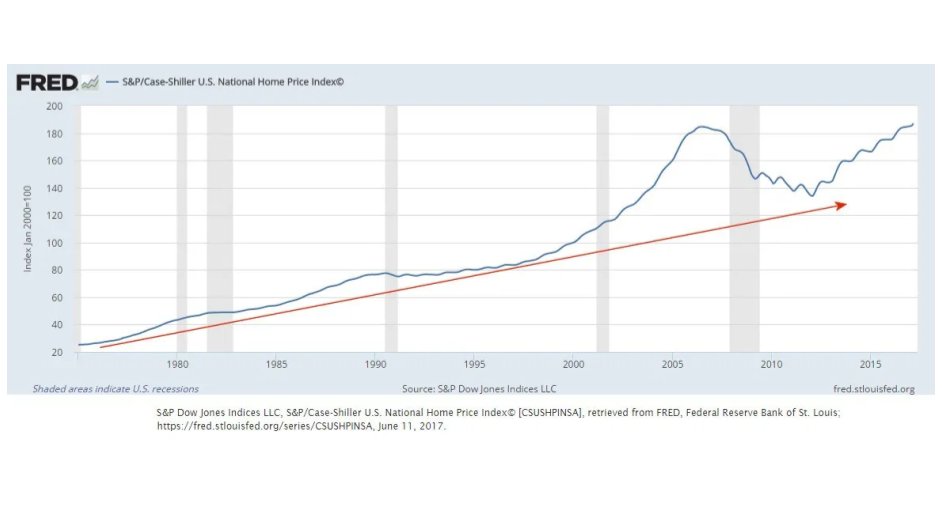

1/ “It wasn’t housing itself that caused the 2008 bubble. If it hadn’t been housing, it would have been somewhere else that easy credit was flowing to. The continuing rise of debt that cannot be paid back was at the heart of the housing crises & will be at the heart of the next.“

2/ “A bubble pops when people wake up and realize that the debt can never be paid off. At that point, credit is removed—and because easy credit was the main thing causing the run-up, assets collapse.”

3/ “This system works on trust—trust that you will pay what you said you would pay.. Remove trust and it affects the credit-worthiness of an individual or company. Remove trust from a system and the entire system can unravel very quickly.”

4/ “With credit continuing to advance globally, it is only a shell game as to where the next crisis originates. In fact, the shell game is now moving to currencies themselves and the entire economic system that is built on top of them.”

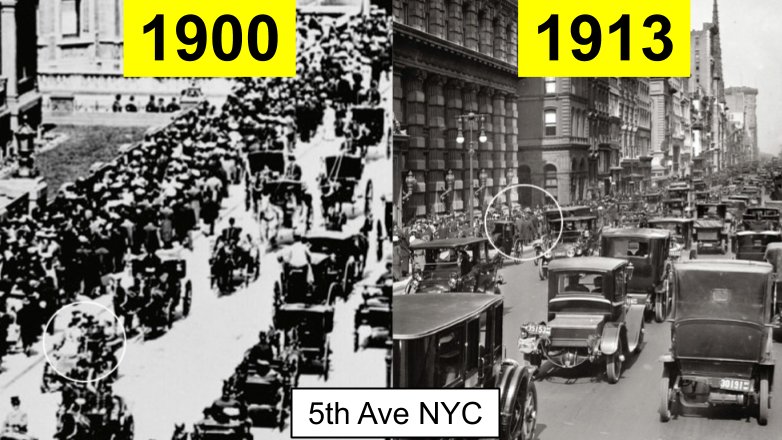

5/ “When economies & high-paying jobs are at risk,.. the easiest thing to do in politics is to blame outsiders or game the situation to provide short-term benefit—and kick the can down the road. This ignores the impact of technological growth and.. create[s] more global tension.”

6/ “Bringing back coal mining jobs at a time when hydrocarbons are being replaced by renewable energy is akin to training more blacksmiths when the horse and buggy was being replaced by the automobile. It doesn’t address the root cause for the jobs disappearing: technology.”

7/ “When debt is growing much faster than a country’s economy, at what point does the music stop? It is often difficult to see, because asset price inflation can make individuals, companies, and even countries feel much better off than they are.”

8/ “This, in turn, fuels asset price inflation, people pile on more debt,...like hamsters on a wheel, they keep going and going around until they fly off or collapse.“

9/ “We fool ourselves into believing that assets, such as stocks or housing, always go up over the long term.. We should ask whether those same assets would have gone up over the last 20 years if there hadn’t been $185T of new capital injected into economies over that time.”

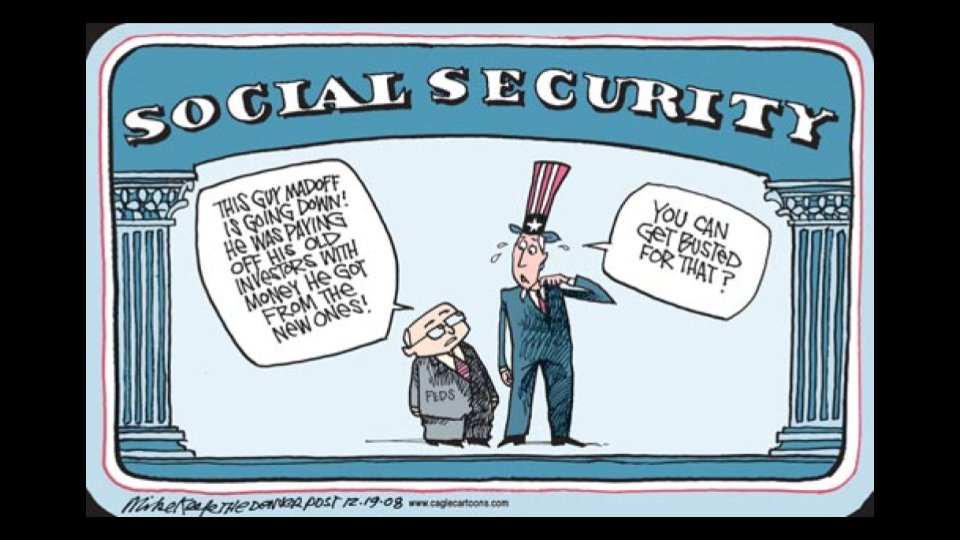

10/ “When that stops, which it eventually will, things will change very quickly. If it takes ever-increasing credit growth to achieve economic growth, how are our economies any different from a Ponzi scheme?”

11/ “To keep the system running, monetary policy all around the world has target inflation rates.. inflation makes debt easier to pay back because you’re paying yesterday, when dollars cost more, with money from tomorrow, when dollars are worth less.”

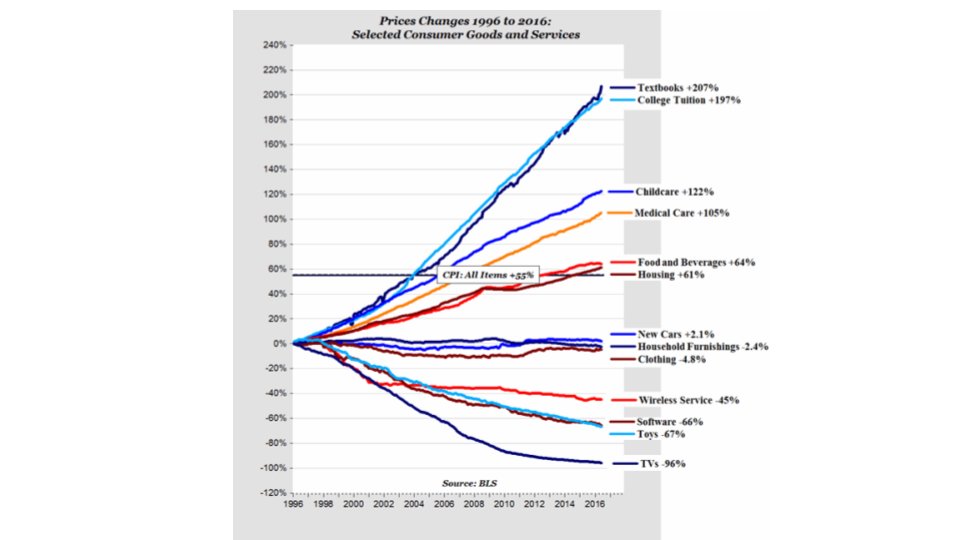

12/ “For those unable to access debt.. and put it into assets that rose in value, the inflation has been punishing because their dollars do not go as far as they used to.”

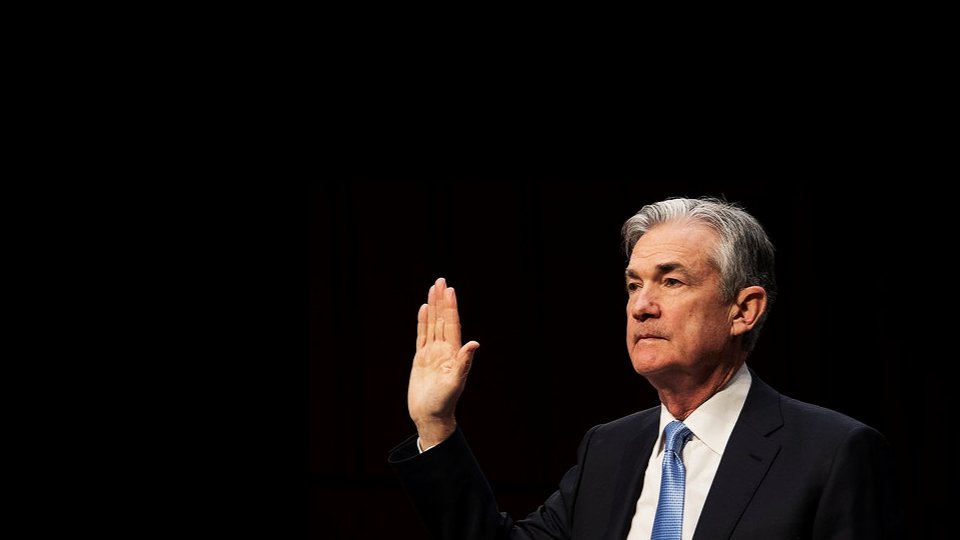

13/ “they [central banks] made a choice that changed capitalism by gifting many of the engineers of the chaos with risk-free returns at the taxpayers’ expense.”

14/ “Quantitative easing refers to the act of injecting liquidity into an economy by a central bank. In order to inject liquidity, new dollars need to be created and they need to be delivered into the economy.”

15/ “In the United States in 2008, banks were given access to borrow federal funds at a 0 percent interest rate. Some non-banks at the time, like Morgan Stanley and Goldman Sachs, changed their charters to become banks to get access to the free money.”

16/ “Without this opportunity, many of the banks and investments banks would have merged, been bought at pennies on the dollar, or collapsed outright.”

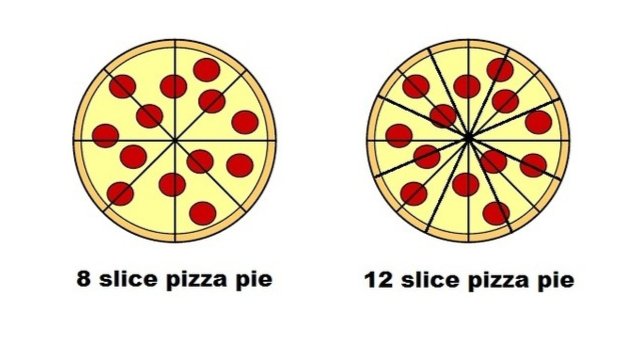

17/ “The government doesn’t actually have more assets; it’s just representing its assets with more units of currency, which means each unit of currency is worth less—like cutting a pizza into twelve slices instead of eight..”

19/ “Countries often devalue currency to help their export markets. But in a globally connected world with many countries driving each of their own national interests and jobs, this makes less sense.”

20/ “This race to the bottom on currencies only serves to further push up global asset prices. And the endless game of reducing the value of currencies relative to others only serves as a short-term panacea..”

22/ “Asset prices collapse. Loans on those assets become non-performing. Most of the banking system collapses. Only the best loans can be repaid. Many people are wiped out as the collapse destroys all who took unnecessary risks.”

23/ “many more are wiped out because of the lack of liquidity in the system, meaning that some investments deemed safe also fail.”

24/ “But in that environment, hard dollars would explode in value and those who had savings and cash would pick up extremely low-priced assets and mispriced deals and make their fortunes.”

25/ “Monetary easing & artificially low interest rates have been a grand experiment played out on the world stage without full consideration of the downstream effects. For the wealthy and those with assets that have been artificially boosted, that experiment has played out well.”

26/ “If we’re being honest with ourselves, much of the wealth and privilege that we enjoy is not from our ingenuity or hard work, but because the governments of the world decided to print money.“

27/ “Our assets, including real estate and stocks, were the beneficiaries, having run up in value far beyond what they would have been without the printing.”

28/ “A market where government reaches in to decide who wins or loses is nothing more than crony capitalism, where wealth is not created by the value you create and the risks you take to get there but by a political system that rewards its insiders.”

29/ “for every person on the winning side of that decision, there are many others on the losing side. Their costs of food, shelter, gas, and healthcare are rising because their cash and wages are less valuable. Assets that they don’t yet own are running away in price.”

END/

For the other half of this book summary, covering the deflationary nature of technology, here you go https://twitter.com/anilsaidso/status/1306287762228695040?s=20

https://twitter.com/anilsaidso/status/1306287762228695040?s=20

For the other half of this book summary, covering the deflationary nature of technology, here you go

https://twitter.com/anilsaidso/status/1306287762228695040?s=20

https://twitter.com/anilsaidso/status/1306287762228695040?s=20

Read on Twitter

Read on Twitter

![5/ “When economies & high-paying jobs are at risk,.. the easiest thing to do in politics is to blame outsiders or game the situation to provide short-term benefit—and kick the can down the road. This ignores the impact of technological growth and.. create[s] more global tension.” 5/ “When economies & high-paying jobs are at risk,.. the easiest thing to do in politics is to blame outsiders or game the situation to provide short-term benefit—and kick the can down the road. This ignores the impact of technological growth and.. create[s] more global tension.”](https://pbs.twimg.com/media/EpOOIGqVEAAlIgt.jpg)

![13/ “they [central banks] made a choice that changed capitalism by gifting many of the engineers of the chaos with risk-free returns at the taxpayers’ expense.” 13/ “they [central banks] made a choice that changed capitalism by gifting many of the engineers of the chaos with risk-free returns at the taxpayers’ expense.”](https://pbs.twimg.com/media/EpOPgqVVgAACWTt.jpg)