We’ve seen a lot of comments/takes on our new dataset on China’s Overseas Development Finance and want to set the record straight:

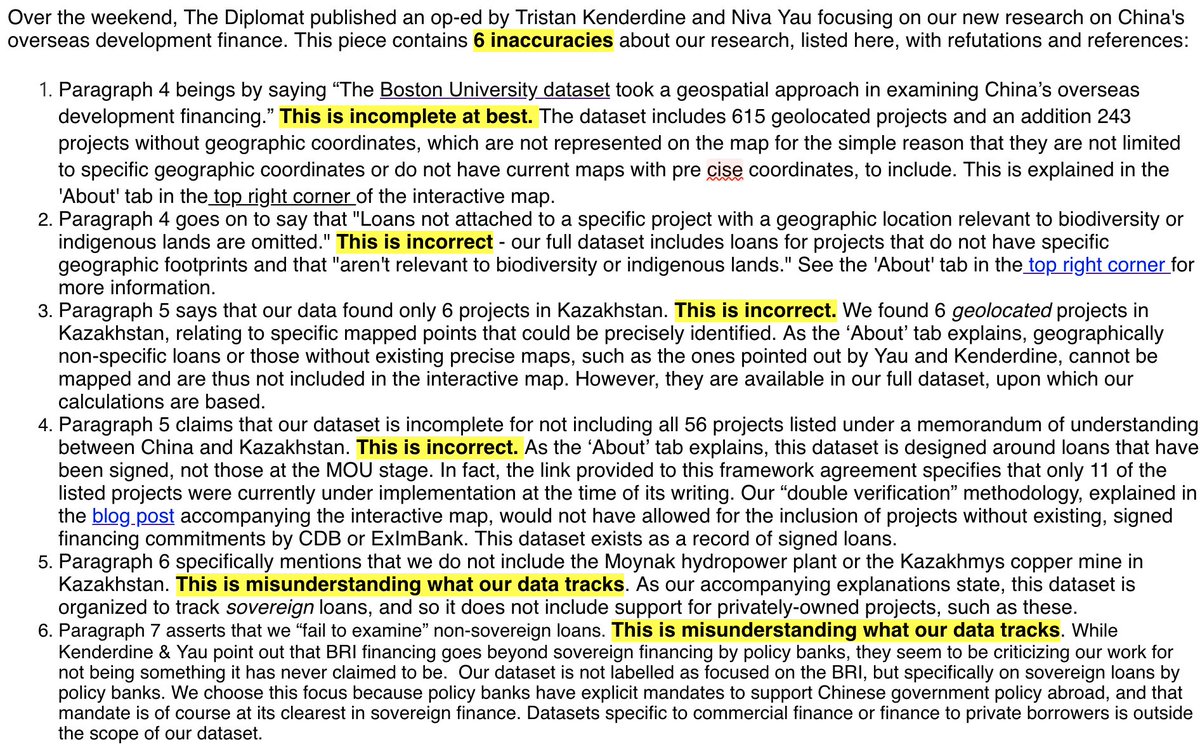

First, there was an article in @Diplomat_APAC over the weekend critiquing our work – unfortunately, this piece includes 6 major inaccuracies of what our research is/isn’t, making their piece misleading. The list of errors is shown here:

We’ve contacted @Diplomat_APAC editor & are waiting for a response about how this piece was published with errors and a fundamental misunderstanding of our work.

We also published a blog to further clarify the scope and findings of our database, explained below: https://www.bu.edu/gdp/2020/12/13/scope-and-findings-chinas-overseas-development-finance-database/

CODF Database tracks all overseas loan commitments to govs & state-owned entities from China’s 2 main policy banks operating abroad – China Development Bank (CDB) & Export-Import Bank of China (ExImBank) – to govs, gov owned banks & funds, & state-owned enterprises, 2008-2019.

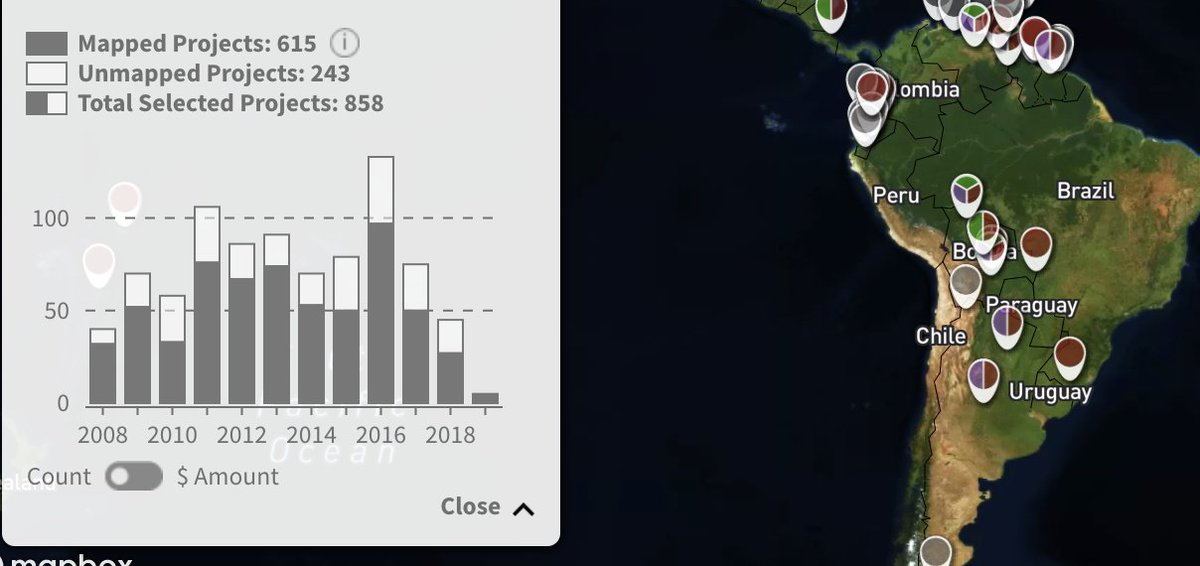

How many and what kind of loans are included? - The CODF Database includes 858 projects: 615 mapped with specific geographic footprints and 243 unmapped because they don’t have specific geo footprints.

The unmapped loans *are still included* in the total amounts of finance that have been reported, both in our blog post about the database and in media reports.

The CODF Database consists of 2 parts: the interactive map of projects with geographic footprints & a table below the map.

*ALL* of the projects - both mapped and unmapped - are now searchable in the table below the map in the interactive: http://www.bu.edu/gdp/chinas-overseas-development-finance/

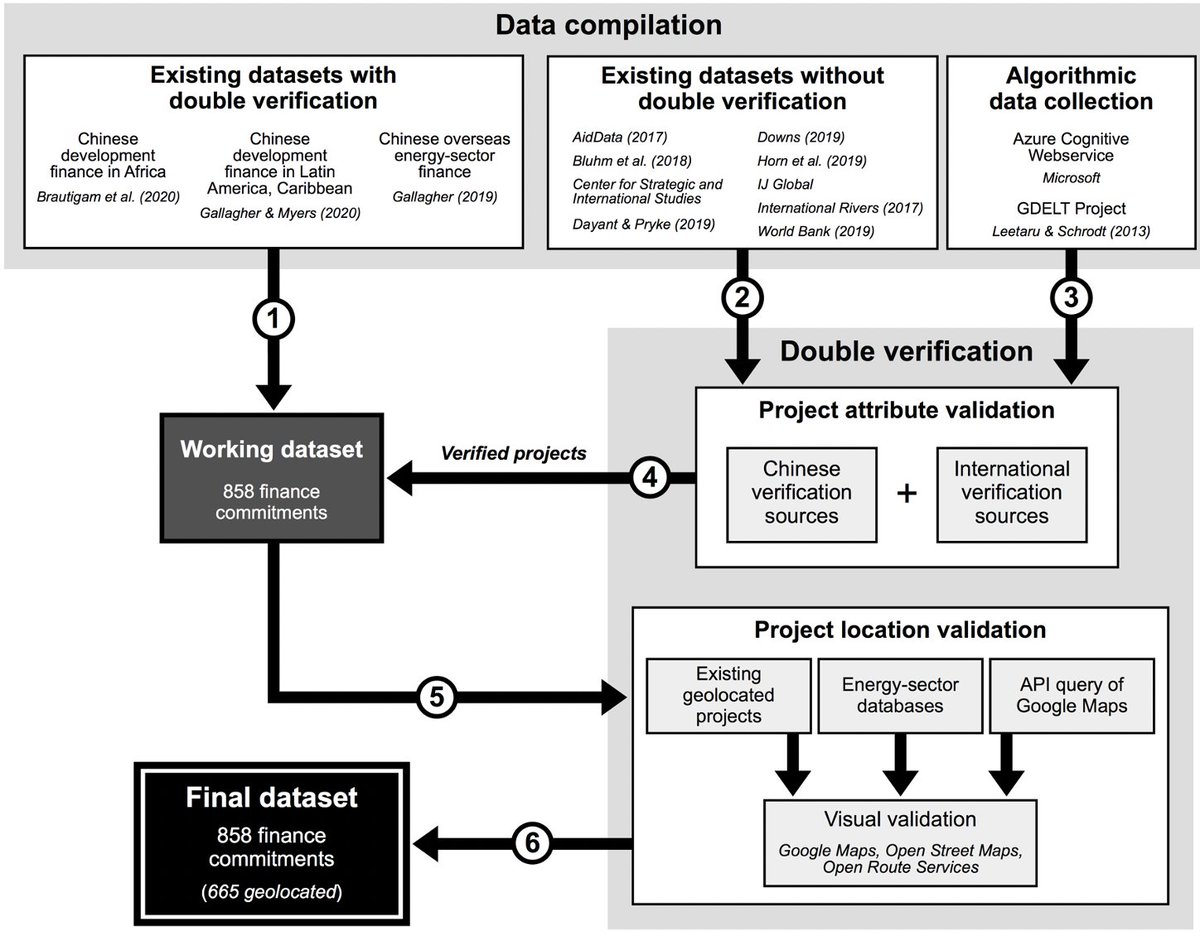

All of the loans in the database were put through a rigorous double verification method, pictured here and explained in our public webinar last week https://www.bu.edu/gdp/2020/12/10/demonstrating-chinas-overseas-development-finance-webinar-summary/

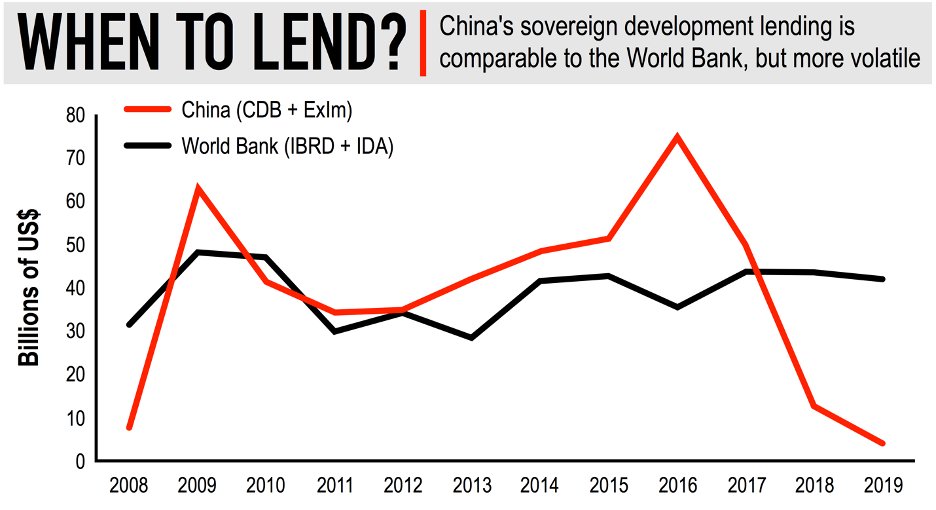

The interactive reveals 3 key findings: 1) Over this time period, CDB and ExImBank extended $462 billion in sovereign finance commitments: just $5 billion less than the World Bank in the same time frame.

This result shows the importance of tracking and analyzing Chinese development finance, which is now by far the world’s largest source of bilateral finance.

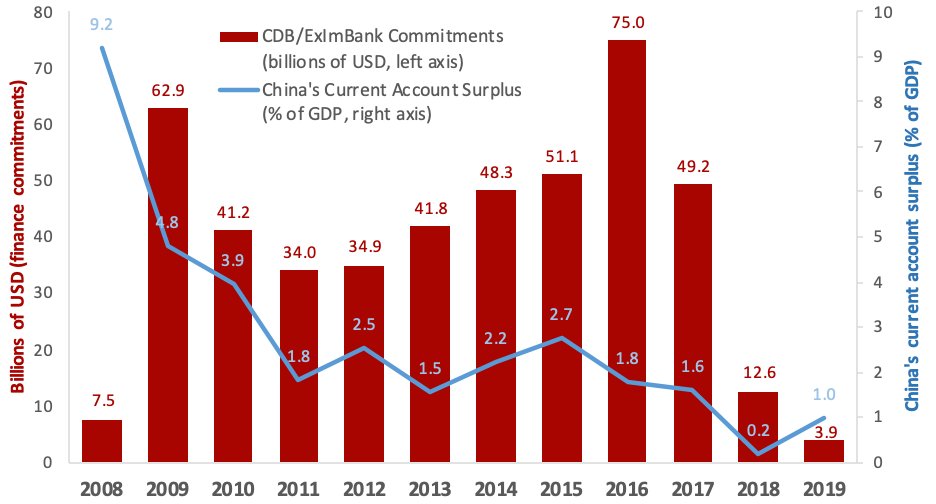

2) There has been a significant drop in these types of loans over the past few years. See Figure here

3) The geo-spatial component of this dataset shows significant overlaps exist between this portfolio of loans & 3 types of sensitive territories: critical habitats, national protected areas, and indigenous peoples’ lands.

What does it not track? - The CODF Database does not track China’s state-owned commercial bank activity, or services exports through supplier credits. Our database fills a gap on tracking the policy bank lending, the ‘first mover’ in development finance.

The CODF Database alone should not necessarily be used as the sole barometer of China’s overseas economic activity in general & BRI in particular. However, downward trend in overseas lending is supported by our other research.

Our recently released ‘China’s Global Power Database’, includes an estimate of Chinese overseas FDI in electric power plants, also points to a slowing in commercial finance. http://Bu.edu/cgp

China’s overall balance of payments trends also track w/ our estimates. Chart here shows China’s current account surplus has been trending downward, similar to the trendline in our CODF findings:

We are always happy to discuss our work with others, but hope that those others will take the time to actually read our research before critiquing.

We stand by our data and welcome people to explore the interactive of the mapped projects and the table below of all 858 projects: https://www.bu.edu/gdp/chinas-overseas-development-finance/

More information on our data and research is available:

- In the 'About' and 'FAQ' tabs of our interactive: https://www.bu.edu/gdp/chinas-overseas-development-finance/

- In our main blogpost: https://www.bu.edu/gdp/2020/12/07/tracking-chinas-overseas-development-finance/

- In the recording of the public webinar: https://www.bu.edu/gdp/2020/12/10/demonstrating-chinas-overseas-development-finance-webinar-summary/

- In the 'About' and 'FAQ' tabs of our interactive: https://www.bu.edu/gdp/chinas-overseas-development-finance/

- In our main blogpost: https://www.bu.edu/gdp/2020/12/07/tracking-chinas-overseas-development-finance/

- In the recording of the public webinar: https://www.bu.edu/gdp/2020/12/10/demonstrating-chinas-overseas-development-finance-webinar-summary/

More info also:

- in the clarifying blog post we published last night: https://www.bu.edu/gdp/2020/12/13/scope-and-findings-chinas-overseas-development-finance-database/

- Other aspects of our research are currently out for peer review for publication in academic journals.

- in the clarifying blog post we published last night: https://www.bu.edu/gdp/2020/12/13/scope-and-findings-chinas-overseas-development-finance-database/

- Other aspects of our research are currently out for peer review for publication in academic journals.

Further questions welcome, please contact our team by emailing [email protected]. /end.

Read on Twitter

Read on Twitter