Attention swap lines nerds & capital flow aficionados! New Bulletin out!

(w/ @EhlersTorsten, Cabanilla, Disyatat, McGuire & von Peter)

Central bank swap lines and cross-border bank flows https://www.bis.org/publ/bisbull34.htm a través de @bis_org

On the importance of elastic balance sheets

1/

(w/ @EhlersTorsten, Cabanilla, Disyatat, McGuire & von Peter)

Central bank swap lines and cross-border bank flows https://www.bis.org/publ/bisbull34.htm a través de @bis_org

On the importance of elastic balance sheets

1/

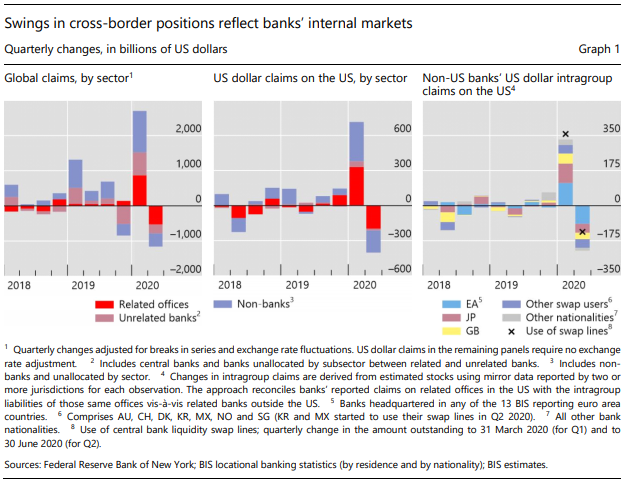

Q1 2020 saw an extraordinary expansion in global cross-border banking flows, driven primarily by a rise in banks’ positions vis-à-vis other banks, both with related (intragroup) and unrelated (interbank) institutions. 2/

Of particular importance were US dollar-denominated claims on bank affiliates located in the United States, which accounted for more than a third of this total. These flows largely reversed in the second quarter as financial conditions improved. 3/

These exceptional movements reflect, in part, how banks manage liquidity across borders through their global network of offices. The use of the Fed’s US dollar swap lines highlights these movements. 4/

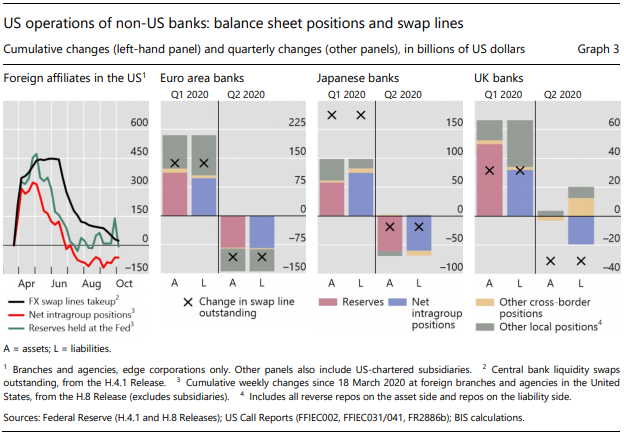

By end-March 2020, $358 billion had been drawn, most prominently by banks in JP, the EA and the UK. Indeed, banks headquartered in these jurisdictions reported the largest increases in dollar claims on their affiliates in the US (right-hand panel above) 5/

The use of the swap lines serves to illustrate the mechanics of cross-border capital flows as well as the

“elastic” nature of the global banking system (central bank plus commercial banks) 6/

“elastic” nature of the global banking system (central bank plus commercial banks) 6/

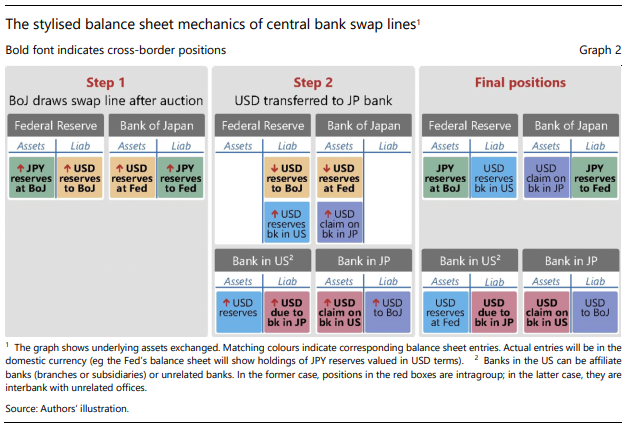

Graph 2 shows a stylised illustration (BoJ as example). The use of the swap lines expands the balance sheets of the central banks as well as those of the commercial banks in both countries. It also comes with cross-border interbank flows (mostly intragroup)

7/

7/

Two things worth noting: 1. the uptake of the SL results in an increase in liquidity (reserves) of affiliated (or

correspondent) banks in the US. So, though a key aim of the SL is to ease global USD liquidity strains, they can also alleviate liquidity tensions of banks in the US

correspondent) banks in the US. So, though a key aim of the SL is to ease global USD liquidity strains, they can also alleviate liquidity tensions of banks in the US

2. the global supply of USD expands on account of both the Fed’s injection of reserves into the US banking system and the increase in non-resident dollar deposits in US-based banks. 9/

In this way, the swap lines leverage on the “elasticity” of the Fed’s and commercial banks’ balance sheets to offset

rising demand for dollar liquidity. This “grand dollar overdraft” reflects the Fed’s critical role as a backstop

for the dollar-based global financial system. 10/

rising demand for dollar liquidity. This “grand dollar overdraft” reflects the Fed’s critical role as a backstop

for the dollar-based global financial system. 10/

For banks in the US, the balance sheet mechanics above suggest that use of the swap lines results

in an increase in liabilities to banks abroad, predominantly in the form of a net due position vis-à-vis a

parent bank, in tandem with an increase in reserves at the Fed 11/

in an increase in liabilities to banks abroad, predominantly in the form of a net due position vis-à-vis a

parent bank, in tandem with an increase in reserves at the Fed 11/

The USD-based global financial system needs a dollar backstop in periods of stress. The Fed has provided that backstop through its extensive network of swap lines. The elasticity of the Fed’s balance sheet also enables commercial banks to flexibly respond to liquidity shocks 12/

Such injections of liquidity flow across borders and show up in the form of a rise in cross-border interbank and intragroup claims. These represent the increase in non-resident holdings of the means of payment that helps to stabilise global dollar liquidity conditions. end/

Read on Twitter

Read on Twitter