We've already established that $INTC is about to lose serious market share in the PC market but truth be told, Intel's most important segment is probably what it terms as the "Data Center Group", it's data center business. So what are Intel's prospects there? Let's do a deep dive https://twitter.com/LucidCap/status/1338208878278926338

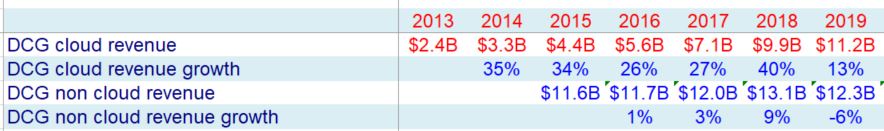

While Intel's CCG segment (the PC segment) is fairly stagnant, The Data center segment (henceforth DCG) has been growing nicely for years. 2019 revenue are ~50% above 2015 and the segment has shown nice growth 2020 so far

So what has enabled an old mature co like $INTC to suddenly grow so fast in a major segment?

It's kind of obvious, isn't it? the CLOUD.

The DCG segment actually contains 2 very different activities - Traditional data center and hyper cloud

It's kind of obvious, isn't it? the CLOUD.

The DCG segment actually contains 2 very different activities - Traditional data center and hyper cloud

And while it's hyper cloud business was booming, it's traditional data center business was stagnating.

We estimate that between 2014-2019, Hyper cloud grew at ~30% CAGR with Traditional data center operating without growth

We estimate that between 2014-2019, Hyper cloud grew at ~30% CAGR with Traditional data center operating without growth

So it's pretty easy do see that the future of $INTC lies in its hyper cloud business. We've established that it faces a bleak future in PC and traditional data center, well, let's just say it's not a growth business.

Hyper cloud is basically 3 companies: $AMZN, $MSFT, $GOOG. What is the competitive dynamic in Hyper cloud (from the CPU perspective)?

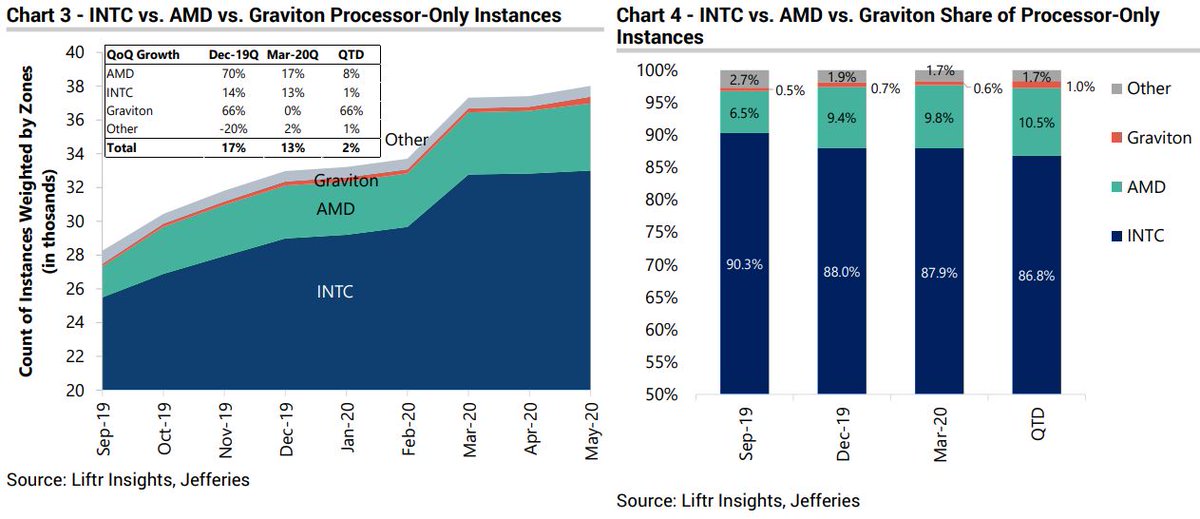

One can see that the hypercloud guys basically have 2 options: $INTC & $AMD

One can see that the hypercloud guys basically have 2 options: $INTC & $AMD

$INTC is rapidly losing market share to $AMD which is a bit alarming and imo is the main reason for its stock behavior lately, but I argue that while the Intel / AMD is certainly of some importance, the market is focusing on the wrong thing

I can't stop myself from thinking about the war of the five kings. While all of Westeros petty kingdoms were fighting in the south, the true threat was forming in the north, waiting to reveal itself

unbeknownst to the southerners, back in 2015 the dark lord Bezos has started gatherings his army by purchasing an obscure Israeli start-up for $350M - Annapurna Labs https://www.extremetech.com/computing/198140-amazon-buys-secretive-chip-maker-annapurna-labs-for-350-million

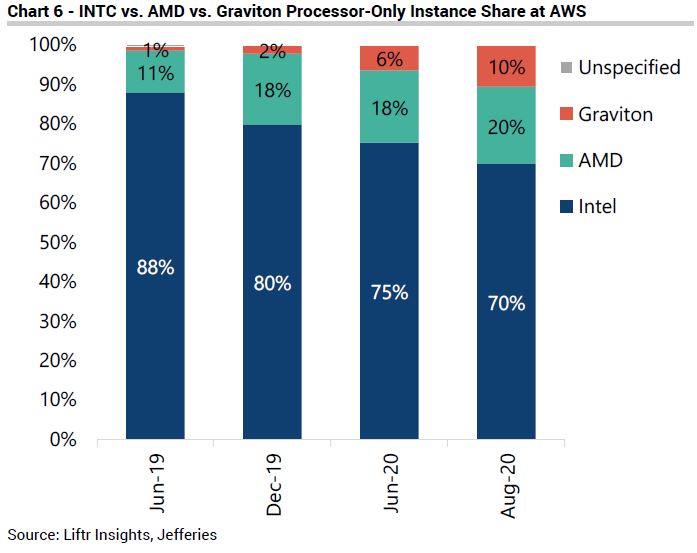

By 2018, Bezos introduced his creation to the world, the first version of his final weapon, the one who will finally vanquish his ancient rivals $INTC & $AMD, the Graviton https://www.geekwire.com/2018/amazon-web-services-introduces-custom-designed-arm-server-processor-promises-45-percent-lower-costs-workloads/

recently on May 2020, AWS released the latest Graviton version (v2) and the attack on the south has officially begun.

Performance benchmarks have been quite telling - it seems like Graviton2 is on par with x86 performance wise, and is much cheaper

Performance benchmarks have been quite telling - it seems like Graviton2 is on par with x86 performance wise, and is much cheaper

maybe direct quotes will illustrate it better:

"The cost analysis section describes ‘An x86 Massacre’, as while the pure performance of the Arm chip is generally in the same region as the x86 competitors, its lower price means the price/performance is substantially better"

"The cost analysis section describes ‘An x86 Massacre’, as while the pure performance of the Arm chip is generally in the same region as the x86 competitors, its lower price means the price/performance is substantially better"

"If you’re an EC2 customer today, and unless you’re tied to x86 for whatever reason, you’d be stupid not to switch over to Graviton2 instances once they become available, as the cost savings will be significant"

btw the quotes are from http://infoq.com . I suggest go directly to the source and read the entire article https://www.infoq.com/news/2020/03/Graviton2-benchmarks/

And that's where we come full circle. What does the future holds for Graviton? luckily for us, we don't have to make some wild prediction, because the future is already here. What is the future you ask? it's the magnificent M1: Black. Magic. Fuckery https://twitter.com/emilio_gold/status/1333926929079132161?s=20

while Graviton is on par with x86 ($INTC) on performance, the M1, which is also based on ARM, blows the x86 out of the water. It's inevitable that at some point in the next 1-2 years, AWS will release a mind blowing version of Graviton akin to the M1

At that point the battle will be lost. the dark lord and his minions will prevail, the southern kingdom ($INTC) will fall like the old great empire of $NOK

Read on Twitter

Read on Twitter