Enough about Millennials vs Baby Boomers when it comes to money.

Let’s talk Gen Z vs Millennials!

Read this thread to get perspective about these two generations across income, credit, attitude and more.

Spoiler alert. It’s not pretty for Millennials

Let’s talk Gen Z vs Millennials!

Read this thread to get perspective about these two generations across income, credit, attitude and more.

Spoiler alert. It’s not pretty for Millennials

1/ Gen Z make up about 20% of the US population and have a spending power of 140Bn. 7 year olds are spending big money on RoadBlock. 22 year olds are spending money on education, experiences and utilities as they start young adulthood. This is the digital and DIY generation.

2/The youngest Millennial is now 24 years old, and the oldest is hitting 40. Making up 22% of the population, Millennials are most meme’d for their love of avocado toast, hipster coffees and debt. While an impressive 1.4 Trillion in spending power, they are dubbed the “Lost” Gen.

3/ Gen Z’s income is expected to increase 5x by 2030 to $33 trillion as they enter the workplace, accounting for over a quarter of global income, they will surpass Millennials’ income by 2031. While this is huge, the two generations have more in common than you’d think.

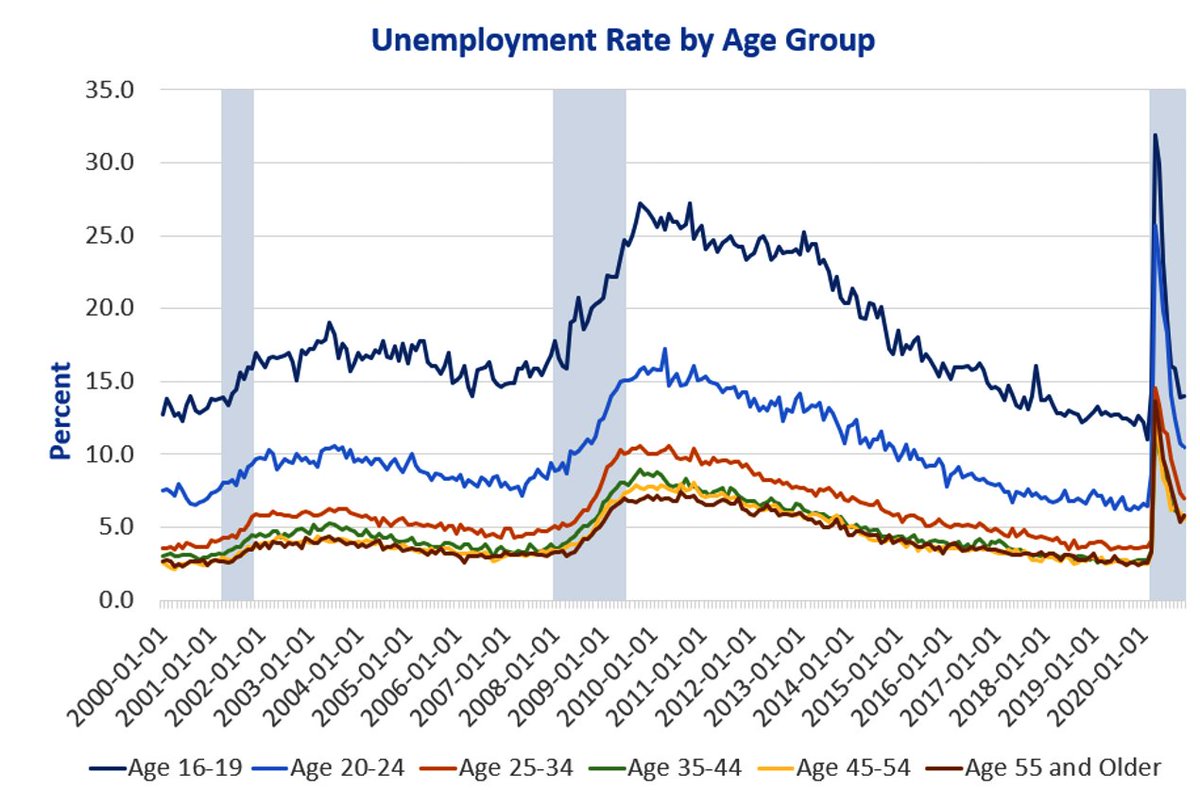

4/Both generations have been hit hard by Covid unemployment as they made up most of the service industry. Both are in the digital age. Both have equal sentiment that the existing world no longer reflects the needs of the future. But it seems this is where the buck stops...

5/While this is the 1st economic downturn for Gen Z’s, it will be the 2nd for Millennials since the GFC. They joined the job market during a recession, have student loans, and the FED printed 24% of all US dollars in 2020 alone which has devalued the dollar and therefore savings.

6/Here’s another key difference. With better income and access to financial services, Gen Z’s have a better credit score. With Gen Z’s yielding a strong credit score at a young age, this will have positive ripple effects through the rest of their financial life.

7/But this isn't the same for Millennials. When they were of age to take out credit, there was a significant contraction in the credit marketplace due to the recession that made loans impossible. This left Millennials little chance to build a strong credit score from a young age.

8/With all this, it seems how well a generation does comes down to the economic environment they were born into. Gen Z’s bright future comes from a favourable economic environment, access to financial education and maturing digital financial products and services.

9/While Millennials now have equal opportunity to democratised financial education and services, their present and future is defined by crisis with 9/11, Covid, recessions and a changing world into digital.

They may have access, but less time to change their future.

They may have access, but less time to change their future.

10/ So there you have it.

A little more about where Gen Z and Millennials sit across income, credit, attitudes and opportunities.

Do you think Millennials are the lost generation? Or there’s a silver lining somewhere in the future for them?

A little more about where Gen Z and Millennials sit across income, credit, attitudes and opportunities.

Do you think Millennials are the lost generation? Or there’s a silver lining somewhere in the future for them?

Read on Twitter

Read on Twitter