$ARPO I have a strong hypothesis about what's going on w/ this unusual Friday AH data drop. I have taken some time to review everything & after my review I believe $ARPO tanked their Glaucoma data on purpose.

$ARPO the main bull thesis this week which was posted by @sentivcapital was that ARPO's drop out rate was historically low for past Glaucoma trials. 195 patients participated in the trial & 194 patients competed the 28 day cycle.

$ARPO after thinking about past competitors trials the low drop-out rate for ARPO was more a red flag than a bull case. The fact only (1) person dropped out of their study makes you wonder what was going on with the trial design.

I honestly believe $ARPO wanted this data to fail and the easiest way to do that was release it Friday AH which protects funds to a degree. Once this news was out, they could begin to initiate their real plan.

$ARPO regardless of data, the shell is clean and has 47M cash as of the last quarter. We estimate they sold about 5M shares since and would thus have ~52M OS and ~55M cash with which they can execute a transaction. Credit @biosleuth

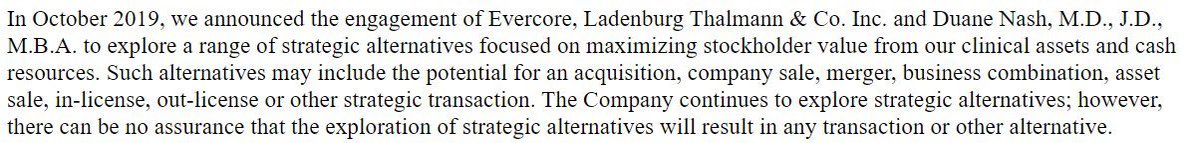

$ARPO To that end, they started working with Evercore + Ladenburg back in 2019, while trimming costs and ditching the old management (see pic sourced from the company’s 10-Q: Credit @biosleuth).

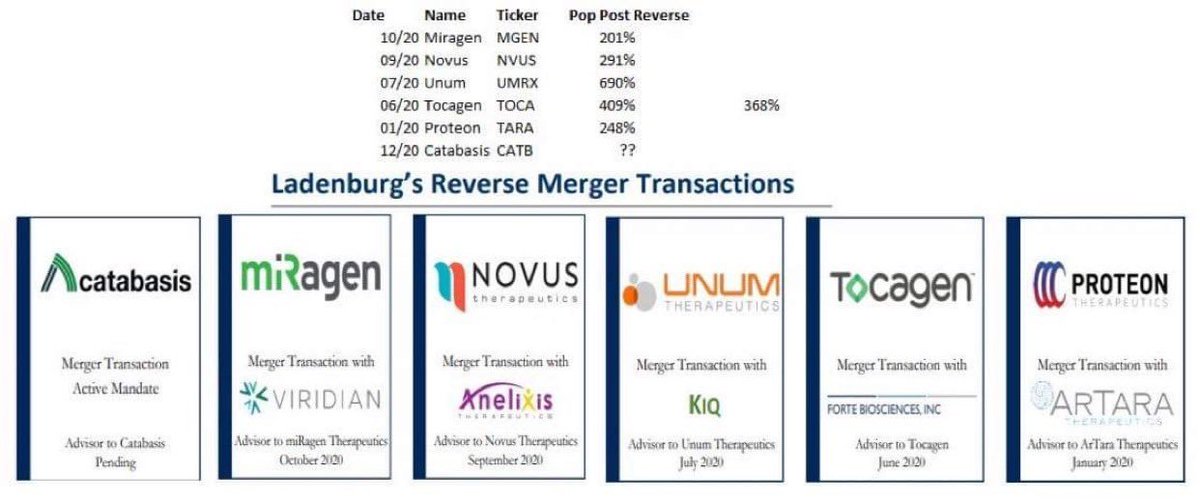

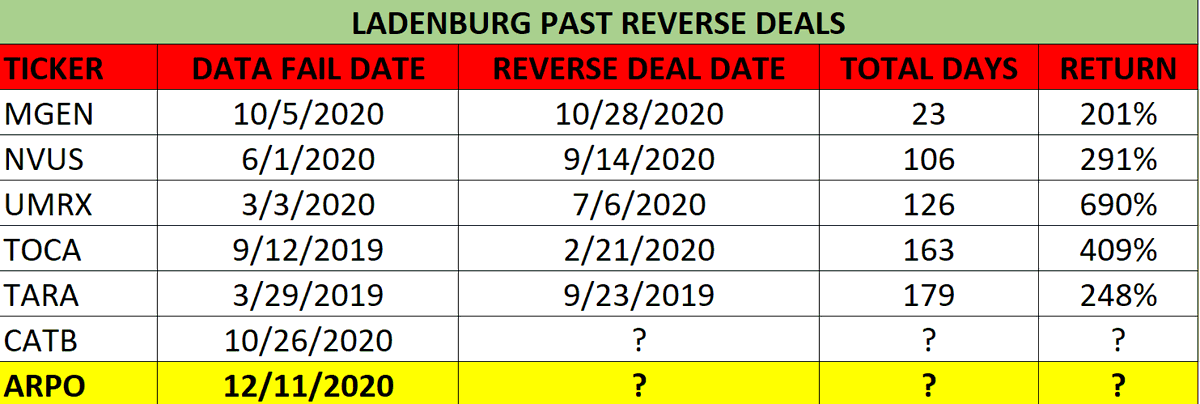

Ladenburg has had significant recent success with these reverse merger deals, the most recent of which is $MGEN +201%. The average return on the last (5) deals has been 368%. Reverse deals are the new IPO in 2020 (see pic: Credit @buysidebio).

All of the previous reverse deals has (3) things in common which most had. First, they all failed data. Second, they almost all had some change in management or layoffs. Lastly, they ALL worked and are working with Ladenburg.

I went back and the it seems there was a very similar theme excluding the $MGEN deal which was 23 days after failed data. The remaining reverse deals all happened between days 100-180 after failed data (see below spreadsheet which I put together)

My theory is $ARPO will take the exact same path as the past mentioned reverse deals. All of these companies posted bad data & all of their PR's were IDENTICAL to the recent $ARPO PR today + the 19' 10Q. If I am right $ARPO will reverse merge in the next 180 days.

$ARPO has 55M in cash roughly ($1.12/share), 52M OS, and a good clean share structure which only makes this deal even better for a reverse merger type deal. Big players like Orbimed, Ladenburg, and Evercore all involved in this stock which only makes this theory stronger.

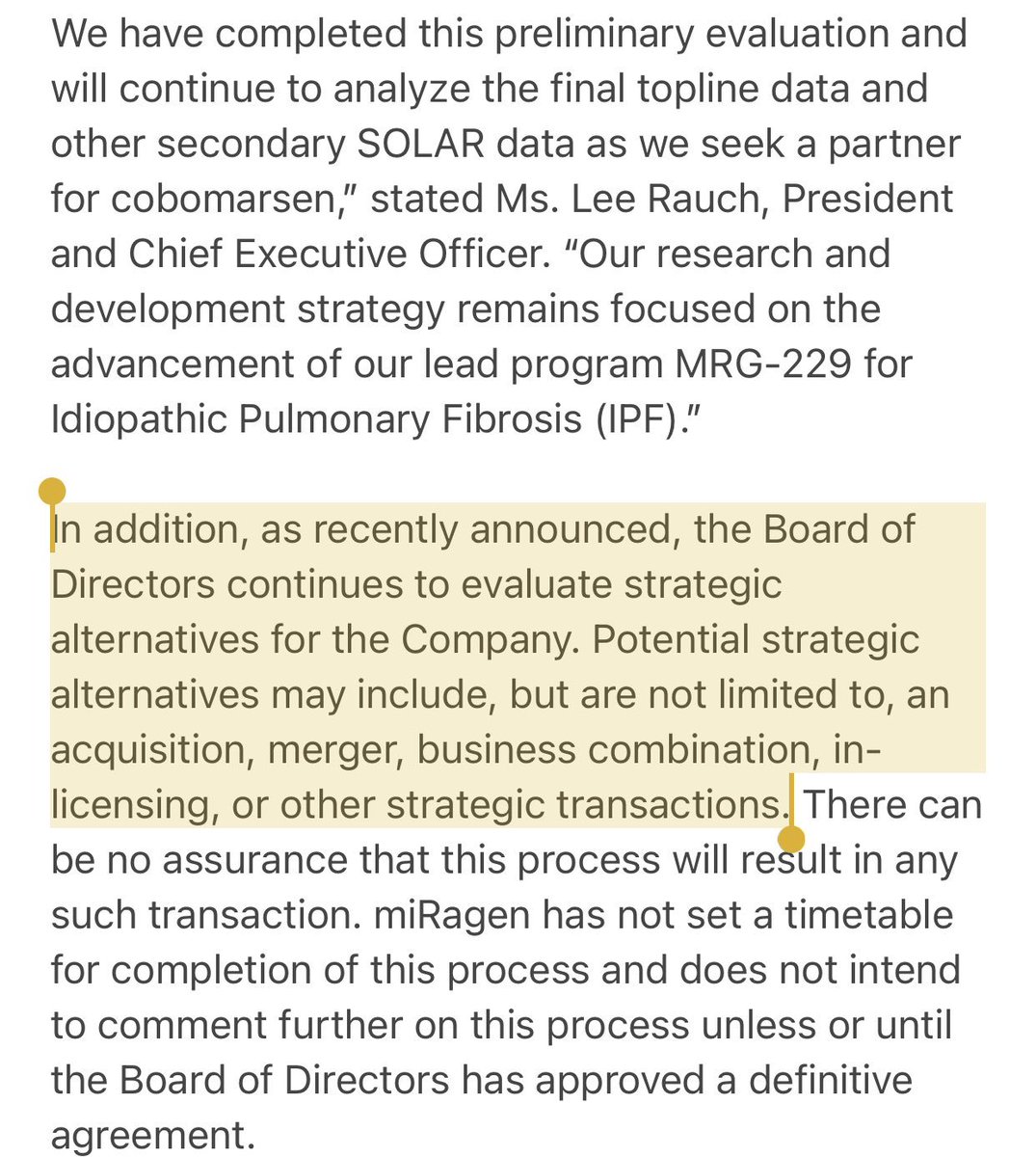

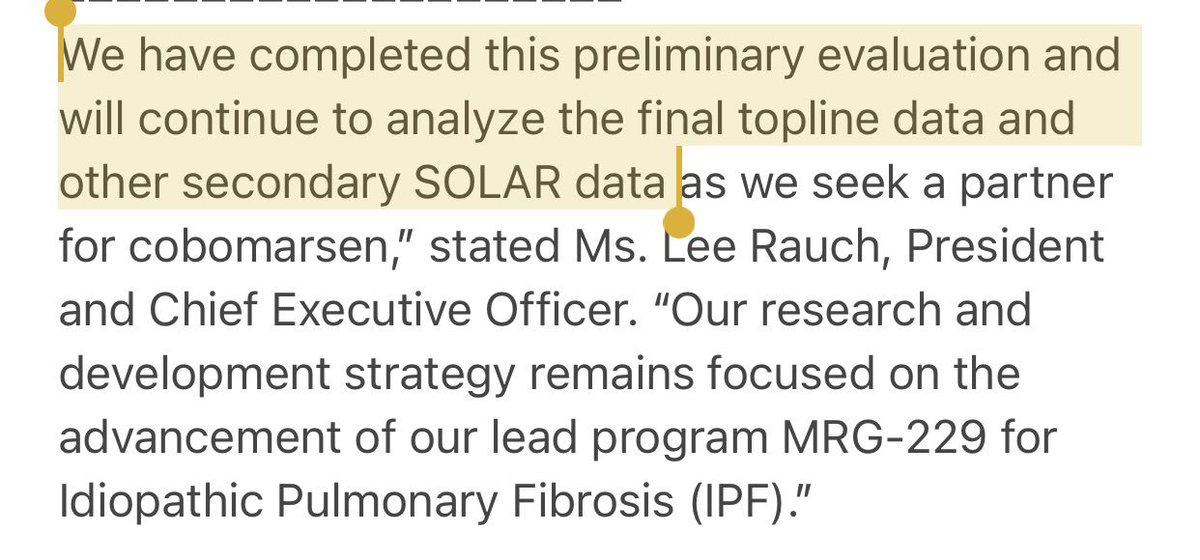

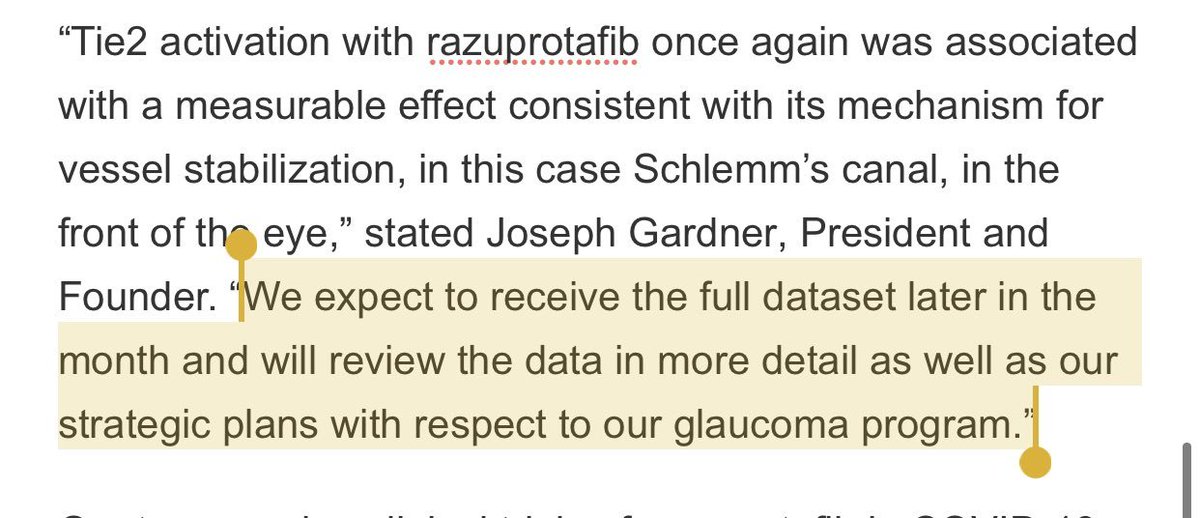

$ARPO see $MGEN PR's after bad data in early October before their reverse deal later that month 20+ days later. Look how similar the language is and compare to the next post when I post the $ARPO PR's + 2019 10Q

$ARPO PR's after bad data on Friday + the old agreement language with Ladenburg + Evercore (almost identical to the $MGEN language)

$ARPO also has a covid-19 drug to help prevent ARDS which has active military funding + is designed to help our troops. They plan to have data late Q4/early 21' which is another possible catalyst which could bring non-dilutive funding for whomever takes the shell.

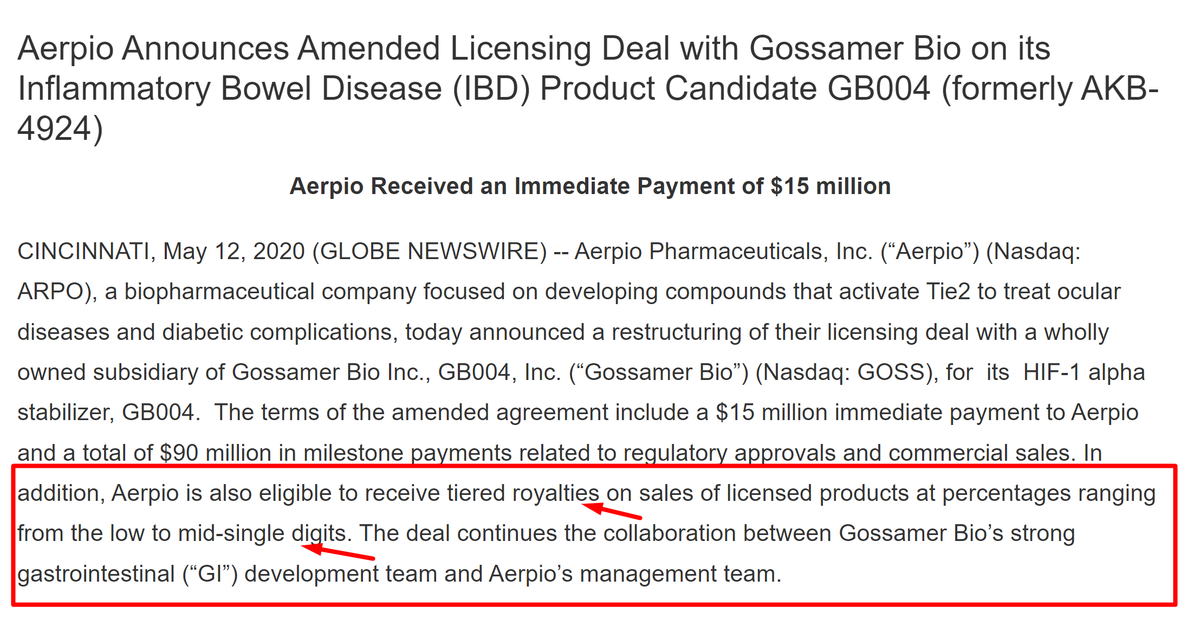

$ARPO on 5/12/20 ARPO announced an Amended Licensing Deal with $GOSS on its (IBD) Product Candidate GB004 (formerly AKB-4924). The terms of the amended agreement include a $15M immediate payment to ARPO + a total of $90M in milestone payments related to approvals/sales.

$ARPO Conclusion: I believe the data was set-up to fail and ARPO/Ladenburg/Evercore wanted to get this bad news out so they could start executing the real plan which is a reverse merger.

$ARPO also has a covid-19 drug to help prevent ARDS which has military funding so we have additional catalyst to get this over $2 (where most own) and possibly much higher if we follow past Ladenburg reverse deals.

$ARPO the past 5 Ladenburg reverse deals created +363% in gains and most reverse deals took 100-180 days after negative data ( $MGEN was 23 days). If this theory is true then $ARPO could run from $1.30 (AH FRIDAY) to 3-$6 which significantly above the AH price.

$ARPO Disclosure

I own 5K shares at $1.95 + 5K shares at 1.24 = 10K @$1.59

If this thesis is right we could have a significant winner in the next 180 days.

I own 5K shares at $1.95 + 5K shares at 1.24 = 10K @$1.59

If this thesis is right we could have a significant winner in the next 180 days.

$ARPO please know there is high risk involved w/ this theory and everyone should do their own DD and make their own financial decisions. I am not a financial advisor and my research should not be used to make investment decisions. I hope everyone enjoyed this and can make some $

Read on Twitter

Read on Twitter