AND HERE’S THE REALLY INTERESTING QUESTION THAT NOBODY IS ASKING :

“Why are the shares of Legacy Automakers not worth more ?”

Let’s think about it . . .

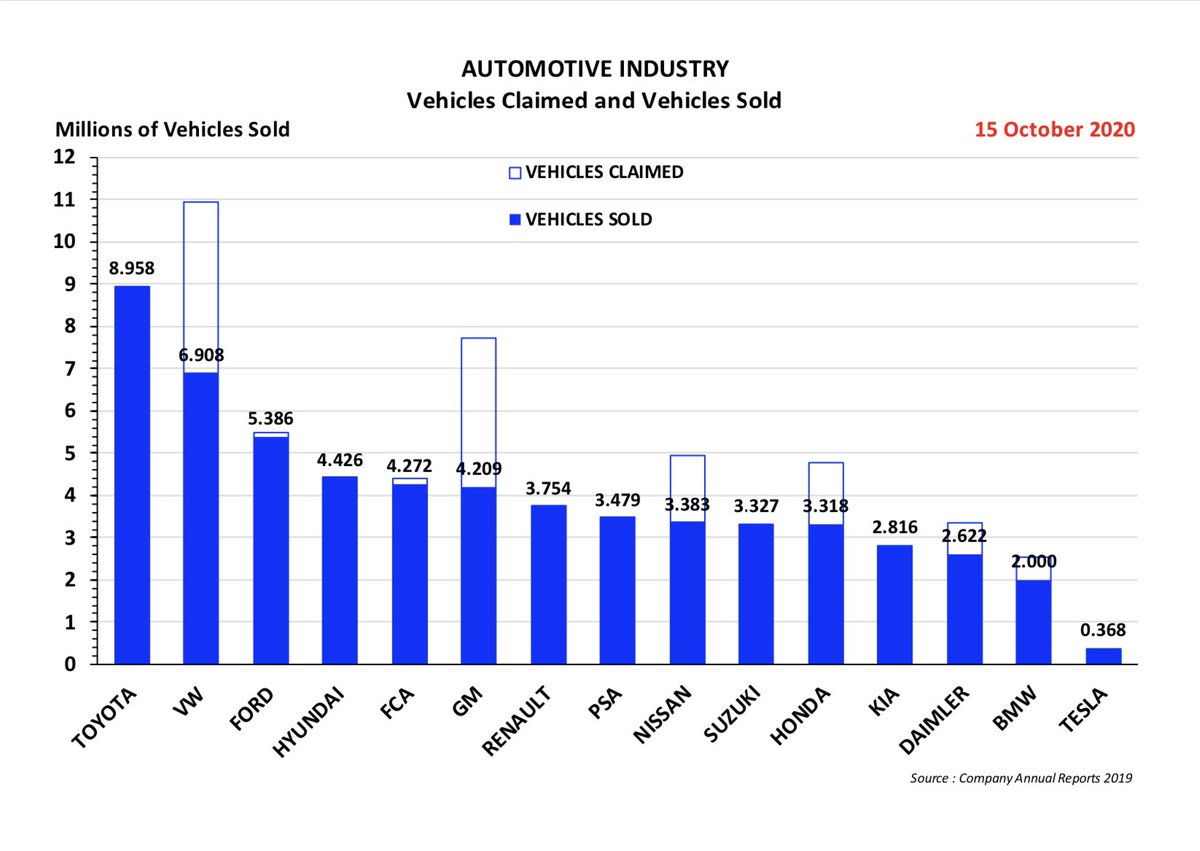

1. Let’s say you are selling 4 million automobiles every year

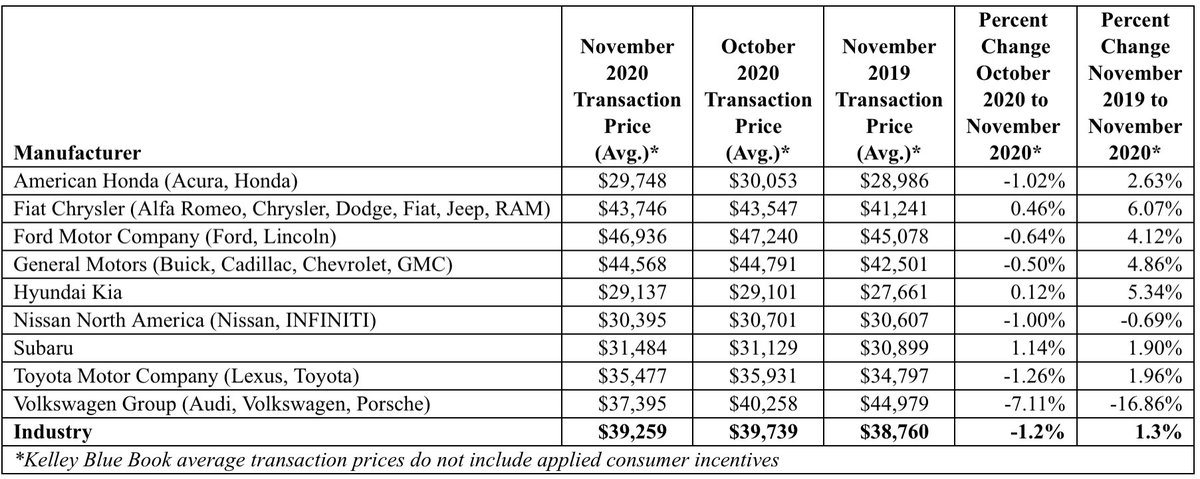

2. The Average Transaction Price in the USA is over $39,000 https://twitter.com/jpr007/status/1338130069605154816

“Why are the shares of Legacy Automakers not worth more ?”

Let’s think about it . . .

1. Let’s say you are selling 4 million automobiles every year

2. The Average Transaction Price in the USA is over $39,000 https://twitter.com/jpr007/status/1338130069605154816

3. Let’s assume that you achieve $35,000 average on your worldwide volume

4. So your revenues are 4 million x $35,000 = $140 billion

5. At a Price to Sales Multiple of 1.0x your Market Cap should be $140 billion

4. So your revenues are 4 million x $35,000 = $140 billion

5. At a Price to Sales Multiple of 1.0x your Market Cap should be $140 billion

6. At that world-class scale you should be making 10% Operating Profit pre-tax and 8% Net Income after tax

7. $140 billion x 8% = $11.2 billion Net Income

7. $140 billion x 8% = $11.2 billion Net Income

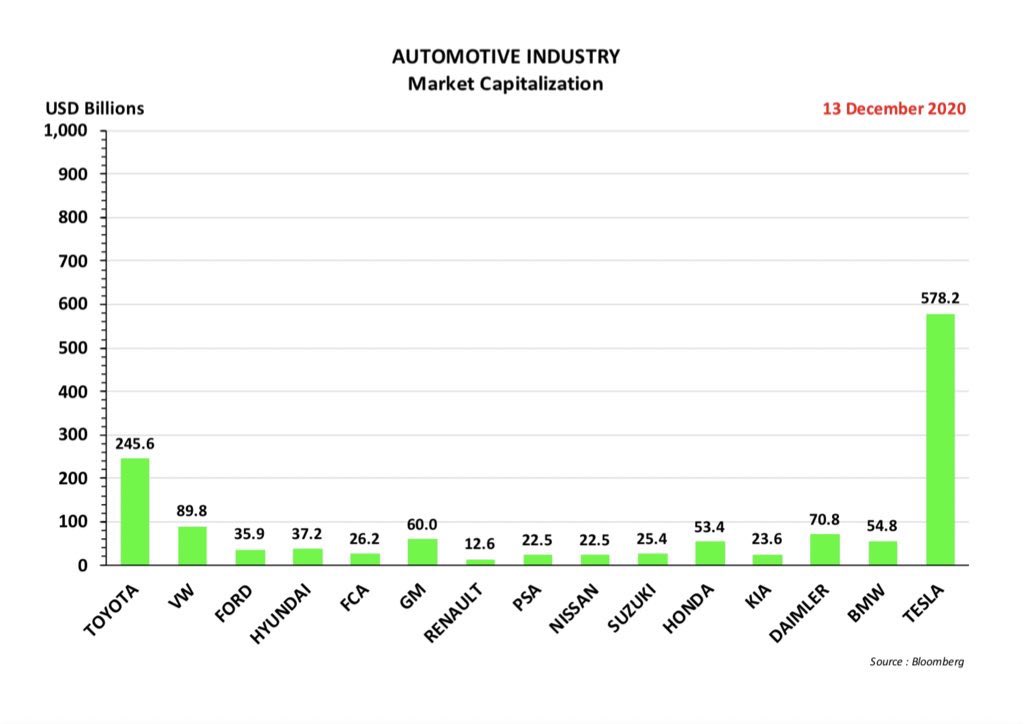

8. At a P/E Multiple of 10x your Market Cap should be $112 billion

9. At a P/E Multiple of 20x your Market Cap should be $224 billion

10. This is for a player with 4 million units

11. Toyota has 9 million units

- so their Market Cap should be in the range of $250~500 billion

9. At a P/E Multiple of 20x your Market Cap should be $224 billion

10. This is for a player with 4 million units

11. Toyota has 9 million units

- so their Market Cap should be in the range of $250~500 billion

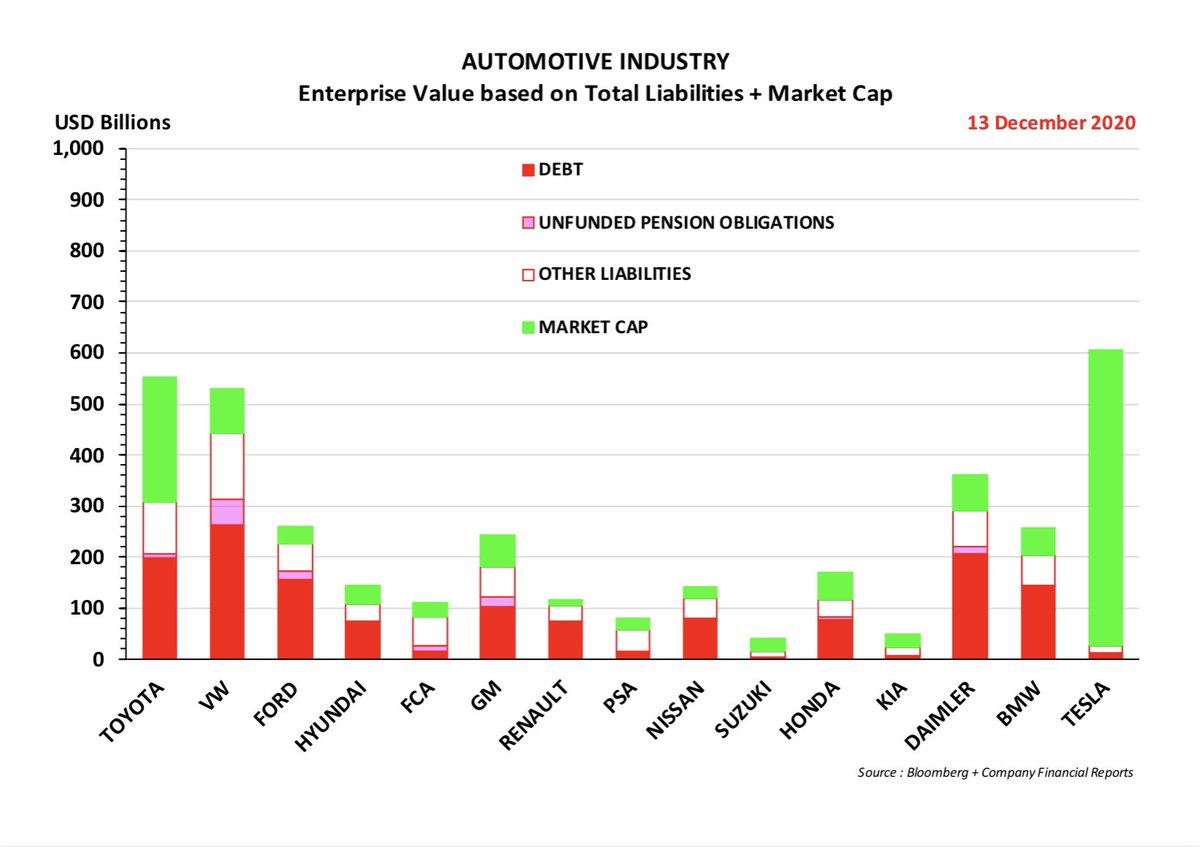

12. These Legacy Automakers are not earning what they should be given their scale

- and investors do not have confidence in them

This is the real issue in the market today

- not Tesla’s valuation

- and investors do not have confidence in them

This is the real issue in the market today

- not Tesla’s valuation

Read on Twitter

Read on Twitter