DarioHealth Thesis:

$DRIO is a micro-cap ($100M) in the same space as $LVGO

This is a turnaround story as new talent poached from $OTRK is helping to revamp its business model around 3 pillars:

1. Shift from B2C to B2B2C

2. Expanding to more chronic conditions

3. Shift to SaaS

$DRIO is a micro-cap ($100M) in the same space as $LVGO

This is a turnaround story as new talent poached from $OTRK is helping to revamp its business model around 3 pillars:

1. Shift from B2C to B2B2C

2. Expanding to more chronic conditions

3. Shift to SaaS

Product:

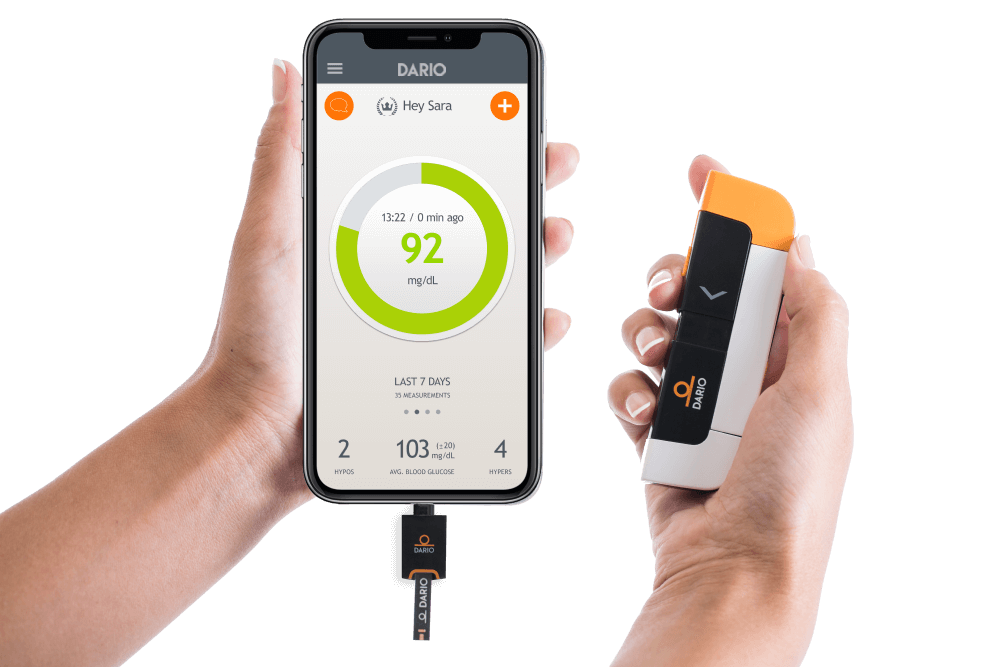

Dario has a glucose monitor that plugs into the user's smartphone strips and supports it with human coaching

Because it integrates with the phone, not only is it more convenient for members to carry around but it also gives Dario a slight cost advantage vs competition

Dario has a glucose monitor that plugs into the user's smartphone strips and supports it with human coaching

Because it integrates with the phone, not only is it more convenient for members to carry around but it also gives Dario a slight cost advantage vs competition

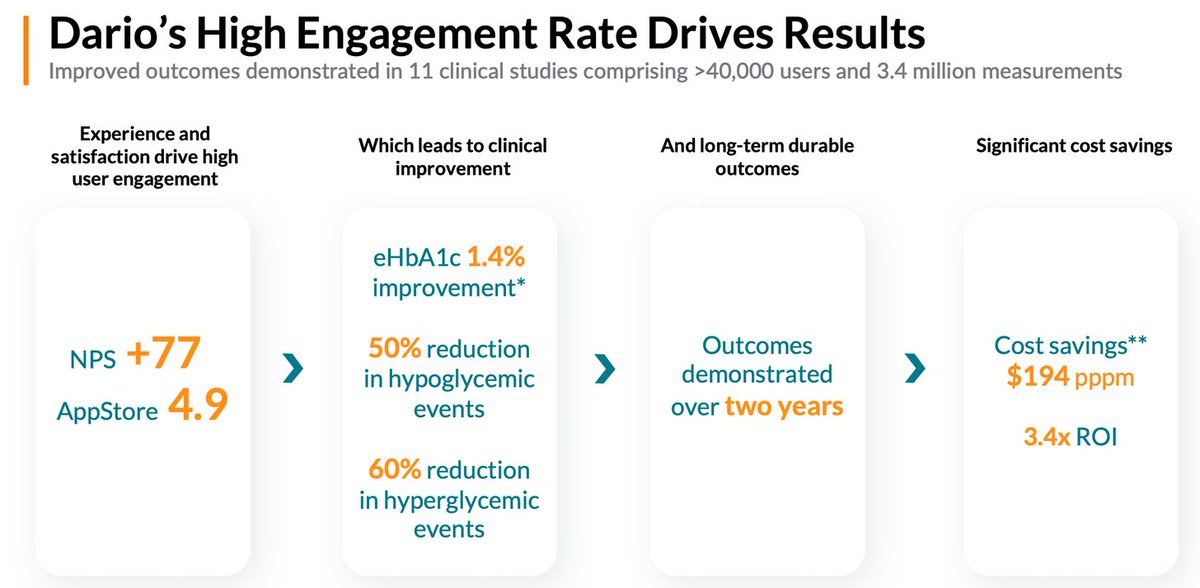

They claim better results than LVGO with 1.4% eHbA1c improvement after 12 months and save $2375 PMPY (3.4x ROI) across 14 studies with 38k members.

They also have a +77 NPS vs Livongo's +64 and 4.9/5 rating on the App Store across >14k reviews and 4.4/5 on Google Play.

They also have a +77 NPS vs Livongo's +64 and 4.9/5 rating on the App Store across >14k reviews and 4.4/5 on Google Play.

3 Points of Differentiation:

1. Fairer billing - DRIO does not charge for members if they stop engaging with the platform

2. Cheaper price (Diabetes starts at $60PMPM vs LVGO’s ~$75)

3. Open platform means easy data sharing and allows provider resources to coach members too

1. Fairer billing - DRIO does not charge for members if they stop engaging with the platform

2. Cheaper price (Diabetes starts at $60PMPM vs LVGO’s ~$75)

3. Open platform means easy data sharing and allows provider resources to coach members too

Shift to B2B2C:

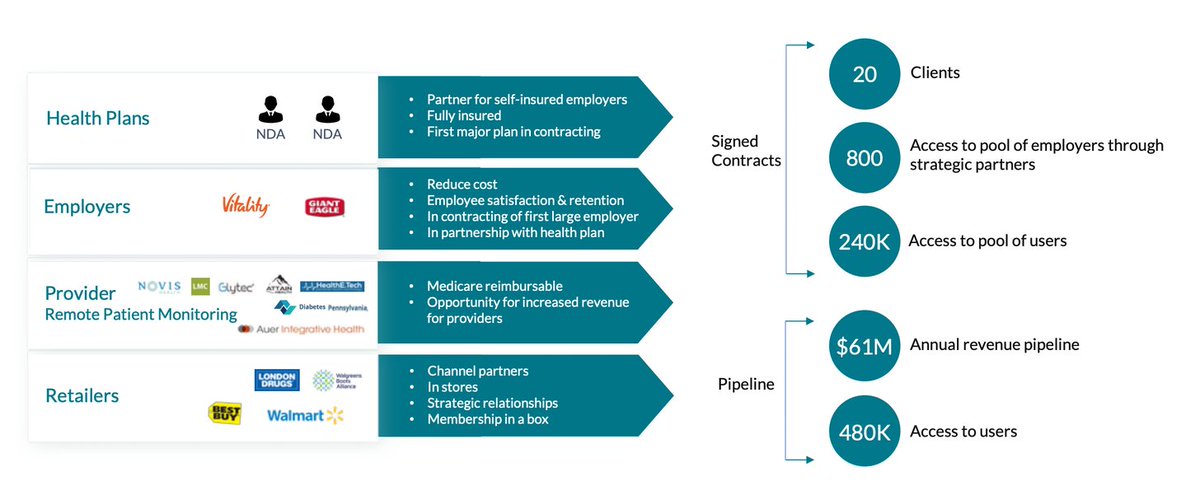

Thus far, they've had a B2C business model through Walmart, Best Buy, and Amazon and have managed to get 63,000 members.

This has been a great source of data and experimentation but it's very hard to gain traction and that has reflected in their performance.

Thus far, they've had a B2C business model through Walmart, Best Buy, and Amazon and have managed to get 63,000 members.

This has been a great source of data and experimentation but it's very hard to gain traction and that has reflected in their performance.

DRIO started to pivot to a B2B2C model like LVGO late last year. They now have a $350M pipeline across employers, health systems, and health plans.

They signed a contract with an F500 employer and an agreement to sell into insurer Vitality and HMC Healthworks’ employer networks

They signed a contract with an F500 employer and an agreement to sell into insurer Vitality and HMC Healthworks’ employer networks

Besides accelerating member growth, they are also seeing a gross margin inflection.

They charge $60-80 per member versus $25 under B2C. Its PaaS solution costs $39 PMPM. They are targeting 70%+ gross margins in 2 years and 80-90% of revenues coming from B2B2C.

They charge $60-80 per member versus $25 under B2C. Its PaaS solution costs $39 PMPM. They are targeting 70%+ gross margins in 2 years and 80-90% of revenues coming from B2B2C.

Shift to SaaS: Currently, 40-45% of their 55,000-user base are subscription members. ARPU was $6 from non-members' one-off sales vs $25 PMPM now.

Multiple Conditions: They launched a hypertension solution late last year and expanded into behavioural health earlier this year.

Multiple Conditions: They launched a hypertension solution late last year and expanded into behavioural health earlier this year.

Financials:

TTM sales were $7.3M which decreased by 2.7% from the previous year. Gross margins were 38.3% which increased from 26.7% in the previous period.

It is very unprofitable but did two capital raises with $37M in the bank which should be enough for the next few years.

TTM sales were $7.3M which decreased by 2.7% from the previous year. Gross margins were 38.3% which increased from 26.7% in the previous period.

It is very unprofitable but did two capital raises with $37M in the bank which should be enough for the next few years.

Last quarter, gross margins took a “one-time” hit which was due to promotions they were offering, this is something to monitor.

They also mentioned some contracts were taking longer than expected to close. However, a number of new clients are set to launch next January.

They also mentioned some contracts were taking longer than expected to close. However, a number of new clients are set to launch next January.

It sports a 100M market cap currently, so 13.7 P/S isn't cheap either.

However, analysts are projecting $12M in revenues next year, or 56% growth, which the CEO said was quite conservative. And $26.2M in 2022.

If they can deliver, this can be a 4-bagger in two years.

However, analysts are projecting $12M in revenues next year, or 56% growth, which the CEO said was quite conservative. And $26.2M in 2022.

If they can deliver, this can be a 4-bagger in two years.

Overall, this is a very high risk, high reward play.

Not sure if their platform is differentiated enough and it’s hard to compete against LVGO but it doesn’t take a lot to move the needle.

I have a tiny position because early indications are positive and I’m very bullish on RPM

Not sure if their platform is differentiated enough and it’s hard to compete against LVGO but it doesn’t take a lot to move the needle.

I have a tiny position because early indications are positive and I’m very bullish on RPM

Read on Twitter

Read on Twitter