Here’s a story about buying a generational stock early - and selling prematurely.

$AAPL

in the late 90’s, Apple was practically broke. Steve Jobs was brought back to the lead the sinking company, but he had his work cut out for him. Apple was in dire straits.

$AAPL

in the late 90’s, Apple was practically broke. Steve Jobs was brought back to the lead the sinking company, but he had his work cut out for him. Apple was in dire straits.

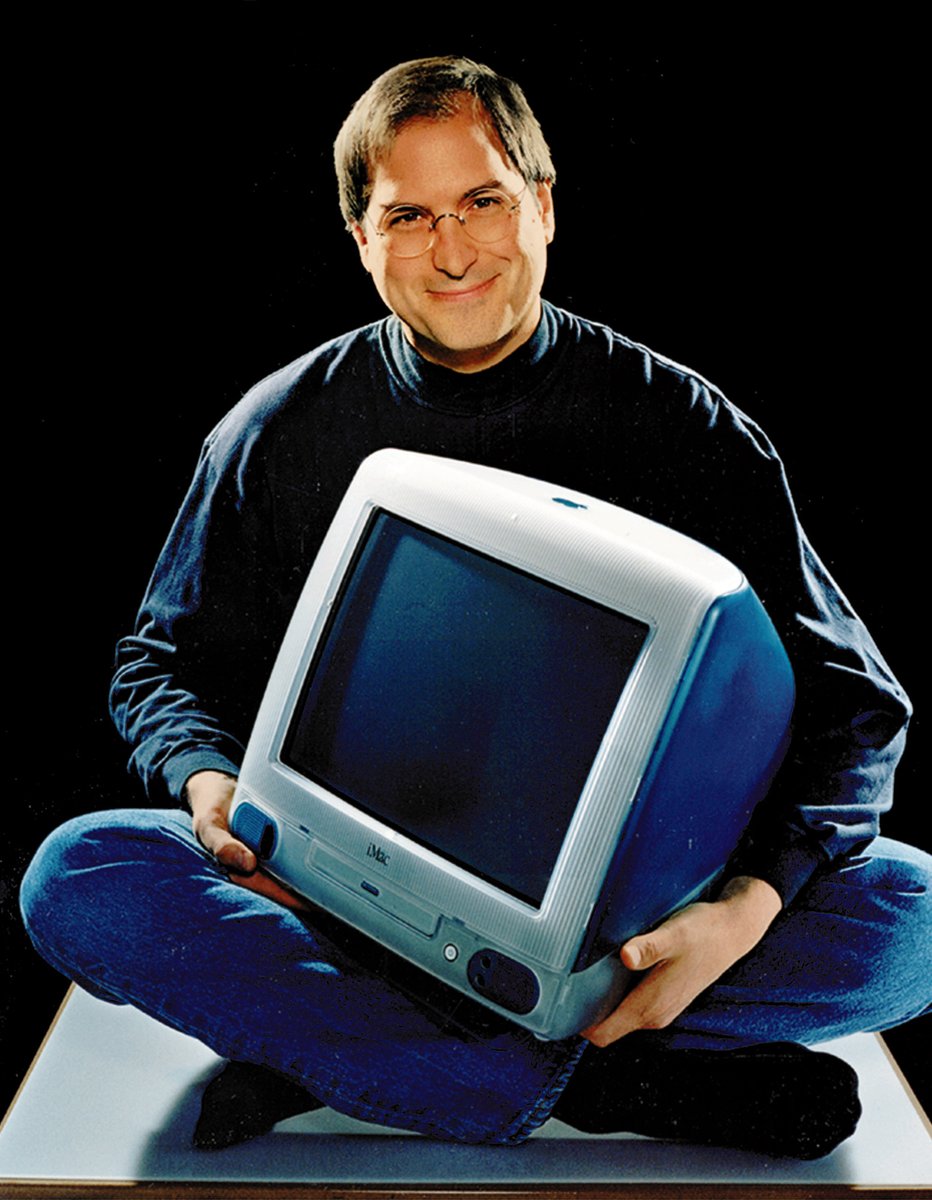

Steve presented the iMac in 1998, and there was a Bondi Blue glimmer of hope.

As a photo student in NYC & avid user of Apple products, I decided to give it a go & invested my savings of DEM4000 (US$2400) in $AAPL

(dates and amounts are approximate, but close enough)

As a photo student in NYC & avid user of Apple products, I decided to give it a go & invested my savings of DEM4000 (US$2400) in $AAPL

(dates and amounts are approximate, but close enough)

Note that most analysts at the time claimed Apple wouldn’t survive as an independent company. Microsoft had won, or so they said.

Things were…hanging by a thread. It was definitely a risky investment.

But I also saw a lot of potential upside in the company.

Things were…hanging by a thread. It was definitely a risky investment.

But I also saw a lot of potential upside in the company.

Then the iPod came out. You started seeing the white cables hanging around by the super-hip crowd on the streets of Soho.

Then came iPhone.

= GREAT PRODUCTS.

And the rest, of course, is history.

Then came iPhone.

= GREAT PRODUCTS.

And the rest, of course, is history.

I held my few $AAPL stocks for years, enjoyed the subsequent rise, but eventually started selling a few here and there.

For instance, when I needed a new “PowerBook” (yes that’s what they were called).

Consumption over Compounding.

Mistake.

For instance, when I needed a new “PowerBook” (yes that’s what they were called).

Consumption over Compounding.

Mistake.

Every laptop I bought from stock proceeds was… expensive. Like, its weight in gold, likely more

For fun, check out what your gadgets have cost you had you invested their purchase price instead: http://investedinstead.com/product.php?c=Apple&p=iphone

For fun, check out what your gadgets have cost you had you invested their purchase price instead: http://investedinstead.com/product.php?c=Apple&p=iphone

I mostly held on to my shares though, although I disliked volatility, and didn’t have a *real* long term mindset.

I eventually sold the remainder of my $AAPL shares around 2015 or so - on a whim - because I thought Apple was getting greedy by pricing their items “too high”

Needless to say, Apple only got more profitable.

I didn’t do any research

Needless to say, Apple only got more profitable.

I didn’t do any research

Had I HODLed, my initial investment of $2,400 would be worth (and this is where it gets ugly)

around $1.5 million today.

Let that sink in.

(and that’s without dividends that could have done some sweet compounding)

https://dqydj.com/stock-return-calculator/

around $1.5 million today.

Let that sink in.

(and that’s without dividends that could have done some sweet compounding)

https://dqydj.com/stock-return-calculator/

so, that didn't happen...

But of course, I started buying $TSLA a few weeks after presentation of Model 3. I held through the volatility and FUD, but the FUD also got to me. I sold after a measly profit of 30% or so.

Why.

That’s not holding, is it?

But of course, I started buying $TSLA a few weeks after presentation of Model 3. I held through the volatility and FUD, but the FUD also got to me. I sold after a measly profit of 30% or so.

Why.

That’s not holding, is it?

Then I started buying $TSLA again and in earnest in 2019. I did my research, found this here amazing Tesla Twitter community (and Youtube U), and have been holding every single share with conviction.

Whenever I have cash on hand, I add. I buy (almost) every dip.

Whenever I have cash on hand, I add. I buy (almost) every dip.

I am writing this thread from the perspective of someone who had the right hunch, but didn’t do his research enough. And that cost me dearly.

However, I don’t mind at all to have made this experience, because it taught me a valuable lesson or three.

However, I don’t mind at all to have made this experience, because it taught me a valuable lesson or three.

Invest wisely, and hold with conviction.

Read what the good wisemen and women here on Twitter write about a company, make your own decision - and stick to it.

Read what the good wisemen and women here on Twitter write about a company, make your own decision - and stick to it.

Stick to your guns.

If you found a generational company early, and invested your money with conviction, stick to it.

$TSLA

If you found a generational company early, and invested your money with conviction, stick to it.

$TSLA

Don’t be that guy who sells prematurely (=old me).

$TSLA

In case there is a S&P squeeze at the end of this week and someone makes you an offer you (seemingly) can’t refuse - refuse.

HOLD.

$TSLA

In case there is a S&P squeeze at the end of this week and someone makes you an offer you (seemingly) can’t refuse - refuse.

HOLD.

Read up about long term investing, follow some of the accounts I’ve tagged here.

Here’s a good primer: https://twitter.com/BrianFeroldi/status/1338148491944751107?s=20

Here’s a good primer: https://twitter.com/BrianFeroldi/status/1338148491944751107?s=20

you might want to follow

@jpr007

@BrianFeroldi

@ICannot_Enough

@hikingskiing

@truth_tesla

@alternatejones

@jasondebolt

@garyblack00

@stevenmarkryan

@TeslaStars

@ConnectDotsToo

@heydave7

@meckimac

@TeslaPodcast

@RandyVegetables

@BrianGriffo

@BrianFeroldi

@jpr007

@BrianFeroldi

@ICannot_Enough

@hikingskiing

@truth_tesla

@alternatejones

@jasondebolt

@garyblack00

@stevenmarkryan

@TeslaStars

@ConnectDotsToo

@heydave7

@meckimac

@TeslaPodcast

@RandyVegetables

@BrianGriffo

@BrianFeroldi

@ray4tesla

@ShaneAParrish

@Tsutsaev_Ruslan

@TashaARK

@freshjiva

@Gfilche

@GinoG01328427

@stevenmarkryan

@bburnworth

@Real_Futurist

& many more. There is so much knowledge + research available here for free - all you have to do is find it, & draw your own conclusions

Go!

@ShaneAParrish

@Tsutsaev_Ruslan

@TashaARK

@freshjiva

@Gfilche

@GinoG01328427

@stevenmarkryan

@bburnworth

@Real_Futurist

& many more. There is so much knowledge + research available here for free - all you have to do is find it, & draw your own conclusions

Go!

Read on Twitter

Read on Twitter