A thread in the "China stock" risks. I wanted to document for myself (after a discussion with a friend) what the risks are investing in stocks listed in the US for companies based in China. Hopefully this will help you manage risk better. $BABA, $JD, $FUTU, $DADA etc.

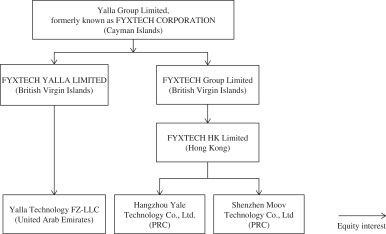

2. There are between 210 - 250 companies with HQ in China that listed in the US markets. Some of them are Cayman entities but most have complex structures with multiple holding companies. See $YALA for example below.

3. 5 major risks (please let me know others). 1) Poor financial controls/fraud (e.g. $LK Luckin Coffee), 2) US Govt may delist companies from China if they dont allow US certified accountants 3) China-US trade relations 4) China CCP control (e.g. Ant Financial), 5) Growth risk

4. 1. Poor financial controls / fraud. In the last year, $LK, $GSX, $NIO, $YY have all been accused of fudging numbers, fraudulent accounting. While you cannot protect against this risk much, check the founders, investors and backers to understand exposure

5. US Govt delisting: The house on Dec 2, passed a bill proposing to delist companies from China (in 2 years) if they did not meet US accounting standards. I think most cos will follow this rule, but CCP might object. Risk is medium in the short term. https://www.marketwatch.com/story/house-on-track-to-pass-bill-that-could-delist-chinese-companies-from-u-s-stock-exchanges-11606930170

6. US-China Trade relations. While the current president initiated the tariffs, it seems unlikely that the next president will change the rules dramatically. This might make certain companies targeting US markets have lower rev growth.

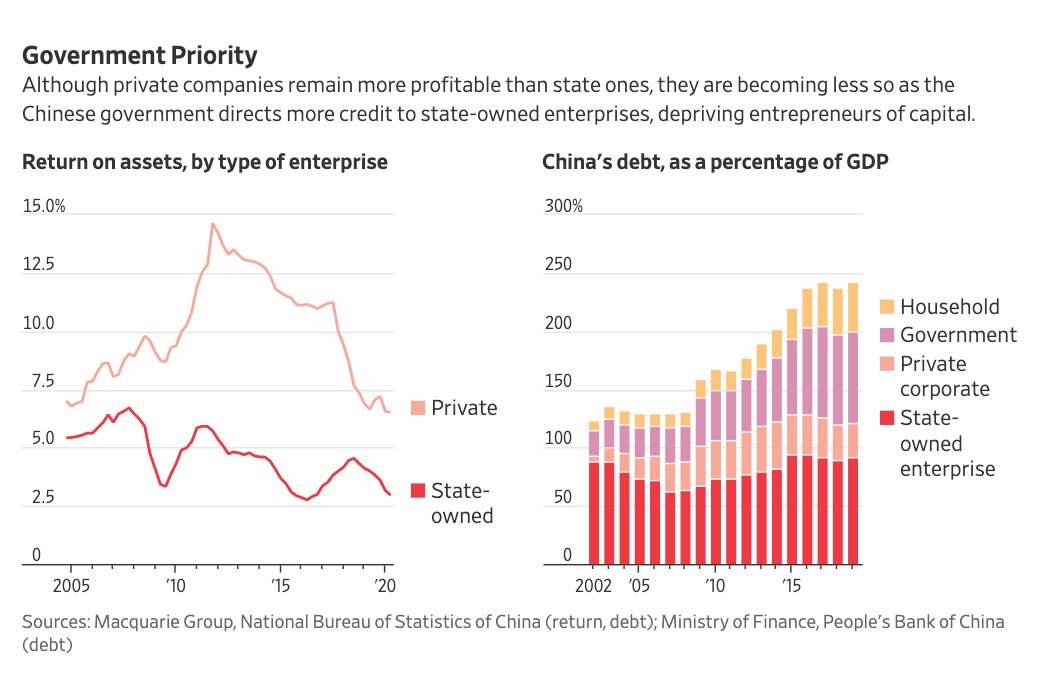

7. Communist China Party: WSJ suggests that CCP wants to reign in private cos and is taking "over" public control of a few. The risk is that the investment in a co might end up with CCP, which does not believe shareholder value alone is top priority https://www.wsj.com/articles/china-xi-clampdown-private-sector-communist-party-11607612531

8. Growth risk. This exists with all cos, but if China sees a slowdown because of Covid (they are seeing the opposite) the companies that target local China customers (E.g. $FUTU) might see dramatic slowdown

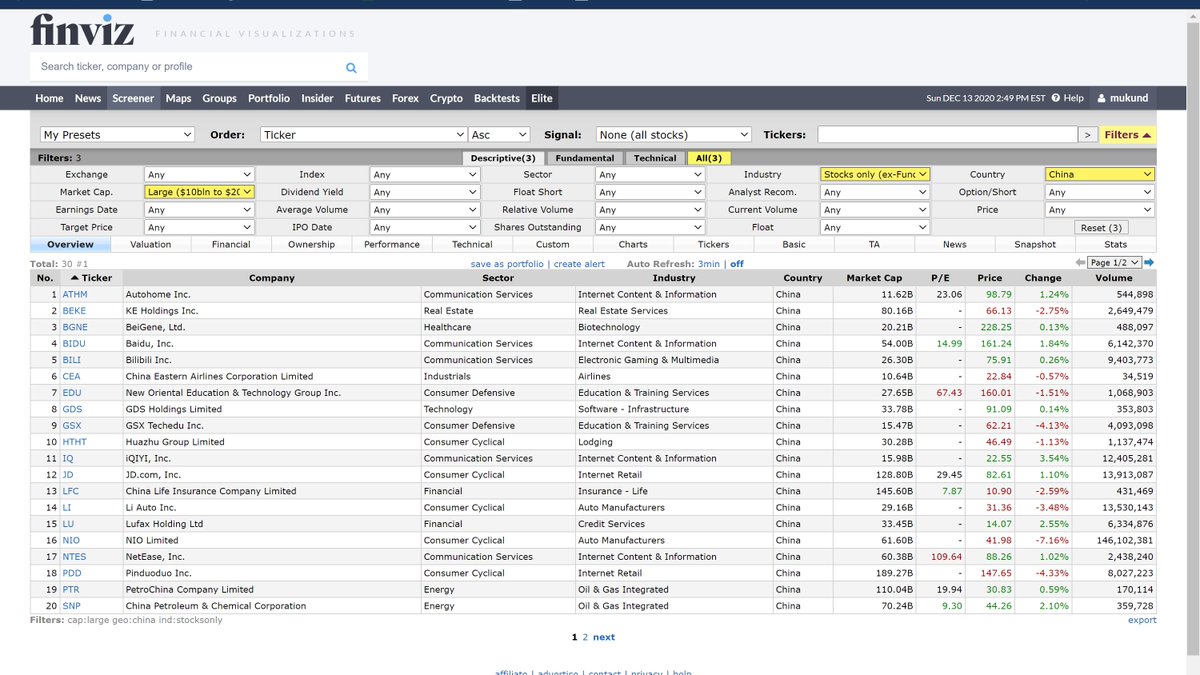

9. There are over 200 cos from China listed in the US. Megacap = 1, Large Cap = 30, Mid Cap = 27, Small Cap = 45 and rest are micro / nano. If you look at valuations, except 2-3 of them the rest are severely discounted relative to their US peers on comparable growth

10. The risks are very real. If you believe the growth in these companies will be reflected in their stock prices in the US, then the risks are worth it. Which is why the discount is factored in most China stocks. The biggest risk (for me) is slow growth not delisting or fraud

11. Here are some resources to read and get yourself educated: https://www.conleyandsilvers.com/winter-virtual-soiree-schedule/tooze-4-zalrt

Read on Twitter

Read on Twitter