MicroStrategy is about to buy $650 million worth of #Bitcoin  and raise their total investment to $1.125 billion.

and raise their total investment to $1.125 billion.

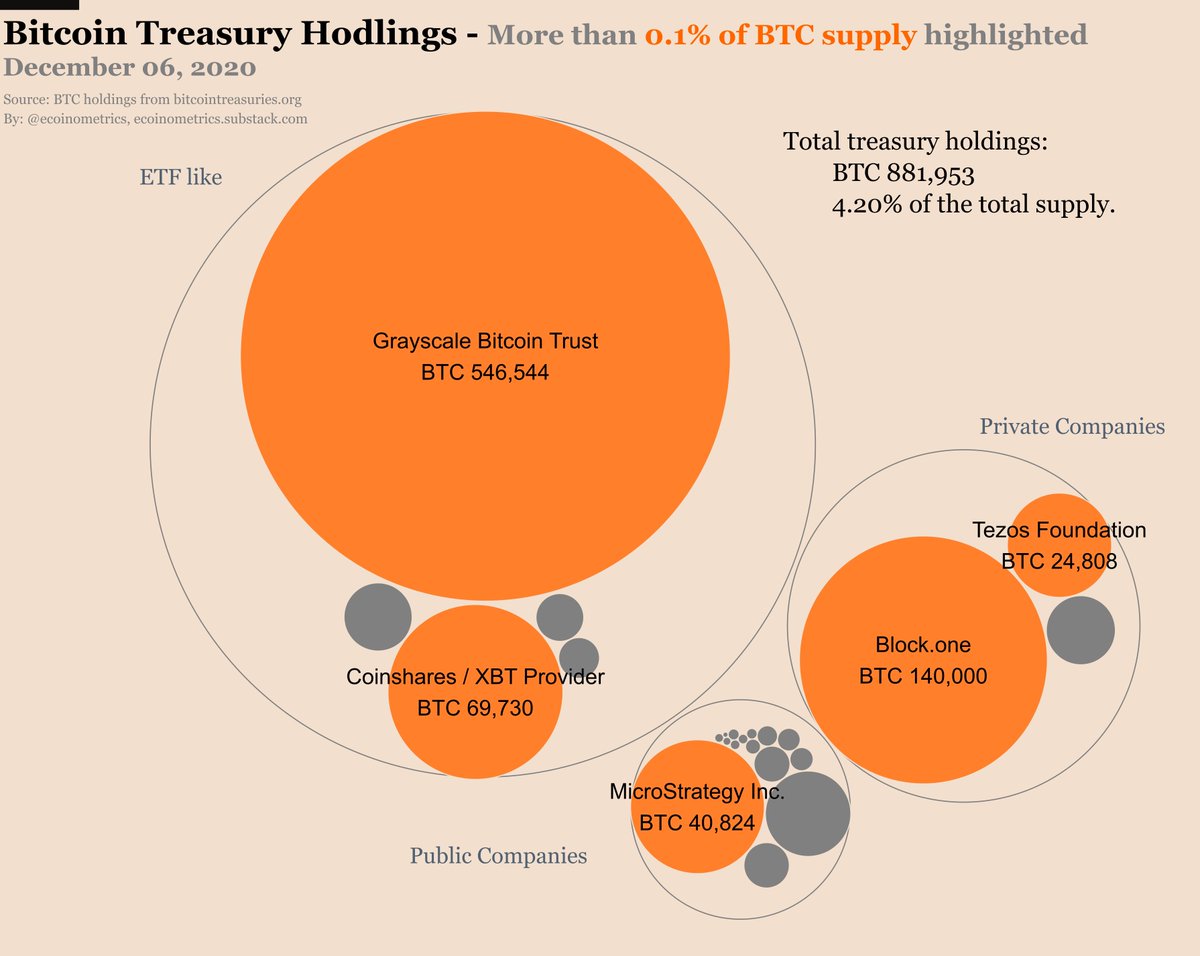

When it comes to public companies $MSTR is winning the #BTC treasury game by a good margin.

treasury game by a good margin.

Time for a thread

and raise their total investment to $1.125 billion.

and raise their total investment to $1.125 billion.When it comes to public companies $MSTR is winning the #BTC

treasury game by a good margin.

treasury game by a good margin.Time for a thread

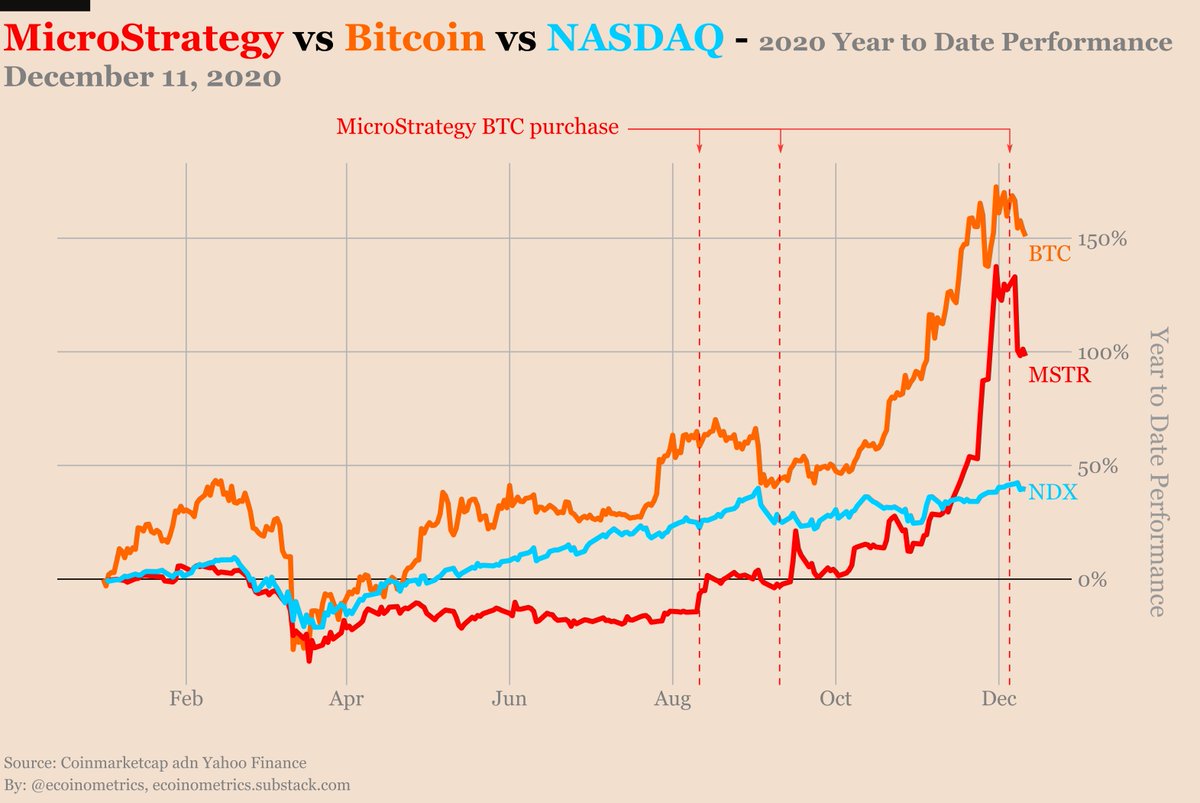

1/ MicroStrategy started their #Bitcoin  treasury program back in August.

treasury program back in August.

The least we can say is that this was good for $MSTR shareholders.

See for yourself

treasury program back in August.

treasury program back in August. The least we can say is that this was good for $MSTR shareholders.

See for yourself

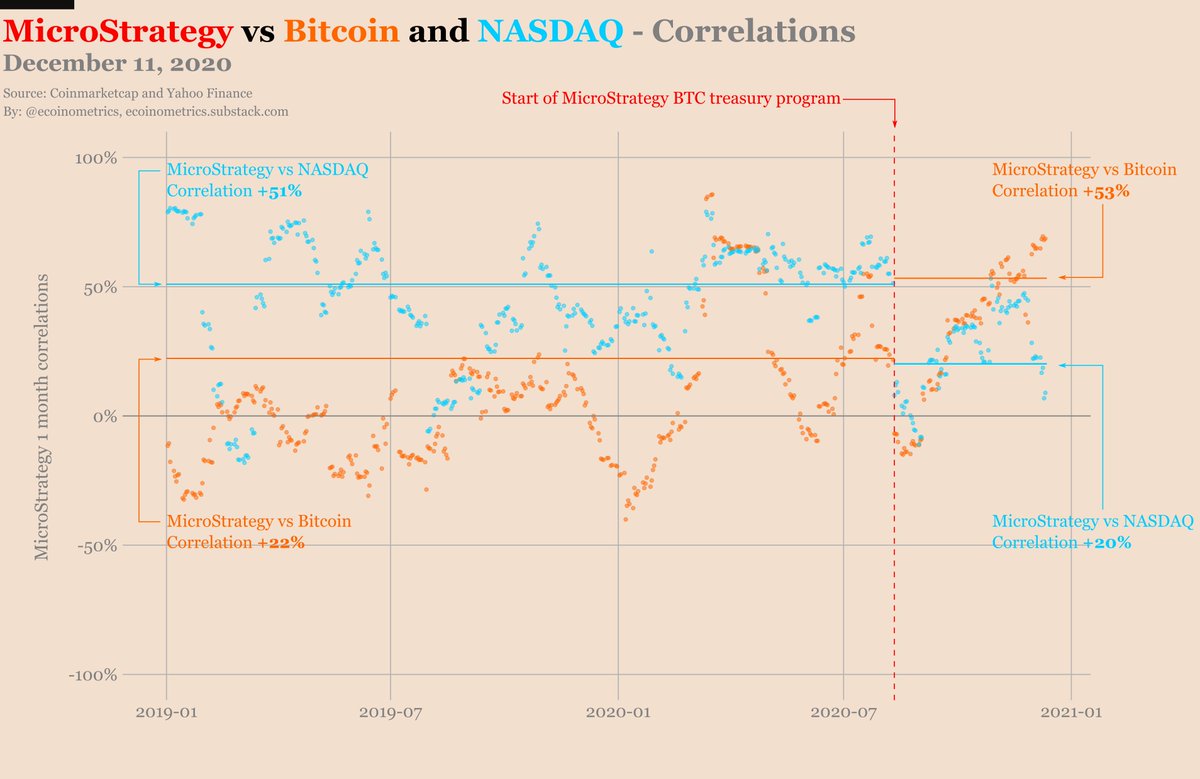

2/ Looking at MicroStrategy's stock correlations it is clear that something happened.

Before:

MSTR vs BTC correlation +22%

MSTR vs NASDAQ correlation +51%

After:

MSTR vs BTC correlation +53%

MSTR vs NASDAQ correlation +20%

Before:

MSTR vs BTC correlation +22%

MSTR vs NASDAQ correlation +51%

After:

MSTR vs BTC correlation +53%

MSTR vs NASDAQ correlation +20%

3/ This jump in the correlation between $MSTR and #Bitcoin  makes a lot of sense when you consider that the current value of their #BTC

makes a lot of sense when you consider that the current value of their #BTC  treasury hodlings is more than 25% of their market cap.

treasury hodlings is more than 25% of their market cap.

makes a lot of sense when you consider that the current value of their #BTC

makes a lot of sense when you consider that the current value of their #BTC  treasury hodlings is more than 25% of their market cap.

treasury hodlings is more than 25% of their market cap.

4/ MicroStrategy's performance is going to be tied to #Bitcoin  in the foreseeable future.

in the foreseeable future.

At the close on Friday $MSTR return on BTC holdings was about 60%.

But this is just the start of this halving cycle. We haven’t seen anything yet.

in the foreseeable future.

in the foreseeable future.At the close on Friday $MSTR return on BTC holdings was about 60%.

But this is just the start of this halving cycle. We haven’t seen anything yet.

5/ @michael_saylor is showing the way:

- Use #Bitcoin as a treasury asset to preserve your purchasing power.

as a treasury asset to preserve your purchasing power.

- Do it early to benefit from the upside of the Bitcoin adoption curve.

More of my thoughts on that here https://ecoinometrics.substack.com/p/ecoinometrics-december-09-2020

https://ecoinometrics.substack.com/p/ecoinometrics-december-09-2020

- Use #Bitcoin

as a treasury asset to preserve your purchasing power.

as a treasury asset to preserve your purchasing power.- Do it early to benefit from the upside of the Bitcoin adoption curve.

More of my thoughts on that here

https://ecoinometrics.substack.com/p/ecoinometrics-december-09-2020

https://ecoinometrics.substack.com/p/ecoinometrics-december-09-2020

Read on Twitter

Read on Twitter