There is a lot of advice out there about how to raise your very first round of funding. I've raised $7M from top tier VCs and learned the hard way that a lot of the common wisdom at the earliest stage isn't true.

Here's my advice on how to fundraise pre-launch

Here's my advice on how to fundraise pre-launch

FALLACY #1 - Talk to VC firms first

MY ADVICE: Get angels & operators onboard, then go to VCs

You only get one chance at a first impression. Angels (particularly other founders & operators) add legitimacy and open doors. VCs will pay more attention with these people onboard

MY ADVICE: Get angels & operators onboard, then go to VCs

You only get one chance at a first impression. Angels (particularly other founders & operators) add legitimacy and open doors. VCs will pay more attention with these people onboard

Not sure where to start? Go through Crunchbase, AngelList, and fundraising announcements of companies in your space. Look through sources like First Round's Angel Track and Conduit. Comb through Linkedin. Add everyone you think might add value to your target list. Then reach out

FALLACY #2 - You need warm introductions

MY ADVICE: This is great if you have them, but most people don't. Save time and go direct

In most cases intros take time to get. They require coordination. There's no guarantee the other person will describe your business the right way

MY ADVICE: This is great if you have them, but most people don't. Save time and go direct

In most cases intros take time to get. They require coordination. There's no guarantee the other person will describe your business the right way

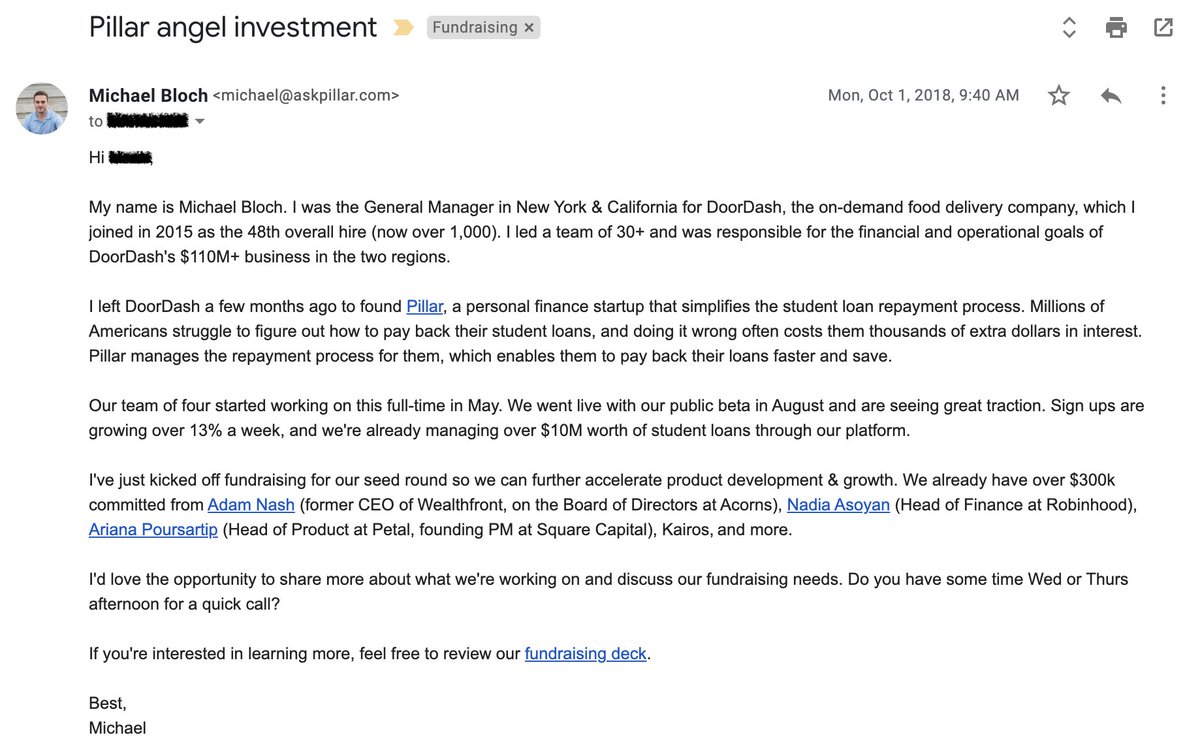

Speed is (always) of the essence. It's better to email yourself vs. waiting days for an intro to materialize. Craft a compelling narrative and be crystal clear on why they should pay attention and want to learn more. Here's an example of what I sent in the early days:

FALLACY #3 - all early-stage VCs invest at the earliest stage. "No idea is too early!" they say. That's BS

ADVICE: find investors that think independently & from first principles, can develop their own conviction, and will invest in pre-launch ideas, not just proven businesses

ADVICE: find investors that think independently & from first principles, can develop their own conviction, and will invest in pre-launch ideas, not just proven businesses

You'd be surprised how many VCs are afraid of taking risks. Many will talk publicly about how no idea is too early or too crazy. Then they'll ask for data no pre-launch startup has, drag their feet, and ghost you. Once you get a big name onboard, they reappear and ask to come in

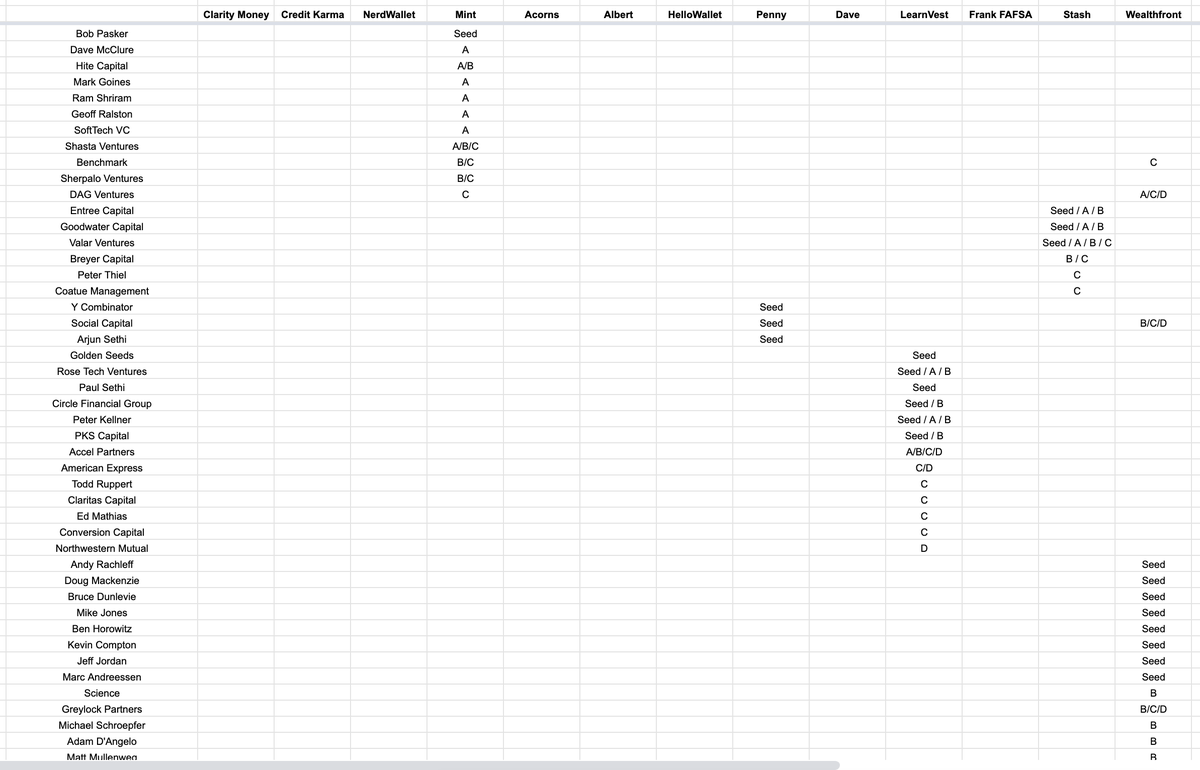

You want people that believe in your vision and will be there for you no matter what. These are some of the people I spoke with when Pillar was starting out. Some of these folks didn't join our first round, but I still respect their intellectual honesty and recommend reaching out

@adamnash @mondesai @rabois @zachweinberg @ronrofe @micahjay1 @svangel @pjux @TimDraper @hunterwalk @Jason @gokulr @iamjakestream @eladgil @mashadrokova @firstround @katiesheasays @ycombinator @noah_weiss @AdamRothenberg @MishaEsipov @arianapours

Note: I'm excluding many great investors at funds that primarily focus post pre-seed since their model doesn't support this approach, and many fantastic angels I've gotten to know since raising our pre-seed in 2018

Overall, it's hard for founders to know who actually invests pre-launch since "early-stage" can encompass everything from just a founder + an idea to companies with proven PMF and millions in ARR. If you're a founder that wants advice on specific people / firms, feel free to DM!

Read on Twitter

Read on Twitter