Wall Street's data dilemma continues -- the past few months have seen some of the most prominent hedge funds reassess their quant strategies or dial back "quantamental" efforts... (1/7) #thread on #HedgeFunds

Incredible detail about the events leading up to the end of Coatue's quant fund from @SaacksAttack @alexmorrell https://www.businessinsider.com/coatue-quant-fund-philippe-laffont-performance-data-science-2020-11?utm_source=bloomberg&utm_medium=ingest (2/7)

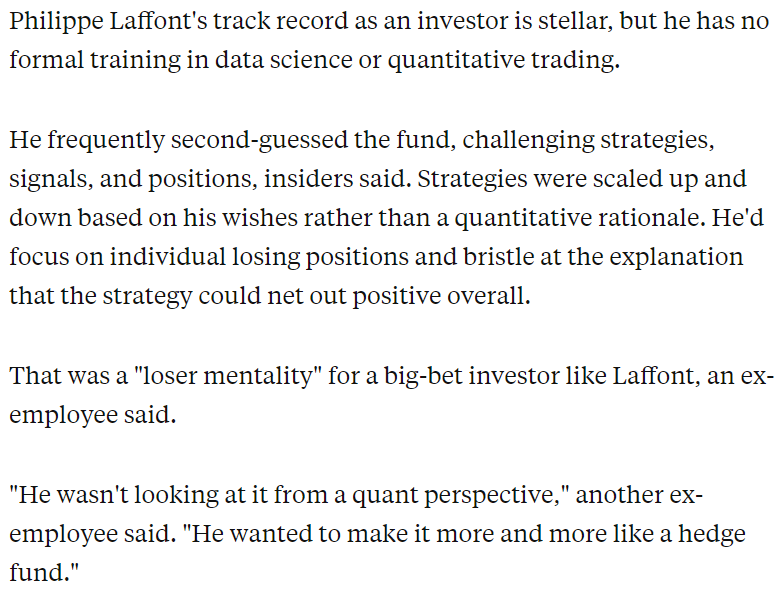

One particularly memorable passage here about the culture clash between discretionary managers and data scientists: (3/7)

. @KatiaPorzo also wrote about a consolidation of Point72's data divisions that appears to have resulted in a more clearly divided line between human and algorithmic decision-making https://www.bloomberg.com/news/articles/2020-12-02/point72-s-matthew-granade-to-leave-firm-in-quant-reorganization (4/7)

I took a stab at trying to write about the data-discretionary culture clash at hedge funds back in 2017 with @vincebielski https://www.bloomberg.com/news/articles/2017-02-15/point72-shows-how-firms-face-culture-clash-on-road-to-quantland?sref=Of91KvFA -- at the time we saw some of these mgrs as forerunners, tho perhaps flawed ones, for trying to blend data and human wagering (5/7)

BlueMountain, which was also in that story, also closed its quant portfolio last year, @parmarhema and Saijel Kishan wrote https://www.bloomberg.com/news/articles/2019-05-03/bluemountain-is-said-to-liquidate-its-1-billion-quant-portfolio?sref=Of91KvFA (6/7)

All these stories suggest effort to blend quant + human decision-making is still fraught with a culture clash that's undermined "quantamental" management. Interested to see where we go from here... (7/7)

Read on Twitter

Read on Twitter