It’s hard to see the value of a decentralized product. It can’t adapt quickly, the UX is worse and the benefits of censorship resistance aren’t obvious

But the products that impact society most will be decentralized. Quick thread on DeFi and @makerdao:

But the products that impact society most will be decentralized. Quick thread on DeFi and @makerdao:

DeFi has become a buzzword but what does decentralized mean? This has been a longstanding debate & masses will ultimately decide, but there are specific traits decentralized products must possess to preserve censorship resistance and have staying power imo

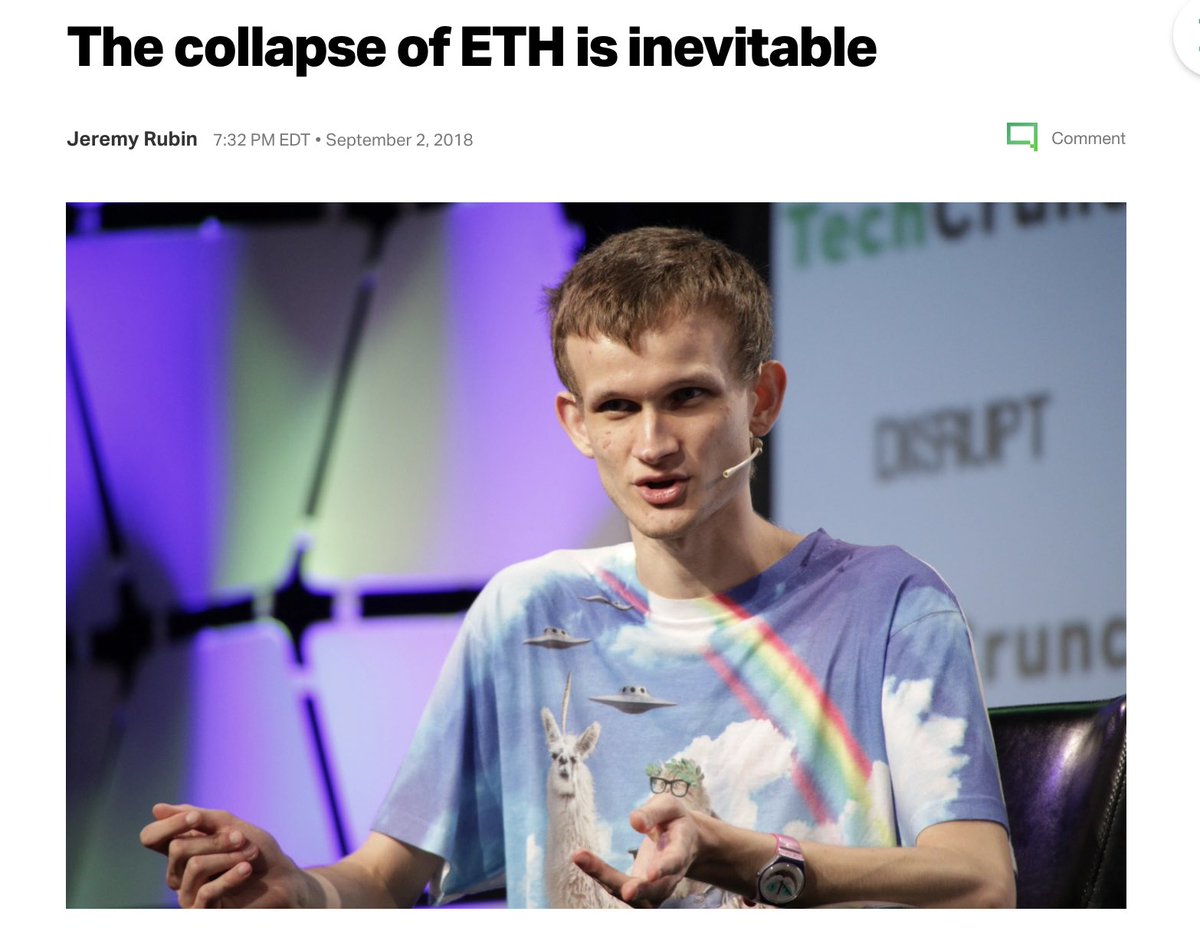

Bitcoiners used to argue that Ethereum was doomed to fail bc it wasn’t decentralized. The argument was primarily based on the pre-mine and the creator. 72M tokens were sold by the EF to investors before genesis and Vitalik controlled the network, the maxis said

Bitcoin was more decentralized. But in practice Ethereum had the traits necessary to preserve censorship resistance: decentralized ownership (anyone could own from the start, no one had a controlling stake) & decision making (miners, devs & users must agree on protocol changes)

Bc of the decentralized decision making, Ethereum’s execution speed was frustrating to many. Other projects popped up and captured mindshare

Ethereum has maintained it’s dapp platform throne bc the community was patient and stayed true to the traits that preserve censorship resistance. The staying power it has gained from that is now clear

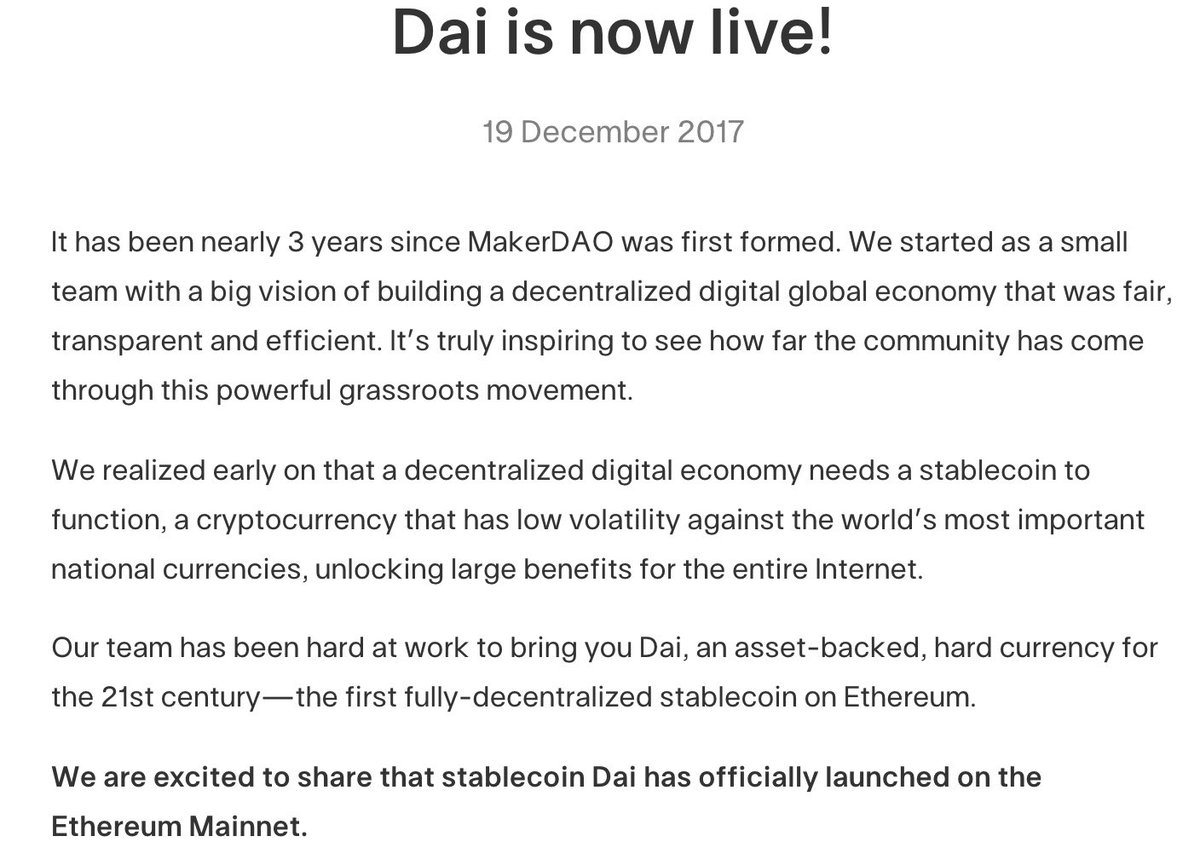

This brings us to @MakerDAO and decentralized finance, the category Maker originated in 2015 when it set out to create a stable, censorship resistant cryptocurrency

Since 2016 anyone could own Maker. No ICO but anyone could acquire tokens on OasisDEX early on, no permission required. Ownership is distributed as a result

Usage of Maker and dai have exploded since, but the product has been slower to evolve bc of the decentralized decision making.

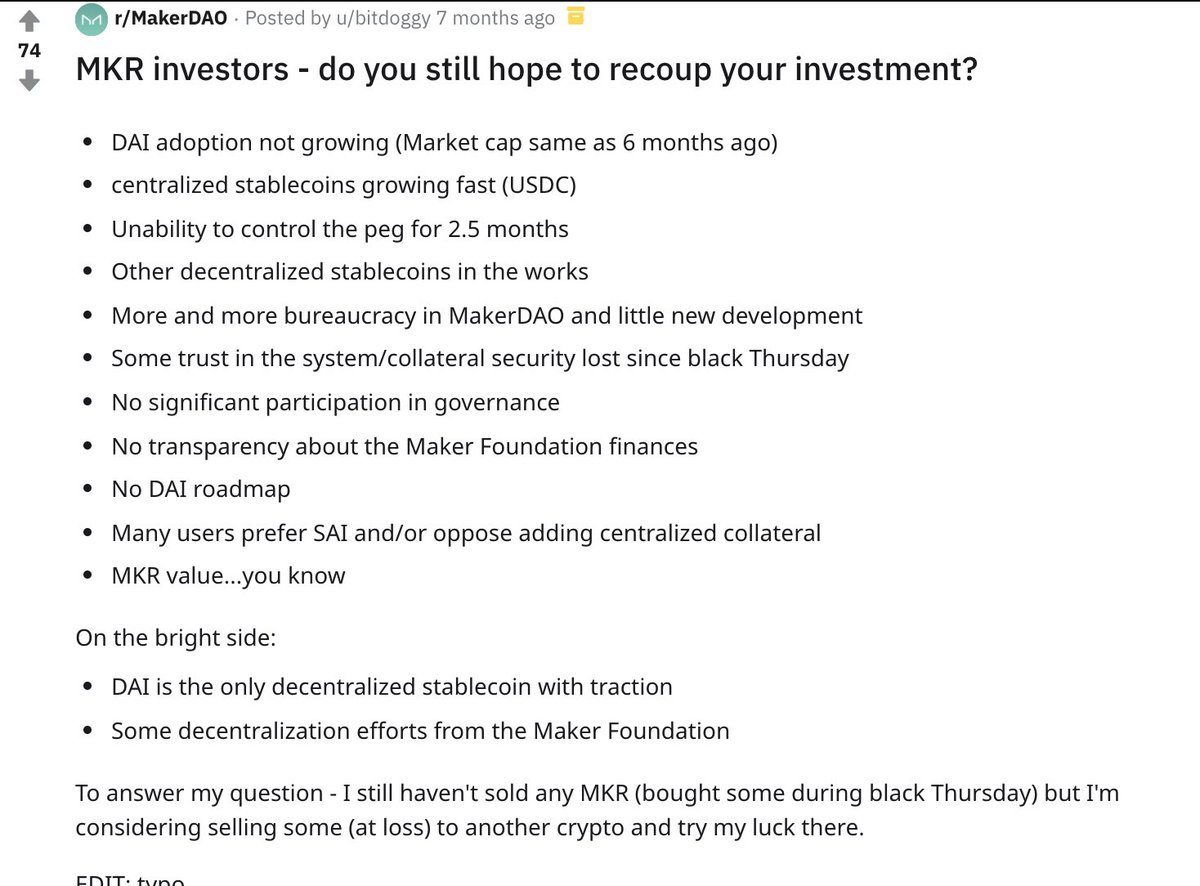

The execution speed has frustrated some & other projects have popped up and captured mindshare. Sound familiar?

The execution speed has frustrated some & other projects have popped up and captured mindshare. Sound familiar?

Yield farming lit the crypto fire in 2020 like ICOs lit the crypto fire in 2017. Maker isn’t structured to move quickly on fads and hasn’t been a part of either phenomenon

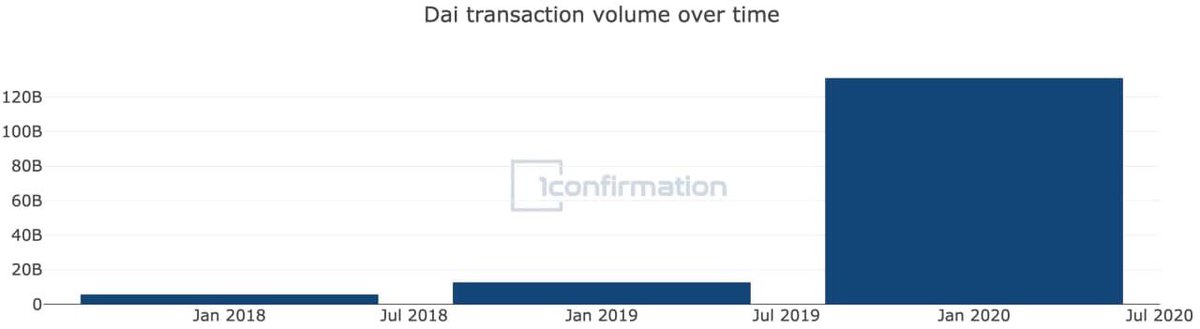

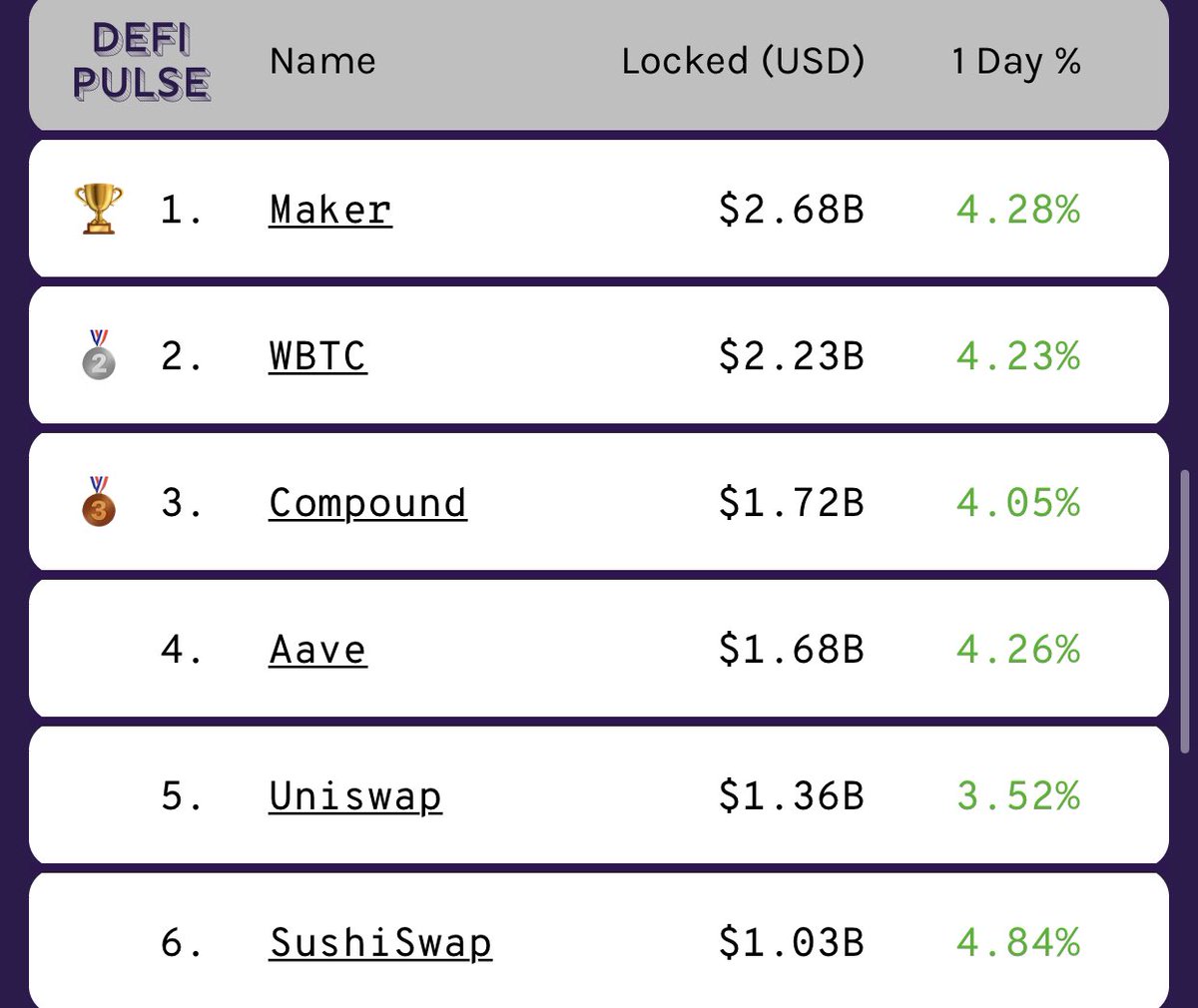

No farming program this year and lots of questions, yet Maker has maintained its DeFi throne. Dai transaction volume has exploded to over $125B and TVL is over $2.6B

Most importantly the community leading Maker has stayed true to the traits that preserve censorship resistance

There’s a million ways to make money in crypto. If capitalizing on short-term momentum is your skillset, great

But the best approach for the average person is to take a long-term view, distinguish short-term fads from world changing disruptions and stay disciplined

But the best approach for the average person is to take a long-term view, distinguish short-term fads from world changing disruptions and stay disciplined

Read on Twitter

Read on Twitter