On December 14th, the Lafayette City Council will review a draft letter that calls for CA’s Housing and Community Development Department (HCD) to reduce its Regional Housing Need Allocations (RHNA) for the Association of Bay Area Governments (ABAG) by 158,000 units. (THREAD)

The letter cites a report from the Embarcadero Institute (EI) that accuses HCD of miscalculating California’s housing need. EI claims HCD made two mistakes: “double counting” for overcrowding and cost burdening, and using incorrect target vacancy rates for owner-occupied homes.

The “double counting” claim is based on the idea that SB 828’s authors and HCD didn’t realize that DOF already included adjustments to headship rates in their projections. But EI’s analysts do not seem to understand the context behind DOF and HCDs’ adjustments.

EI correctly identifies that DOF assumed higher headship rates in their models, an indirect adjustment made because atypical data from the Great Recession skewed their 2030 projections. http://www.dof.ca.gov/Forecasting/Demographics/Projections/

HCD further adjusted the allocations directly based on overcrowding and cost burdening, as SB 828 calls for, with the intention of making CA’s housing market more closely resemble healthier markets in other parts of the country. https://leginfo.legislature.ca.gov/faces/billNavClient.xhtml?bill_id=201720180SB828

EI calls HCD’s adjustment an unintentional “double count,” when the second adjustment was SB 828’s intended purpose: After decades of underdevelopment, the state legislature decided that it needed to increase RHNA numbers to ensure CA’s housing market would meet the housing need.

Seemingly unbeknownst to the EI report’s authors, ABAG and HCD agreed to treat DOF’s projections as a “baseline,” as defined in the State Administrative Manual, for HCD’s projections. https://abag.ca.gov/sites/default/files/consultation_packet_abag_mtc_rhnd_6th_cycle.pdf

In fact, ABAG requested that HCD use DOF’s projections rather than ABAG’s own regional forecasts specifically to avoid a double count.

Even if we accept their premise that there is some “double count,” EI’s numbers are wrong. EI just added up all of HCD’s adjustments and called them a mistake, when HCD and ABAG agreed on methodologies for more ambitious adjustments during their consultation period.

The “incorrect vacancy rate” claim is based on EI’s inference that HCD accidentally used a 5% vacancy rate for owner-occupied homes, which EI thinks is too high. They write that SB 828 “specifies that a 5% vacancy rate applies only to the rental housing market.” This is wrong.

SB 828 actually says that “the vacancy rate for a healthy rental housing market shall be considered no less than 5 percent.” The bill does not define or limit the owner-occupied vacancy rate. Ultimately, HCD used an overall 5% vacancy rate for all units.

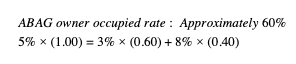

In ABAG, this 5% overall vacancy rate is mathematically equivalent to 8% for rental units and 3% for owner-occupied. HCD has defined healthy vacancy rates as 4-8% for rental units and 1-4% for owner-occupied. There’s nothing extraordinary about a 5% overall vacancy rate.

Fundamentally, EI frames political grievances as mathematical errors demanding corrective action. And they do so in a particularly misleading way, calling their methodology the “Conventional Economist Approach” because HCD used the same methodology in the past when in reality...

… EI’s approach has nothing to do with economics. Economics consider prices; the modern models measure housing shortages by comparing housing prices to the cost of development. More housing is needed where housing prices are significantly higher than development costs.

Even if EI were correct that HCD overestimated CA’s housing need, their conclusion that “Market-rate housing doesn’t need state incentives. Affordable housing needs state” funding makes no sense.

To begin with, the state is not “incentivizing” market-rate housing. The state is forcing cities to reduce regulations that prevent market-rate housing. “Incentivizing” involves subsidies or tax breaks, which the state has not provided for market-rate development.

So ALLOWING market-rate housing, which costs nothing, and INCENTIVIZING affordable housing are not mutually exclusive. We agree with EI that the state should provide more funding for affordable housing, but EI’s dichotomy between affordable and market-rate housing is strange.

Following EI’s suggested policy course could actually hurt the housing market! Econometric evidence suggests that providing subsidies for affordable housing without increasing housing supply leads to faster price increases across the market as a whole. CA can do both.

Lafayette, please write letters to the Council at [email protected] or attend Monday’s meeting to speak directly to the Council. Let them know that you support development in Lafayette and that the Council should not endorse EI’s misleading accusations!

Inclusive Lafayette produced this draft letter for anyone to use. https://docs.google.com/document/d/1F_3kf2a6SztGtno5BE4FKLo9PtnFBRfwBmfZKvxBBxE/edit?usp=sharing

Leadership from Inclusive Lafayette have already sent two letters to the city. Feel free to draw from them for your own letter or public comment. The first letter focuses on misleading rhetoric in the EI letter and housing economics: https://docs.google.com/document/d/1oYDQus5wK9TMT_loAKkrKJCMLefIc_TnFN0dP9cWvK4/edit?usp=sharing

A second letter explores HCD’s methodology in greater depth, elaborating on the legal context behind recent changes: https://docs.google.com/document/d/1B6jHvMjoSnjfYCKJknShv_-qpVUOqhtog5vTyJs5dTo/edit?usp=sharing

We also recommend this thread from @cselmendorf, which helped guide our research and portions of our responses: https://twitter.com/CSElmendorf/status/1309373655709659136?s=20

Read on Twitter

Read on Twitter