Seeing lots of talk about the surge in M1 money supply in the last week and the potential for very high inflation.

Let's dive into this in some more detail.

Let's dive into this in some more detail.

First, we know from the financial crisis that M1 is a terrible, I repeat, TERRIBLE measure of future inflation.

It's just not broad enough to understand what's going on....

It's just not broad enough to understand what's going on....

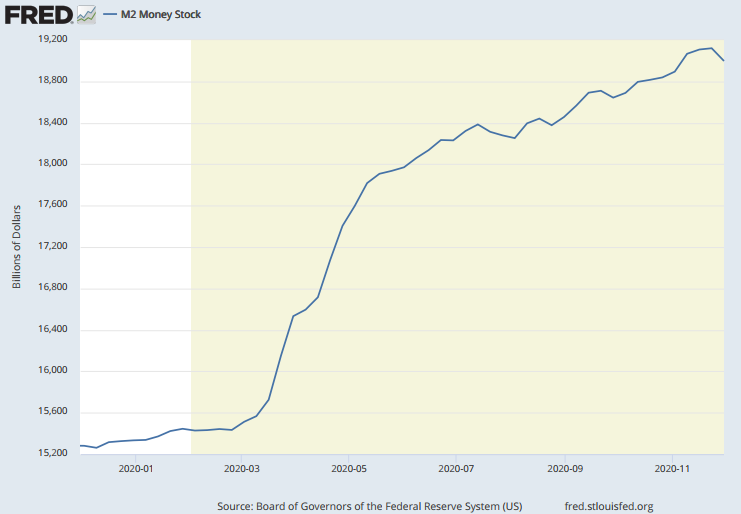

Second, if we look at broader measures we don't see a corresponding rise in recent weeks. Here's M2 which includes M1 plus: savings deposits, small-denomination time deposits (time deposits and balances in retail money market mutual funds.

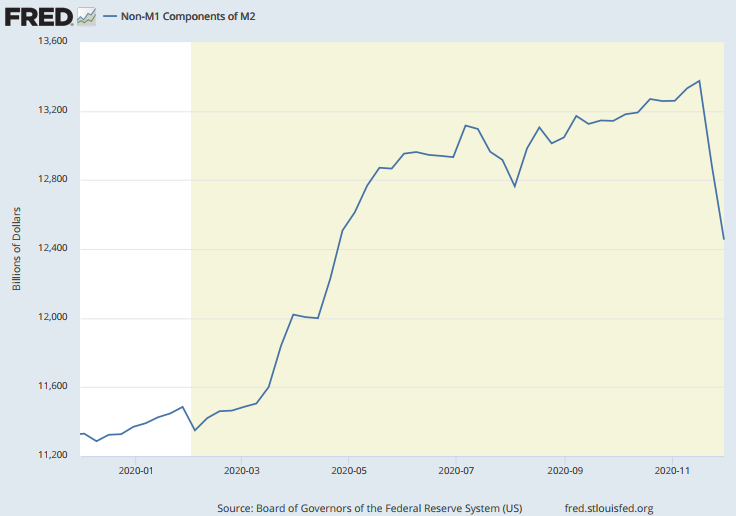

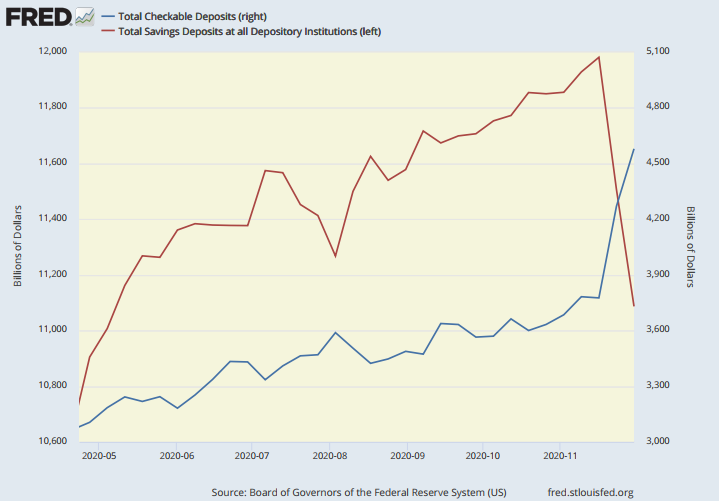

What explains all of this? If you diver deeper it looks like a big reclassification of deposits and savings deposits probably due to the Fed's evolving programs.

In any case, nothing much has changed in recent weeks so don't go freaking out about cherry picked M1 charts.

In any case, nothing much has changed in recent weeks so don't go freaking out about cherry picked M1 charts.

The broader lessons here:

1) beware of money supply measures that don't reflect the broader money supply.

2) inflation is more than a monetary phenomenon so beware of narratives that imply inflation must increase due to a money supply increase.

1) beware of money supply measures that don't reflect the broader money supply.

2) inflation is more than a monetary phenomenon so beware of narratives that imply inflation must increase due to a money supply increase.

Read on Twitter

Read on Twitter