Since I'm doing some research on some juniors anyway, I am just going to write a little thread about it.

In addition to the holiday season, tax-loss selling is upon us ...

But what is this tax-loss selling and why should you care? Let's have a look.

#mintwit $silver #taxloss

In addition to the holiday season, tax-loss selling is upon us ...

But what is this tax-loss selling and why should you care? Let's have a look.

#mintwit $silver #taxloss

1 - What is it actually?

American and Canadian investors are allowed to deduct investment losses from their taxes, as long as you take your losses before the end of this year (27 of dec. for Canadians). This is a little bit uncommon in Belgium, and maybe in the whole of EU?

American and Canadian investors are allowed to deduct investment losses from their taxes, as long as you take your losses before the end of this year (27 of dec. for Canadians). This is a little bit uncommon in Belgium, and maybe in the whole of EU?

2 - Why do I care?

As most of you know, miners reached yearly highs in August followed by a lengthy consolidation period. Investors buying in July/August are thus holding a loss and might sell these for tax-optimisation reasons.

E.G. Vizsla with losses up to 40%

As most of you know, miners reached yearly highs in August followed by a lengthy consolidation period. Investors buying in July/August are thus holding a loss and might sell these for tax-optimisation reasons.

E.G. Vizsla with losses up to 40%

3 - Personally I would have loved to add some #uranium miners, however, due to the bullish breakout of #uranium, most U-miners are breaking yearly highs again and thus no losses to declare (yay, profits!)

4. I've been watching some $silver and $gold jrs which I would love to add given their current discount, which increased further in the last few weeks due to #taxloss selling.

As always, no investment advice, just some Belgian craft-beer infused thoughts.

As always, no investment advice, just some Belgian craft-beer infused thoughts.

5. #preciousmetals should be entering their final days of this lengthy consolidation phase we've entered since August. I do anticipate a breakout to the upside rather soon and thus hope to enter these three names by next week.

$Silver $UAG

$Silver $UAG

6. #1 $VZLA - @ResourcesVizsla

With it's Panuco project, VZLA is dominantly a silver-play, which experienced a healthy retracement by now. Currently hoovering around the 0.618 rertr. level, however if this one fails, we have some idle space underneath and we might fill the gap.

With it's Panuco project, VZLA is dominantly a silver-play, which experienced a healthy retracement by now. Currently hoovering around the 0.618 rertr. level, however if this one fails, we have some idle space underneath and we might fill the gap.

7. #1 $VZLA

Panuco is a epithermal vein system, with historically mapped veins to which new discoveries are being added thanks to an extensive drilling program. In addition, majors such as $AG are active in the region as well.

Panuco is a epithermal vein system, with historically mapped veins to which new discoveries are being added thanks to an extensive drilling program. In addition, majors such as $AG are active in the region as well.

8. #1 $VZLA

Currently, VZLA is an exploration company with an active drilling program. However, thanks to an option on existing infrastructure (mills, tailings, etc.), they are capable to move into production rather quickly.

Currently, VZLA is an exploration company with an active drilling program. However, thanks to an option on existing infrastructure (mills, tailings, etc.), they are capable to move into production rather quickly.

9. #1 $VZLA

Their resource holds local high-grade AgEq vein systems, with grades of 1000 g AgEq/ton and more. Furthermore, they have an experienced board in place, including Craig Parry of my favourite U play $ISO. With no recent insider sales, consider me interested!

Their resource holds local high-grade AgEq vein systems, with grades of 1000 g AgEq/ton and more. Furthermore, they have an experienced board in place, including Craig Parry of my favourite U play $ISO. With no recent insider sales, consider me interested!

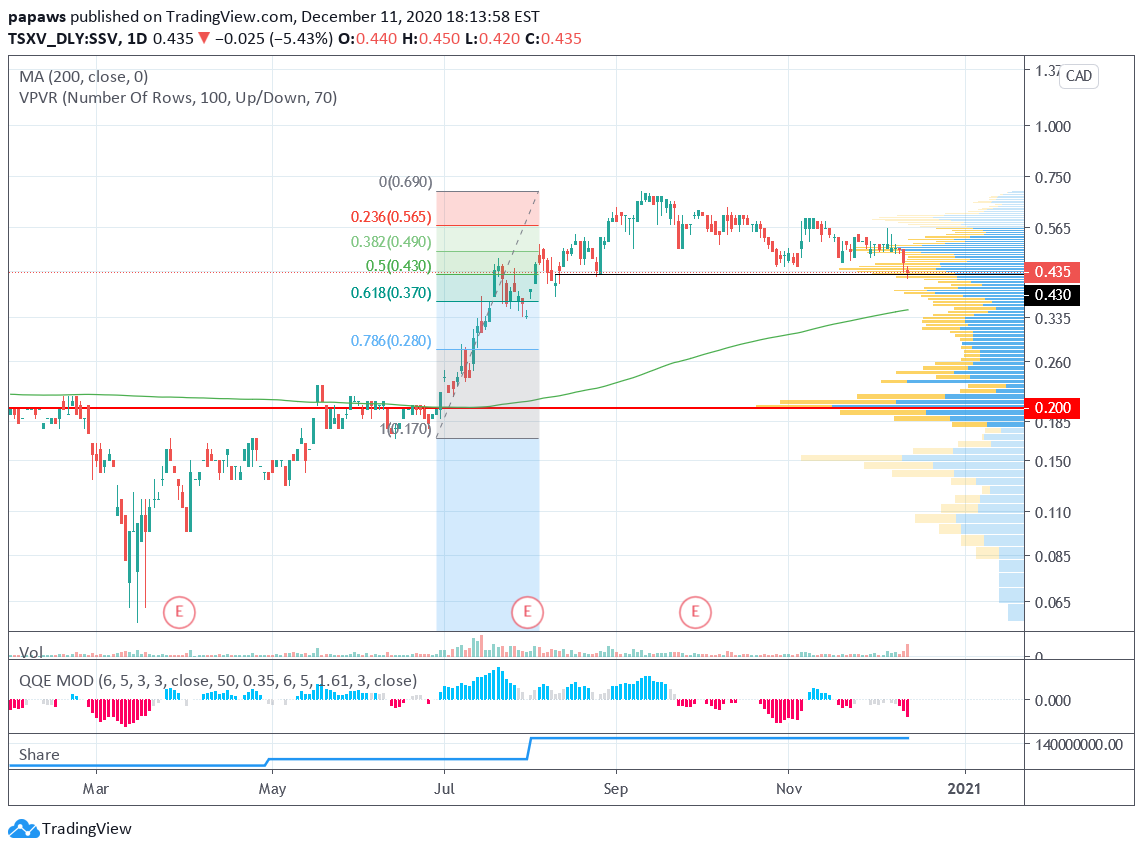

10. #2 $SSV - @Southern_Silver

SSV has two projects, Cerro las Minetas (CLM) and Oro, of which the former is the important one imo. CLM is a Ag-Pb-Zn skarn type of deposit, which is my favourite type of ore-deposit, due to it's continuity and richness.

SSV has two projects, Cerro las Minetas (CLM) and Oro, of which the former is the important one imo. CLM is a Ag-Pb-Zn skarn type of deposit, which is my favourite type of ore-deposit, due to it's continuity and richness.

11. #2 $SSV

Currently sitting at it's 0.5 retracement, SSV's share price should find some support over here. In addition, it is a greenfield discovery with a current resource of 272 M Oz AgEq at a rather high average grade.

Currently sitting at it's 0.5 retracement, SSV's share price should find some support over here. In addition, it is a greenfield discovery with a current resource of 272 M Oz AgEq at a rather high average grade.

12. #2 $VZLA

Add to that an active drilling program, focussing on higher-grade targets in the skarn zone, and you've got yourself a potentially expanding resource estimate. Furthermore, they are surrounded by the big guys such as $CDE, $HL, etc.

Add to that an active drilling program, focussing on higher-grade targets in the skarn zone, and you've got yourself a potentially expanding resource estimate. Furthermore, they are surrounded by the big guys such as $CDE, $HL, etc.

13. #2 $VZLA

Add that up with the Oro-project, which is an under explored Au-Cu-Mo porphyry system and you've got yourself my second favourite to watch with taxloss season closing upon us.

Add that up with the Oro-project, which is an under explored Au-Cu-Mo porphyry system and you've got yourself my second favourite to watch with taxloss season closing upon us.

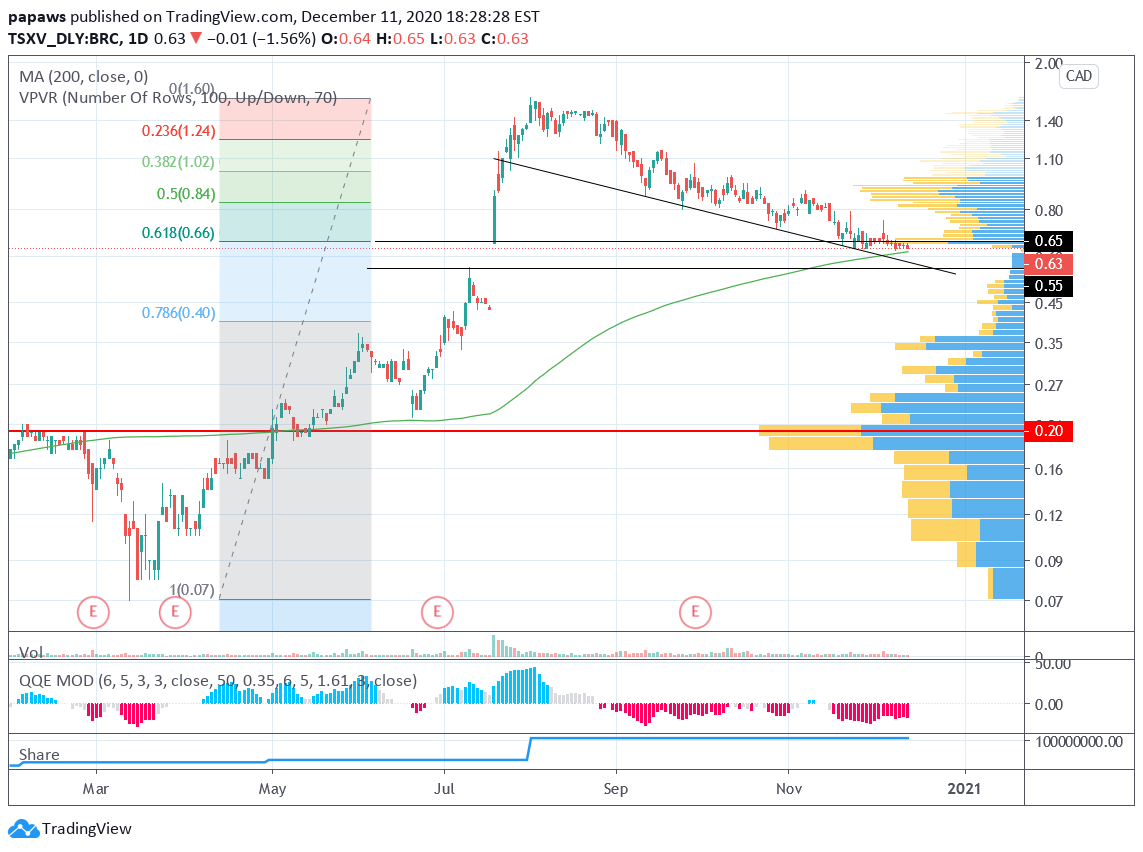

14. #3 $BRC - @BRCGOLD

First I've to give credits to Goldfinger and @CEOeditor, since this one got on my radar thanks to this article:

https://ceo.ca/@goldfinger/goldfingers-2020-tax-loss-silly-season-shopping-list

The stock currently sits below the 0.618 retracement and might go for the gap fill due to the idle space we're in.

First I've to give credits to Goldfinger and @CEOeditor, since this one got on my radar thanks to this article:

https://ceo.ca/@goldfinger/goldfingers-2020-tax-loss-silly-season-shopping-list

The stock currently sits below the 0.618 retracement and might go for the gap fill due to the idle space we're in.

15. $BRC

But why am I intrigued by them? They hold two high-grade claims, Tonopah $Silver and Silvercloud $Gold, located in #Nevada. A top-notch mining district in a "stable" country.

But why am I intrigued by them? They hold two high-grade claims, Tonopah $Silver and Silvercloud $Gold, located in #Nevada. A top-notch mining district in a "stable" country.

16. $BRC

Tonopah is a historical claim, with historical high AgEq production (dominated by #silver). However, thanks to a drilling program, $BRC identified two new vein systems of which assays are still pending.

Tonopah is a historical claim, with historical high AgEq production (dominated by #silver). However, thanks to a drilling program, $BRC identified two new vein systems of which assays are still pending.

17. $BRC

Silvercloud's neighbour is $HL and has been exploited in the past. However, thanks to new regional geological knowledge (partly due to $HL) and a new drilling program, $BRC aims to increase its resource. In addition, this campaign will focus on the border near $HL.

Silvercloud's neighbour is $HL and has been exploited in the past. However, thanks to new regional geological knowledge (partly due to $HL) and a new drilling program, $BRC aims to increase its resource. In addition, this campaign will focus on the border near $HL.

18. $BRC

Important to notice is that they are planning to spin-out the #silvercloud property, which would mean they get listed underneath a separate symbol (of which you'll get shares of course).

Important to notice is that they are planning to spin-out the #silvercloud property, which would mean they get listed underneath a separate symbol (of which you'll get shares of course).

Read on Twitter

Read on Twitter