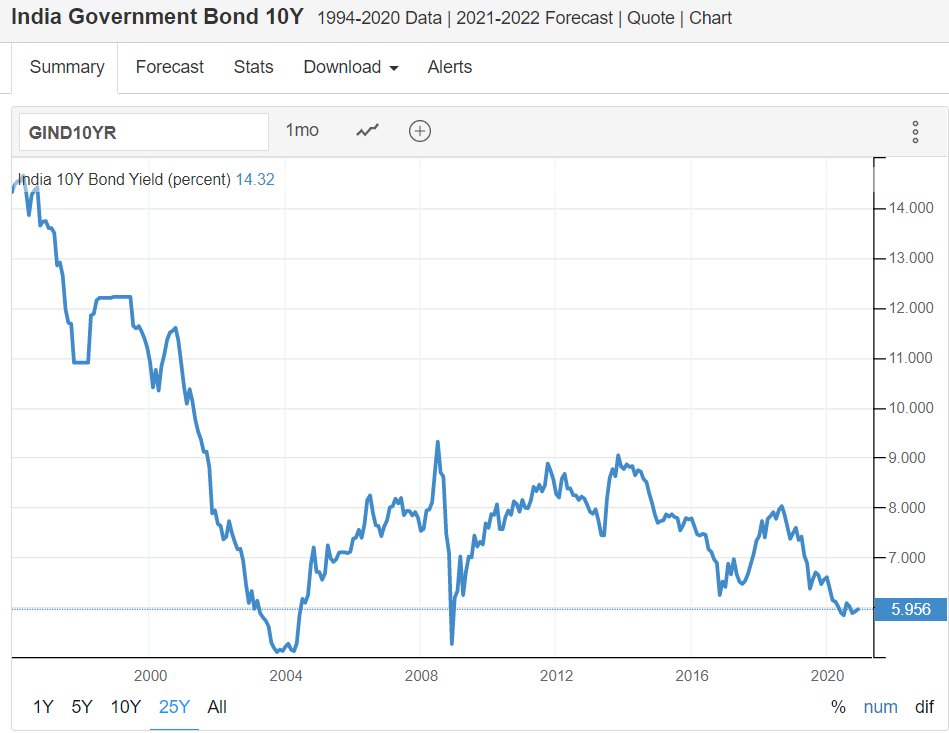

A look at India govt bond yields for last 25 years show that global investors trusted Atalji and Modi a lot more than Dr. Singh.

Bond yield is interest rate that investors charge for lending the govt money.

It means lower the interest rate, the more they world trusts you (1/n)

Bond yield is interest rate that investors charge for lending the govt money.

It means lower the interest rate, the more they world trusts you (1/n)

First see the sharp downward slope of the graph from 1996 onwards.

As Atalji strengthens the economy, people are willing to lend to India at lower and lower interest rates

(2/n)

As Atalji strengthens the economy, people are willing to lend to India at lower and lower interest rates

(2/n)

And just see the spectacular upturn of the graph in 2004.

Sonia ji wins the election and allegedly worlds greatest economist becomes PM.

Immediately investors lose confidence and start demanding higher rates.

(3/n)

Sonia ji wins the election and allegedly worlds greatest economist becomes PM.

Immediately investors lose confidence and start demanding higher rates.

(3/n)

All the while that UPA1 is posting high growth rates, investors keep demanding higher and higher interest rates.

Whatever the publicity by Cong chamchas, investors don't trust the Indian economy.

(4/n)

Whatever the publicity by Cong chamchas, investors don't trust the Indian economy.

(4/n)

The 2008 recession is of course an anomaly. With stock markets collapsing, investors worldwide turn to safety of govt bonds for a brief period.

(5/n)

(5/n)

But as soon as 2008 panic recedes, bond yields start climbing again. Look at the high interest rates investors were charging during UPA 2.

(6/n)

(6/n)

And look!

The interest rates start falling immediately from 2014, as soon as Modi comes to power.

Trust in Indian economy increases.

(7/n)

The interest rates start falling immediately from 2014, as soon as Modi comes to power.

Trust in Indian economy increases.

(7/n)

There are small ups and downs of course, but at no point do the interest rates under Modi reach what UPA had to pay.

And for last 2 years when media has been crying about economy, the rates have actually fallen.

(8/n)

And for last 2 years when media has been crying about economy, the rates have actually fallen.

(8/n)

In other words, global investors trust the Indian economy under Modi.

A lot more than they ever trusted Dr. Singh.

Investors don't care what Ravish Kumar or Dhruv Rathee think.

(n/n)

A lot more than they ever trusted Dr. Singh.

Investors don't care what Ravish Kumar or Dhruv Rathee think.

(n/n)

Read on Twitter

Read on Twitter