Last week the @ECB extended its current asset purchase program, now totalling €1.8 tn. Several EU states can borrow at negative interest rates.

10 years ago, the eurozone almost collapsed, a result of a misconstructed currency that was meant to fail from the outset.

A thread

10 years ago, the eurozone almost collapsed, a result of a misconstructed currency that was meant to fail from the outset.

A thread

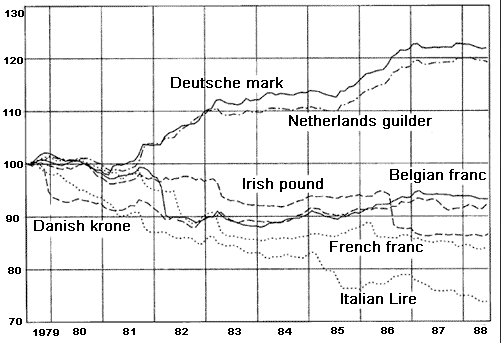

1/Before the introduction of the euro, fluctuating exchange rates were seen as threat for economic integration & embarrassment for those who were inflating their currencies faster than others.

The European Monetary System, set up in 1979, was an attempt to stabilise fx rates.

The European Monetary System, set up in 1979, was an attempt to stabilise fx rates.

2/The EMS was doomed to fail as members applied different monetary policies while trying to keep their fx rates in a pre-defined corridor.

The German Bundesbank refused to devalue the Mark when other centr. banks inflated their currencies - strengthening the Mark by comparison.

The German Bundesbank refused to devalue the Mark when other centr. banks inflated their currencies - strengthening the Mark by comparison.

3/Traditionally, Southern EU countries have been more prone to inflation & high debt levels due to a large public sector, strong labour unions & generous pension systems.

Northern countries like Germany & the Netherlands typically had more prudent monetary & fiscal policies.

Northern countries like Germany & the Netherlands typically had more prudent monetary & fiscal policies.

4/To get rid of the stubbornly conservative Bundesbank & monetise public deficits more easily, Southern countries spearheaded by France pushed for a single currency and used Germany’s desire for reunification in 1989 to make it give up the D-Mark. https://twitter.com/HODLdax/status/1311315953779499008?s=20

5/Germany eventually agreed on the introduction of the euro but insisted that certain criteria have to be met by countries who want to join the European Monetary Union (EMU), most importantly:

- Public deficit not higher than 3% of GDP

- Public debt not higher than 60% of GDP

- Public deficit not higher than 3% of GDP

- Public debt not higher than 60% of GDP

6/The enforcement mechanisms of the rules were toothless as proposals for automatic sanctions against violations were rejected.

Regardless of the stability criteria, the European Council could decide with a qualitative majority to admit countries to the eurozone.

Regardless of the stability criteria, the European Council could decide with a qualitative majority to admit countries to the eurozone.

7/Although Belgium & Italy violated the stability criteria, both were admitted to the EMU. Goldman Sachs helped Greece in faking its debt statistics to be allowed into the eurozone. No country was ever fined, penalties were subject to political decisions. https://www.spiegel.de/international/europe/greek-debt-crisis-how-goldman-sachs-helped-greece-to-mask-its-true-debt-a-676634.html

8/France & Germany were also spending above their limits & violated the EMU provisions in 2005 but refused to accept any sanctions which watered down the stability pact, creating moral hazard & discouraging other states from bringing their houses in order. https://www.dw.com/en/germany-set-to-violate-eu-deficit-rules-in-2005/a-1183676

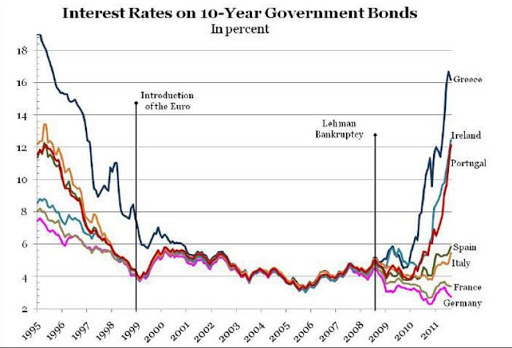

9/When the euro launched in 1999, fx rates between the different national currencies were fixed & interest rates converged. Investors thought the sound principles of the Bundesbank would be transferred to the ECB, leading to artificially low interest rates in Southern countries.

10/Low interest rates caused a credit boom in countries like Spain, Italy, Portugal & Greece. Cheap money flowed into the construction sector fuelling a housing bubble & bloated the public sector. Higher wages & inflexible labour markets reduced competitiveness & boosted imports.

11/Before the euro, countries could regain competitiveness by currency devaluation, lowering real wages & making exports cheaper. This was no longer possible in a common monetary system - the only way for many economies to grow was through consumption driven by cheap credit.

12/Fast forward to 2009: After states worldwide bailed out the banking sector & fought against recession, public deficits & debt reached record levels.

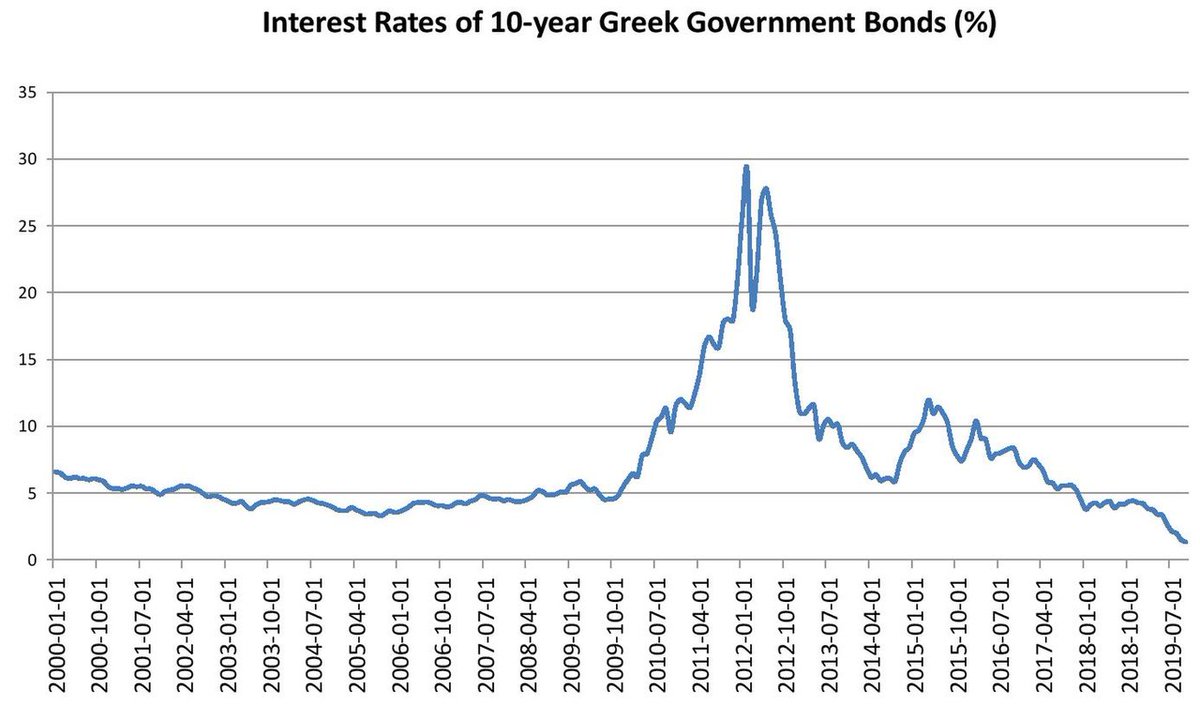

Greece revealed a public debt of 113% of GDP & deficit of 13.6% of GDP as opposed to the reported 6.7%.

Greece revealed a public debt of 113% of GDP & deficit of 13.6% of GDP as opposed to the reported 6.7%.

13/Investors became nervous that Greece & other PIIGS countries (Portugal, Ireland, Italy & Spain) would default on their debt. Agencies downgraded Greece’s credit rating to junk status. Interest rates for Greek debt increased massively, reaching a peak of almost 30% in 2012.

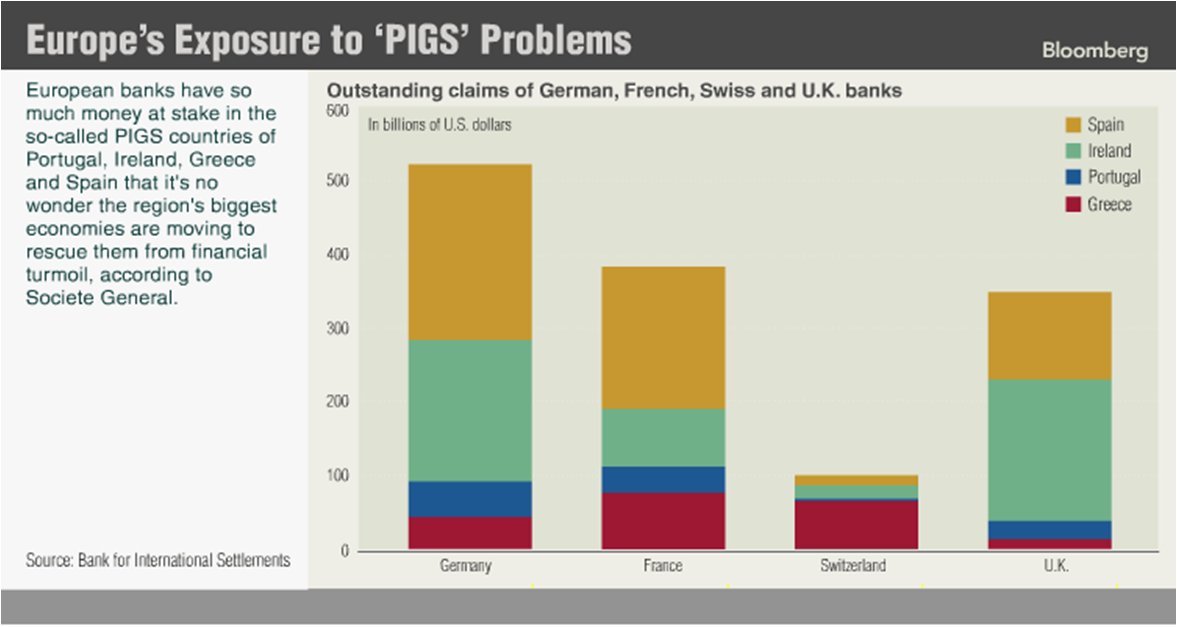

14/In Feb 2010, Deutsche Bank, which owned large portions of Greek debt, pressured German Chancellor Merkel to agree on a bailout. The request was rejected as a bailout would violate the treaty of the EU stating that member states are not responsible for other members’ debt.

15/Following demands by the EU, the Greek government promised substantial deficit cuts through higher taxes & salary cuts for civil servants. While this caused popular anger & street protests, it gave Merkel the political capital she needed to sell a bailout to the German public.

16/In May, the EU and IMF agreed to provide a €110 bn bailout loan, in return Greece announced austerity measures which led to more intense protests & social unrest. The ECB dropped its previous rating requirements for bonds & accepted Greek debt as collateral no matter what.

17/Few days later, agencies downgraded other PIIGS countries. Stock markets & the euro crashed. Yields of bonds went up sharply. French & German banks held huge amounts of debts from PIIGS & there was fear that a default would lead to the collapse of the EU banking system.

18/The EU & IMF launched a €750 bn emergency loan package. In exchange, struggling countries agreed on deficit cuts, mainly by cutting government salaries & raising taxes. As euro states were guaranteeing for the loans, the EMU officially transformed into a redistribution union.

19/In total, Greece received 3 bailouts worth €310 bn. Private investors took a “haircut” when Greece’s debt was reduced by 50% in 2011. Other countries receiving government bailouts were Ireland, Portugal & Cyprus. The Spanish banking system was also bailed out with €100 bn.

20/While countries managed to reduce their deficits through austerity, the recession only got worse. Greece’s GDP declined by 7% in 2011, over 100k companies went bankrupt & unemployment rose to 28% in 2013. Living standards in other countries with austerity declined as well.

21/To avoid painful negotiations on bailouts & austerity, the ECB started quantitative easing in 2014, simply buying bonds from all eurozone states & do „whatever it takes“ to save the euro. In addition to QE, the ECB introduced negative interest rates. https://twitter.com/HODLdax/status/1298946476446384128?s=20

22/That way, there are no longer any costs for being fiscally irresponsible, instead all EU citizens are shouldering the burden through inflating asset prices & destruction of savings. Cheap credit flows without limits & previously prudent countries gave up their resistance.

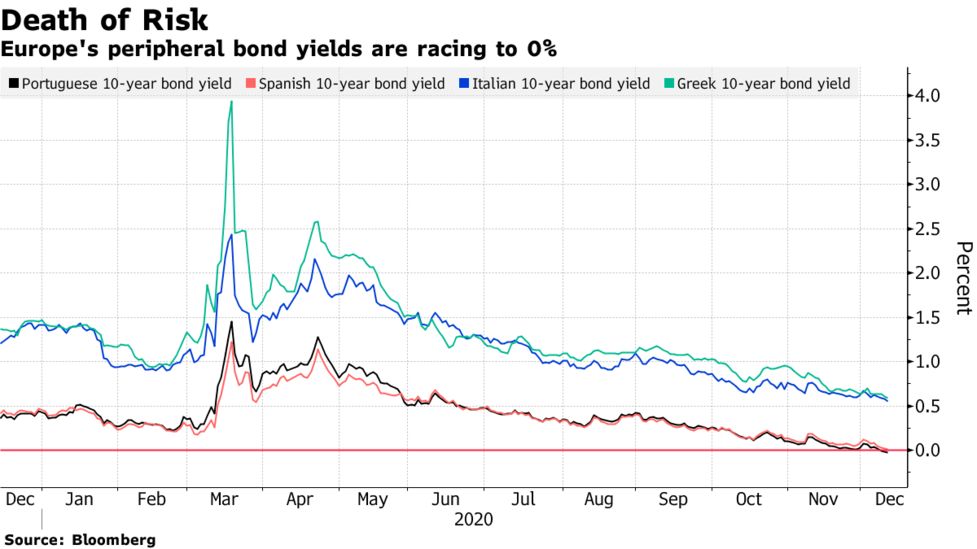

23/Since there is no free market determining the cost of capital anymore but the @ECB buying up all the junk with the help of the money printer, quasi-bankrupt states can earn money through the issuance of debt. Last week Spanish & Portuguese bonds traded with negative yields.

24/TLDR: The euro is a failed construct since day 1 & instead of uniting Europe led to social division, destruction of savings & bloated public sectors. To everyone living in the eurozone: sell your inflationary fiat shitcoin & protect your savings with sound money. #bitcoin  .

.

.

.

Read on Twitter

Read on Twitter