1/18

Long thread ahead of $TSLA's first S&P week with some advice.

First off, to people only holding stock, my general advice is sit back, relax, and watch the show. Even before factoring in Tesla Energy and Autobidder, EVTOL jets, cooperation with The Boring Company, HVACs,

Long thread ahead of $TSLA's first S&P week with some advice.

First off, to people only holding stock, my general advice is sit back, relax, and watch the show. Even before factoring in Tesla Energy and Autobidder, EVTOL jets, cooperation with The Boring Company, HVACs,

2/18

manufacturing as a service, electric boats, and various other potential lines of business, Tesla's long-term potential is enormous.

Tesla is basically untouchable in automotive, autonomy, and autonomous mobility as a service. Tesla will be a monster of a company 10-15 ...

manufacturing as a service, electric boats, and various other potential lines of business, Tesla's long-term potential is enormous.

Tesla is basically untouchable in automotive, autonomy, and autonomous mobility as a service. Tesla will be a monster of a company 10-15 ...

3/18

years from now, selling and managing massive fleets of AEVs. If you're worried $TSLA might be becoming overvalued, perhaps so looking backwards, but it's still a hell of an investment looking far into the future.

I explained all this in this post:

https://teslainvestor.blogspot.com/2019/12/my-tesla-investment-thesis-20-teslas.html

years from now, selling and managing massive fleets of AEVs. If you're worried $TSLA might be becoming overvalued, perhaps so looking backwards, but it's still a hell of an investment looking far into the future.

I explained all this in this post:

https://teslainvestor.blogspot.com/2019/12/my-tesla-investment-thesis-20-teslas.html

4/18

For people who have no choice but to time the market during the next couple of weeks, either because they hold options, or because of a need to sell some shares (living expenses, big purchase, etc.), I have three pieces of advice.

For people who have no choice but to time the market during the next couple of weeks, either because they hold options, or because of a need to sell some shares (living expenses, big purchase, etc.), I have three pieces of advice.

5/18

My first piece of advice is to be aware of what outcomes are unacceptable to you, and to eliminate the possibility of them occurring entirely.

My first piece of advice is to be aware of what outcomes are unacceptable to you, and to eliminate the possibility of them occurring entirely.

6/18

If you have 20% of your portfolio in short-term calls, and seeing 20% of your portfolio going up in smoke is an unacceptable outcome to you, trim that position immediately, so that it is impossible that 20% of your portfolio will go up in smoke.

If you have 20% of your portfolio in short-term calls, and seeing 20% of your portfolio going up in smoke is an unacceptable outcome to you, trim that position immediately, so that it is impossible that 20% of your portfolio will go up in smoke.

7/18

If you need to divest 40% of your $TSLA to finance the purchase of a house in January, and it is unacceptable to you to have missed the opportunity to sell @ $700, then sell as soon as it reaches $700, and don't bet on it going higher, even if you think it likely will.

If you need to divest 40% of your $TSLA to finance the purchase of a house in January, and it is unacceptable to you to have missed the opportunity to sell @ $700, then sell as soon as it reaches $700, and don't bet on it going higher, even if you think it likely will.

8/18

My second piece of advice is to have a general plan of what you want to do, that you can use a blueprint over the next weeks. New information will present itself, and the situation will likely be different in a couple of trading days, but I think it's better to...

My second piece of advice is to have a general plan of what you want to do, that you can use a blueprint over the next weeks. New information will present itself, and the situation will likely be different in a couple of trading days, but I think it's better to...

9/18

stick too much to your original plan, than to be too fickle.

The reason for this is that a plan should mostly be based on logic, whereas decisions made on the fly are much more likely to be influenced by emotions.

Adjust your plan, but have a plan.

stick too much to your original plan, than to be too fickle.

The reason for this is that a plan should mostly be based on logic, whereas decisions made on the fly are much more likely to be influenced by emotions.

Adjust your plan, but have a plan.

10/18

My final piece of advice is to not read too much into short-term price movements. The next 1-2 weeks could be very volatile for $TSLA. If a very large run-up indeed happens, it's not a question of if, but a question of when pullbacks will happen.

My final piece of advice is to not read too much into short-term price movements. The next 1-2 weeks could be very volatile for $TSLA. If a very large run-up indeed happens, it's not a question of if, but a question of when pullbacks will happen.

11/18

Big options positions will be sold for profits, and momentum traders could amplify such profit taking. During those times it's important to keep in mind that real big shareholders generally won't behave like that. If they dump so many shares in such a short period that...

Big options positions will be sold for profits, and momentum traders could amplify such profit taking. During those times it's important to keep in mind that real big shareholders generally won't behave like that. If they dump so many shares in such a short period that...

12/18

it crashes the market, how are they going to sell the other 90% or 95% of their holdings for a good price? Big shareholders will generally sell off positions more slowly, and swift crashes are generally more likely to be caused by momentum traders.

it crashes the market, how are they going to sell the other 90% or 95% of their holdings for a good price? Big shareholders will generally sell off positions more slowly, and swift crashes are generally more likely to be caused by momentum traders.

13/18

The advice I'm trying to give here is to not automatically assume a top has been reached when there's any sort of pullback. It's easy to get scared at times like this, but it's important to make decisions based on data and logic. The past week was a perfect example of this

The advice I'm trying to give here is to not automatically assume a top has been reached when there's any sort of pullback. It's easy to get scared at times like this, but it's important to make decisions based on data and logic. The past week was a perfect example of this

14/18

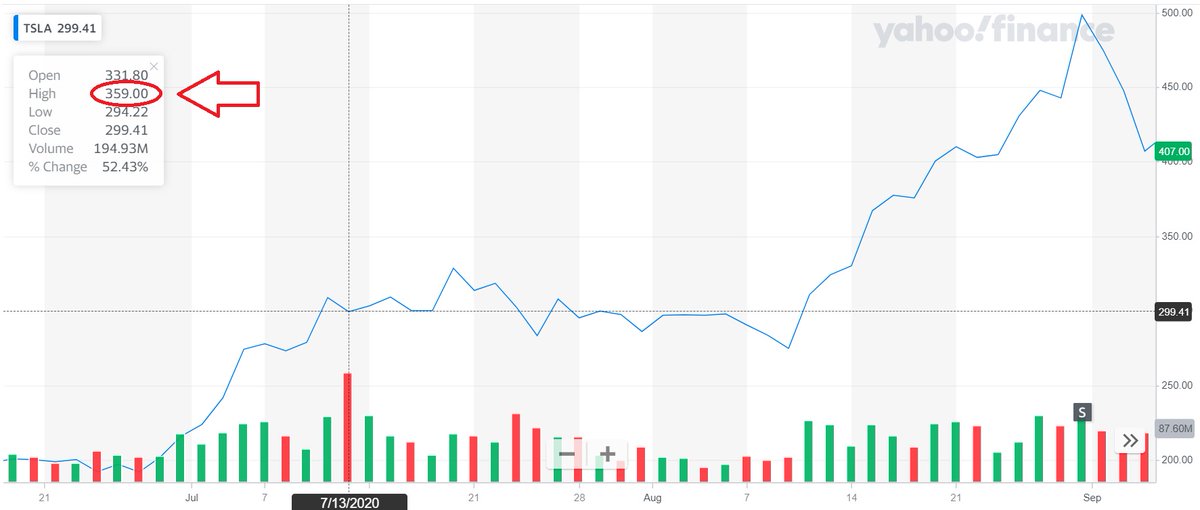

To illustrate this third and final piece of advice, here are a few examples of pullbacks. This first one is from July 13th, when the stock reached $1,800 during the morning, then crashed back down and closed at $1,500. A month later the run-up continued.

To illustrate this third and final piece of advice, here are a few examples of pullbacks. This first one is from July 13th, when the stock reached $1,800 during the morning, then crashed back down and closed at $1,500. A month later the run-up continued.

15/18

The second example is from early February, when $TSLA peaked at $950, and then made a dramatic crash. However, afterwards it continued its run-up, only halted by the COVID crash in March.

The second example is from early February, when $TSLA peaked at $950, and then made a dramatic crash. However, afterwards it continued its run-up, only halted by the COVID crash in March.

16/18

The final example is of real large shareholder selling from H1'19. The big crash in December was due to a broader market sell-off, and the crash on Jan 18th due to bad news. However, most of this 50% drop was over the course of 6 months, not in a short period.

The final example is of real large shareholder selling from H1'19. The big crash in December was due to a broader market sell-off, and the crash on Jan 18th due to bad news. However, most of this 50% drop was over the course of 6 months, not in a short period.

17/18

The lesson to learn here is to be careful about being overly influenced by big short-term price movements. They are often (but not always) due to profit taking/momentum trading. So don't blindly assume a top has been reached when there is a brief pullback.

The lesson to learn here is to be careful about being overly influenced by big short-term price movements. They are often (but not always) due to profit taking/momentum trading. So don't blindly assume a top has been reached when there is a brief pullback.

18/18

To summarize:

1) It's still hard to beat $TSLA over the next 10-15 years.

2) Eliminate unacceptable outcomes.

3) Have a plan. Adjust it, but don't abandon it due to emotions.

4) There will be profit taking. Be careful not to be overly influenced by the momentum changes.

To summarize:

1) It's still hard to beat $TSLA over the next 10-15 years.

2) Eliminate unacceptable outcomes.

3) Have a plan. Adjust it, but don't abandon it due to emotions.

4) There will be profit taking. Be careful not to be overly influenced by the momentum changes.

Read on Twitter

Read on Twitter