I did a deep dive into the history + biggest lessons from two companies that went public this week: @Airbnb and @DoorDash.

In its simplest form, this is my attempt to distill down what these IPOs mean for the greater tech echo-system.

Topics I explore in this mega-thread:

In its simplest form, this is my attempt to distill down what these IPOs mean for the greater tech echo-system.

Topics I explore in this mega-thread:

1. Setting the Stage

via @RobinhoodSnacks:

- DoorDash: The IPO was priced at $102 a share. By the time shares hit the NYSE, they were already trading at $182. Now Dash has a $59B market value, more than 3X its June valuation.

via @RobinhoodSnacks:

- DoorDash: The IPO was priced at $102 a share. By the time shares hit the NYSE, they were already trading at $182. Now Dash has a $59B market value, more than 3X its June valuation.

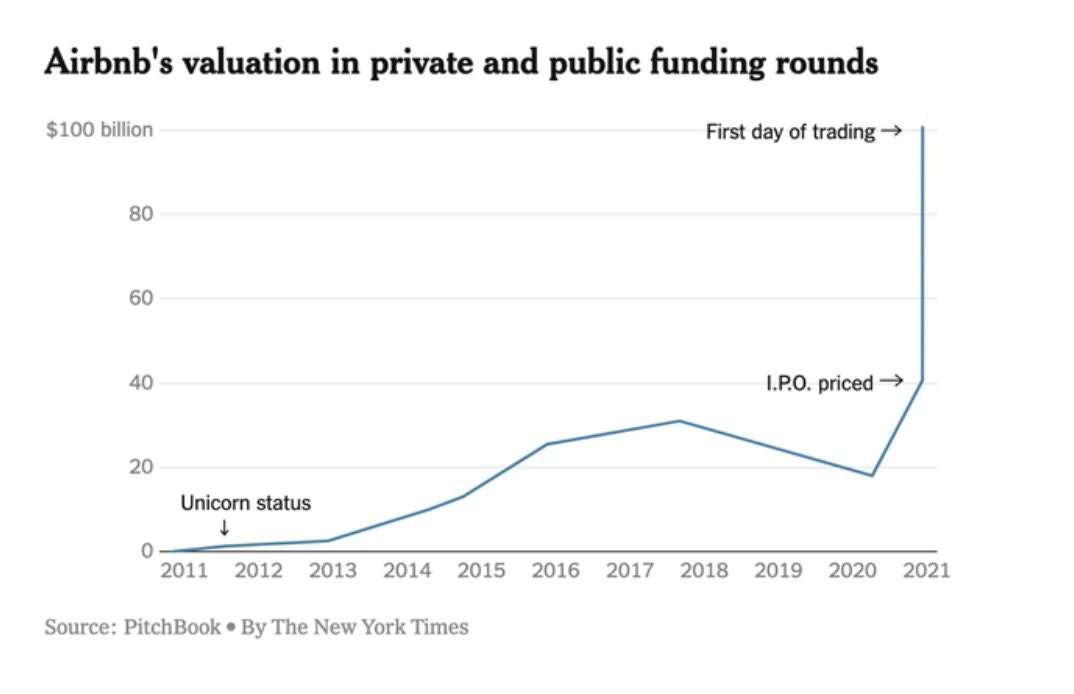

- Airbnb: It IPO'd at $68, but opened on the Nasdaq at $146. Its market value soared to over $100B, more than Marriott, Hilton, and Hyatt combined — and more than 5X its valuation in April.

When Brian was told of the pre-trading price on live TV Thursday morning, his reaction was incredible: https://twitter.com/business/status/1337069727500427267?s=20

"That’s the first time I’ve heard that number. In April, when we raised money, and it was debt financing, that price would have priced us around $30. So I don’t know what to say, that is… I’m very humbled by it."

And as Fortune points out about his reaction:

"This is key:

And as Fortune points out about his reaction:

"This is key:

Brian then cogently summed up the flip side of attaining such a high valuation:

"The higher the stock price, the higher the expectations.”

He's right. No one wants to be the company whose stock was hyped during the IPO process but gets rebalanced after its first earnings call."

"The higher the stock price, the higher the expectations.”

He's right. No one wants to be the company whose stock was hyped during the IPO process but gets rebalanced after its first earnings call."

This begs the question: how does this day-of “pop” happen?

And is it good or bad?

I will address this question in point number six, further down in this thread.

But first, let’s go back to the beginning: https://twitter.com/paulg/status/1334490043537362946?s=20

And is it good or bad?

I will address this question in point number six, further down in this thread.

But first, let’s go back to the beginning: https://twitter.com/paulg/status/1334490043537362946?s=20

2. An Overnight Success

"All overnight success takes about 10 years."

- Jeff Bezos

You can watch DoorDash’s 2-minute YC application video here:

"All overnight success takes about 10 years."

- Jeff Bezos

You can watch DoorDash’s 2-minute YC application video here:

And Airbnb’s night-before Hail Mary to get into YC: https://twitter.com/paulg/status/1337011619268882432?s=20

The grit over the years is evidenced in everyone who talks about both of the company founder’s maniacal focus.

What I like about juxtaposing these two companies, is that you can see two clear category winners, but from different perspectives:

What I like about juxtaposing these two companies, is that you can see two clear category winners, but from different perspectives:

- DoorDash was the classic “why will you win in a crowded space?”

- Airbnb was the classic “why will you win big in a new, untested, market?”

What were the things that helped them both, in being break-out successes?

- Airbnb was the classic “why will you win big in a new, untested, market?”

What were the things that helped them both, in being break-out successes?

As @lennysan succinctly summarizes this Tweet thread by @michaelxbloch, an early DoorDash employee, turned investor (obviously), there were three key reasons: https://twitter.com/lennysan/status/1335786723838623744?s=20

3. The Unseen Winners

The founders and employees of Airbnb and DoorDash were, of course, the biggest beneficiaries from two of the biggest IPO’s in history.

But, I also want to call out two other winners:

The founders and employees of Airbnb and DoorDash were, of course, the biggest beneficiaries from two of the biggest IPO’s in history.

But, I also want to call out two other winners:

- @ycombinator

They invested in both companies at the seed stage.

YC cut a check to Airbnb for $20K, in exchange for 6%, the equivalent of $2.2B at yesterday’s close (dilution included).

Many passed on Airbnb in the early days.

They invested in both companies at the seed stage.

YC cut a check to Airbnb for $20K, in exchange for 6%, the equivalent of $2.2B at yesterday’s close (dilution included).

Many passed on Airbnb in the early days.

You can read two articles that YC published this week. First one on Airbnb, written by PG. And the second on Doordash. written by YC Partner, Paul Buchheit.

- https://blog.ycombinator.com/the-airbnbs/

- https://blog.ycombinator.com/doordash-from-application-to-ipo/

- https://blog.ycombinator.com/the-airbnbs/

- https://blog.ycombinator.com/doordash-from-application-to-ipo/

Here’s the YC class, led by @jesslivingston, @theSamParr and @paulg: https://twitter.com/justinkan/status/1337122637483364354?s=20

- The Customers

I believe that, overall, consumers have won because of these two companies.

If you look at the customers on both sides of the marketplaces (drivers/restaurants+eaters and hosts+guests), it’s a win-win overall.

I believe that, overall, consumers have won because of these two companies.

If you look at the customers on both sides of the marketplaces (drivers/restaurants+eaters and hosts+guests), it’s a win-win overall.

It’s worth taking note that this is very difficult to do successfully, especially at scale, and across so many unique markets.

4. Are We in a bubble?

Stay with me, people.

It’s the natural question to be asked, especially by those who do not know the business mechanics to the degree that early stage investors, and of course, the founders, know them.

Stay with me, people.

It’s the natural question to be asked, especially by those who do not know the business mechanics to the degree that early stage investors, and of course, the founders, know them.

It was the first question that popped up, in several of my text threads with friends about the IPOs this week. “Okay, DoorDash was huge. I bet Airbnb will be too. Do we think we’re in a bubble that is about to pop?”

The reality is, global equities did hit $100T for the first time ever this past week.

So, it is fair to consider the rising valuation (revenue multiples), both in the public markets and private markets. But, Airbnb in particular has had a rollercoaster of a year.

So, it is fair to consider the rising valuation (revenue multiples), both in the public markets and private markets. But, Airbnb in particular has had a rollercoaster of a year.

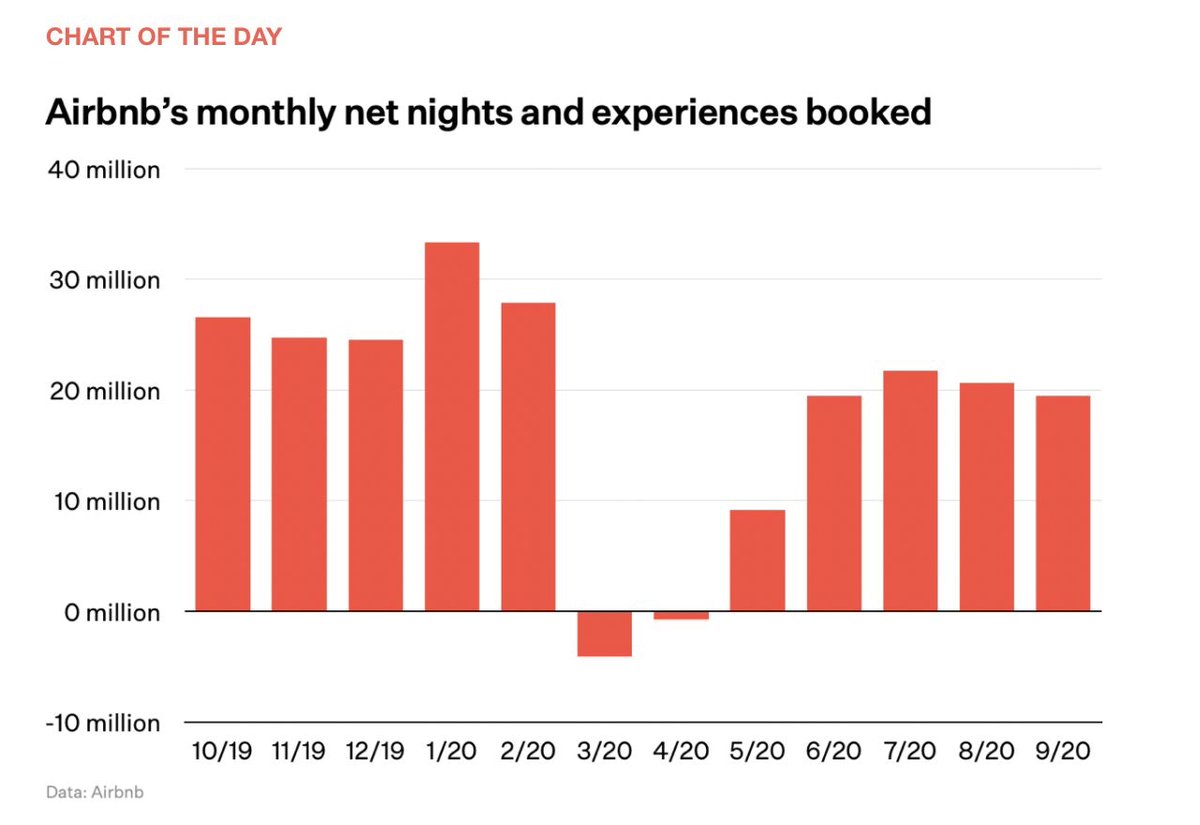

Airbnb had to lay off 25% of their employees (they kindly vested all shares).

And got hit very hard by the impacts of Covid in 2020:

And got hit very hard by the impacts of Covid in 2020:

5. Is the IPO Process Broken?

Mega-thread continues here: https://twitter.com/brendanjshort/status/1337561223877914624?s=20

Mega-thread continues here: https://twitter.com/brendanjshort/status/1337561223877914624?s=20

Read on Twitter

Read on Twitter