HOW TO READ A PROSPECTUS

A what?!

It’s a document required by the SEC giving you details about an investment (stocks, bonds, mutual funds).

Why should you care?

Because it provides insights about fees, performance, objectives of the investment.

if you

if you  money

money

//THREAD//

A what?!

It’s a document required by the SEC giving you details about an investment (stocks, bonds, mutual funds).

Why should you care?

Because it provides insights about fees, performance, objectives of the investment.

if you

if you  money

money//THREAD//

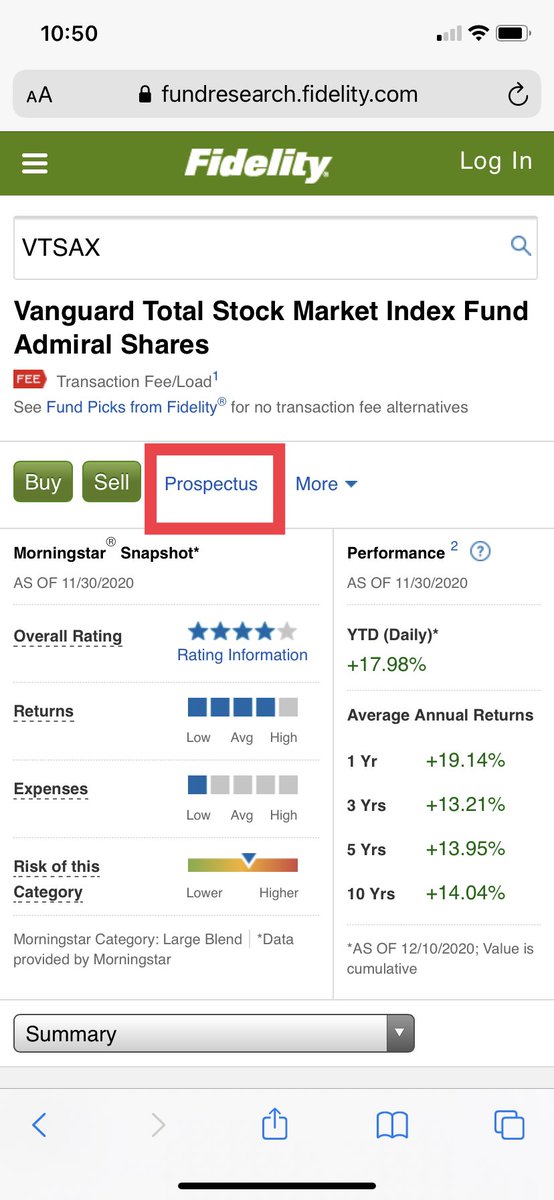

I’m going to show you how to do that with Fidelity.

They do a great job of finding different prospectus’ for different funds.

However, a Google search would work just as well.

Via Fidelity, use their fund search and type vtsax in their search.

https://fundresearch.fidelity.com/

They do a great job of finding different prospectus’ for different funds.

However, a Google search would work just as well.

Via Fidelity, use their fund search and type vtsax in their search.

https://fundresearch.fidelity.com/

Now we are at the $VTSAX ticker from within Fidelity’s site and we want to click on the prospectus button (image below) and look at the Summary Prospectus.

Why the Summary Prospectus?

Because two of the key ingredients that we want to look at are:

> Fees

> Returns (pre-tax vs after-tax)

Because two of the key ingredients that we want to look at are:

> Fees

> Returns (pre-tax vs after-tax)

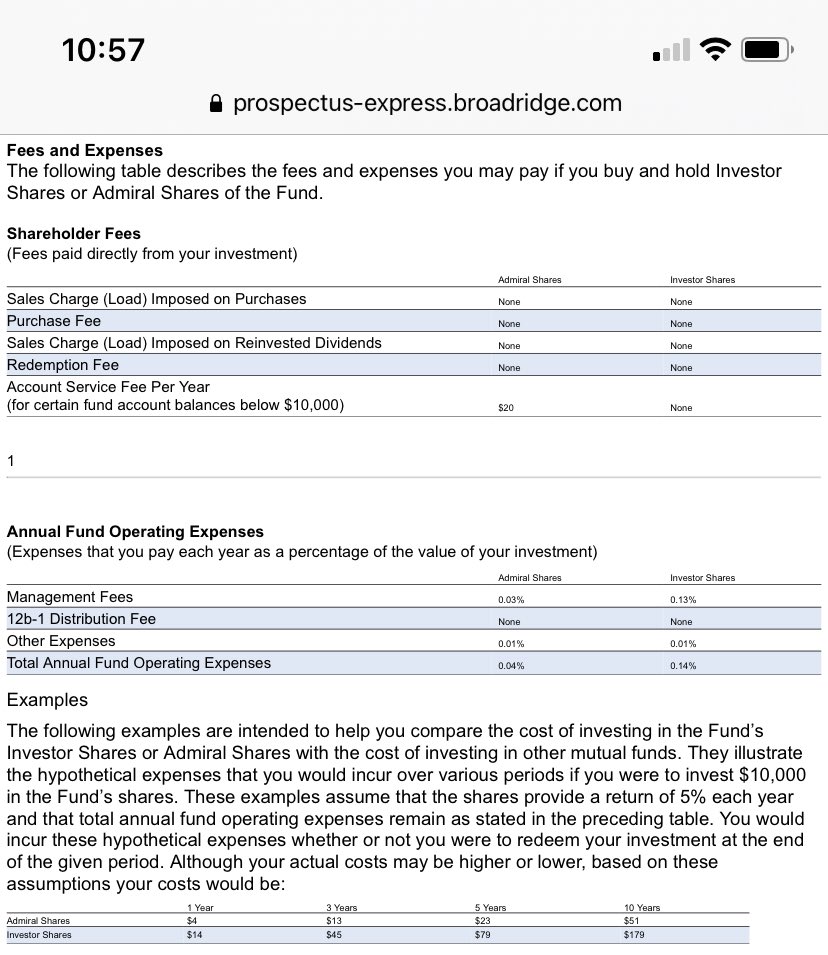

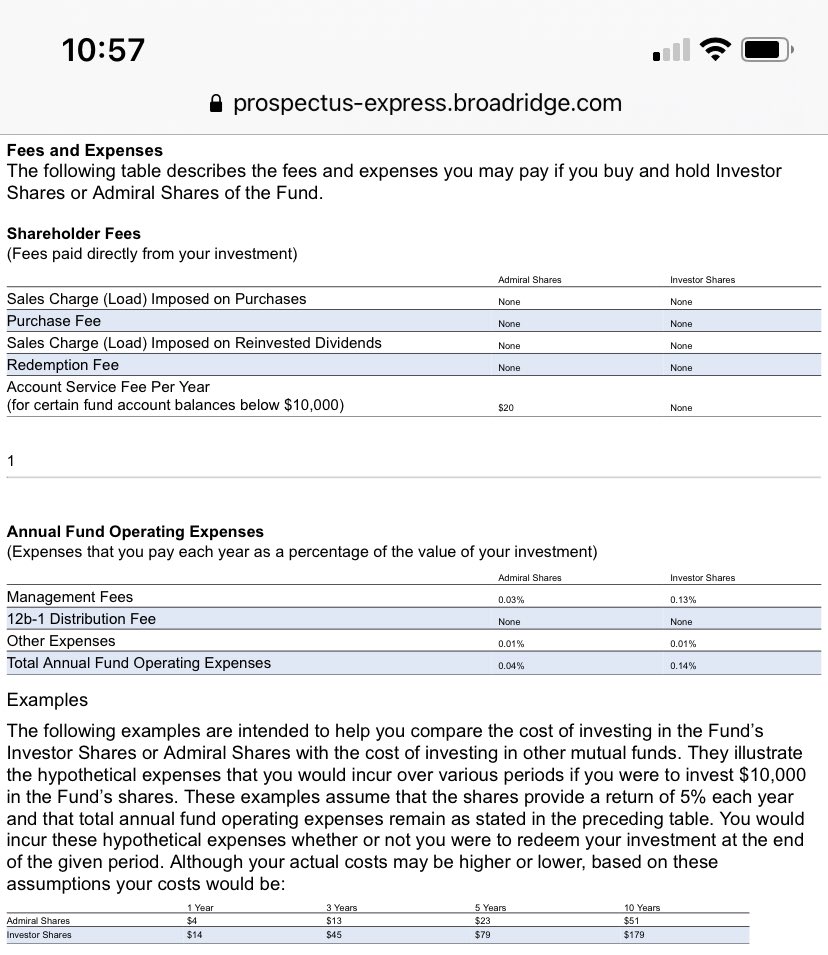

Let’s start with the fees.

Shareholder fees - these are fees you pay to persons involved with responding to investor Qs & providing investors with info about the fund.

Look closely and you’ll see Admiral Shares vs Investor Shares.

Shareholder fees - these are fees you pay to persons involved with responding to investor Qs & providing investors with info about the fund.

Look closely and you’ll see Admiral Shares vs Investor Shares.

New customers can’t invest in Investor shares anymore. (ticker: $VTSMX)

The key to realize here is different funds have different share classes.

Different classes may have different fees.

What else do you see?

Admiral shares come with a $20 fee for balances below $10K

The key to realize here is different funds have different share classes.

Different classes may have different fees.

What else do you see?

Admiral shares come with a $20 fee for balances below $10K

This isn’t to say Admiral shares are bad, it’s more of making you the investor aware that this is a fee you wouldn’t be aware of just looking at the expense ratio.

This is why the prospectus is great because you get the full view of what you are paying.

This is why the prospectus is great because you get the full view of what you are paying.

Moving along we get into Annual Fund Operating Expenses.

Depending on the class, they have different requirements and perks. Example: Admiral shares in this case are 0.04% compared to 0.14% with Investor shares.

When comparing apples to apples, cheaper is definitely better.

Depending on the class, they have different requirements and perks. Example: Admiral shares in this case are 0.04% compared to 0.14% with Investor shares.

When comparing apples to apples, cheaper is definitely better.

Now to Returns.

Within the prospectus you’ll find the 1-5-10 year annual returns.

Look at the difference in performance between “Return Before Taxes” vs “Return After Taxes on Distributions”

This gives a scenario of the impact of holding in a tax deferred vs taxable account.

Within the prospectus you’ll find the 1-5-10 year annual returns.

Look at the difference in performance between “Return Before Taxes” vs “Return After Taxes on Distributions”

This gives a scenario of the impact of holding in a tax deferred vs taxable account.

What I want to point out here is evaluate your tax situation closely.

Don’t leave on the table.

on the table.

Remember, that the pre-tax difference is compounding in retirement accounts ( 401k,403b, IRA).

Don’t leave

on the table.

on the table.Remember, that the pre-tax difference is compounding in retirement accounts ( 401k,403b, IRA).

If you want to see how 401k fees can impact your retirement, go check out https://upshotwealth.com/blogs/blog/what-are-average-401k-fees

Read on Twitter

Read on Twitter