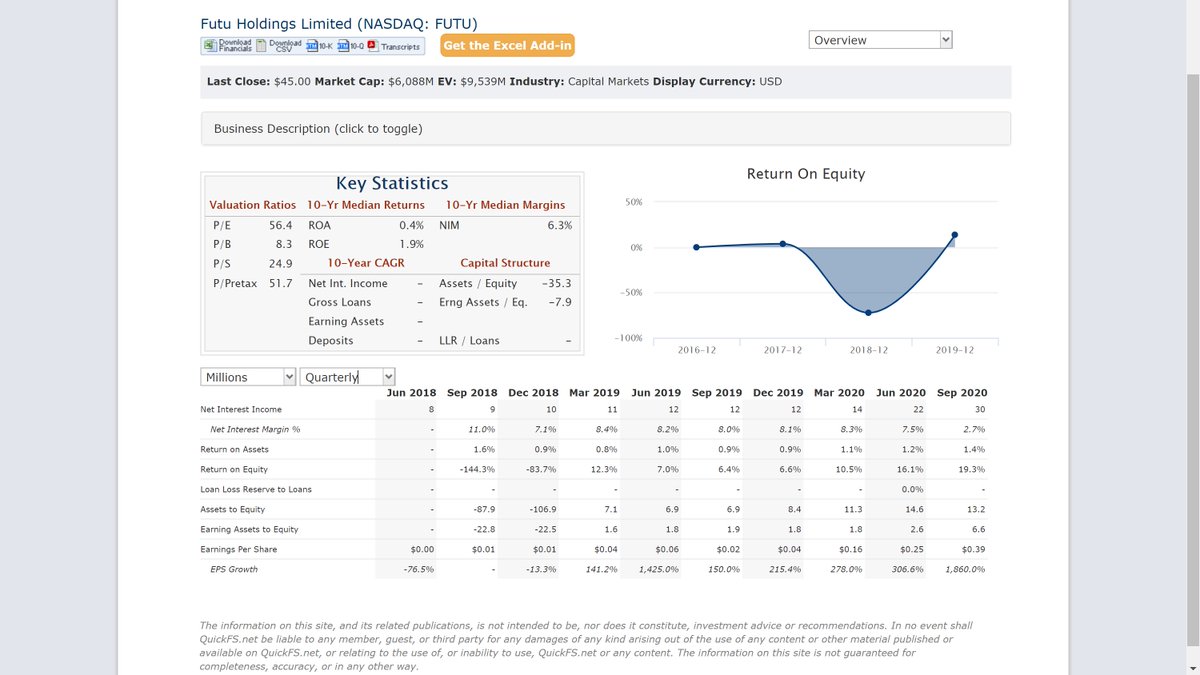

1. $FUTU ($43.78, +336% YTD), 52WL8.15, 52WH 51.1, MCap $6.17B is a China based Fintech company, helping young affluent Chinese invest in stocks

2. $FUTU: Since others have written about it briefly, I will like to that, but I wanted to focus more on the product, experience and why I like this company long term

Read: Basic overview: https://getbenchmark.substack.com/p/a-look-at-futu-celsius-and-uber-

Read: About founder: https://www.ft.com/content/2251f7bf-274b-4983-84ca-59f95bde557e

Read: Basic overview: https://getbenchmark.substack.com/p/a-look-at-futu-celsius-and-uber-

Read: About founder: https://www.ft.com/content/2251f7bf-274b-4983-84ca-59f95bde557e

3. $FUTU: Company is backed by $TCEHY and founded by Leaf Hua Li, who was an ex $TCEHY employee, who loved trading and was frustrated with traditional brokerages in China at that time. Think $SCHW vs. $Robinhood

4. $FUTU: Q3 Revenue (11/19/2020 reported) jumped 272% to USD$122M, earnings jumped to 39c from 2c a year ago.

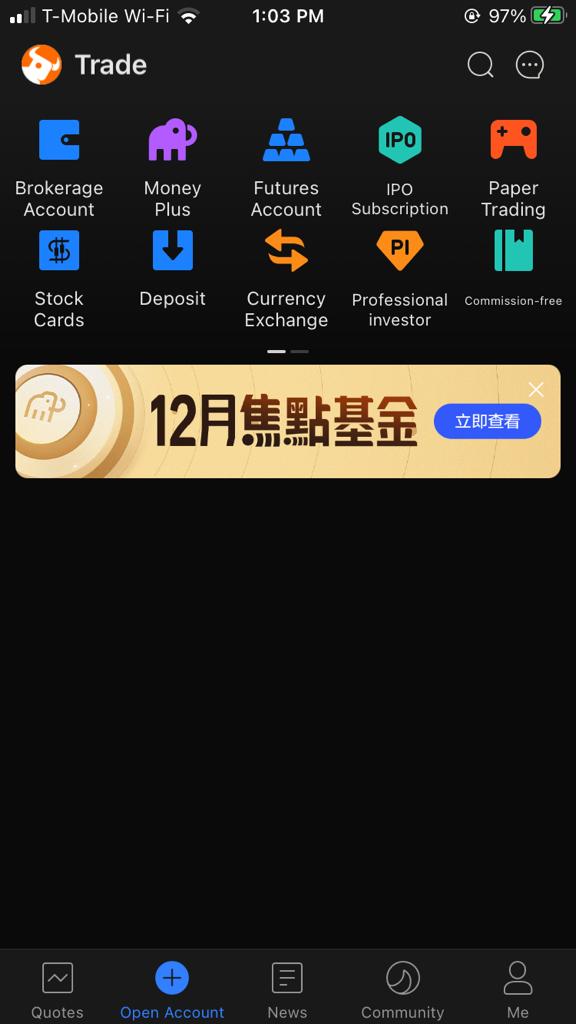

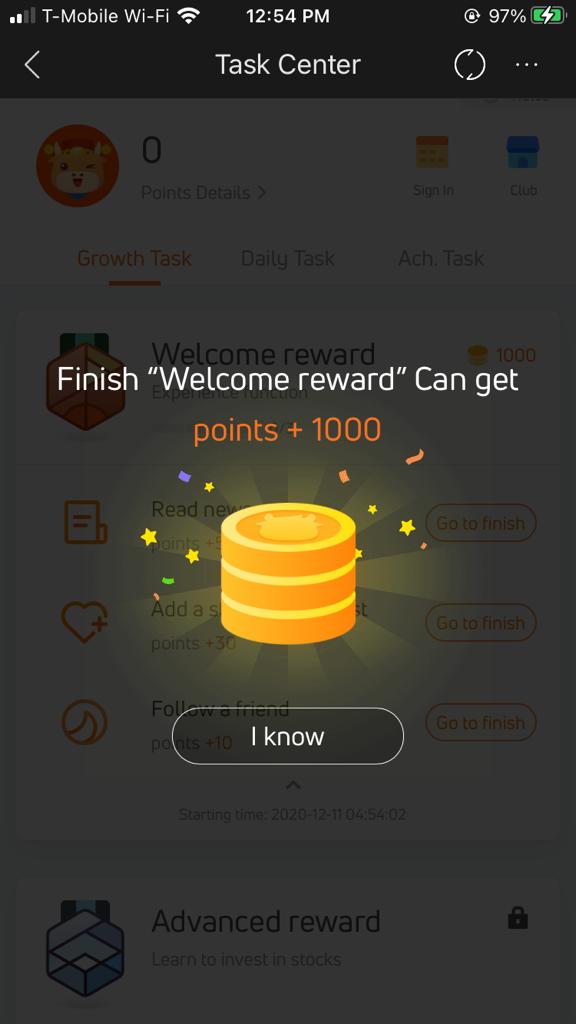

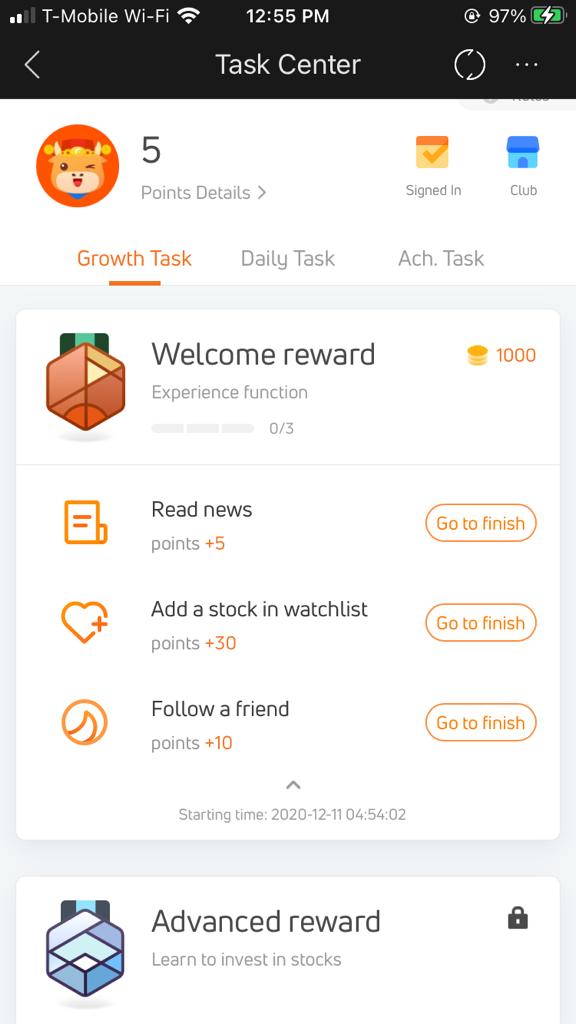

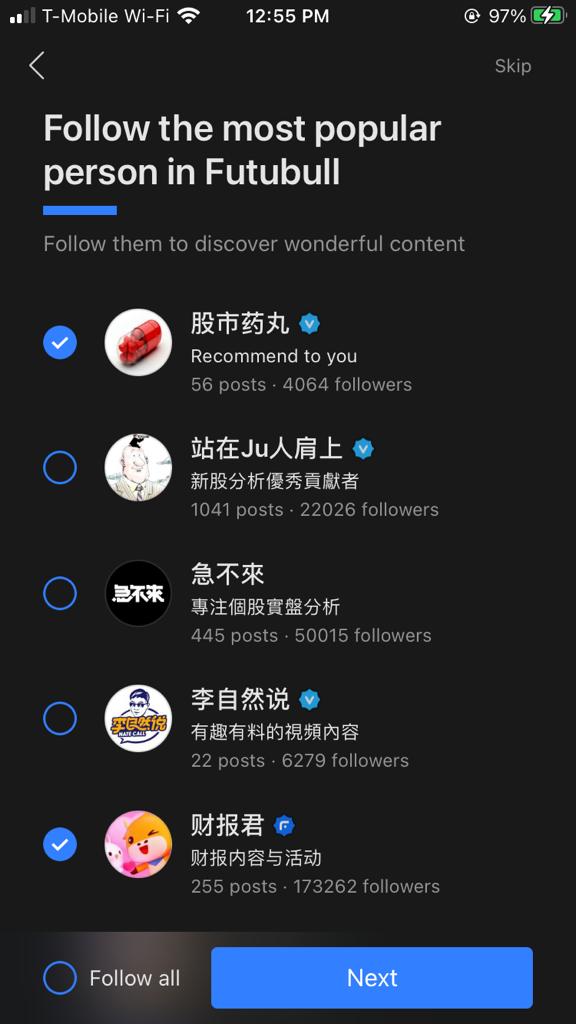

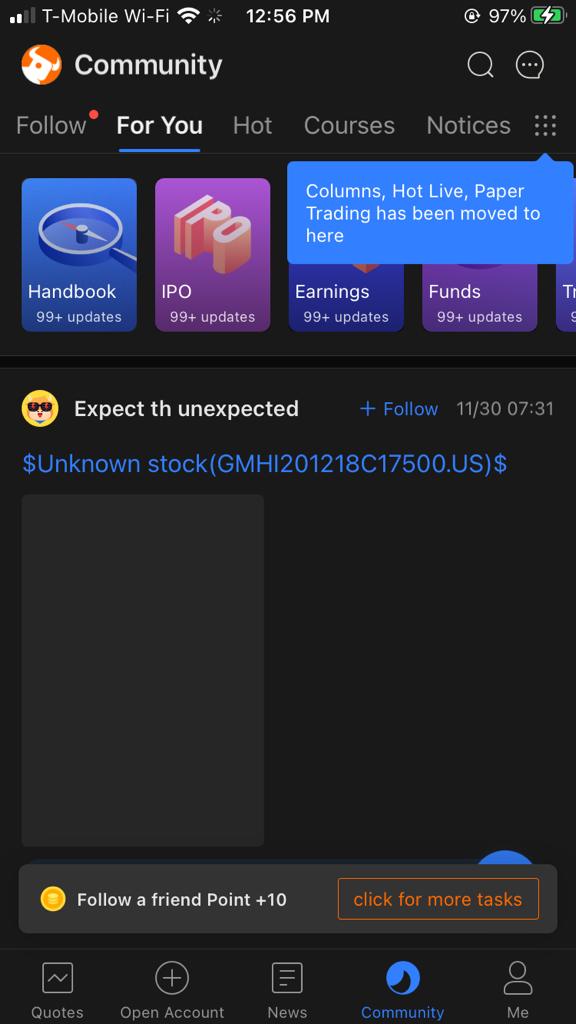

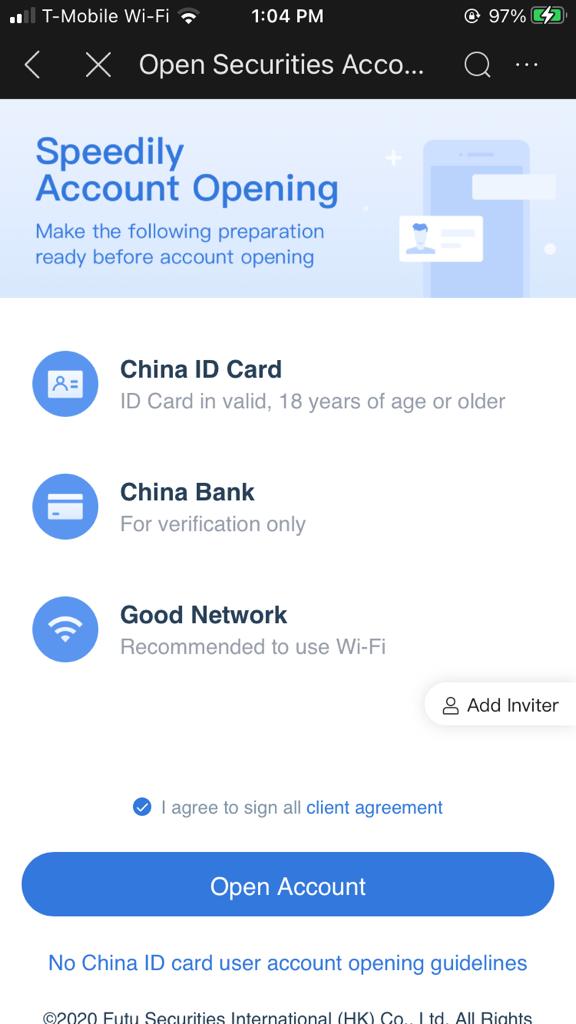

6. $FUTU: Company operates 2 trading apps - FutuBull and Moomoo. I have downloaded and setup a non-operating account (you need a China issued ID to open an operating account).

7. $FUTU: The company has 1.2 Million registered users (comparison Robinhood has 3+ Million last reported users as of 3/20).

8. $FUTU: Rather than offering mainland China stocks, Futu differentiates itself by offering investors stock trading in HKG market. This includes $BABA, Xiaomi, etc.

9. $FUTU: Providing broker services for A shares is really competitive and the licenses aren’t that easy to get. $FUTU has acquired the licenses to operate in Singapore and U.S. as well, and is currently testing its products before a wider launch.

11. $FUTU: Competitors in China include Ant Financial, $LU Lufax and $CAN Canan for stock (local) access

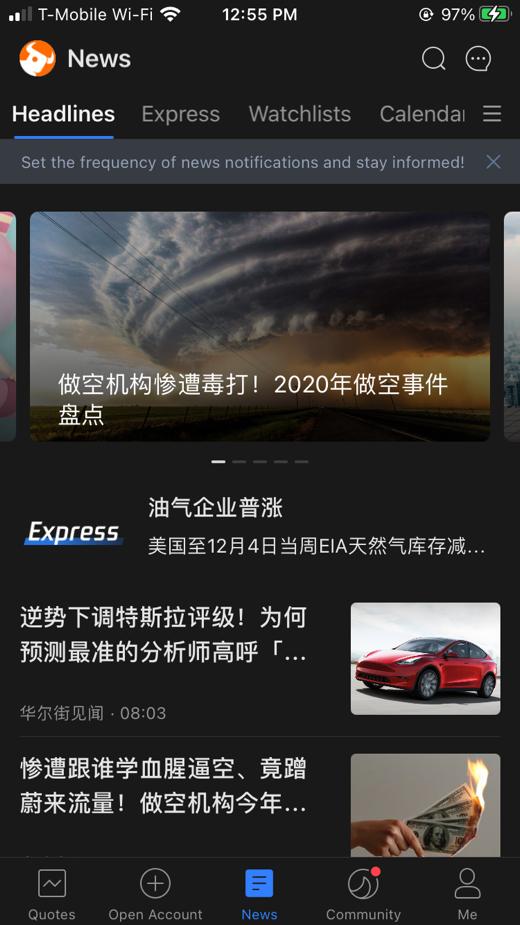

12. $FUTU: The company makes money by transaction fees and margin (unlike Robinhood which makes most if its money on PFOF (Payment for order flow).

13. $FUTU: The app itself is very social. Imagine you had Twitter + Robinhood + Facebook all combined in one. You can follow company, get comments, opinions, follow "top investors" mirror their portfolio and trade all in one place

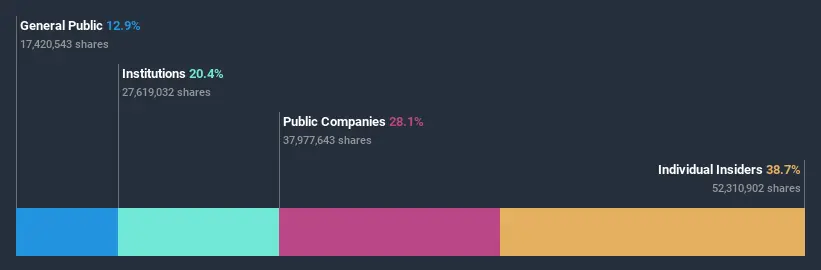

14. $FUTU: Market: Household wealth in China is expected to increase to $35 Trillion by 2025. Combined with a large, young, aggressively focused on wealth building population the company I think will do very well

15. $FUTU: Key metrics and numbers you should track to understand how the business is doing:

1. # of Users

2. Assets under Management (AUM)

3. Trading volume (indicator for revenue)

4. Margin and lending balance ($ and # clients)

5. # of top trading profiles (platform engagement)

1. # of Users

2. Assets under Management (AUM)

3. Trading volume (indicator for revenue)

4. Margin and lending balance ($ and # clients)

5. # of top trading profiles (platform engagement)

16. $FUTU: RISKS:

1. China risk (not going to extrapolate)

2. Trading revenues are correlated with market perf. So, revenues might be up and down since markets are doing well now

3. Competition from $CAN and local (Haitong, Huatai) can get international licenses and drop fees

1. China risk (not going to extrapolate)

2. Trading revenues are correlated with market perf. So, revenues might be up and down since markets are doing well now

3. Competition from $CAN and local (Haitong, Huatai) can get international licenses and drop fees

17. $FUTU: Overall:

Positives: The product (I wish we had this in the US), the user experience, the founder's story, $TCEHY is invested, growth numbers, market potential

Negatives: China concerns, Stock is UP 300+% already in 2020, and brokerage is VERY competitive biz

Positives: The product (I wish we had this in the US), the user experience, the founder's story, $TCEHY is invested, growth numbers, market potential

Negatives: China concerns, Stock is UP 300+% already in 2020, and brokerage is VERY competitive biz

18. $FUTU: I have bought and will continue to buy this stock, with an expectation that I will keep this for a year and expect to have support at $40 and a target of $72 by 2021 end (upside 67% from Dec 2020)

19. $FUTU: Errors / Omissions and mistakes (1): As of 2020 Robinhood has 13 Million users, As of 2018 the number was 3 Million (My mistake, I took the wrong number from Wikipedia)

https://en.wikipedia.org/wiki/Robinhood_(company)

https://en.wikipedia.org/wiki/Robinhood_(company)

20. $FUTU: Support for my $67 PT in 1 year assumes

a) growth rates at over 90% annual to rev at USD$245M (estimates are 100%),

b) stock market continues to trend upward in 2021 (HKG,US),

c) P/E at 55 (peers are lower at 35) and

d) China stock discount at 15%

a) growth rates at over 90% annual to rev at USD$245M (estimates are 100%),

b) stock market continues to trend upward in 2021 (HKG,US),

c) P/E at 55 (peers are lower at 35) and

d) China stock discount at 15%

Read on Twitter

Read on Twitter

followed by

followed by