Excellent article on Behavioral Finance.

h/t @CatanaCapital

A very useful topic to be aware of, especially when there's a lot of exuberance in the Markets (like now, in few sectors and IPOs/SPACs... ). https://catanacapital.com/blog/behavioral-finance-avoid-biases-successful-investment-decisions/

). https://catanacapital.com/blog/behavioral-finance-avoid-biases-successful-investment-decisions/

h/t @CatanaCapital

A very useful topic to be aware of, especially when there's a lot of exuberance in the Markets (like now, in few sectors and IPOs/SPACs...

). https://catanacapital.com/blog/behavioral-finance-avoid-biases-successful-investment-decisions/

). https://catanacapital.com/blog/behavioral-finance-avoid-biases-successful-investment-decisions/

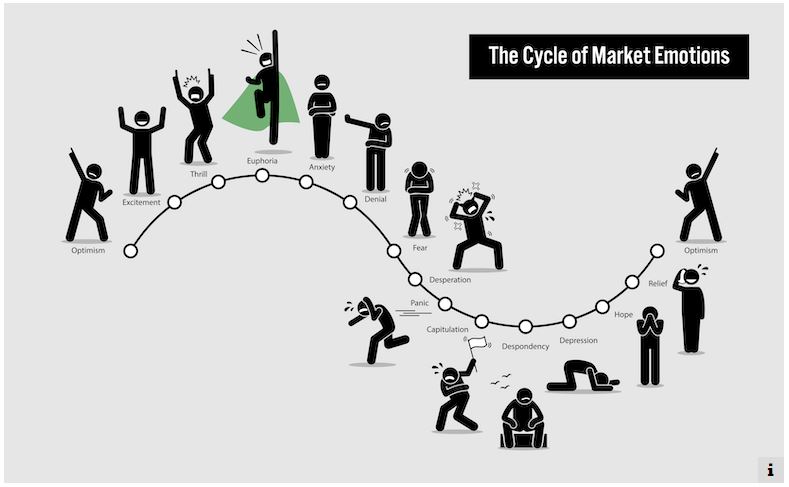

The best long-term results in the Markets are achieved, when you moderate your behavior (and have a good plan and stick to it), instead of your actions/moods entirely being influenced by the Market cycle, like this guy below.

Some more good pts.

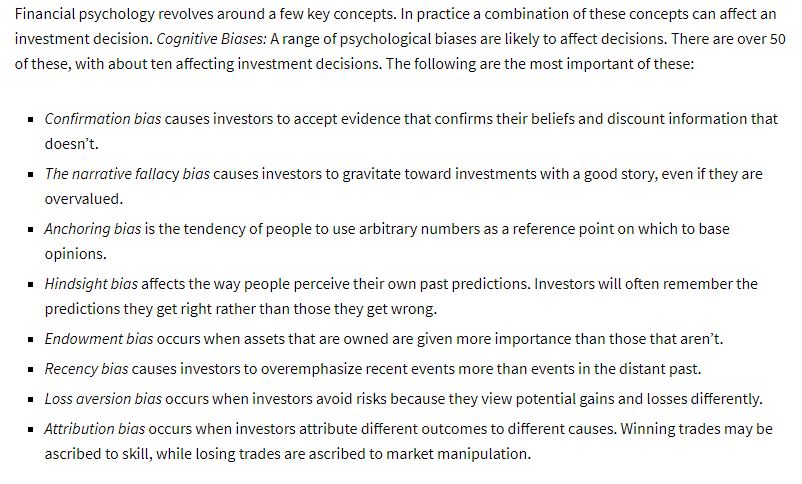

Behavioral finance is a field that considers the decision making of "normal" rather than "rational" people.

Behavioral finance is a field that considers the decision making of "normal" rather than "rational" people.

"Behavioral investing theory explores the fact that investors are not (always) rational. It also considers various motivations investors have for making decisions. To an extent, it explains certain anomalies between financial models and real-world outcomes."

"Firstly, understanding the different ways our decision-making process can be affected can help us avoid common traps in the stock market.

Secondly, an understanding of the financial behaviors of other market participants can help us identify opportunities."

Secondly, an understanding of the financial behaviors of other market participants can help us identify opportunities."

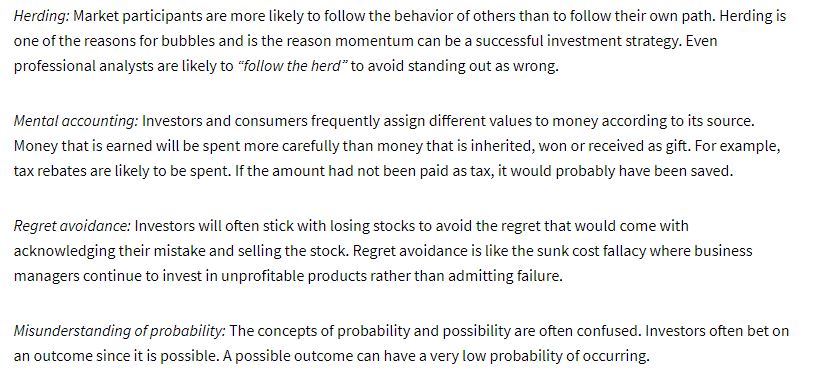

Currently there are lot of narrative fallacies (good stories leading to great stock gains) & herding (into the same sectors, asset classes) going on in the Markets.

If you know your strengths, understand what you're doing & why, what to do when the tide turns, good for you.

END

If you know your strengths, understand what you're doing & why, what to do when the tide turns, good for you.

END

Read on Twitter

Read on Twitter