Have had many ask how much money is enough for (presumably early) #financialindependence in India. Is it 25x, 30x, or 40x of current annual expenses?

My opinion.

//THREAD//

My opinion.

//THREAD//

1/ The first thing we come across when researching financial independence is the 4% rule – 25x your current annual expenses saved = FI. Many early retirement bloggers also preach this so let’s dig into this a little bit.

2/ This is the result of the 1998 US-based Trinity University study which found that using a 4% withdrawal rate on a 75:25 stock:bond portfolio over 30 years had a success rate of 98%.

Let’s understand the assumptions therein.

Let’s understand the assumptions therein.

3/ First, portfolio mix assumes constant rebalancing across 30 years to maintain the 75:25 ratio of stocks to bonds. How many of us can do this diligently year after year and maintain it thru all stages of a market cycle?

4/ Second, the 75% equity was in S&P 500. If our equity is in a different geography or index, obviously results will skew differently. Especially for India where the stock market is truly only about 30 years old, since India liberalized in 1992.

5/ Third, the study had a time horizon of 30 years. If we want “early retirement” in our 30s or 40s, we likely have more than 30 years left in our lives.

For the above three reasons we cannot use conclusions from the Trinity study blindly.

For the above three reasons we cannot use conclusions from the Trinity study blindly.

6/ Equally important is that inflation in India tends to be more volatile and higher than in a developed market like the US. Also, the stock market participation is much narrower. This presents additional systemic risk.

7/ Thus, concluding that 25x of current annual expenses = FI can be injurious to our financial health.

We should also consider

a) what our portfolio mix is

b) geographic diversification / concentration

c) remaining lifespan

We should also consider

a) what our portfolio mix is

b) geographic diversification / concentration

c) remaining lifespan

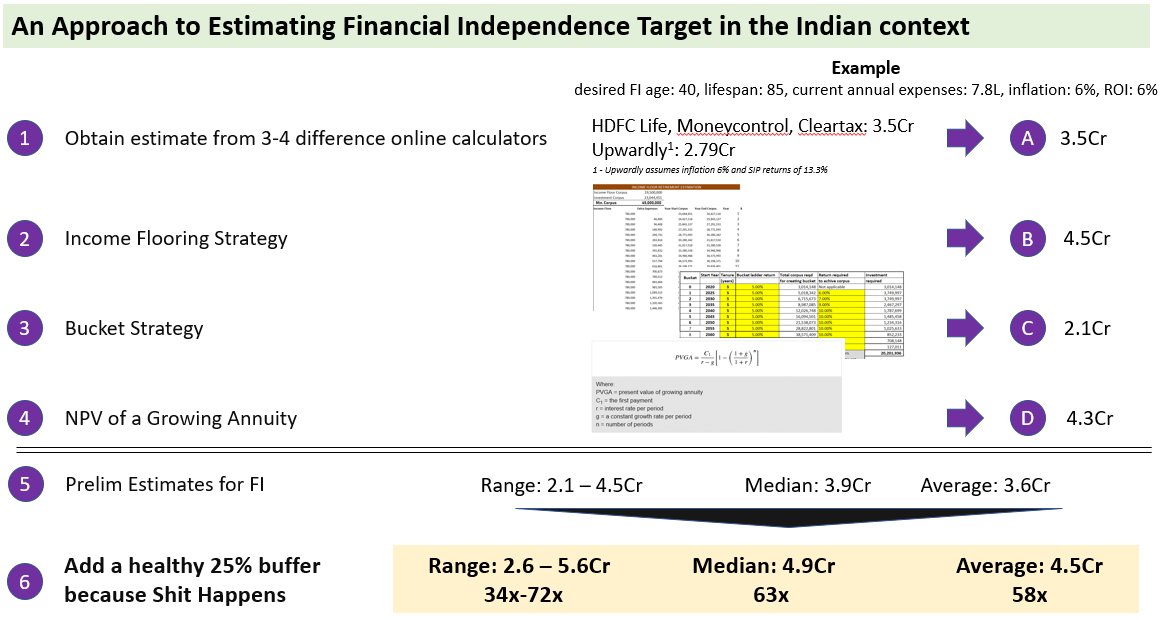

8/ So what’s the number for India? I believe point estimates are harder to estimate correctly than a range which contains the correct number. Hence, I advocate the following estimation method.

9/ First, let’s use 3-5 different online traditional retirement calculators provided by Indian insurance and MF companies.

Critically important: understand their assumptions on ROI and inflation, especially if we are not able to input those values!

Critically important: understand their assumptions on ROI and inflation, especially if we are not able to input those values!

10/ Second, we use the Income Flooring strategy expounded by @freefincal – to benefit from a different method.

Link to Income Flooring Strategy at end of thread. For now, read on.

Link to Income Flooring Strategy at end of thread. For now, read on.

11/ Third, use another method - the bucket strategy - to estimate our “reduced” retirement corpus.

@sriniveshIndia has an easy to use bucket strategy calculator available for download

@sriniveshIndia has an easy to use bucket strategy calculator available for download

12/ Fourth, observe that our expenses during retirement is a series of annually increasing (thanks to inflation) cash flows.

We need a starting principal which must grow enough to deliver those cash flows.

This is a classic NPV of a Growing Annuity problem

We need a starting principal which must grow enough to deliver those cash flows.

This is a classic NPV of a Growing Annuity problem

13/ Once we have the above 4 measures, we have a preliminary range of values for FI.

If keen to get a single number to target, use either median or average.

Or if super conservative, use the maximum.

If keen to get a single number to target, use either median or average.

Or if super conservative, use the maximum.

14/ During this exercise, the models spit out values based on our inputs and it’s important to keep them realistic otherwise it will be GIGO (Garbage In, Garbage Out).

Be realistic about expenses. There’s a certain threshold below which quality of life will suffer.

Be realistic about expenses. There’s a certain threshold below which quality of life will suffer.

15/ And let’s not underestimate inflation or overestimate returns.

I prefer to use returns = inflation i.e., real returns of zero.

A half-decent portfolio will generally do better than that in the long term, so this is admittedly on the conservative side.

I prefer to use returns = inflation i.e., real returns of zero.

A half-decent portfolio will generally do better than that in the long term, so this is admittedly on the conservative side.

16/ I have not taken the impact of taxes into account because there are many nuances in terms of where we hold our assets, age, ever changing tax rules etc.

Death and taxes are guaranteed. Returns are not.

Death and taxes are guaranteed. Returns are not.

17/ It’s easy to say “I will be frugal” but sometimes life doesn’t let us be frugal.

The older we and our dependents grow, higher is the likelihood of large one-time or recurring health expenses that can quickly burn a hole in our stash.

stash.

Life happens, shit happens.

The older we and our dependents grow, higher is the likelihood of large one-time or recurring health expenses that can quickly burn a hole in our

stash.

stash. Life happens, shit happens.

18/ If someone says this looks hard to achieve, I agree. But it is better to have a little more money than we need vs. less.

What’s the point of thinking ourselves FI only to have the first unforeseen circumstance reduce us to a level where we are forced to work again?...

What’s the point of thinking ourselves FI only to have the first unforeseen circumstance reduce us to a level where we are forced to work again?...

19/ …which by the way, may not be easy. If we have had a gap from the workforce, our ability to command pay reduces, sometimes dramatically depending on length of break. Not to mention that skills get outdated soon + there is rampant ageism virtually everywhere.

20/ FI is as much about peace of mind as it is a target number; we should get a good night's sleep at the end.

Each of our circumstances is different - our FI journeys & destinations are personal choices. Becoming FI is not a race, social status, or comparison game.

Each of our circumstances is different - our FI journeys & destinations are personal choices. Becoming FI is not a race, social status, or comparison game.

21/ TL;DR – My opinion is that 25x is very likely too little and over optimistic for #financialindependence in India, especially if we look at the desired early retirement age of 40.

50-55x at 40 is a more reasonable, albeit conservative, target in the Indian context.

50-55x at 40 is a more reasonable, albeit conservative, target in the Indian context.

22/ More details on the Trinity Study by @thepoorswiss is at https://thepoorswiss.com/trinity-study/

23/ The Income Flooring strategy by @freefincal is explained more here: https://freefincal.com/ideal-retirement-plan-income-flooring/

Good morning @dmuthuk sir, I've seen you also get asked this question often: how much money is enough for financial independence?

Would like to hear your opinion on my thread above and if you think it useful, please do consider sharing with your readers. Thanks.

and if you think it useful, please do consider sharing with your readers. Thanks.

Would like to hear your opinion on my thread above

and if you think it useful, please do consider sharing with your readers. Thanks.

and if you think it useful, please do consider sharing with your readers. Thanks.

Hi @FI_InvestIndia I've seen you also get asked this question often: how much money is enough for financial independence?

Would like to hear your opinion on my thread above

and if you think it useful, please do consider sharing with your readers. Thanks.

Would like to hear your opinion on my thread above

and if you think it useful, please do consider sharing with your readers. Thanks.

Read on Twitter

Read on Twitter