The Effect of Compounding!

Compounding is the ability of an

asset to generate earnings, which

are then reinvested or remain

invested with the goal of

generating their own earnings.

In other words, compounding

refers to generating earnings from

previous earnings.

Compounding is the ability of an

asset to generate earnings, which

are then reinvested or remain

invested with the goal of

generating their own earnings.

In other words, compounding

refers to generating earnings from

previous earnings.

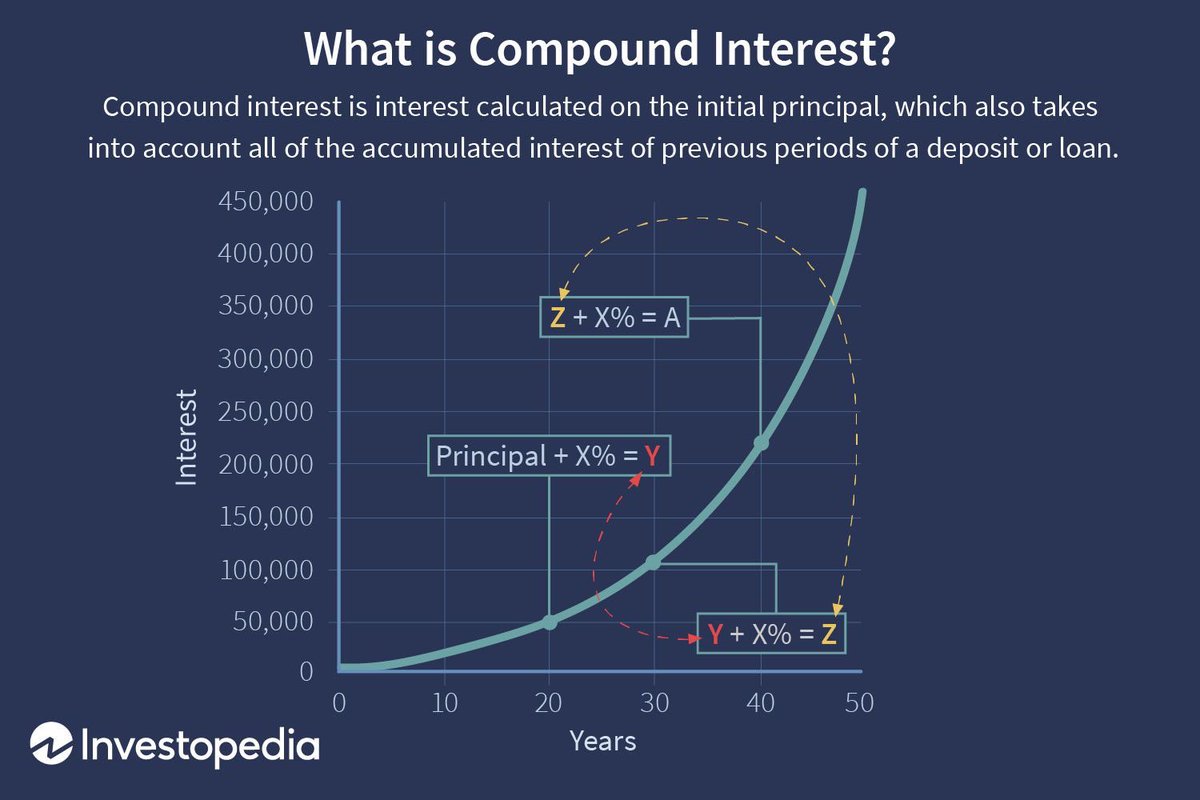

Let’s say you invest $10,000 in $AAPL.

The first year, the shares rise 10%.

Your investment is now worth $11,000.

In the second year, the shares appreciate another 10%.

Your $11,000 grows to $12,100.

The first year, the shares rise 10%.

Your investment is now worth $11,000.

In the second year, the shares appreciate another 10%.

Your $11,000 grows to $12,100.

Rather than your shares

appreciating an additional $1,000

(10%) like they did in the first year,

they appreciate an additional

$1,100, because the $1,000 you

gained in the first year grew by

10% too.

appreciating an additional $1,000

(10%) like they did in the first year,

they appreciate an additional

$1,100, because the $1,000 you

gained in the first year grew by

10% too.

If $10K returns 10% annually

for 25 years would grow to nearly

$110,000 without investing additional money.

Interest is often compounded

monthly, quarterly, semiannually or annually.

With compounding,

any interest earned immediately

begins earning interest on itself.

for 25 years would grow to nearly

$110,000 without investing additional money.

Interest is often compounded

monthly, quarterly, semiannually or annually.

With compounding,

any interest earned immediately

begins earning interest on itself.

For it to work it requires three things:

1-The original investment remain invested,

2-The reinvestment of earnings

3-Time.

The more time you give your

investments, the more you may be

able to accelerate the income

potential of your original

investment.

1-The original investment remain invested,

2-The reinvestment of earnings

3-Time.

The more time you give your

investments, the more you may be

able to accelerate the income

potential of your original

investment.

Read on Twitter

Read on Twitter