1/ Another day...another big IPO! I'd argue two common themes are playing out (note: I'm making a huge generalization):

a) Companies are leaving money on the table

b) The markets are frothy

I'll add another narrative, which I'll refer to as "the gravitational pull of capital"

a) Companies are leaving money on the table

b) The markets are frothy

I'll add another narrative, which I'll refer to as "the gravitational pull of capital"

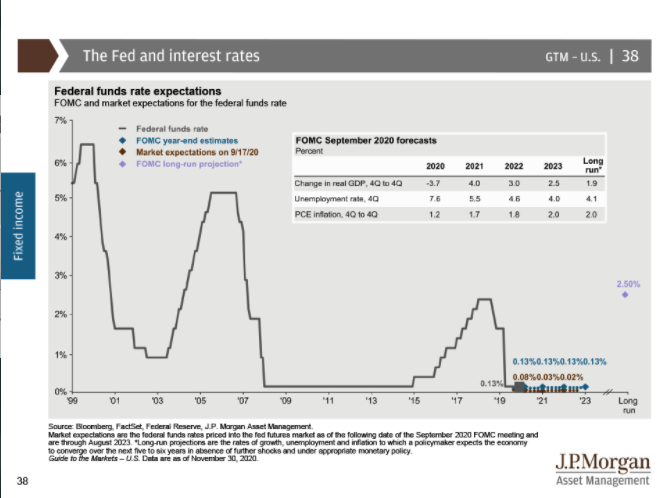

This gravitational pull is caused by a few different factors, mainly: interest rates, money supply, and capital pools. I'll explain more...

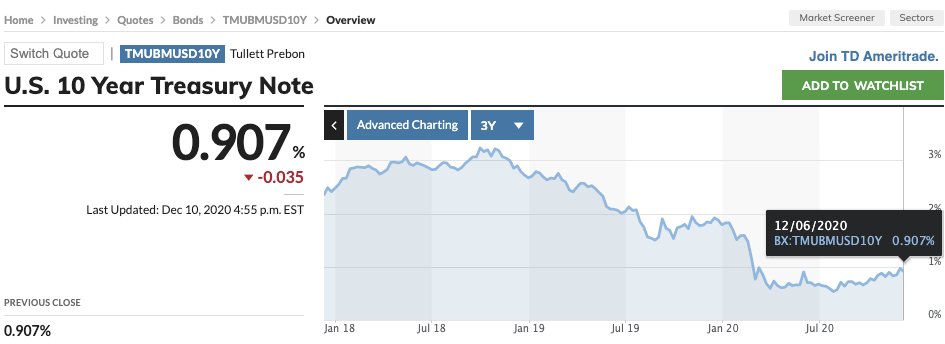

If you look at the 10-year Treasury Note, yields continue to plummet. This should be no huge surprise as the Fed announced last month that it will continue to "increase its holdings of Treasury securities."

The Fed continues to buy and yields fall.

https://www.federalreserve.gov/monetarypolicy/files/monetary20201105a1.pdf

The Fed continues to buy and yields fall.

https://www.federalreserve.gov/monetarypolicy/files/monetary20201105a1.pdf

With all of those asset purchases—or in Fed vernacular "open market operations"—we've seen money supply take off. This one from @arampell is all you need to see as evidence.

As open market operations took off to combat the pandemic, so did money supply https://twitter.com/arampell/status/1336718888763936768?s=20

As open market operations took off to combat the pandemic, so did money supply https://twitter.com/arampell/status/1336718888763936768?s=20

This leads us to capital pools. All of this money needs to be parked somewhere. Enter the "gravitational pull of capital."

In general, capital can gravitate to three places: savings (bank accounts), bonds, or equities. But what happens in an ultra-low interest rate environment?

In general, capital can gravitate to three places: savings (bank accounts), bonds, or equities. But what happens in an ultra-low interest rate environment?

For the non-savers, you can typically pick between bonds and equities.

Rational investors will want to earn the highest yield possible (in most cases, maximizing risk-adjusted returns, or Sharpe Ratio's) in the process.

With bonds, getting that additional yield is tough...

Rational investors will want to earn the highest yield possible (in most cases, maximizing risk-adjusted returns, or Sharpe Ratio's) in the process.

With bonds, getting that additional yield is tough...

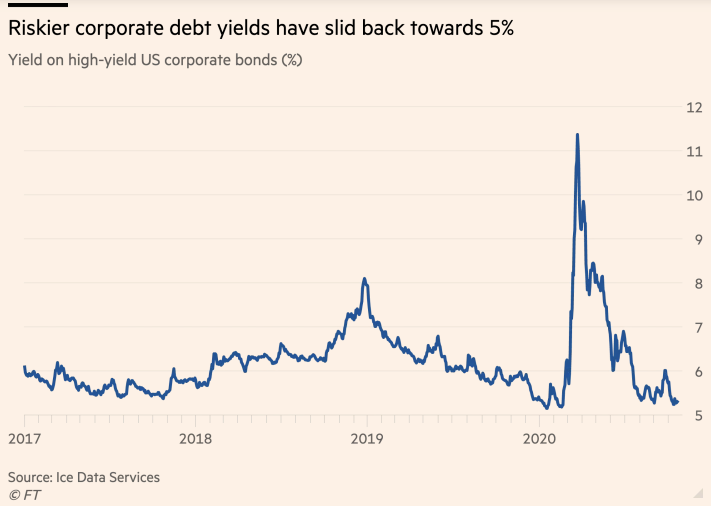

According to the FT, "Roughly 86 per cent of the $60tn global bond market tracked by ICE Data Services traded with yields no higher than 2 percent" https://www.ft.com/content/b44281c0-2ddb-46ae-83e2-150461faed65

...and this is a reason why investors are scouring the market to maximize yield, even if that means buying "junk."

https://www.ft.com/content/5886cb87-721d-4c41-898a-a634500108ea

https://www.ft.com/content/5886cb87-721d-4c41-898a-a634500108ea

This gravitational pull is real for many institutional investors who are managing pensions and need extra yield for retirees.

In a recent OECD report, aging populations, low growth, and low returns were already weighing heavily on pensions. http://www.oecd.org/pensions/oecd-pensions-outlook-23137649.htm

In a recent OECD report, aging populations, low growth, and low returns were already weighing heavily on pensions. http://www.oecd.org/pensions/oecd-pensions-outlook-23137649.htm

This can explain why some of these investors are fleeing traditional capital pools and entering new ones, like private equity. https://www.institutionalinvestor.com/article/b1nf5v5h2h97jd/Ultra-Low-Interest-Rates-Are-Driving-Insurers-Into-the-Arms-of-Private-Equity

This also applies to endowments, which also need additional yield for universities. Based on a recent NACUBO study, 22.6% of endowment assets went to PE & VC (up from 4.4% in 2008 and above the trailing ten year median of 16%)

https://www.nacubo.org/Research/2020/Public-NTSE-Tables

https://www.nacubo.org/Research/2020/Public-NTSE-Tables

For a huge swath of the population, investing in private equity isn't feasible, so we turn to public equities.

In turn, capital gravitates towards stocks, pushing up asset prices along the way, and leading to the inevitable question -are we in a bubble?

https://ycharts.com/indices/%5ESPX

In turn, capital gravitates towards stocks, pushing up asset prices along the way, and leading to the inevitable question -are we in a bubble?

https://ycharts.com/indices/%5ESPX

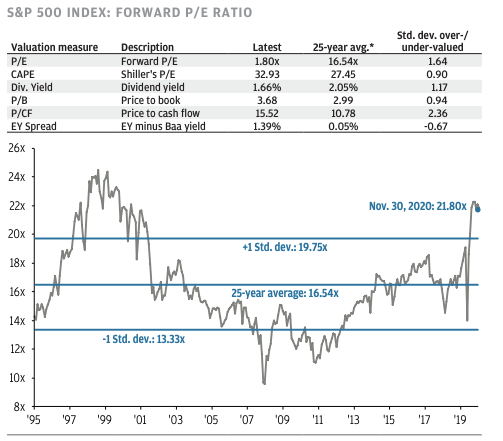

Looking at price-to-earnings multiples, one would assume that we're potentially in "frothy" territory.

JPMAM's Investment Outlook for 2021 illustrates how multiples (I like the CAPE ratio) are at their highest since the dot-com bubble.

https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/insights/market-insights/investment-outlook-2021-us.pdf

JPMAM's Investment Outlook for 2021 illustrates how multiples (I like the CAPE ratio) are at their highest since the dot-com bubble.

https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/insights/market-insights/investment-outlook-2021-us.pdf

While this may be correct, there are narratives that suggest this isn't tulip-mania.

A recent article from @RobertJShiller articulates the "relative attractiveness of equities, particularly given a potentially protracted period of low-interest rates" https://www.project-syndicate.org/commentary/making-sense-of-soaring-stock-prices-by-robert-j-shiller-et-al-2020-11

A recent article from @RobertJShiller articulates the "relative attractiveness of equities, particularly given a potentially protracted period of low-interest rates" https://www.project-syndicate.org/commentary/making-sense-of-soaring-stock-prices-by-robert-j-shiller-et-al-2020-11

As a result, that gravitational pull of capital continues to prop up equity values and the stock market continues to thrive.

For investors wanting additional yield, that even means buying newly minted IPOs at a BIG premium.

For investors wanting additional yield, that even means buying newly minted IPOs at a BIG premium.

So are companies leaving money on the table?

Maybe, but in a world where interest rates are low, money supply is high, and capital pools are gravitating towards extra yield, it seems like "frothy markets" may just be the new normal and are here to stay.

Maybe, but in a world where interest rates are low, money supply is high, and capital pools are gravitating towards extra yield, it seems like "frothy markets" may just be the new normal and are here to stay.

And there's plenty of capital out there... https://www.economist.com/business/2020/12/09/companies-have-raised-more-capital-in-2020-than-ever-before

f/ Disclaimer: I'm not an economist nor am I a capital markets expert. I'm just weaving together multiple themes in order to create a narrative that seems to make sense to me

Read on Twitter

Read on Twitter