[Thread] Adyen - $ADYEN $ADYEY $ADYYF

Time for a stock review from my home turf on payment giant Adyen!

I will try to highlight the main points and my findings to the best of my abilities.

TLDR: Adyen checks many boxes, but valuation remains debatable

Time for a stock review from my home turf on payment giant Adyen!

I will try to highlight the main points and my findings to the best of my abilities.

TLDR: Adyen checks many boxes, but valuation remains debatable

1/ Business Model

Adyen operates as a global payment platform. This includes technical, contractual, reconciliation and settlement processes and operations from customer interface to backend technology.

Adyen operates as a global payment platform. This includes technical, contractual, reconciliation and settlement processes and operations from customer interface to backend technology.

2/ Adyen's platform is provided as a service (PaaS) and unifies POS, e-commerce, fraud prevention and customer data for merchants.

Benefits:

-Higher authorization rates

-Lower processing costs

-Faster settlements

-Better shopping experiences

Main target: large enterprises.

Benefits:

-Higher authorization rates

-Lower processing costs

-Faster settlements

-Better shopping experiences

Main target: large enterprises.

3/ Adyen’s platform is also strongly focused on data analytics to maximize revenues while minimizing risks. The platform uses machine learning to optimize payments, provide unique shopper insights and prevent fraud.

1 out of 5 payments is often declined!

1 out of 5 payments is often declined!

4/ Through its platform, Adyen earns money in the following ways:

-Settlement Fees (89%): transaction size based fees

-Processing Fees (7%): fixed fee per transaction

-Sales of Goods (0.5%): POS terminals

-Other Services (3.5%): FX, terminal service and other fees

-Settlement Fees (89%): transaction size based fees

-Processing Fees (7%): fixed fee per transaction

-Sales of Goods (0.5%): POS terminals

-Other Services (3.5%): FX, terminal service and other fees

5/ Adyen’s Approach

Adyen builds everything themselves on a single platform, allowing full control. Over 40% of employees are software engineers, enabling continuous innovation and new functionalities that are added to the platform.

Adyen builds everything themselves on a single platform, allowing full control. Over 40% of employees are software engineers, enabling continuous innovation and new functionalities that are added to the platform.

6/ Therefore, Adyen does not believe in M&A.

Following the words of Adyen’s CEO:

“We don’t believe in all those mergers, that is if you believe that it (payments) is a commodity, we believe it’s about functionality”.

Following the words of Adyen’s CEO:

“We don’t believe in all those mergers, that is if you believe that it (payments) is a commodity, we believe it’s about functionality”.

7/ Customer Focus

Four customer segments were presented at the last CMD:

- Enterprise Digital & Online: $UBER, $SPOT, $MSFT, $FB

- Enterprise Retail, F&B and Hospitality: $MCD & Subway

- Enterprise Platforms and Marketplaces: $EBAY, $ETSY, $WIX, $FVRR, $FTCH

- Mid-Market

Four customer segments were presented at the last CMD:

- Enterprise Digital & Online: $UBER, $SPOT, $MSFT, $FB

- Enterprise Retail, F&B and Hospitality: $MCD & Subway

- Enterprise Platforms and Marketplaces: $EBAY, $ETSY, $WIX, $FVRR, $FTCH

- Mid-Market

8/

- Low volume churn (<1%)

- Top 10 customers 33% of revenues

- No customer more than 10% of revenues

“We rely heavily on Adyen RevenueProtect to solve fraud for us… With Adyen’s risk management solution, we decreased chargebacks by 70%” - $SPOT

- Low volume churn (<1%)

- Top 10 customers 33% of revenues

- No customer more than 10% of revenues

“We rely heavily on Adyen RevenueProtect to solve fraud for us… With Adyen’s risk management solution, we decreased chargebacks by 70%” - $SPOT

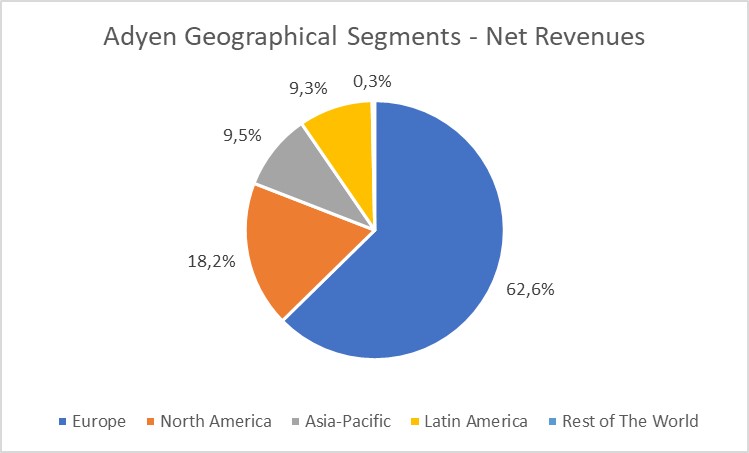

9/ Geographics

Adyen derives most of its revenues (H1 2020) from Europe, but experienced the highest growth rates for H1 2020 in North America (58.3%) & Asia-Pacific (27.7%), followed by Europe (21.3%) & Latin America (15.5%).

Adyen derives most of its revenues (H1 2020) from Europe, but experienced the highest growth rates for H1 2020 in North America (58.3%) & Asia-Pacific (27.7%), followed by Europe (21.3%) & Latin America (15.5%).

10/ Net revenue growth has decelerated over the years as Adyen reaches a larger scale.

For H1 2020, growth has obviously slowed due to the pandemic, as Adyen has considerable exposure to heavily hit industries such as Airlines, Hospitality and Retail.

For H1 2020, growth has obviously slowed due to the pandemic, as Adyen has considerable exposure to heavily hit industries such as Airlines, Hospitality and Retail.

11/ Take Rate

Looking at the whole transaction, the picture below provides a simplistic overview of how the fees are divided between all parties involved.

Adyen's cut is what is referred to as the “take rate” and averaged 21.7 bps for H1 2020 (up from 21.2 bps in H1 2019).

Looking at the whole transaction, the picture below provides a simplistic overview of how the fees are divided between all parties involved.

Adyen's cut is what is referred to as the “take rate” and averaged 21.7 bps for H1 2020 (up from 21.2 bps in H1 2019).

12/ Tailwinds

I would argue that Adyen experiences three main tailwinds:

- Globalization: need for a platform that works on a global scale

- Digitalization: need for unified and omni-channel commerce

- Evolvement of payment schemes: rise of payment alternatives

I would argue that Adyen experiences three main tailwinds:

- Globalization: need for a platform that works on a global scale

- Digitalization: need for unified and omni-channel commerce

- Evolvement of payment schemes: rise of payment alternatives

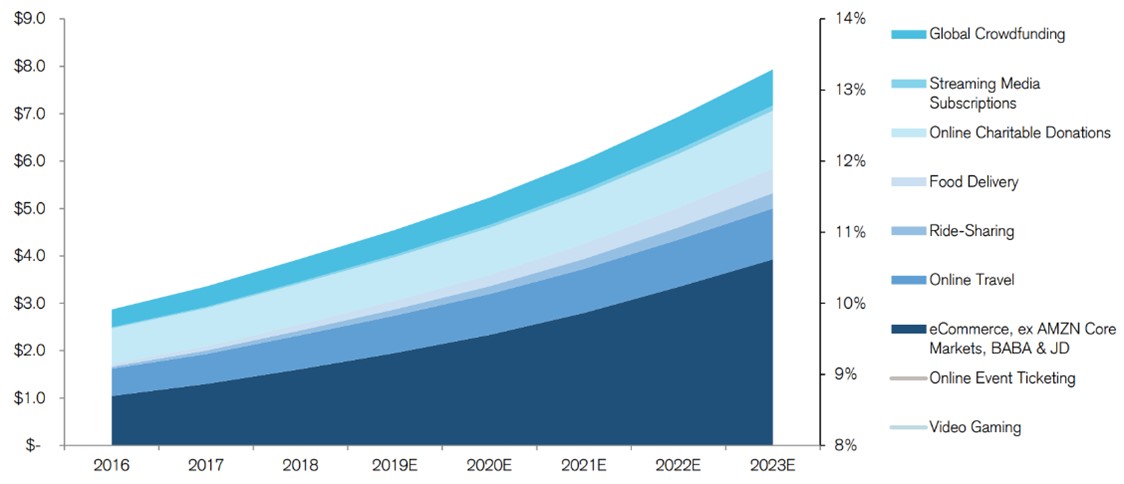

13/ Industry

The global payment industry is huge and fragmented.

- Adyen has mentioned $21T TAM before

- PayPal's true TAM estimated between $4T-$8T

Either way low penetration (2020E: €300B Volumes)

“I don’t see a reason why we shouldn’t be able to grow there (€1T)” - CEO

The global payment industry is huge and fragmented.

- Adyen has mentioned $21T TAM before

- PayPal's true TAM estimated between $4T-$8T

Either way low penetration (2020E: €300B Volumes)

“I don’t see a reason why we shouldn’t be able to grow there (€1T)” - CEO

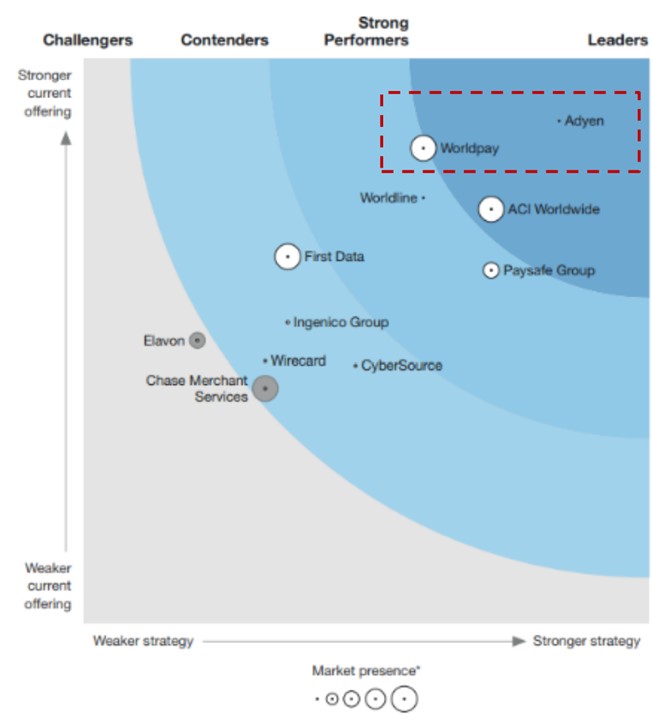

14/ Competitors

Adyen’s main competitors are:

-PayPal

-Stripe

-World Pay ($FIS)

-Traditional Banks

$SQ could become a future competitor, as both companies start to target the mid-market segment. However, their respective core segments (Enterprise vs. SMB) do not overlap.

Adyen’s main competitors are:

-PayPal

-Stripe

-World Pay ($FIS)

-Traditional Banks

$SQ could become a future competitor, as both companies start to target the mid-market segment. However, their respective core segments (Enterprise vs. SMB) do not overlap.

15/ Competitive Advantage

- Strong organic growth & low churn (<1%)

- EU banking license (US in progress)

- eBay contract won in favour of PayPal

- Mentioned as a leader by Forrester's (Q4 2018: Does not include PayPal's Braintree or Stripe!)

- Strong organic growth & low churn (<1%)

- EU banking license (US in progress)

- eBay contract won in favour of PayPal

- Mentioned as a leader by Forrester's (Q4 2018: Does not include PayPal's Braintree or Stripe!)

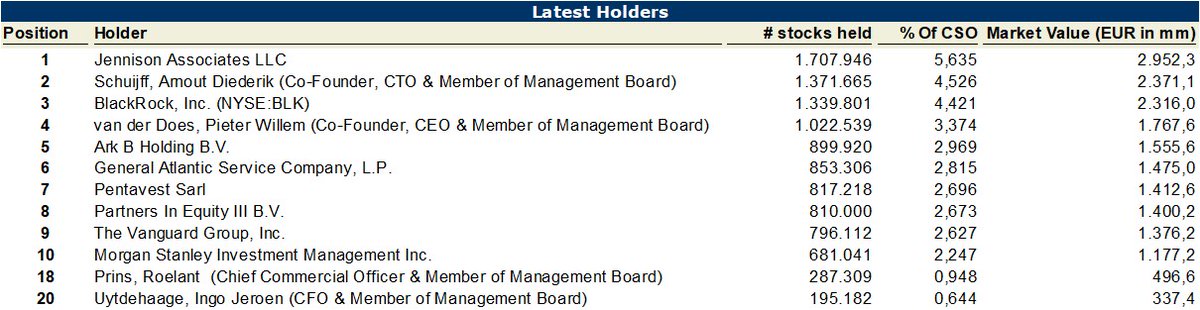

16/ Management

CEO & co-founder: Pieter van der Does

Soon ex-CTO & co-founder: Arnout Schuijff.

CFO: Ingo Uytdehaage, since 2011

Management appears to be extremely competent, ambitious and has skin in the game (see ownership list).

CEO & co-founder: Pieter van der Does

Soon ex-CTO & co-founder: Arnout Schuijff.

CFO: Ingo Uytdehaage, since 2011

Management appears to be extremely competent, ambitious and has skin in the game (see ownership list).

17/ Company Culture

Adyen focuses on a strong company culture consisting of eight principles, called the Adyen Formula.

Looking at Glassdoor ratings, Adyen scores quite high with 4.4/5 stars and 95% (!) CEO approval, with many reviews praising the company’s culture.

Adyen focuses on a strong company culture consisting of eight principles, called the Adyen Formula.

Looking at Glassdoor ratings, Adyen scores quite high with 4.4/5 stars and 95% (!) CEO approval, with many reviews praising the company’s culture.

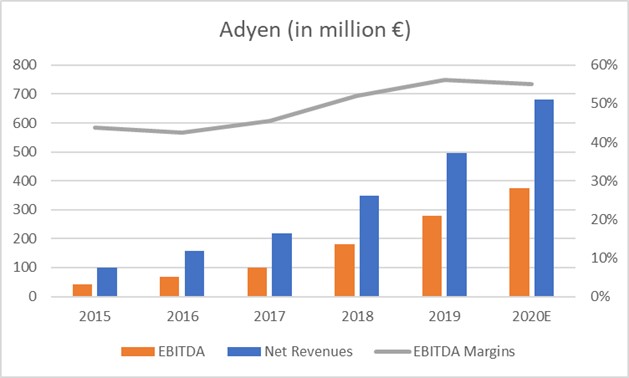

18/ Financials

Adyen has consistently derived 80%+(!) of its growth from merchants within the platform.

Some key metrics:

- Net Revenue CAGR (2015-2019): 50%

- EBITDA CAGR (2015-2019): 60%

- EBITDA Margin: 56%

- Free cash flow conversion rate: >90%

- ROIC: >20% from 2015-2019

Adyen has consistently derived 80%+(!) of its growth from merchants within the platform.

Some key metrics:

- Net Revenue CAGR (2015-2019): 50%

- EBITDA CAGR (2015-2019): 60%

- EBITDA Margin: 56%

- Free cash flow conversion rate: >90%

- ROIC: >20% from 2015-2019

19/

- Adyen is already extremely profitable.

- Still has room for margin expansion

- Robust balance sheet with negative net debt of €2B.

Goals:

- Net Revenue CAGR between mid-twenties & low-thirties

- Improving EBITDA margins (>55%)

- Maintain CapEx up to 5% of Net Revenues

- Adyen is already extremely profitable.

- Still has room for margin expansion

- Robust balance sheet with negative net debt of €2B.

Goals:

- Net Revenue CAGR between mid-twenties & low-thirties

- Improving EBITDA margins (>55%)

- Maintain CapEx up to 5% of Net Revenues

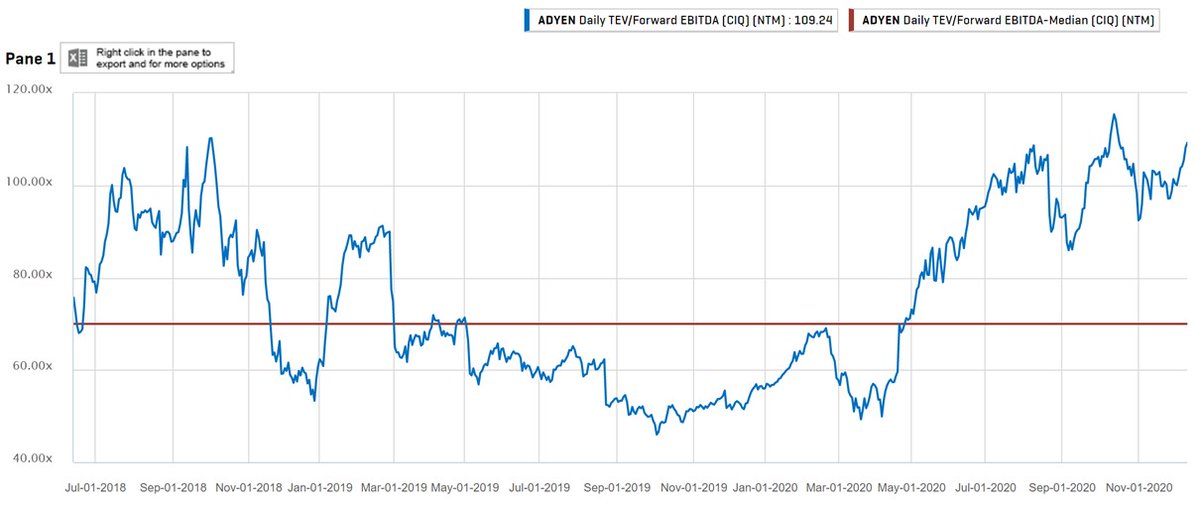

20/ Valuation

2020E multiples:

EV/NR: 75

EV/EBITDA: 135

P/E: 210

Adyen trades at a premium compared to both historic multiples and peers. Premium to peers can be explained by higher growth rates and margins but seems excessive.

2020E multiples:

EV/NR: 75

EV/EBITDA: 135

P/E: 210

Adyen trades at a premium compared to both historic multiples and peers. Premium to peers can be explained by higher growth rates and margins but seems excessive.

21/ Forecast

Using several assumptions, I see Adyen currently as fully valued. Using a 25x EV/EBITDA exit multiple and 10% DR, I conclude there is no significant upside to today’s price. My bear-case (25% NR CAGR) shows a 35% downside.

Note: highly subjective & sensitive

Using several assumptions, I see Adyen currently as fully valued. Using a 25x EV/EBITDA exit multiple and 10% DR, I conclude there is no significant upside to today’s price. My bear-case (25% NR CAGR) shows a 35% downside.

Note: highly subjective & sensitive

22/ Risks

- Increased competition

- Not keeping up with innovations (e.g. Stripe Treasury)

- Management Execution (Schuijff leaving and increased insider selling)

- Stronger than expected growth deceleration

- Loss of large customers (e.g. $EBAY)

- Increased competition

- Not keeping up with innovations (e.g. Stripe Treasury)

- Management Execution (Schuijff leaving and increased insider selling)

- Stronger than expected growth deceleration

- Loss of large customers (e.g. $EBAY)

23/ Checklist

- Secular tailwinds

- Large & growing TAM

- Visionary/founder-led management

- Sustainable competitive advantage/Moat -ish

-ish

- Customer/Industry diversification

- High top line growth

- Strong margin/profit potential

- Reasonable Valuation

- Secular tailwinds

- Large & growing TAM

- Visionary/founder-led management

- Sustainable competitive advantage/Moat

-ish

-ish- Customer/Industry diversification

- High top line growth

- Strong margin/profit potential

- Reasonable Valuation

24/ Conclusion

I believe Adyen possesses many of the factors to succeed and provide strong shareholder returns over the long-term.

I do however believe current valuation is stretched, which can cause underperformance for the short/medium-term.

Disclosure: I’m long $ADYEN

I believe Adyen possesses many of the factors to succeed and provide strong shareholder returns over the long-term.

I do however believe current valuation is stretched, which can cause underperformance for the short/medium-term.

Disclosure: I’m long $ADYEN

Read on Twitter

Read on Twitter![[Thread] Adyen - $ADYEN $ADYEY $ADYYFTime for a stock review from my home turf on payment giant Adyen! I will try to highlight the main points and my findings to the best of my abilities.TLDR: Adyen checks many boxes, but valuation remains debatable [Thread] Adyen - $ADYEN $ADYEY $ADYYFTime for a stock review from my home turf on payment giant Adyen! I will try to highlight the main points and my findings to the best of my abilities.TLDR: Adyen checks many boxes, but valuation remains debatable](https://pbs.twimg.com/media/Eo4mBbVW4AU4mEO.jpg)