As states head into legislative sessions in early 2021, it’s high time for lawmakers to focus on wealth taxes. A thread / 1 https://www.cbpp.org/research/state-budget-and-tax/improved-state-taxes-on-wealth-high-incomes-can-help-fuel-an-equitable

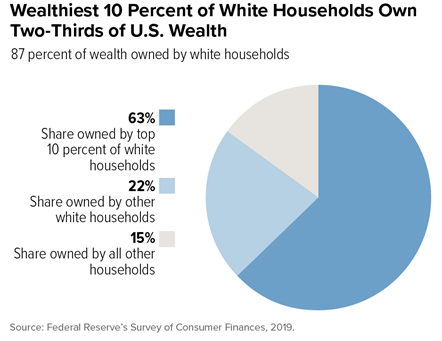

#COVID19 has caused so, so much hardship. But not quite as much for many wealthier families, who are disproportionately white / 2 https://www.nbcnews.com/business/business-news/how-coronavirus-has-widened-chasm-between-rich-poor-n1240622

To respond to the pandemic and ensure support for education, healthcare, and things we all need, we need to increase taxes on wealth and high incomes at the state level / 3 https://www.cbpp.org/research/state-budget-and-tax/improved-state-taxes-on-wealth-high-incomes-can-help-fuel-an-equitable

The #COVID19 pandemic has largely spared people with wealth and high incomes. The employment rate for higher-paid workers is pretty much where it was pre-pandemic. Not so much for workers paid low wages - disproportionately women, people of color, and immigrants / 4

The stock market keeps increasing, and the luxury housing market is doing well. Since the pandemic is increasing the wealth of people who already have a lot while so many are losing their lives and livelihoods, now is the right time for states to increase taxes on wealth / 5

Meanwhile the pandemic has slashed tax revenue for states, localities, tribal nations, and territories. State and local shortfalls are likely to exceed $500b over the next 2 years / 6 https://www.cbpp.org/research/state-budget-and-tax/pandemics-impact-on-state-revenues-less-than-earlier-expected-but

Cuts will deepen and prolong the recession and worsen racial inequities. But wealth taxes can raise badly-needed state revenue to maintain healthcare, education, and other crucial priorities and contribute to an equitable, antiracist pandemic response / 7 https://www.cbpp.org/research/state-budget-and-tax/3-principles-for-an-antiracist-equitable-state-response-to-covid-19

Option #1: millionaire’s taxes. States can create new personal income tax brackets and increase rates at the top. To be clear: research shows that tax level differences have *little to no effect* on states’ economic health overall / 8 https://www.cbpp.org/research/state-budget-and-tax/raising-state-income-tax-rates-at-the-top-a-sensible-way-to-fund-key

NJ made this change recently, and other states should follow suit / 9 https://www.cbpp.org/blog/new-jersey-budget-deal-advances-equity-with-millionaires-tax-and-more

Option #2: mansion taxes. The pandemic has largely spared high-value homes, with increasing sales and home values / 10 https://www.redfin.com/news/luxury-real-estate-q3-2020/

States can increase rates for high-value homes when they’re bought or sold (real estate transfer tax) or through state and local property tax systems. Several states have already taken this step, and more should / 11

Option #3: capital gains (profit on the sale of art or stocks or other assets). The federal government taxes this income at lower rates than wages/salaries, so there’s lots of room for state increases / 12 https://www.cbpp.org/research/state-budget-and-tax/state-taxes-on-capital-gains

That’s especially true because the vast majority of capital gains income goes to extremely wealthy people / 13

States can eliminate existing breaks, decouple from problematic Opportunity Zone provisions, or impose a pandemic surcharge / 14 https://www.cbpp.org/blog/states-should-decouple-their-income-taxes-from-federal-opportunity-zone-tax-breaks-asap

Option #4: estate & inheritance taxes. None or limited ones contribute to wealth concentration and racial inequities, and deprive states of revenue needed to make investments that help communities thrive / 15

In our current era of sky-high inequality made even worse by #COVID19, states that have estate/inheritance taxes should lower exemptions and increase rates. States that don’t should enact them / 16 https://www.cbpp.org/research/state-budget-and-tax/state-taxes-on-inherited-wealth

Read on Twitter

Read on Twitter