A deep dive into David Perdue.

A deep dive into David Perdue.

Why exactly is Perdue corrupt?

Perdue’s criminality goes WAY back.

Grab a coffee, strap in, and enjoy the rabbit hole.

David Perdue is set to face Jon Ossoff in the Jan 5th runoff for 1 of the 2 Georgia senate seats.

The GA Sen race was close:

- Perdue: 49.7%

- Ossoff: 47.9%

With <100 000 votes being the difference.

Also: @ossoff was right. Let's find out why Perdue cowered out of the debates.

The GA Sen race was close:

- Perdue: 49.7%

- Ossoff: 47.9%

With <100 000 votes being the difference.

Also: @ossoff was right. Let's find out why Perdue cowered out of the debates.

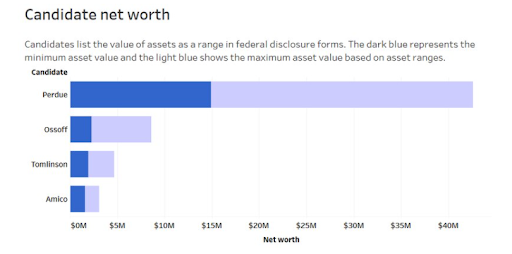

Perdue is insanely rich, with most of his wealth being in his investment profile. It's important to note that Perdue has multiple LLCs he conducts business and investments through.

Most of Ossoff's net worth is from his media company.

Most of Ossoff's net worth is from his media company.

Important:

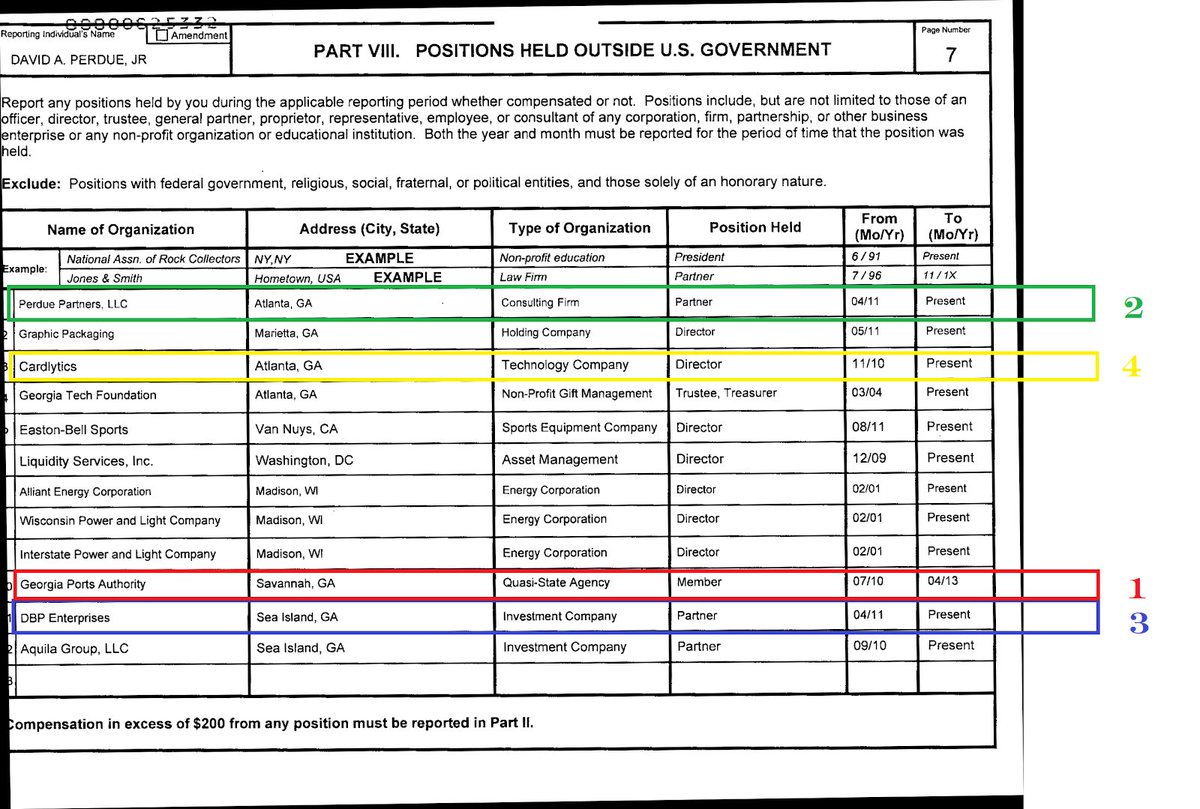

Here’s a snapshot of the companies Perdue directed or owned prior to becoming Senator.

The numbers correspond to different key companies/organizations, which are of significant importance to this thread.

Note: "Present" in the pic is Oct 31, 2013.

Here’s a snapshot of the companies Perdue directed or owned prior to becoming Senator.

The numbers correspond to different key companies/organizations, which are of significant importance to this thread.

Note: "Present" in the pic is Oct 31, 2013.

To make it easier, I divide this thread into three sections:

1) Before Perdue’s Senate tenure (Pre Jan the 3rd 2015).

2) Senate tenure ( Jan the 3rd 2015 till Jan 2020).

3) Coronavirus period (Jan 2020 till 9th of Dec).

1) Before Perdue’s Senate tenure (Pre Jan the 3rd 2015).

2) Senate tenure ( Jan the 3rd 2015 till Jan 2020).

3) Coronavirus period (Jan 2020 till 9th of Dec).

𝐁𝐞𝐟𝐨𝐫𝐞 𝐏𝐞𝐫𝐝𝐮𝐞’𝐬 𝐬𝐞𝐧𝐚𝐭𝐞 𝐭𝐞𝐧𝐮𝐫𝐞 (Pre Jan the 3rd 2015).

𝐁𝐞𝐟𝐨𝐫𝐞 𝐏𝐞𝐫𝐝𝐮𝐞’𝐬 𝐬𝐞𝐧𝐚𝐭𝐞 𝐭𝐞𝐧𝐮𝐫𝐞 (Pre Jan the 3rd 2015).Between July 19, 2010 – April 2013, Perdue served on the board of directors of Georgia Ports Authority (GPA) (Number 1).

In 2011, Perdue and his cousin George Ervin "Sonny" Perdue III, who at that time had just finished his tenure as Governor of Georgia, formed a company called:

“Perdue Partners LLC” – a Global logistics firm (Number 2).

“Perdue Partners LLC” – a Global logistics firm (Number 2).

Three notes regarding the above:

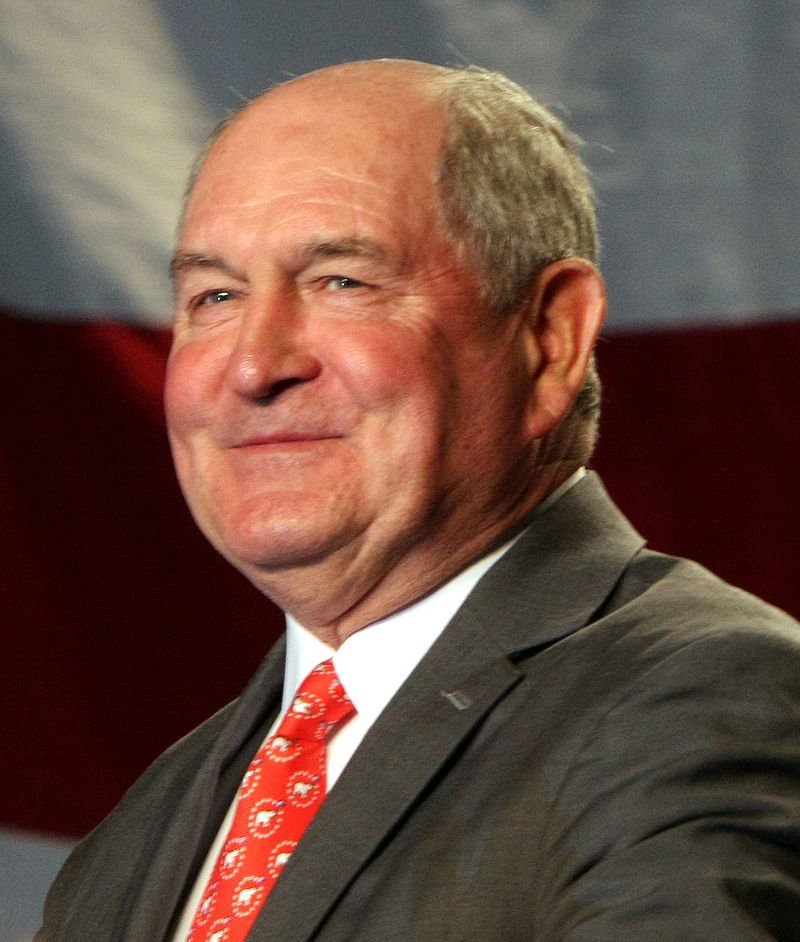

1) David Perdue was appointed to the Board of Directors of the GPA by Sonny Perdue

2) Sonny is Trump’s CURRENT Sec of Agriculture

3) Perdue was chairman of the Ports Development Committee - oversees infrastructure @ Savannah/Brunswick terminals

1) David Perdue was appointed to the Board of Directors of the GPA by Sonny Perdue

2) Sonny is Trump’s CURRENT Sec of Agriculture

3) Perdue was chairman of the Ports Development Committee - oversees infrastructure @ Savannah/Brunswick terminals

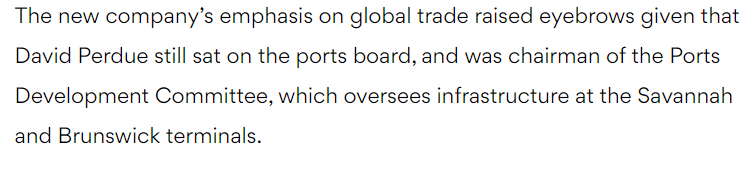

While on the board of the GPA, Perdue purchased a trucking company that hauled cargo at the port he was directly making decisions about.

Perdue took votes on 10s of millions of dollars worth of infrastructure improvements designed to streamline/ improve transport at the gateway

Perdue took votes on 10s of millions of dollars worth of infrastructure improvements designed to streamline/ improve transport at the gateway

In Georgia - officials who serve on the public boards are required to file affidavits attesting to the fact that they have not taken any votes which affected their private financial or business interests.

Perdue failed to file the required ethics disclosure.

Perdue failed to file the required ethics disclosure.

It gets VERY messy even when looking at the Perdue partners LLC, David Perdue, and Sonny Perdue’s shady connections, transactions, and deals, but I will leave all of this to another thread.

Continuing on, though, we get to…

Continuing on, though, we get to…

𝗦𝗲𝗻𝗮𝘁𝗲 𝘁𝗲𝗻𝘂𝗿𝗲 (Jan the 3rd 2015 till Jan 2020).

𝗦𝗲𝗻𝗮𝘁𝗲 𝘁𝗲𝗻𝘂𝗿𝗲 (Jan the 3rd 2015 till Jan 2020).David Perdue assumed office as Senator from Georgia on January the 3rd, 2015.

Perdue has or is currently sitting on a number of committees, including:

- Banking, Housing & Urban affairs

- Agriculture, nutrition & forestry (remember Sonny

Perdue?)

- Budget committee

- Armed services

Within these committees are subcommittees.

- Banking, Housing & Urban affairs

- Agriculture, nutrition & forestry (remember Sonny

Perdue?)

- Budget committee

- Armed services

Within these committees are subcommittees.

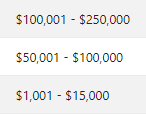

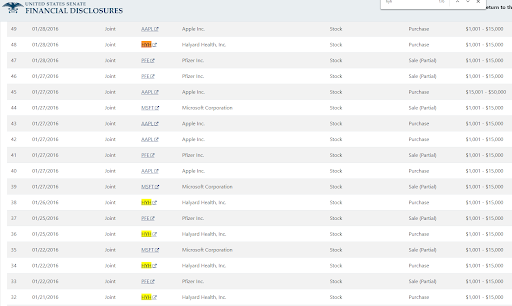

Some background info about Senate Financial disclosures before moving on:

Unfortunately, they are very vague and don’t classify the value of their assets in specific amounts, e.g., $15 000 -$50 000.

Which is why I say "upwards" of:

However…

Unfortunately, they are very vague and don’t classify the value of their assets in specific amounts, e.g., $15 000 -$50 000.

Which is why I say "upwards" of:

However…

Perdue has been the most prolific trader of stocks, funds, or shares in the Senate.

- Perdue has made almost one-THIRD of all trades among members

- Perdue’s trades are roughly the equivalent to the combined sum of trades conducted by the 2nd to 6th most active traders in the Sen

- Perdue has made almost one-THIRD of all trades among members

- Perdue’s trades are roughly the equivalent to the combined sum of trades conducted by the 2nd to 6th most active traders in the Sen

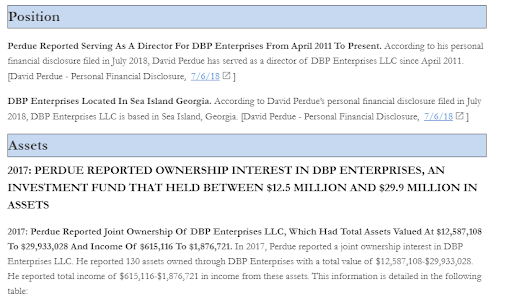

It's time to bring in number 3 - "DBP Enterprises."

DBP Enterprises is an LLC owned by Perdue & his wife, which they do most of their trading and investing through.

They still use this to this day.

The 2nd photo was the estimated net worth of the LLC in 2017.

DBP Enterprises is an LLC owned by Perdue & his wife, which they do most of their trading and investing through.

They still use this to this day.

The 2nd photo was the estimated net worth of the LLC in 2017.

As mentioned before, Perdue has been or is a member of several influential committees.

Since his tenure on the Senate & on these committees, Perdue has made 100s of trades in companies w/ interests in committees Perdue sits on inc. Cybersecurity firms, defense firms & banks.

Since his tenure on the Senate & on these committees, Perdue has made 100s of trades in companies w/ interests in committees Perdue sits on inc. Cybersecurity firms, defense firms & banks.

Ok, now we get to the good stuff.

Let's have a look at what Perdue got up to while on these important and influential committees.

Let's have a look at what Perdue got up to while on these important and influential committees.

On Jan 27, 2016, the Senate Judiciary Committee convened to take a hard look at the opioid crisis.

On Jan 27, 2016, the Senate Judiciary Committee convened to take a hard look at the opioid crisis.From January to Feb 2016, Perdue purchased ~$150 000 worth of stock in Halyard health.

A medical company that specialized in pain management alternatives to opioids.

As legislation was moving through the senate.

Perdue started selling the Halyard stock.

During the 7 months period between when Perdue bought and sold the stock, Perdue reaped a 33 to 54% profit.

Perdue started selling the Halyard stock.

During the 7 months period between when Perdue bought and sold the stock, Perdue reaped a 33 to 54% profit.

From 2017 till early 2018:

From 2017 till early 2018:While Perdue was on the Senate Banking Committee, he bought hundreds of thousands of dollars worth of stocks in Regions Financial Corporation.

While on the Senate Banking Committee, Perdue co-sponsored a Senate bill that would reduce financial regulation on medium-sized banks such as Region Financial Corporation.

His regulations became law in May 2018 –by then, his Regions stock had risen by 35%.

His regulations became law in May 2018 –by then, his Regions stock had risen by 35%.

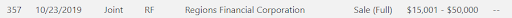

Here’s where the Regions Financial Corps' story gets even more interesting.

As far as I can tell (I looked at all his disclosed + his pre-Senate records), he only bought stock ONCE before his Regions Financial Corp spree, and that was back in 2015 for between $15 000 - $50 000

As far as I can tell (I looked at all his disclosed + his pre-Senate records), he only bought stock ONCE before his Regions Financial Corp spree, and that was back in 2015 for between $15 000 - $50 000

AND ALSO:

Regions Financial Corp had donated to his campaigns in both 2014 & 2017.

To make things even dodgier.

John M Turner Jr, the CEO of Regions Financial Corp, had also donated to his 2019 re-election campaign.

(It's AL because Regions Financial Corp HQ is in Alabama)

Regions Financial Corp had donated to his campaigns in both 2014 & 2017.

To make things even dodgier.

John M Turner Jr, the CEO of Regions Financial Corp, had also donated to his 2019 re-election campaign.

(It's AL because Regions Financial Corp HQ is in Alabama)

In Feb 2017 while sitting on Senate Banking Committee which has jurisdiction over the financial industry:

In Feb 2017 while sitting on Senate Banking Committee which has jurisdiction over the financial industry:Perdue attempted (& partially succeeded) to remove regulations the Consumer Financial Protection Bureau (CFPB) had imposed on the prepaid debit credit card industry.

From June 2017 – April 2019, Perdue invested in First data, a company that held massive interest/power in the prepaid debit card industry.

The Daily Beast reported: "coincided w/ both policy announcements affecting the company & a major merger that sent its stock price soaring"

The Daily Beast reported: "coincided w/ both policy announcements affecting the company & a major merger that sent its stock price soaring"

Perdue made fortuitous "purchases & sales, inc six-figure acquisitions of shares in the company, fell around key events, such as the finalization of the CFPB rule that softened regulatory language designed to crack down on prepaid debit cards, a key... of First Data’s business."

This is what David Perdue's buying and selling of First Data looked like between June 2017 – April 2019.

In Jan 2019, shortly before becoming chairman of the Armed Services subcommittee on Seapower, Perdue bought up to $190 000 worth of stock in BWX technologies, which builds nuclear power components for submarines.

In Jan 2019, shortly before becoming chairman of the Armed Services subcommittee on Seapower, Perdue bought up to $190 000 worth of stock in BWX technologies, which builds nuclear power components for submarines.Perdue had never invested in BWX before then.

While as the Seapower chairman, Perdue was one of a few lawmakers handpicked by party leadership to decide on the final bill. Perdue secured $4.7 billion in the 2020 National Defense Authorization act to build Virginia-class nuclear subs that would use BWX parts.

From Feb to July 2019, as he was shaping the Defense bill and working on a submarine bill, he sold off and subsequently profited between $15,000 and $50,000.

This is what his trades looked like:

This is what his trades looked like:

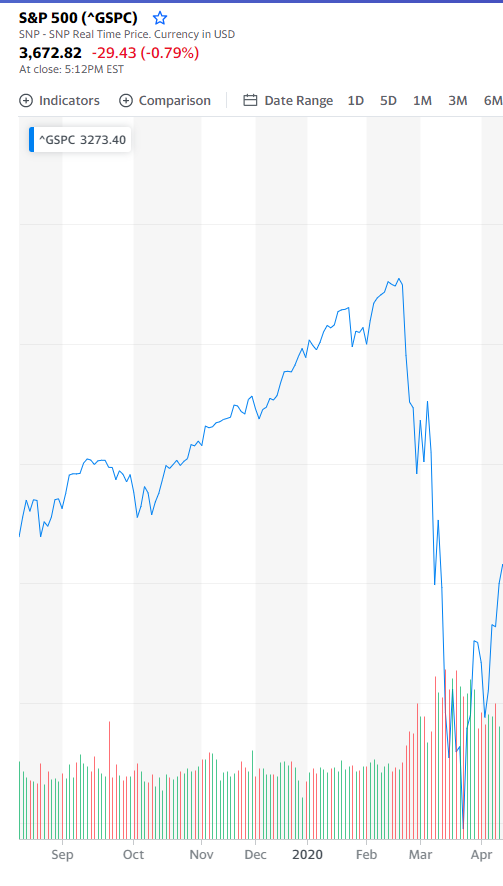

𝗖𝗼𝘃𝗶𝗱-𝟭𝟵 𝗽𝗲𝗿𝗶𝗼𝗱 (Jan 2020 till Now).

𝗖𝗼𝘃𝗶𝗱-𝟭𝟵 𝗽𝗲𝗿𝗶𝗼𝗱 (Jan 2020 till Now).The four most important trades of this period involve:

1) Cardlytics

2) Dupont

3) Pfizer.

4) Caesar entertainment

AND his overall trading trends.

For some background:

- The 2020 Stock Market Crash occurred between the 20th of Feb - 7th of April.

- You’d want to sell before the stock market crash & buy during the stock market crash.

- No one is omniscient; however, with inside knowledge, you can make better stock decisions.

- The 2020 Stock Market Crash occurred between the 20th of Feb - 7th of April.

- You’d want to sell before the stock market crash & buy during the stock market crash.

- No one is omniscient; however, with inside knowledge, you can make better stock decisions.

On Jan 23rd, 2020 - Cardlytics

On Jan 23rd, 2020 - CardlyticsPerdue directed his financial adviser to sell >$1 million worth of stock in the finance firm Cardlytics (No.4 - he was previously the director).

Two days before the sale, Cardlytics CEO sent Perdue sent an email mentioning “upcoming changes''.

Perdue sold off between $1million – $5 million in Cardlytics stocks at $86 a share.

Weeks later, once the stock market crashed, Perdue bought the stock back for $30 a share.

As of now, the Stock has more than quadrupled at $128 a share.

Tell me what this looks like:

Weeks later, once the stock market crashed, Perdue bought the stock back for $30 a share.

As of now, the Stock has more than quadrupled at $128 a share.

Tell me what this looks like:

Jan 24th - DuPont de Nemours

Jan 24th - DuPont de NemoursTHE SAME DAY as the private Sen briefing on COVID (Loeffler also attended), Perdue bought stock in DuPont (Loeffler bought too)

DuPont is a chem company that also supplies/manufactures PPE

Overall, Purdue bought upwards of $185,000 worth of stock

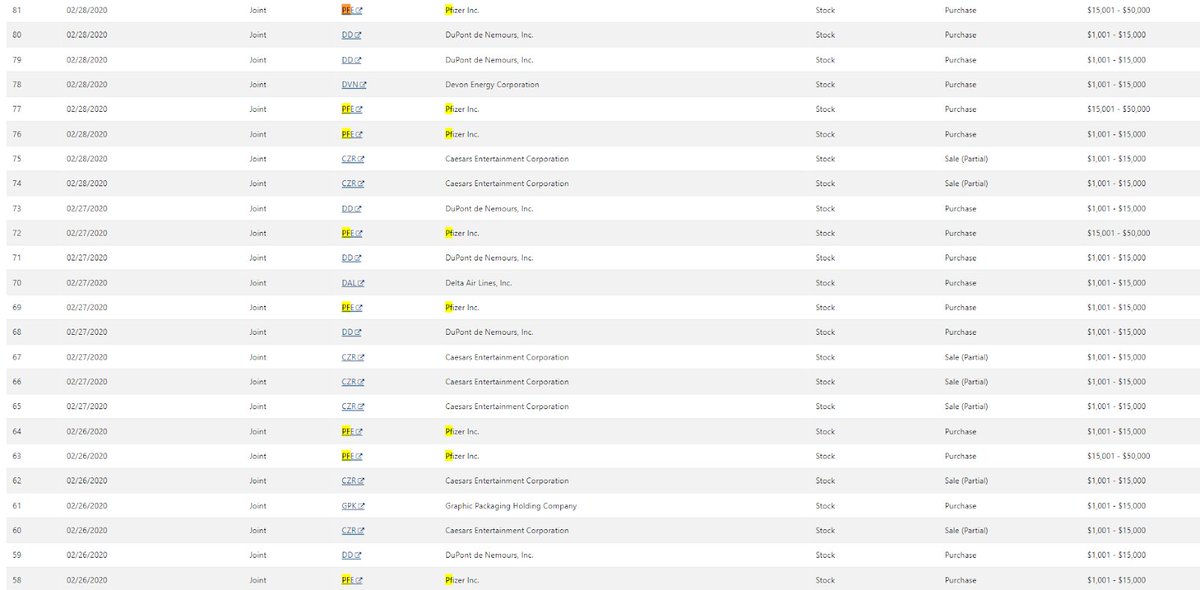

In Feb 2020 - Pfizer

In Feb 2020 - PfizerPerdue made upwards of $260 000 worth of stocks between Feb 26 and Feb 28

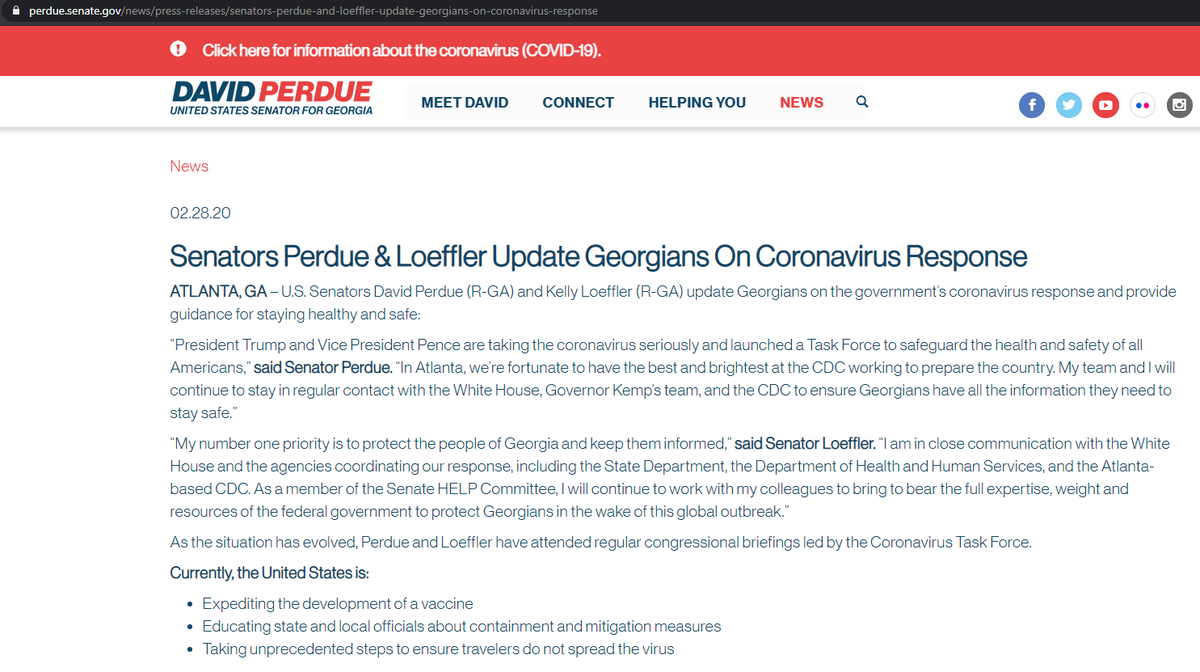

On the 28th of Feb Perdue & Loeffler released a news release that they had regularly attended briefings led by the Covid taskforce.

He purchased Pfizer again on the same day.

This is what happened to the stock of Pfizer that Perdue had spent upwards of $260 000 on.

Note: Perdue was "forced" to sell because of the optics of it (I will talk about this soon).

Note: Perdue was "forced" to sell because of the optics of it (I will talk about this soon).

Also in late Feb 2020 - Caesars Entertainment Corporation.

Also in late Feb 2020 - Caesars Entertainment Corporation.Just before the stock market crashed:

Perdue sold upwards of $165 000 of Caesars Entertainment Corporation - a casino company

Casinos were particularly hit hard by the stock market crash.

Overall trading trends

Overall trading trendsIn March 2020: Congress passed 3 different spending bills & Perdue increased his trading compared to pre-coronavirus by nearly threefold.

In the early months of 2020, Perdue bought & sold around $5.8 million & $5.6 million worth of stocks, respectively

In April 2020 during the height of the Covid insider trader scandal Perdue (like Loeffler) dumped most but NOT all of his individual stocks.

The main goal was for optics to get re-elected to the senate. W/ the senate Perdue has access to limitless influence, power, and donors

The main goal was for optics to get re-elected to the senate. W/ the senate Perdue has access to limitless influence, power, and donors

Investigations:

Investigations:Perdue was also subject to investigations by the DOJ, SEC, and Senate Ethics Committee just like Loeffler, and they also cleared him. They mostly looked at the Cardlytics and DuPont trades.

However….

Read on Twitter

Read on Twitter