Another 2020 IPO and Doordash is now worth over $60b. I'm pumped for the employees and their stock options, but it's bittersweet. Why?

We estimate that $DASH employees left $954 million on the table – $924k per person because they didn't exercise their options.

A case study

We estimate that $DASH employees left $954 million on the table – $924k per person because they didn't exercise their options.

A case study

Come sale, employees are taxed at:

- 53% (ordinary income) for unexercised options

- 37% if they exercised at least a year before selling post-IPO

That’s because profits then count as long term capital gains.

(53% and 37% are CA rates)

With DoorDash numbers, that is...

- 53% (ordinary income) for unexercised options

- 37% if they exercised at least a year before selling post-IPO

That’s because profits then count as long term capital gains.

(53% and 37% are CA rates)

With DoorDash numbers, that is...

34,554,510 unexercised DoorDash options at a $2.41 avg strike price ( p246 of DoorDash’s S1)

p246 of DoorDash’s S1)

That means...

Pre-tax gain: $178 (= $180 - $2.41)

Profit per share:

$84 at ordinary income tax (53%)

$112 at long term cap gains (37%)

Difference: $28 per share

p246 of DoorDash’s S1)

p246 of DoorDash’s S1)That means...

Pre-tax gain: $178 (= $180 - $2.41)

Profit per share:

$84 at ordinary income tax (53%)

$112 at long term cap gains (37%)

Difference: $28 per share

Multiply $28 by 34,554,510, the number of unexercised DoorDash options:

$954,231,260

That's the *estimated* amount could’ve ended up with employees and now likely on its way to the IRS and CA in taxes when employees sell their options/shares.

$954,231,260

That's the *estimated* amount could’ve ended up with employees and now likely on its way to the IRS and CA in taxes when employees sell their options/shares.

DoorDash currently has 3279 employees. But they stopped awarding stock options (switched to RSUs) in 2018, when they had 1032 employees.

So let’s use 1032 as our upper bound on the # of stock option holders.

Then the average DoorDash employee missed out on $924,643.

So let’s use 1032 as our upper bound on the # of stock option holders.

Then the average DoorDash employee missed out on $924,643.

So – why didn’t they just exercise their stock options?!

Unfortunately, it’s not that easy. The first problem is a lack of education.

Most startup employees don’t know the tax benefits of exercising. (Hope my tweets help a little bit )

)

Or they find out when it’s too late.

Unfortunately, it’s not that easy. The first problem is a lack of education.

Most startup employees don’t know the tax benefits of exercising. (Hope my tweets help a little bit

)

)Or they find out when it’s too late.

How can it be ‘too late’?

Well that’s the paradox of hypergrowth startups. On the one hand, it’s the outcome everyone wants. On the other hand, it makes exercising stock options quickly unaffordable.

Like, seriously unaffordable. The costs explode.

Well that’s the paradox of hypergrowth startups. On the one hand, it’s the outcome everyone wants. On the other hand, it makes exercising stock options quickly unaffordable.

Like, seriously unaffordable. The costs explode.

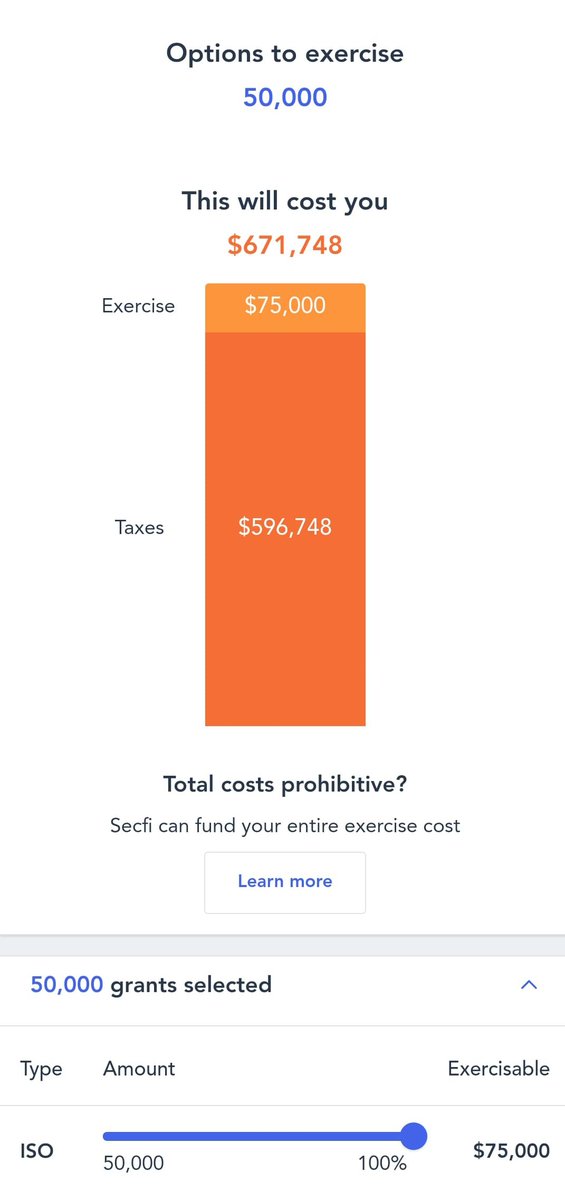

Say in 2017 you join DoorDash as an engineer and get 50,000 ISOs at a $1.50 strike price.

Two years later you consider exercising (ignore vesting). Pre-tax, that would cost 50,000 * $1.5 = $75

Assume the 409A value is now around $15, then taxes crank that cost up to $321,748

Two years later you consider exercising (ignore vesting). Pre-tax, that would cost 50,000 * $1.5 = $75

Assume the 409A value is now around $15, then taxes crank that cost up to $321,748

You decide not to exercise.

Fast-forward to September 2020. Rumors of an IPO start to spread, and you look into your ISOs again.

By now, the 409A value has grown to around $35. This increases your tax liability, bringing total exercises costs to…

$671,748

Fast-forward to September 2020. Rumors of an IPO start to spread, and you look into your ISOs again.

By now, the 409A value has grown to around $35. This increases your tax liability, bringing total exercises costs to…

$671,748

Nearing the IPO, at some point you’re informed about a deadline: the last chance to exercise your stock options pre-IPO.

After that deadline, there’s a blackout and you won’t be allowed to exercise.

409A by now: ~$60

Costs to exercise:

$1,109,248

After that deadline, there’s a blackout and you won’t be allowed to exercise.

409A by now: ~$60

Costs to exercise:

$1,109,248

Needless to say, exercising your ISOs was difficult from the start and often gets much worse with each 409A update.

So you don’t exercise – you call it good and just wait for the IPO.

So you don’t exercise – you call it good and just wait for the IPO.

But that’s a shame.

At a sell price of $180, you'll now make $4,253,676

If you had exercised, that would've been $5,677,113 due to the tax savings.

Don't get me wrong. Both AMAZING outcomes... But $1.4 million is no small difference

At a sell price of $180, you'll now make $4,253,676

If you had exercised, that would've been $5,677,113 due to the tax savings.

Don't get me wrong. Both AMAZING outcomes... But $1.4 million is no small difference

Even at that cost of $1.1 million right before the blackout, that’s still a 128% return on investment. Not too shabby.

(Note that the $1.4 million is a difference in *profit* so the $1.1 million spent on exercising the ISOs is already factored in.)

(Note that the $1.4 million is a difference in *profit* so the $1.1 million spent on exercising the ISOs is already factored in.)

Of course, not every company will be as successful as DoorDash and taxes aren't the only factor to consider.

At the same time, they often have the biggest impact and employees need to start learning and potentially taking action earlier so they don't miss out on exit

At the same time, they often have the biggest impact and employees need to start learning and potentially taking action earlier so they don't miss out on exit

Closing thoughts. We have a culture of employee equity, which I love.

Our vehicle of choice is the stock option, but it’s not without its flaws.

It's our biggest success stories that bring out the best and the worst in how they work.

Our vehicle of choice is the stock option, but it’s not without its flaws.

It's our biggest success stories that bring out the best and the worst in how they work.

If you want to read more, I wrote a blog post with more detail below. https://www.secfi.com/blog/doordash-ipo-case-study

Btw if you want to quickly see your tax liability / total exercise costs – there’s a free online calculator here https://www.secfi.com/products/exercise-tax-calculator

Read on Twitter

Read on Twitter