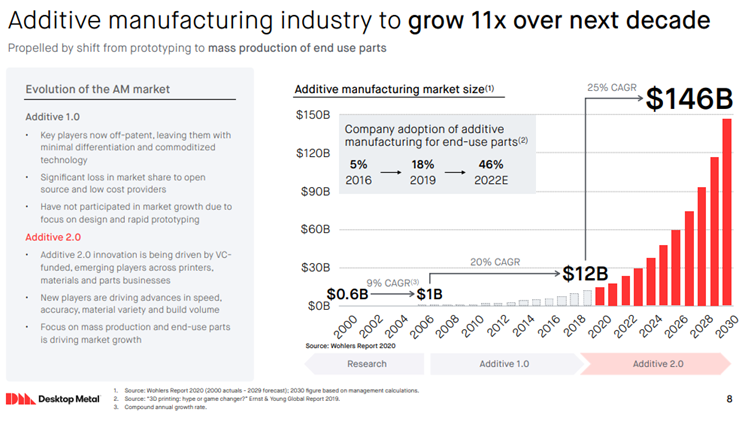

The 3D printing industry is positioned to deliver explosive growth reaching 10x market size in the decade.

A 3D printing unicorn is ready to revolutionize the space.

Time for a breakdown

A 3D printing unicorn is ready to revolutionize the space.

Time for a breakdown

1}Desktop Metal $DM was co-founded in 2015 by Ric Fulop and five founders to make 3D printing accessible to engineers, designers, and manufacturers.

- 4/5 founders are MIT Professors

- 25+ employees with PhDs

- 120+ patents filed/pending

- 4/5 founders are MIT Professors

- 25+ employees with PhDs

- 120+ patents filed/pending

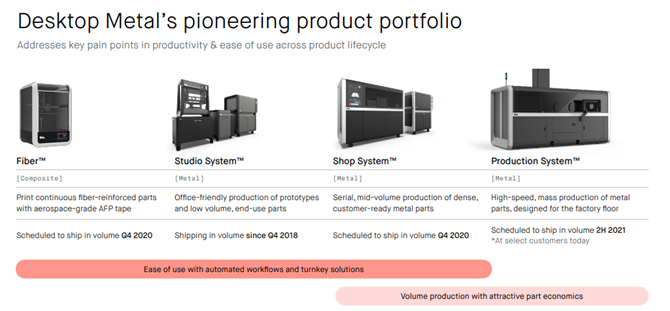

2}The company delivers a solution that starts from product development to ultimately mass production across various industries.

This makes it the FIRST 3D company that is focused on volume production of end-use parts instead of just design and prototyping.

This makes it the FIRST 3D company that is focused on volume production of end-use parts instead of just design and prototyping.

3}The global manufacturing industry is a $12.8 trillion monster that has some limitation due to conventional machining methods.

- High upfront costs of tools/equipments

- Long lead times for design & production

- Design limitations

- Lack of customization

- Waste

- High upfront costs of tools/equipments

- Long lead times for design & production

- Design limitations

- Lack of customization

- Waste

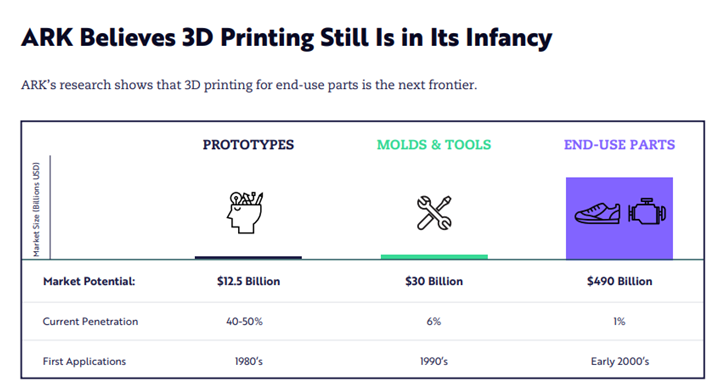

4}Research presented from @ARKInvest shows that 3D printing will revolutionize the manufacturing industry and grow to $97B by 2024.

- 3D Printing 1.0 was focused on design and prototyping

- 3D Printing 2.0 will focus on mass production and end-use parts.

- 3D Printing 1.0 was focused on design and prototyping

- 3D Printing 2.0 will focus on mass production and end-use parts.

5} $DM is positioned well to be a leader in the $490B end-use parts market which as 1% penetration. They will build a $10B+ 3D Printing 2.0 company delivering:

- Design Flexibility

- Mass Production

- Sustainability

- End-Use Production

- Domestic supply chain

- Design Flexibility

- Mass Production

- Sustainability

- End-Use Production

- Domestic supply chain

6} The top five phrases in the investor conference call in August:

1. Additive manufacturing

2. Mass production

3. Production system

4. Distribution network

5. Entire product lifestyle

1. Additive manufacturing

2. Mass production

3. Production system

4. Distribution network

5. Entire product lifestyle

7}Desktop Metal delivers the following platforms to become a market leader:

- Production System: first 3D printing system for mass production: H2 2021

- Studio System: first office-friendly 3D printing system: shipping since Q4 2018 (86% of revenue)

- Shop system & Fiber

- Production System: first 3D printing system for mass production: H2 2021

- Studio System: first office-friendly 3D printing system: shipping since Q4 2018 (86% of revenue)

- Shop system & Fiber

8}Desktop Metal competes with HP, Stratasys, Digital Metal, 3DEO, ExOne.

- HP has metal 3D printing systems in development

- The company has 90+ reservations for its Production system. With current economic conditions, there is risk of not converting them into orders.

- HP has metal 3D printing systems in development

- The company has 90+ reservations for its Production system. With current economic conditions, there is risk of not converting them into orders.

9}Desktop Metal has the following moats:

- Technology: three core key print process innovations with 120+ patents filed/pending

- Team: founder-led with vast experience as engineers

- Global Distribution Network: 80 resellers across 60 countries

- Technology: three core key print process innovations with 120+ patents filed/pending

- Team: founder-led with vast experience as engineers

- Global Distribution Network: 80 resellers across 60 countries

10}The company is positioned to dominate the space.

- Revenue - 2025E: $941.5M (211.6% CAGR)

- Gross Profit – 2025E: $508.3M (54.0%)

- Adj EBITDA – 2025E: $268.2M (28.5% margin)

- Free Cash Flow – 2025E: $230.5M (200% CAGR)

- EV / Revenue – 2025E: 1.9x

- Revenue - 2025E: $941.5M (211.6% CAGR)

- Gross Profit – 2025E: $508.3M (54.0%)

- Adj EBITDA – 2025E: $268.2M (28.5% margin)

- Free Cash Flow – 2025E: $230.5M (200% CAGR)

- EV / Revenue – 2025E: 1.9x

11}Desktop Metal plans to grow with the following strategies:

- Strategic Acquisitions: 10+ opportunities under contract & 60+ opportunities ~$2B opportunity

- Distribution Channels: Expansion to Asia and Africa. Current revenue in Asia-Pacific is 11%

- Strategic Acquisitions: 10+ opportunities under contract & 60+ opportunities ~$2B opportunity

- Distribution Channels: Expansion to Asia and Africa. Current revenue in Asia-Pacific is 11%

12}Desktop Metal has a $1.8B EV and supported by world-class investors and operators such as @LeoHindery, @MillerValue, @chamath.

If you learned anything today and want to get more breakdown of public equities, subscribe to Equity Breakdown by going here: https://equitybreakdown.substack.com/

If you learned anything today and want to get more breakdown of public equities, subscribe to Equity Breakdown by going here: https://equitybreakdown.substack.com/

Read on Twitter

Read on Twitter