For those trying to make sense of today’s $tsla price action: Decline likely sparked by secondary selling and order book fill, magnified by tech sell-off over concerns about excessive valuations (e.g. Doordash). Much of $tsla float in very weak (short term) hands following...

2/ ...48% $TSLA run-up in 3 weeks, and many traders chose to take profits today rather than wait until next Wed-Fri to sell to indexers who have to buy 120M shares. Once $TSLA discloses they have completed $5B ATM secondary, TSLA should move higher into next week’s S&P inclusion.

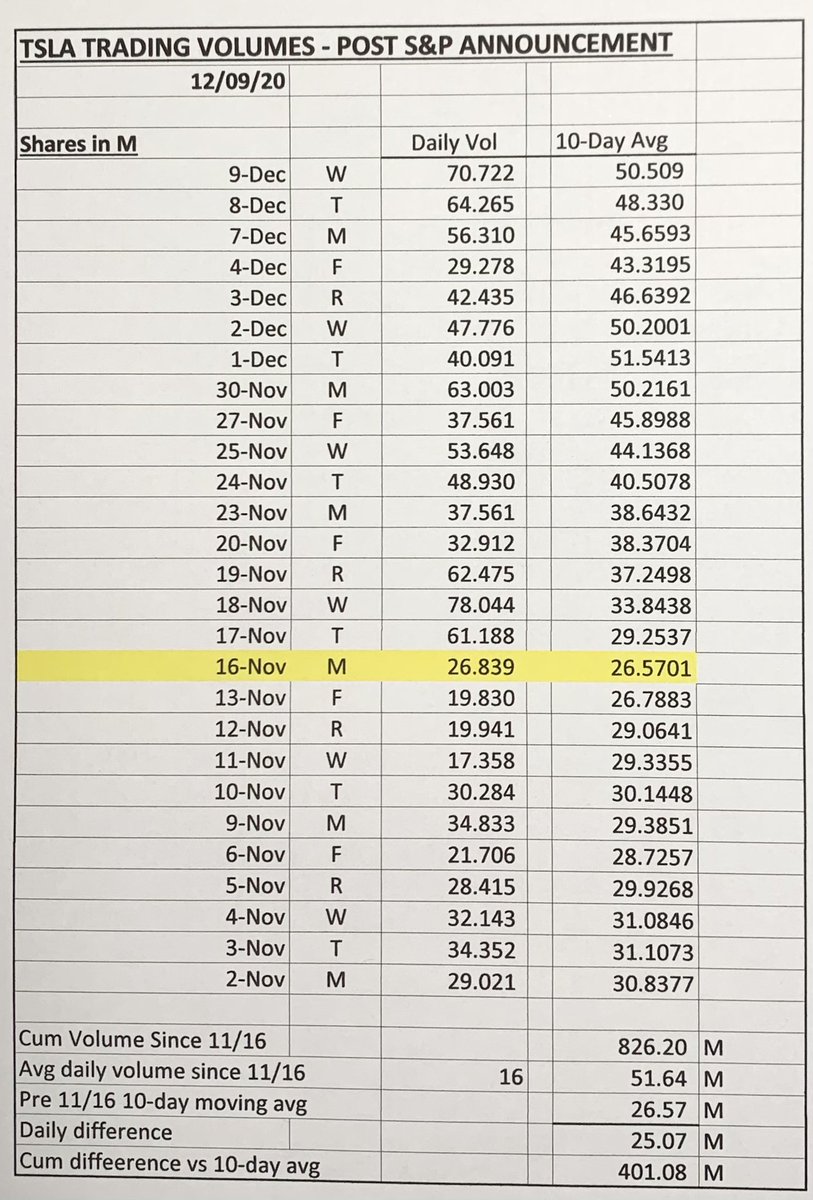

3/ Many here have underestimated the amount of buying by hedge funds/speculators hoping to capitalize on next week’s index buy in. There is no chance $TSLA soared 48% in three weeks on 2x normal volume on FSD & other catalysts. Today’s amplified TSLA selling confirmed this view.

Read on Twitter

Read on Twitter