$PDSB -

PDS Biotech has a platform focused on encapsulating antigens in positively charged lipids which are taken up by dendritic cells and presented to CD4 and CD8 killer T cells. https://twitter.com/MattBiotech/status/1328430191933149185?s=20

PDS Biotech has a platform focused on encapsulating antigens in positively charged lipids which are taken up by dendritic cells and presented to CD4 and CD8 killer T cells. https://twitter.com/MattBiotech/status/1328430191933149185?s=20

These activated cells then kill the antigen-specific tumor cells by secreting IFN-γ and Granzyme-β. The platform’s first product is PDS0101 to treat HPV-associated cancers.

Phase 1 data showed HPV-specific Activated Killer T-Cells and Total Activated T-Cells over 20x baseline.

Phase 1 data showed HPV-specific Activated Killer T-Cells and Total Activated T-Cells over 20x baseline.

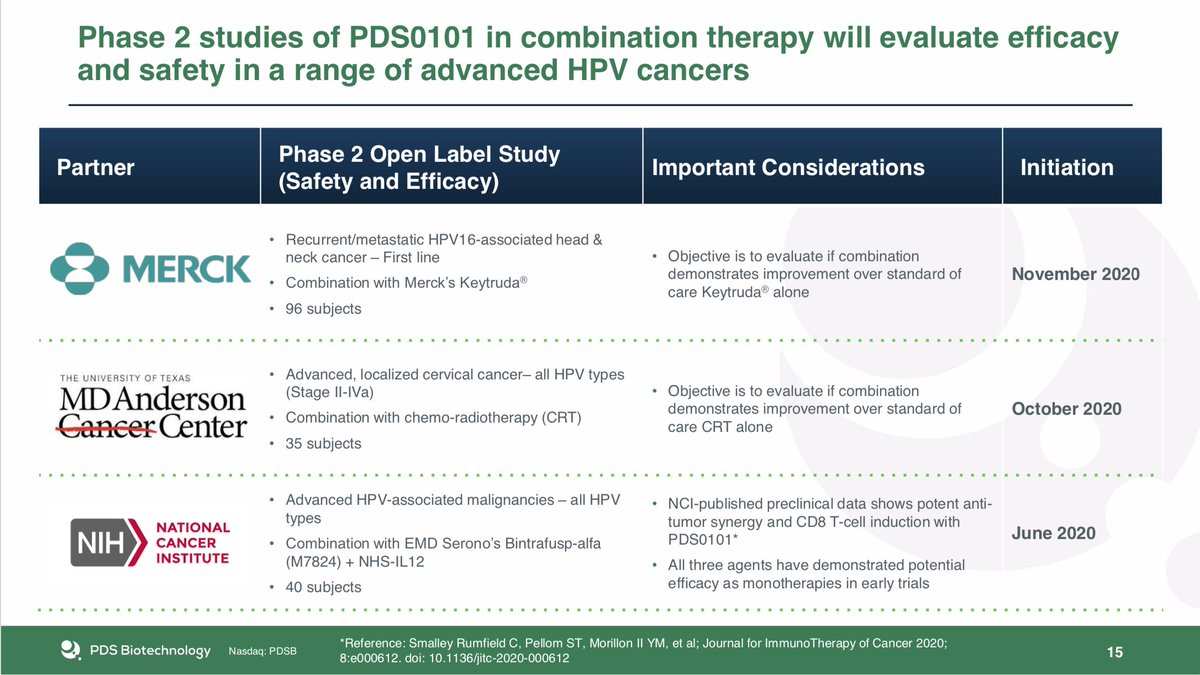

Three Phase 2 trials are now recruiting. Two ISTs, one with NIH (combo with multiple agents) and one with MD Anderson (combo with chemo). And the most important trial, a n=96 trial in combination with Keytruda for *first line* HPV16-associated head and neck cancer.

The NIH study has been recruiting with no interruption since June 2020 and the CEO has guided to initial efficacy data late in Q1 2021. The study is small but recently upsized (from n=28 to n=40) and the drug is being used in combination with Bintrafusp-alfa and NHS-IL12.

So while single agent effect will not be conclusive, any + data is positive for $PDSB at this market cap and will hopefully provide a nice share price pop. New management has been smart and opportunistic about their microcap status using large pops in share price to finance.

Smart conservation of cash has provided a current runway to mid-2022, long enough to get to the interim readout of the “VERSATILE-002” Keytruda combo trial. Further cash would give runway to the final readout of that trial and advance the next three oncology products.

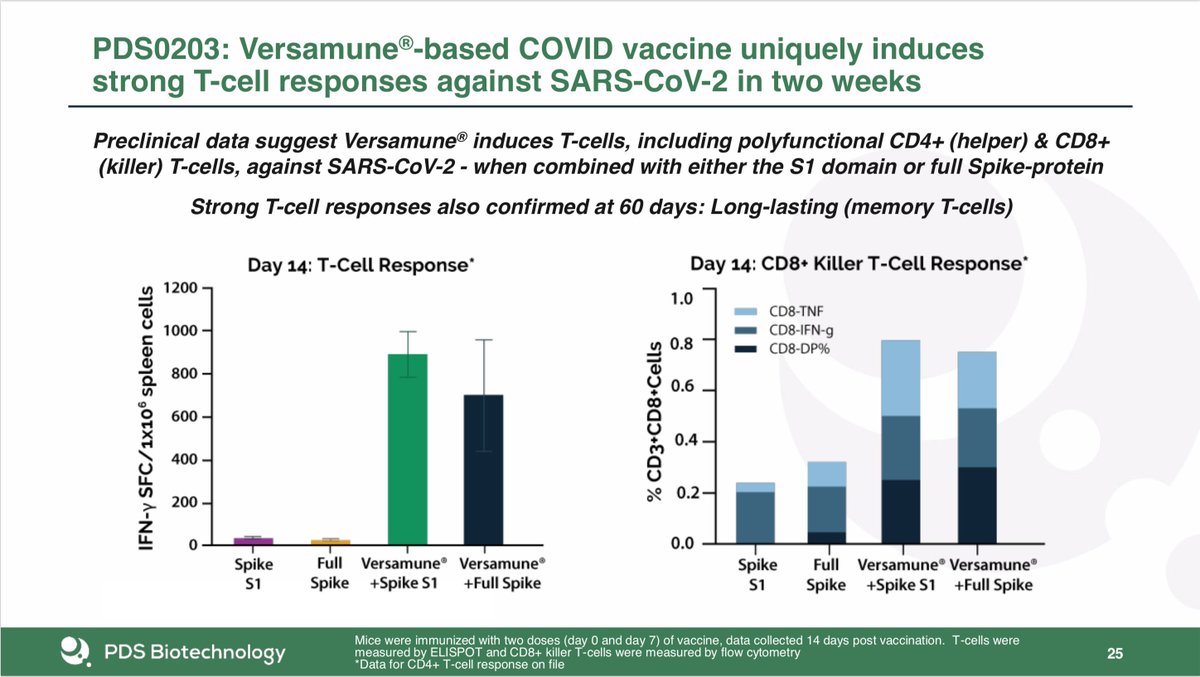

PDS has preclinical infectious disease programs, too, for prevention of tuberculosis, a universal flu vaccine, and a COVID vaccine focused on lasting T-cell response. While their aspirations are broad, smartly, these preclinical programs are being brought along only with funding.

The COVID vaccine isn’t as appealing as maybe it was 6 months ago but still could be valuable in a year if immunity from others isn’t long lasting. It can be partnered in the US and EU. The universal flu vaccine is more interesting to me and is funded by NIH, PDS has all rights.

PDS Biotech is the smallest company I follow and that makes me a little nervous but they are doing everything you want from a microcap: cost control, opportunistic financing, multiple shots on goal, and a management team with great pedigrees.

Your CEO worked on the development of Abelcet and PEG-Intron. Your CMO worked for 30 years at NCI and was former director of Cancer Research (Cancer Vaccine Branch). Your CSO worked at Merck and Regeneron. You could do worse for $47m MktCap.

Risks to $PDSB in my Q1 picks are: data will take longer than expected (NIH trial), market won’t appreciate good results (PDS0101 combined with two other agents), or my understanding is all wrong and the drug does nothing. I can live with that at $1.4/sh cash at time of readout.

Read on Twitter

Read on Twitter